Forbearance

It is a term that defines a temporary reduction of payments.

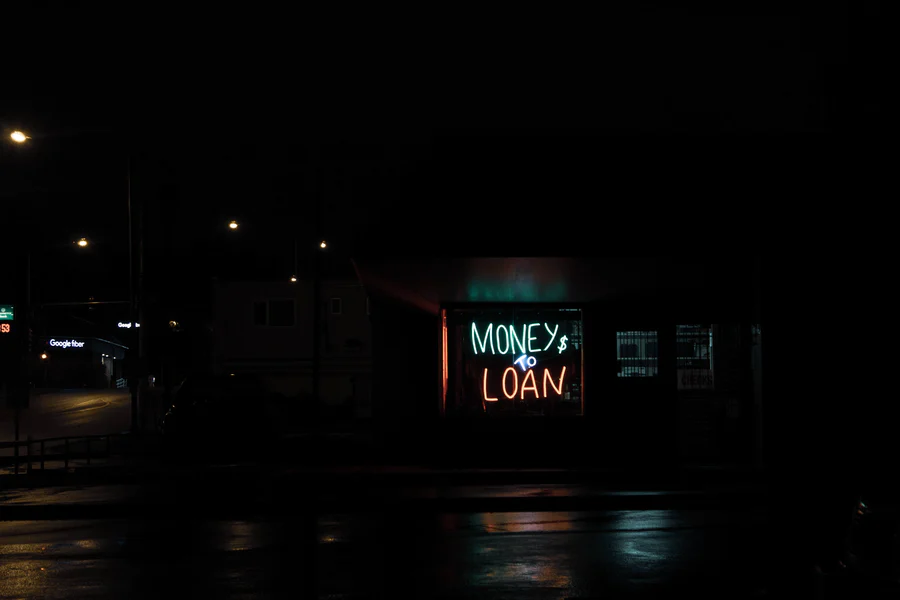

Forbearance is a term that defines a temporary reduction of payments, typically for loans like loans or mortgages. It occurs when lenders of debt grant a form of relief to borrowers for hardships and unforeseen circumstances (i.e., illnesses and natural disasters).

If you're a borrower facing unforeseen circumstances that inhibit your ability to pay the lender, you may want to inquire about more information regarding payment relief with your lender.

Although the relief allows one to pay the debt off later, borrowers are still required to pay any reduced or missed payments later.

Remember, a loan is a binding contract between two or more parties. Therefore, the lender will have a say too. That's why the terms of the payment relief will need to be negotiated between the two parties if the situation arises.

Lenders and insurers are typically willing to negotiate because the losses caused by defaults typically fall on them. Allowing the borrower more time to pay the loan prevents this issue.

It sounds similar to a loan deferment, but they're not the same. A deferment of a loan doesn't accrue interest to your loan balance during the relief period, whereas the former does.

If you can choose between the two options, deferment is the best option because there is no interest expense from the relief period, but both can be good short-term options if you face financial hardship.

While both options can help you avoid loan defaults, there are more reasonable long-term solutions.

If you expect your financial hardship to stay the same, the best course would be to enroll in an income-driven repayment plan instead of pausing repayment.

How does it work?

Forbearance is usually used for student loans and mortgages, but it can apply to any loan. It allows a borrower more time to obtain the means to pay the loan off.

Borrowers who may be going through hard financial times due to extraordinary circumstances benefit greatly. Otherwise, these borrowers would have to spend additional money on fees for foreclosures and defaults.

Loan services, or services that collect the payment for the loan but don't own the loan, will probably be less likely to agree on temporary relief since they carry little financial risk.

These agreements are largely dependent on if the borrower will have the ability to pay the loan in later months. The lender may reduce the payment, so the borrower can afford the charges once the grace period is over.

In some cases, temporary relief from loan payments may be legally required. For example, during the global pandemic, the government enacted the Coronavirus Aid, Relief, and Economic Securities (CARES) Act.

The CARES Act was designed for some economic relief due to the many Americans' lack of available work. The CARES Act included a provision for student loans; student loan payments were deferred, and some individuals were lucky enough to have their student loans canceled.

The government also helped people struggling to pay their mortgages due to financial hardships caused by the pandemic.

Some states enacted similar provisions on the local level to protect their citizens and the economy.

Do I qualify for it?

You must contact your lender or loan service to see if you can get payment relief. In addition, you must demonstrate a high need to put off payments most of the time.

This could be:

-

Financial Hardship: An unexpected loss or drastic change in income

-

Medical Hardship: Any medical condition or illness that affects your ability to make payments

-

Disaster: A more recent example that is still in everyone's minds is Covid-19. Covid-19 affected most people's ability to make money, resulting in many people not having the means to make payments.

-

Drastic Change in Family's Income: This could be from a divorce or the death of the family's primary income earner.

Forbearance isn't an all-or-nothing deal. The terms must be negotiated. Lenders have a lot of discretion when deciding whether they want to offer relief or not. When borrowers display a consistent track record of payments, they are more likely to receive relief.

For example, a borrower who has worked a stable job over the past seven years and has never missed a loan payment but recently fell ill and hasn't been able to work is a more favorable candidate for relief than someone who has bounced around jobs and constantly misses payments.

As mentioned above, the Coronavirus made exceptions to the usual conditions of forbearance relief. As a result, everyone with student loans could pause until the scheduled date of August 31st, 2022.

The U.S. Department of Education's Federal Student Aid office also set interest rates at 0% and stopped the collection of defaulted loans. These benefits are also scheduled to end after August 31st, 2022.

Some people might have to take out private loans to pay for college. Although the provision enacted by the government covers these loans, some private lenders also offer relief.

Different types of Forbearance

It is available for all types of loans, but there are generally three situations where it is extremely common.

Those three types of loans are:

1. Mortgage

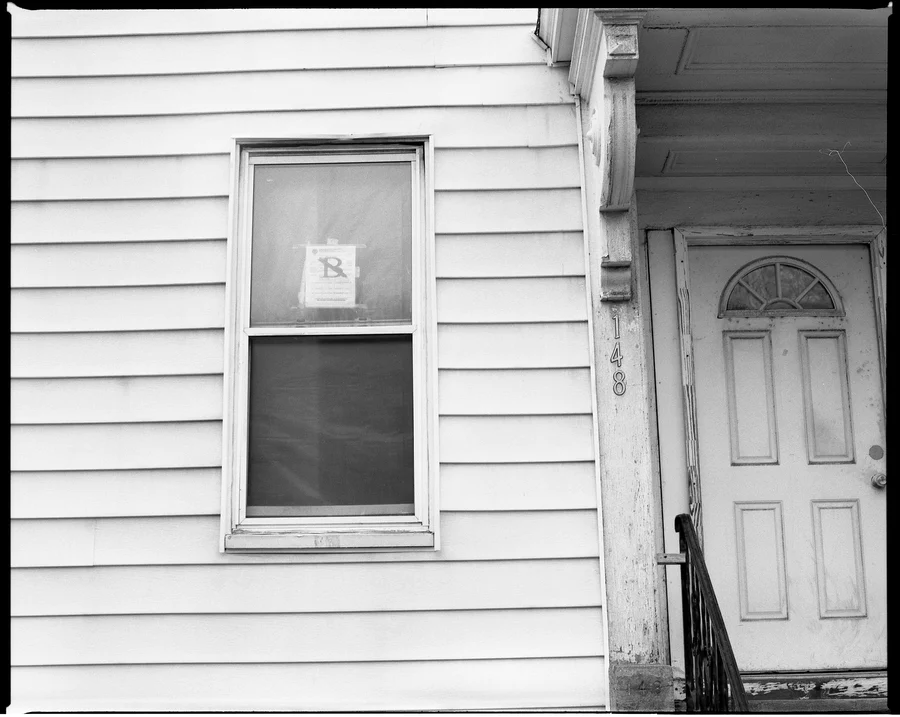

If you have a mortgage and run into unforeseen circumstances not allowing you to pay the loan off, you may qualify for payment relief.

Banks and other lenders understand that sometimes people face hardships not allowing borrowers to meet their monthly payments. Most of the time, these institutions will try and work with you to sort out the situation.

When you are sorting out the situation, you will go over the length of the relief period, how much the payment will be reduced, and exactly how much you will owe the lender.

Sometimes you may have to repay the lender at a high-interest rate, but you will still get to keep your house and avoid foreclosure. It can also save your credit score from dropping tremendously.

2. Student loans

Student loans are the most common kind of loan deferment. However, student loans are risky as they can easily rack up over time. This causes many former students to place their loans in Forbearance at least once.

A pretty eye-opening statistic about student loans is that 57% of all debt from federal student loans remains in Forbearance until September 2022. This means that most student loan debt currently needs to be paid off.

Luckily, because of Covid-19, all federal student loans are set at a 0% interest until the end of August 2022, so borrowers don't have to worry so much about interest expenses accruing.

In normal circumstances, if you get relief on your student loans, you will be responsible for paying the interest expenses that accrue along with the principal. So it's always important to be mindful of these different costs, like interest.

3. Credit card

As you may know, missing credit card payments is a big way to tank your credit. However, many banks have implemented relief programs for people facing hardships, so their credit stays relatively high.

If you're facing any hardships inhibiting you from making your credit card payments, you need to call your bank and ask for their credit counselor.

Credit counselors should be able to answer any questions about the relief programs and point you in the right direction.

Credit Card defaults were a big issue during the Great Recession in 2008-2009. Credit card default rates rose exponentially during this period. Then during the first half of 2020, the same kind of uncharacteristic rise in rates happened again due to the pandemic.

Benefits and Risks

Forbearance can be great for individuals who are usually consistent about paying their loan payments but are experiencing some hardship preventing them from making payments.

It gives borrowers some breathing room to allow them to pay essential expenses. In addition, this temporary relief will enable borrowers to avoid defaulting on their loans.

Borrowers will also not have to worry about their credit score crashing due to defaulting on a loan and missing loan payments; the temporary pause on payments doesn't affect your credit score.

If you have a mortgage, you will also be avoiding foreclosure. Foreclosure can be scary because you will lose your house and have to worry about finding somewhere else to stay while also dealing with the hardships you're experiencing.

If borrowers fail to meet the terms of the agreement, there may be a negative impact on their credit score. However, this is only if the borrower fails to fulfill the terms of the contract.

Also, borrowers will still have to worry about interest accruing over the relief period. They will have to pay this off eventually, which will be difficult if they're experiencing extreme financial hardships.

The amount you will have to pay off will be more than if you didn't enter the agreement.

Remember, it isn't a permanent solution, so you must make sure you're doing everything you can to obtain the means to make the payments when the relief period ends. Otherwise, you can be at risk of defaulting on your loan.

FAQs

In most cases, the answer is yes. Again, it is up to the discretion of both parties, but generally, lenders want to work with borrowers to come to a compromise. It's in their best interest because if borrowers default; the financial burden is placed on the lenders.

No, this will not affect your credit score. However, your credit score will tank if you miss payments or default on your loan. Therefore, your credit score should always be on your mind when deciding about your loans.

It definitely affects your ability to refinance. Most lenders will not allow you to refinance if you miss payments. This can depend on the individual and the lender, but for most circumstances, you will not be able to refinance with missed payments.

When borrowers go through hardships and can't make loan payments, they may request temporary relief from these payments. Borrowers must go to their lenders and request forbearance (as both parties have discretion).

If the lender agrees, both parties will sort out the rest of the terms, like the relief's length and the repayment plan.

Borrowers will start making payments again when the relied period ends. They will then have to start paying the money they missed. They will also have to pay the interest accrued over the relief period. There are different payment options borrowers have when the period ends.

They may pay the sum all at once. There are also payment plans that usually span over a year, and borrowers would make monthly payments. The payment plan will have already been agreed upon between the lender and borrower at the time of the contract.

Researched & authored by Alexander McCoy | LinkedIn

Reviewed & Edited by Raghav Dharmarajan

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?