Equated Monthly Installment (EMI)

The fixed amount paid as part of repayment towards the outstanding loan at a specific date by the borrower to the lender every month.

Equated Monthly Installment refers to the fixed amount paid as part of repayment towards the outstanding loan at a specific date by the borrower to the lender every month.

In simple terms, the equated monthly installment is the service banks, and other financial institutions provide to their clients. It allows them to borrow a loan amount to meet urgent cash flow demands and then return it in fixed installments over a certain loan term.

The consumer must make these payments each calendar month on a specific day. The fixed installment makes personal financial planning or budgeting easier for borrowers.

The availability of EMIs relieves the stress of making huge lump-sum payments for significant purchases in an era of growing inflation by allowing us to know the precise amount to be paid monthly without burning a hole in our wallets.

How is Equated Monthly Installment calculated?

It can be calculated by both the flat rate method and the reducing balance method, as discussed below:

1. Flat rate method

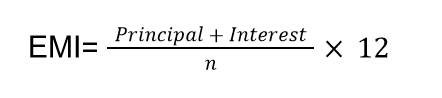

In the flat rate method, the principal loan, and interest on the principal, are added together. Then, the resulting total is divided by the number of periods or years times the number of months.

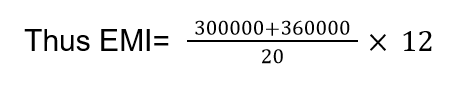

Assume that the person takes a loan or mortgage of $300000 to buy the house at the fixed interest rate of 6% for 20 years. In this example, the principal is equal to $300000, and the total interest amount will be equal to$ 360000.

If there is no default or partial payment over the loan's term, the monthly installment for a loan with a fixed interest rate remains constant.

2. Reducing balance method

The flat rate technique calculates interest on the initial loan or principal amount. Still, in the reducing balance method, interest is computed on the principal amount that has been lowered due to each payment.

The principal mortgage balance of the borrower's loan decreases as the person makes monthly payments, which also results in a lower interest payment.

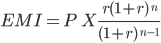

The formula to determine EMI using the reducing balance method is as follows:

where

P= Principal amount

r= Monthly rate of interest

n= Total number of payments

EMI amount according to the reducing balance method in the above example will be calculated as follows:

= {6% (1 + 6%)240}/ (1 + 6%)240 - 1 x 300000

= 2149.29

The interest calculated above from the reducing balance method is $600 is lower than the interest calculated from the flat rate method. Since there are fewer overall interest payments with the reducing-balance way, it benefits borrowers more.

Factors affecting EMI

The EMI amount depends on many factors like the interest rate charged on the loan, principal amount, loan tenure, downpayment, etc. Some of them are described below:

1. Principal

It is the original amount borrowed from the bank by the borrower. Therefore, it is the primary factor that affects the installment amount. The larger the principal amount, the higher the EMI, and the smaller the Principal amount, the lower the EMI.

2. Rate of Interest

The rate of interest charged by banks or financial organizations for debt repayment. The rate is based on evaluating the borrower's credit history and other calculations.

There are two kinds of interest rates: fixed interest rates and floating interest rates. The fixed interest rate remains the same throughout the term of the loan. Consequently, the monthly installment payments also stay the same.

A floating interest rate is one where the rate fluctuates in response to market conditions. Usually, the rate is linked to some base rate. The rate adjusts automatically in response to changes in the base rate.

3. Loan tenure

The loan's duration is the time the borrower has to repay the borrowed amount plus interest.

Loans with shorter terms have lower interest rates (even though their monthly payments are larger) than loans with longer times (which will have lower EMIs but a higher interest rate).

How to calculate EMI in Excel

Several online and offline calculators are available for calculating EMI amounts. However, it may also be calculated in Excel.

The PMT function is used to compute monthly installment amounts in excel. For example, when a loan or investment has a fixed interest rate and a fixed amount, the PMT function in Excel is used to determine the payments that must be made.

When we select any insurance or loan from a bank, this is just the EMI we pay for our loan or invested amount. Therefore, the function is called PMT since it determines the payment amount.

Syntax:

PMT(rate, nper, pv, [fv], [type])

The following arguments are part of the PMT function syntax:

Rate – Monthly interest rate on loan. (Annual interest rate/ 12)

Nper -The total number of payments.

Pv - The present value of the loan or Principal amount.

Fv ( Optional) -The future value or a cash balance after the last payment is made. If fv is not specified, it is considered 0 (zero), implying that the loan's future value is zero.

Type (Optional): The number 0 (zero) or 1 denotes the payment due date. The numbers 0 and 1 indicate that payments are due at the end of the month and at the beginning of the month, respectively.

Key takeaways

- Equated monthly installment is the fixed amount the borrower pays to the lender every month as a part of the outstanding loan repayment. It is delivered on a specified date every month.

- There are two methods of calculating monthly installments of the borrowers, which are the fixed rate method and the reducing balance method.

- In the fixed rate method, interest is fixed throughout the tenure of the loan. It is calculated by dividing the sum of the principal and total interest by the number of monthly payments.

- In the reducing balance method, interest is calculated on the lowered principal after every payment. In this method, good is not calculated on the original principal but on the principal balance after every charge.

- EMI amount depends on factors like Principal, rate of return, and loan tenure.

- The EMI amount can also be calculated in excel by using the PMT function. The formula used for monthly installment in excel is PMT(rate, nper, pv, [fv], [type]).

or Want to Sign up with your social account?