Passive Income

The income generated with minimal labor. It is the income received from a source that is not the employer

What is Passive Income?

Passive income is defined as the income generated with minimal labor and is received from a source that is not the employer.

While there might be little to no labor, an individual has to contribute their time, resources, and, in many cases, an initial investment.

Once the streams of income are set up and function efficiently, they yield nearly consistent earnings on a regular basis with little to no involvement. This makes it an attractive choice to diversify an individual's financial portfolio.

Passive income is primarily used as a means to gain financial independence and stability. It is often complemented with a regular full-time job. Broadening one’s income sources helps reduce the dependency on traditional employment that often has multiple restrictions.

An individual looking to generate additional income can explore various sources such as investment, mutual funds, stocks, real estate, affiliate marketing, social media, etc.

They should carefully make their choice after thoroughly assessing their available resources and the amount of time they can commit to each option.

Key Takeaways

- Passive income is income generated with minimal labor and can provide financial independence, stability, and increased well-being.

- Common sources of passive income include digital sources like affiliate marketing and YouTube ads, investments in financial instruments, and real estate rental income.

- Passive income requires little ongoing effort and can continue to generate income even when not actively working, while active income is earned through traditional work or services.

Different Ways to Build Passive Income

Passive income can be generated through various sources, each with its unique characteristics. Below are the most common streams of passive income generation.

Digital Sources

Digital sources, on their own, encompass a wide range of options. Some of which are efficient, some of which aren’t.

Individuals who dabble in these sources often make their revenue by engaging in the following options:

- Sponsors: Companies and brands pay influencers to create and post content that promotes their products and services.

- Affiliate marketing: The popularity of affiliate marketing has sharply increased, particularly during the COVID-19 pandemic. This was primarily due to its ease of generation.

- Income gets generated when viewers click on links and make purchases through these links inserted by the content maker. This income is called passive, as income is earned without having to put in the work physically.

- YouTube ads: Successful YouTube channels that meet the requirements of the ‘YouTube Partner Program’ earn money from ads on long-form videos and ads between short-form videos.

Investment In Financial Instruments

Another way of generating such income is through initially investing in stocks, bonds, cryptocurrencies, deposits, etc. After this initial investment, the investor earns their income through interest payments on these financial instruments from the borrower.

Real Estate

Property owners often make a passive income by renting out their properties. This source is particularly popular given that it allows the individual greater control and flexibility. Unlike the source of financial instruments, income from real estate is steady and fixed

Real Estate Investment

Additionally, there are 3 types of real estate investment:

- Residential Properties: This refers to income generated by renting out property to those tenants looking to reside in the estate for a fixed period of time.

- Commercial Real Estate: Passive income can be earned by renting out warehouses, retail spaces, commercial buildings, and office spaces. Any property rented out for the purpose of conducting commercial works comes under this category.

- Real Estate Investment Trusts: These trusts allow individuals to buy a share of the real estate property and earn an income when the property makes profits. This is preferred by those investors who do not want to get involved in the management of the property.

Benefits of Passive Income

Passive income is highly praised by a lot of people. Some benefits it offers are described below.

Financial Independence

Young individuals across the globe struggle to achieve financial independence. They juggle various commitments like college, part-time jobs, and internships. Yet, given the current economic state, their efforts still fall short.

Passive income offers a reliable way of earning money and achieving financial independence, providing an alternative to solely relying on active work for decades.

Stability

Passive income removes the challenges that arise when living from paycheck to paycheck. This income, in addition to that obtained from a full-time job, provides an extra layer of stability.

Additionally, it acts like a cushion to fall on in case of emergencies and any other uncertainties of life.

Increased Mental Well-being

Passive income relieves a worker's day-to-day financial pressures. It most certainly diminishes stress and anxiety.

It frees up time, a valuable and finite resource, which can then be used to attain one’s personal aspirations. They can now take care of their physical and mental well-being, take up new hobbies, and explore other personal interests.

The relief from the constant necessity to work significantly the weight on one's shoulders. This leads to a more fulfilling and balanced life.

Accumulation Of Wealth

The revenue generated from a source of passive income can oftentimes be reinvested into other streams such as stocks, bonds, or real estate.

This initial investment earns an additional income, and these earnings also have the capacity to generate larger income. This leads to the accumulation of wealth.

Furthermore, this collected wealth can be passed down to many generations.

Another benefit that accumulated wealth offers is that of early retirement. It allows individuals to retire peacefully without having to rely on retirement accounts, allowing them to avoid withdrawal penalties and other restrictions.

Challenges of Passive Income

While passive income offers attractive benefits, it is vital to look at the challenges this kind of income involves. Some of these are explained below.

Initial investment

Real estate or financial instruments require a substantial initial capital investment. This can be particularly straining for those who do not possess this kind of wealth, like students or daily wage workers.

Recovering this investment largely depends on the performance of the income source and often requires a considerable amount of time. Additionally, there are no guaranteed returns.

Unpredictability And Instability

Certain investments, like those in stocks, bonds, and deposits, are subject to economic and financial conditions. The economy in itself is never in a constant state of equilibrium and changes instantaneously.

Furthermore, these economic and financial conditions are inherently unpredictable. The economy has frequent downturns, crashes, varying interest rates, and volatility in general.

This leads to varying income levels and, in some cases, even losses. This makes passive income extremely risky as a sole source of income.

Lack Of Control

Various passive income sources depend on external factors, often out of an individual's control. Some of these factors include:

- Economic conditions

- Market trends

- Political events

- Central Bank decisions (particularly for financial instruments like stocks, bonds, etc.)

- Interest rates

- Changes in consumer behavior (in the case of online businesses)

- Changes in copyright laws and piracy

Lack Of Immediate Returns

Another challenge brought on by passive income is the lack of immediate returns. An individual having urgent financial needs cannot rely on this kind of source.

Furthermore, there’s a huge opportunity cost involved. The funds could be used for other investments with higher returns but are now locked up in the passive income source

Other Passive Income Ideas

Earning income passively is an extremely efficient and effective way for individuals to achieve financial freedom and stability. Below are different ways and concepts to generate passive income.

Create A Course

One way to generate passive income is by teaching something you comprehend through audio or video. This can then be posted on educational platforms like:

- Coursera

- Skillshare

- Udemy

These platforms will help distribute and sell your product. You will receive cash flows depending on the sale of the product.

Create A YouTube Channel

YouTube is one of the best platforms to point out your skills and talents and generate income globally.

You can start a cost-free channel, generating income per video based on audience viewing.

Some popular content ideas are as follows:

- Day in your life

- Review of a cookery show

- Recent restaurant dining experience

- Game sessions with friends

App Creation

Creating an app is one of the simplest ways to prepare in advance and subsequently generate profits in the long term. The app could be gaming-oriented, or it could help users perform some of their basic demands with simplicity.

Income is generated depending on the number of app downloads. Occasionally, adding new features and regular updates are necessary for an app to perform well.

Affiliate Marketing

You can earn a decent passive income by just inserting a link into your social media accounts, your YouTube channel, your app, or even your course.

Rent Your Home For Short-term

Rent out your current space while you're away for a summer vacation, business trips, or visiting your family. You can then generate income through the rent and additionally could have the tenant take care of your belongings, pets, or home plants.

Sell Designs/Photographs Online

Another method of generating a side income is by selling items and your printed designs. There are many different platforms like CafePress and Zazzle where you can post them.

On the other hand, if you're a photographer, you can earn income by taking photos of individuals on the streets and giving them spot-printed ones. You can then charge them for the quality of the pictures and the printing.

Active vs. Passive Income

Active and passive income are two distinct and divergent forms of income. Understanding their differences is crucial to earning and building wealth. Below is a comprehensive overview of these 2 concepts.

Active Income

Active income refers to the income earned by performing traditional works or services that include wages or self-employment. It is associated with the income earned from your career path. It requires you to participate in work-related activities actively.

Active income is directly dependent on time. The more you work, the more you earn, and when you stop working, your income either drops drastically or completely ceases.

This income is often limited and cannot be increased without putting in more hours or expanding your business.

Active income is considered to be stable and consistent but usually has a lower ceiling with limited growth prospects. This type of income is burdened with high tax rates in most countries. Some examples are the individual's job, business, and freelance work.

Passive Income

Passive Income is income generated with little to no work effort to produce or maintain. Passive income is less time-dependent once the initial setup is complete. After it's set up, you can continue generating income even while you're not working.

This income can be increased on a large scale without having to put in the proportional hours or effort. Passive income has a great potential for higher returns, but that comes with its own risks.

The tax rates on passive income vary based on 2 factors:

- Source of the income

- Tax laws of the country

The Internal Revenue Service (IRS) in America collects taxes at a rate similar to that of active income. Whereas some European countries like Georgia and Cyprus have really low (~1%) to zero taxes for income generated from a passive source.

Some examples of passive income sources are investments, dividends, and royalties.

Following is a table to better visualize these differences.

| Aspect | Active Income | Passive Income |

|---|---|---|

| Definition | Income earned by performing traditional works | Income generated with little to no work effort to produce or maintain |

| Time Dependency | Income is directly dependent on time | Income is less time-dependent once established |

| Source | Job, employment, self-employment | Investments, dividends, stocks, royalties |

| Scalability | Limited and cannot be increased without putting in proportional hours | Can be increased on a large scale without having to put in the proportional hours or effort. |

| Rewards | Stable and consistent but has a lower ceiling, with limited growth prospects. | |

| Taxation | Burdened with high tax rates | Rates are highly variable (depending on the source and the country’s tax laws) |

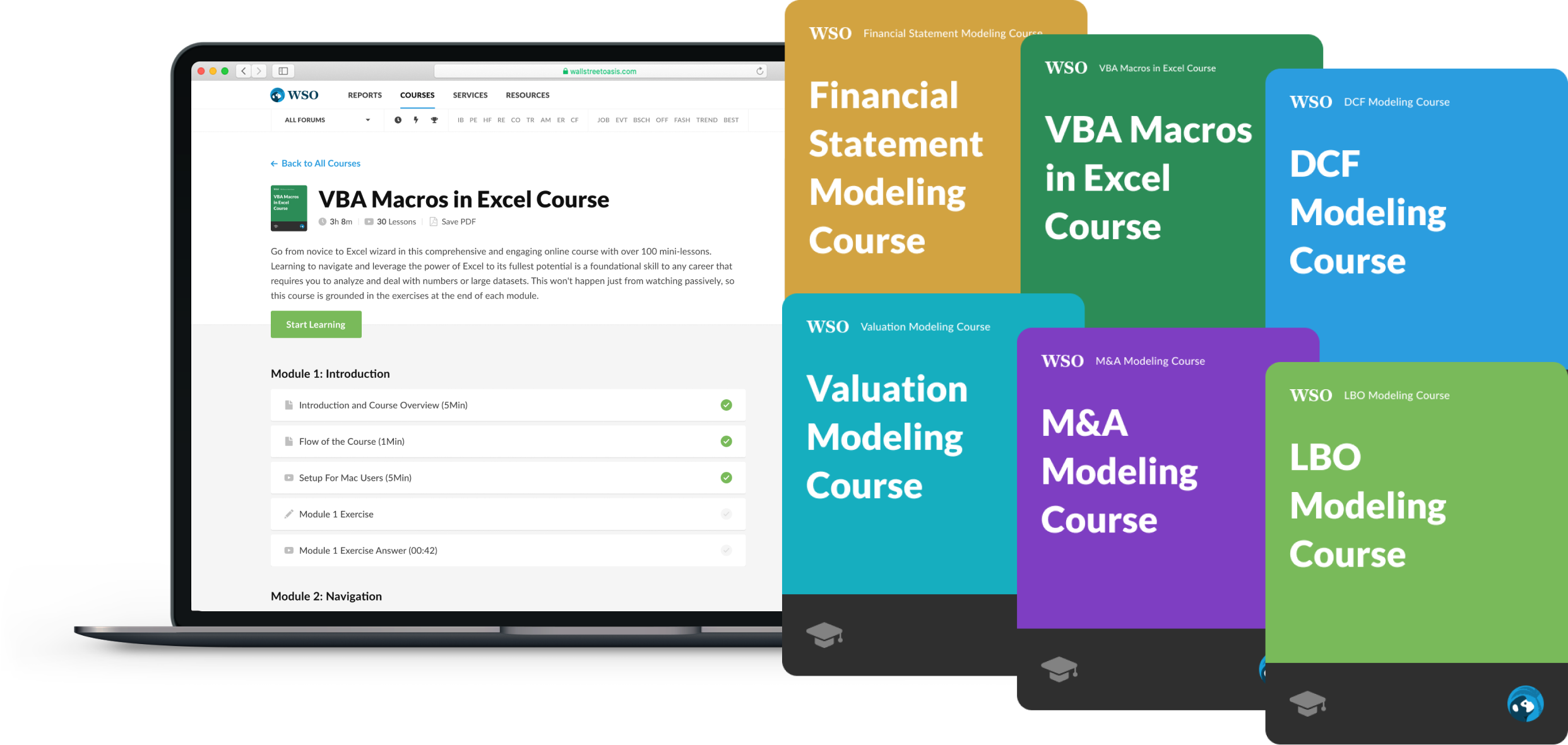

Everything You Need To Master Financial Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?