Offering Memorandum

A document that summarizes information relating to the stock, bond, or other security offered via private placement

What Is an Offering Memorandum?

An offering memorandum is a legal document that summarizes information about the security offered via private placement. Due to its nature, the document is also commonly referred to as a Private Placement Memorandum (PPM).

Securities offered via private placement are available to a limited number of investors. These securities are not registered under the law but are sold using one of the exemptions.

This memorandum is prepared on the company's behalf for prospective investors. The document enables potential investors to understand the specifics of the deal and helps them decide whether to participate.

The document typically includes information on the company and its operations, its financial statements, information on the offering, and more.

Alternatively, securities can be offered via public offering when they are available to all investors. When securities are offered via public offering, a document called a prospectus is prepared.

The offering memorandum and the prospectus have many similarities, ranging from the type of information included to terms and conditions. For example, both documents describe the terms of the offer, information on the issuer, risks associated with the investment, etc.

Key Takeaways

- An offering memorandum summarizes details for securities in private placement, which is accessible to a limited number of investors. This document is often compared to a prospectus.

- Both the offering memorandum and prospectus share similarities, but they serve distinct purposes - the former for private placement and the latter for public placement.

- The content of an offering memorandum is variable, depending on factors like the type of security, market conditions, and deal complexity.

- Preparation of an offering memorandum is an extensive and costly process involving professionals from diverse fields, underlining the critical need for truthful information to avoid severe consequences.

Understanding Offering Memorandum

As mentioned earlier, it is a legal document that summarizes information relating to the security offered.

More specifically, it provides an overview of the company issuing a security, the terms of the offering, risk factors associated with an investment, information on the use of proceeds, and more.

An offering memorandum content will vary depending on the type of security sold, the governing body of the transaction, the targeted investors, the complexity of the transaction, etc.

Having said that, the basic outline of the document is as follows:

1. An introduction

It outlines the basic terms of the offering, including all the necessary disclosures required by the respective law.

2. Summary of the terms

It outlines the material terms of the offering as well as the capital structure of the company before and after the offering.

3. Risk factors

It outlines factors that may impact the investors’ investment decisions. For example, risk factors could be industry-specific, company-specific, etc.

4. Company information

It outlines information about the company. This section may include detailed information on the company’s operations, its management, and any other relevant information that could be relevant to the potential investor.

5. Use of proceeds

It provides information on the use of funds raised due to the offering.

6. Description of securities

It outlines information on the securities offered, including the rights, restrictions, etc.

7. Subscription procedures

It covers the investing instructions.

8. Exhibits/appendices

These include any supplemental information and other information that could be material to the investment decision.

Many people prepare an offering memorandum – investment bankers, lawyers, the company’s employees and management, and external auditors, among others. Therefore, the preparation takes time and lots of resources, including financial resources.

Importance of Issuing An Offering Memorandum

An offering memorandum, also known as an information memorandum or private placement memorandum, plays a crucial role in financial transactions, particularly when a company is raising capital through private placements or offering securities.

Here are key points explaining the importance of an offering memorandum:

1. Legal Requirement

It is often a legal requirement for private placements and securities offerings, providing a comprehensive disclosure of information to potential investors.

2. Investor Protection

Safeguards the interests of investors by providing them with the necessary information to make informed investment decisions.

3. Regulatory Compliance

Ensures compliance with regulatory requirements and securities laws governing private placements, reducing legal risks for both the issuer and investors.

4. Record of Agreement

Serves as a formal document recording the terms agreed upon by both parties, reducing the likelihood of misunderstandings or disputes in the future.

5. Marketing Tool

Acts as a marketing tool for the company, presenting its strengths, market position, and growth potential to attract potential investors.

Offering Memorandum VS Prospectus

| Comparison Terms | Offering Memorandum | Prospectus |

|---|---|---|

| Legal Purpose | Typically used in private placements to provide potential investors with information about the offering, including risks and terms. | Required for public offerings to provide detailed information about the securities being offered, including financial data and risk factors. |

| Regulatory Requirement | Generally required for private placements but not as strictly regulated as prospectuses. | Mandated by securities regulators for public offerings to ensure transparency and protect investors. |

| Audience | Targeted towards sophisticated investors or institutions participating in private placements. | Aimed at retail investors and the general public for public offerings in stock markets. |

| Contents | Provides a summary of the investment opportunity, risks involved, management details, and terms of the offering. | Contains comprehensive information about the company, its financial performance, management, use of proceeds, and legal disclosures. |

| Distribution | Typically circulated among a limited number of potential investors in private placements. | Filed with securities regulators and distributed widely to the public through stock exchanges or other channels for public offerings. |

Note

Information provided in an offering memorandum must be accurate. Failure to provide truthful information could result in heavy fines when it is determined that the investors were deceived when making an investment decision.

Offering Memorandum examples

Let’s look at two real-life examples of an offering memorandum.

First, we’ll look at Metinvest B.V., Ukraine's largest vertically integrated mining and steel business. Second, we’ll explore Berrett-Koehler Publishers, one of the leading independent book publishers in the US.

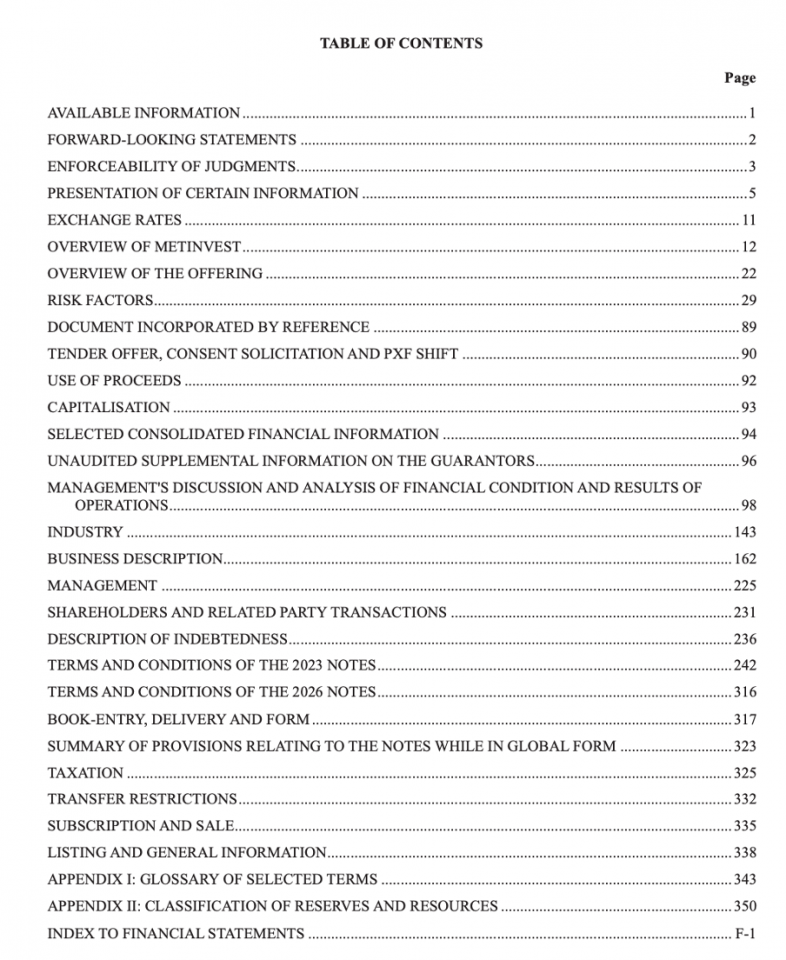

Let’s look at our first example - Metinvest B.V. – offering of debt securities.

In April 2018, Metinvest B.V. successfully refinanced its debt by issuing new tranches that replaced a significant part of the existing debt.

The offering memorandum of Metinvest B.V. comprised listing particulars for the application to the Irish Stock Exchange plc trading as Euronext Dublin for listing each series of the notes.

The table of content of Metinvest B.V.’s offering memorandum is provided below:

Source: Offering memorandum of Metinvest B.V.

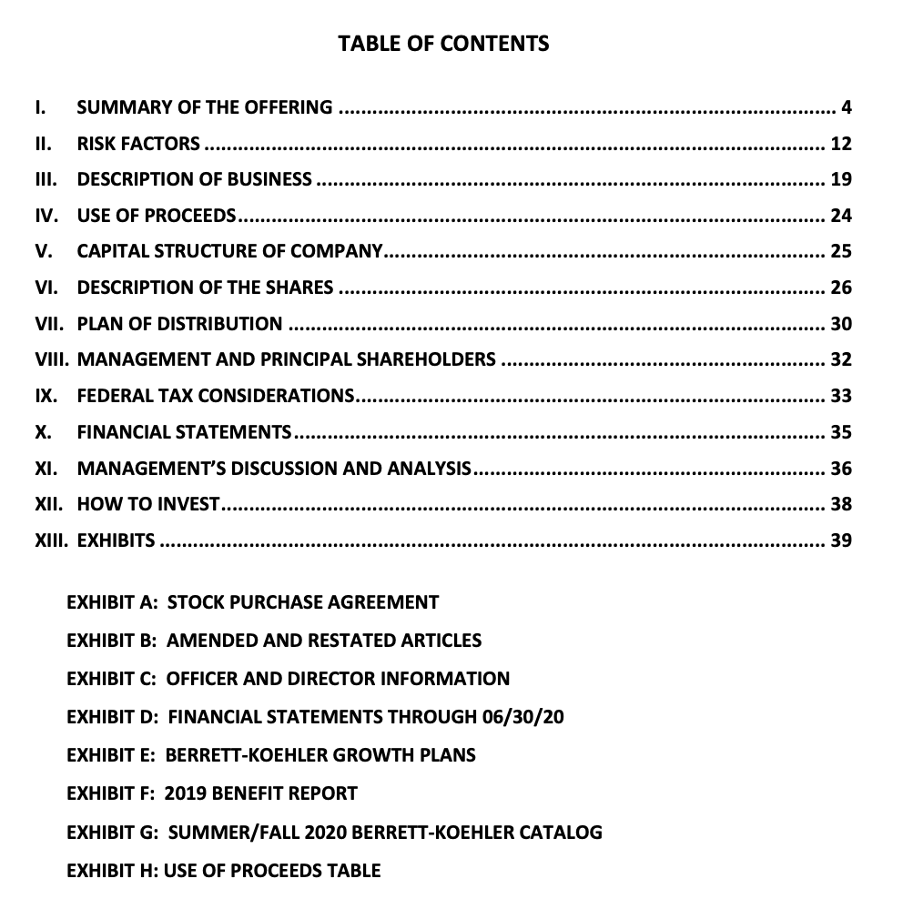

For the second example, we’ll look at - Berrett-Koehler Publishers – offering of preferred stock.

In October 2020, Berrett-Koehler Publishers successfully offered shares of series B preferred stock.

The offering was conducted under Section 4(a)(6) of the Securities Act of 1933, Regulation Crowdfunding, and filed by the company with the Securities and Exchange Commission (SEC).

The table of content of Berrett-Koehler Publishers’ offering memorandum is provided below:

Source: Offering memorandum of Berrett-Koehler Publishers

As you can see, examples cover different securities offered in different markets. Thus, the formats of offering memorandums differ. However, the common topics covered in the previous section remain the same despite the above-mentioned differences.

Conclusion

An Offering Memorandum is a crucial document summarizing details about securities offered privately. It ensures legal compliance, safeguards investor interests, and fosters transparency.

It meets legal requirements, ensures regulatory compliance, formalizes agreements, and serves as a marketing tool. Real-life examples like Metinvest B.V. and Berrett-Koehler Publishers highlight its adaptability, emphasizing its fundamental role in financial transactions.

Furthermore, it serves as a shield against potential disputes by providing accurate and truthful information, preventing fines and legal consequences that may arise from deceptive practices.

Moreover, the Offering Memorandum acts not only as a legal requisite for private placements but also as a strategic marketing tool. By showcasing a company's strengths, market position, and growth potential, it attracts potential investors and facilitates capital raising.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?