Blended Rate

An effective interest rate considers the interest rate and the fees charged on a loan

What is a blended rate?

A blended rate is an effective interest rate that considers both the interest rate and the fees charged on a loan. This rate is designed to give borrowers a more accurate picture of the true cost of a loan.

When shopping for a loan, comparing apples to apples is important. That means looking at the total cost of the loan, not just the interest rate. This rate is a good way to compare loans because it includes interest and fees.

This can be beneficial if you qualify for a lower interest rate on one product but need a higher loan amount than what that product offers.

Borrowers should be aware of lenders who quote a low-interest rate but then add on fees. These lenders are trying to trick people into thinking they're getting a great deal. But in reality, you're paying a higher rate altogether.

This rate can be useful when comparing different interest rates, but it is important to remember that they are just an average and do not represent the true cost of borrowing.

So be sure to ask for the blended rate when shopping for a loan.

Key Takeaways

- A blended rate is an effective interest rate that considers both the interest rate and fees charged on a loan.

- Blended rates are useful for borrowers who qualify for a lower interest rate on one product but need a higher loan amount.

- The blended rate concept extends to the pooled cost of funds, which measures the average cost of all funds in a pool, considering fees, commissions, and other costs.

- When seeking a loan, understanding and asking for the blended rate is crucial for making informed financial decisions, ensuring transparency in cost comparisons, and avoiding potential pitfalls associated with hidden fees and changing interest rates.

Understanding the blended rate

It is an average of two or more rates. This rate is often used to reduce the cost of borrowing money.

For example, if you have a variable-rate loan with an interest rate of 5% and a fixed-rate loan with an interest rate of 3%, you can get a new rate of 4% by taking an average of the two rates.

This can be a useful tool for reducing your monthly payments, but it's important to remember that the average interest rate will be higher over the life of the loan. This is because this rate doesn't consider the different terms of the loans.

For example, a fixed-rate loan may have a term of 30 years, while a variable-rate loan may have a period of 10 years. This means that the rate will be higher than the true average interest.

This rate type is important because it allows you to give your customers the best possible rate.

How Do Blended Rates Work?

A blended rate is a rate that results from combining the rates of two or more different investment vehicles. The purpose of this rate is to provide the investor with a higher overall rate of return.

It is calculated by adding the variable rate to the fixed rate and dividing it by two. For example, if the prime rate is 3% and the fixed rate is 6%, the blended rate would be 4.5%.

These rates can be useful for borrowers who want the stability of a fixed rate but also want the potential for lower rates if the prime rate decreases. However, borrowers should be aware that their interest rate will increase if the prime rate increases.

For example, let's say an investor has $10,000 to invest. The investor could put the entire $10,000 into a certificate of deposit (CD) that pays 3% interest.

However, the investor could also choose to put $5,000 into a CD that pays 3% interest and $5,000 into a mutual fund that pays 5% interest. In this case, the new rate would be 4% (3% + 5% / 2).

While the blended rate is higher than the rate of the individual investment vehicles, it is important to remember this rate is not guaranteed.

What is the Pooled Cost of Funds?

The blended rate is the weighted average of the rates of the underlying funds in a pool. This can measure the cost of funds for a collection of assets.

The blended rate can measure the cost of funds for a pool. The cost of funds is the total expense incurred by the fund manager in managing the fund. It includes fees, commissions, and other costs.

This rate can be used to compare the cost of different investment funds. It is a useful tool for investors to compare various funds' fees and other expenses.

The pooled cost is the average cost of all the funds in a pool. It's used to compare the cost of different types of investment funds.

The cost of a fund is usually expressed as a percentage of the money you have invested. For example, if a fund has a 2% annual management fee and you have invested $1,000 in it, then the cost of the fund is $20.

The pooled cost of funds considers the fees of all the funds in a pool. So it's a good way to compare the cost of different investment funds.

For example, if you're looking at two funds with the same management fee, but one has a higher expense ratio, then the one with the higher expense ratio will have a higher pooled cost of funds.

How is the Pooled Cost of Funds Calculated?

The concept of a pooled cost fund is often used in the context of insurance. It is a way of pooling the resources of a large number of policyholders to reduce the overall cost of risk.

The funds are typically used to pay for claims that exceed the policyholder's deductible. There are several different ways to calculate the pooled cost fund, but the most common method is to use the expected losses of the policyholders.

This approach considers that some policyholders will have a higher risk of making a claim than others. By pooling the resources of the policyholders, the insurer can spread the cost of risk over a larger number of people and reduce the overall cost.

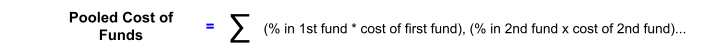

As we discussed, the pooled cost is the weighted average cost in a pool. The weights are based on the percentage of each fund's assets in the total pool. The calculation is

(% in the first fund x cost of the first fund) + (% in the second fund x cost of the second fund) + (% in the third fund x cost of the third fund)

For example, if the first fund has 20% of the assets and the second fund has 80%, the cost of the first fund is 5%, and the cost of the second fund is 3%, the pooled cost would be:

(0.2 x 0.05) + (0.8 x 0.03) = 0.034 or 3.4%

Example of Calculating Blended Rates

Suppose a company has a loan with an interest rate of 7% for the first year, 8% for the second year, and 9% for the third year. The new rate for this loan would be 8%.

While the new rate may be lower than the highest interest rate on a loan, it is still important to remember that the blended rate is a single interest rate and will fluctuate over time.

This can impact the interest the company pays on loans and monthly payments.

In some cases, these averaged rates can be helpful; in others, they can lead to more debt if not used carefully. This is because the rate can sometimes mask the true cost of borrowing.

In another example, let's say you have a loan with a blended rate of 15%. But the loan has an interest rate of 5%, and a credit card with an interest rate of 20%. In this case, the rate is higher than the interest you would pay on a loan alone.

These rates can be useful when managed properly, but they can also be a burden otherwise.

While a lower interest rate may be appealing, there are some dangers to be aware of. First, you may pay more interest with the rate if you have multiple debts with different repayment terms.

Second, if the interest rates on your debts change, your rate will also change. This could cause your payments to go up or down, which can be difficult to keep track of.

or Want to Sign up with your social account?