Balanced Budget

A financial situation when the total expected revenues are equal to the total expected expenditures for a specific period, usually a fiscal year, ensuring there is neither a deficit nor a surplus.

What is a Balanced Budget?

A balanced budget refers to a financial situation when the total expected revenues are equal to the total expected expenditures for a specific period, usually a fiscal year, ensuring there is neither a deficit nor a surplus.

Total Expected Revenue = Total Expected Spending

The idea of a balanced budget can be used for various organizations but is commonly associated with government budgets. A budget is considered balanced when the total earnings and expenditures over the entire year even out.

A balanced budget indicates a balance between surpluses and deficits. However, it can also describe a budget with a surplus and no deficit. In other words, a fiscal balance can have higher revenues than expenses, but not the other way around.

A balanced budget is often considered a significant indicator of financial responsibility and stability. A balanced budget indicates that a government or institution is living within its means, not overspending, and not accumulating debt.

This can lead to economic stability and investor confidence by showing the government's capacity to handle its finances sensibly.

Key Takeaways

- A balanced budget occurs when anticipated income equals anticipated expenses within a specific timeframe, usually a fiscal year.

- A balanced budget is important for fiscal responsibility as it helps the government avoid too much debt, keeps the economy stable, and ensures there's enough money for important social programs.

- An unbalanced budget occurs when expected revenues do not align with planned expenditures. This imbalance occurs when either income surpasses or falls short of intended spending.

- A balanced budget amendment refers to a constitutional provision preventing the government from spending beyond its means to reduce deficit spending and encourage fiscal responsibility.

Understanding a Balanced Budget

A balanced budget is a state where a government's total revenue equals its total expenditures over a specific period, commonly a fiscal year. This equilibrium between income and spending is crucial for economic stability, sustainability, and growth.

Imagine the government has a certain amount of money derived from taxes and other sources (its income). This money is then allocated to fund various public services like schools, hospitals, and infrastructure projects (its expenses).

When these two sides - income and spending - align perfectly, the government achieves a fiscal balance.

A fiscal balance, in its ideal form, materializes when a government's income perfectly matches its expenditures. In real life, governments often have surpluses or deficits, which have big effects on the economy.

A budget surplus is a rare financial achievement, signifying effective fiscal management. It occurs when a government's revenues surpass its expenditures, leaving a surplus that can be allocated in various ways.

Surpluses are the financial cushion nations yearn for; they signify economic prudence and often lead to speculation about tax cuts, increased public spending, or debt reduction.

In the corporate realm, a surplus empowers companies to reinvest in themselves. This reinvestment might take the form of research and development initiatives, employee bonuses, or dividends to shareholders, bolstering the company's stability and growth.

In the context of government, a surplus implies that the state's financial health is strong. Historically, achieving a budget surplus has been rare for many governments.

A budget deficit occurs when government spending exceeds its revenue, necessitating borrowing to cover the shortfall. This borrowed money accumulates into a national debt, a burden that can impact future generations.

Example of a Balanced Budget

Balanced budgets, where revenues match expenses, are rare due to fluctuating factors contributing to surpluses or deficits.

For instance, in fiscal year 2022, the US federal government spent $1.38 trillion more than it earned, resulting in a deficit. A deficit happens when government spending exceeds its income.

Conversely, the budget is considered balanced if the government's revenue and expenditure total $2 trillion for the year.

Countries such as Germany, Switzerland, and South Korea have successfully achieved budget surpluses, signifying a fiscal balance scenario where their revenues exceed their expenditures.

It's crucial to recognize that balanced budgets can be crafted on different timelines—annually, biennially, or cyclically.

- An annual balanced budget ensures equilibrium within a single financial year.

- A biennial balanced budget allows for fluctuations across two years. If there is a surplus in one year, it can offset a deficit in the following year, ensuring that the budget remains balanced over two years.

- Ex:- Ohio follows a biennial budget system. This means that every two years, the state's programs and agencies are allocated funds. Typically, these budget plans are approved by July 1 of odd-numbered years.

- Cyclically balanced budgets adapt to economic conditions. During economic downturns, they may operate with a deficit, allowing necessary investments. Conversely, during periods of economic prosperity, they could generate surpluses to prepare for future downturns.

Germany, one of the world's leading economies, employs a cyclically balanced approach to its budgetary management.

Illustration

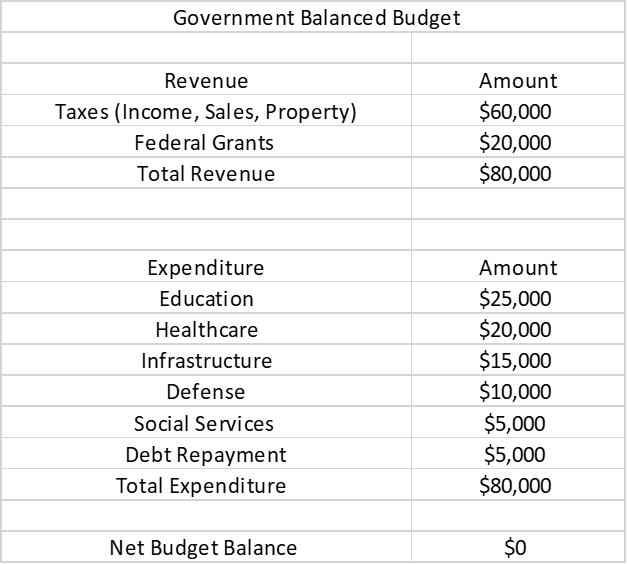

In this illustrative scenario of a government's balanced budget, the financial statement is a comprehensive overview of revenue and expenditure components.

In this example:

- Total Revenue is $80,000, comprising taxes (income, sales, property) and federal grants.

- Total Expenditure is $80,000, covering categories like Education, Healthcare, Infrastructure, Defense, Social Services, and Debt Repayment.

- The Net Budget Balance is $0, indicating a perfectly balanced budget. The government is neither running a surplus nor a deficit; it's spending exactly what it's earning.

Importance of a Balanced Budget

Achieving equilibrium between expenditures and revenues holds significant implications for various facets of a nation's well-being.

Below are several reasons that show the importance of a balanced budget, delving into its role in fiscal responsibility, reducing debt burdens, and promoting economic stability.

- Fiscal Responsibility: A fiscal balance signifies financial prudence and responsibility on the part of the government. It demonstrates an ability to live within its means, ensuring expenditures do not surpass available revenues.

- Debt Reduction: Achieving a balance enables governments to allocate resources towards current debts. Governments can avoid substantial interest payments that might burden future generations by decreasing the national debt.

- Economic Stability: Fiscal balance contributes to economic stability by preventing excessive borrowing. Excessive borrowing can lead to inflation, reduced purchasing power, and economic instability.

- Lower Interest Rates: A government with a fiscal balance is perceived as creditworthy. This credibility results in lower interest rates on government bonds, subsequently reducing borrowing costs for businesses and individuals. Decreased interest rates promote investment, driving economic growth.

- Preparedness for Emergencies: A fiscal balance allows governments to respond effectively to economic downturns or unexpected emergencies. During crises, governments can implement necessary stimulus measures without worsening the fiscal situation.

- Sustainable Social Programs: A fiscal balance ensures the sustainability of social welfare programs such as healthcare, education, and social security. It prevents financial pressures that might otherwise force reductions in crucial services, safeguarding the welfare of the populace.

- Future Investment: Governments can secure resources for future investments in sectors like infrastructure, technology, and education by avoiding deficits. These investments are essential for fostering long-term economic growth and maintaining competitiveness in the global arena.

Advantages of a Balanced Budget

Understanding the advantages of a balanced budget is vital for informed decision-making, enabling individuals and policymakers to advocate for sound fiscal policies.

Below are the important advantages of a Balanced Budget:

- Economic Stability: A balanced budget ensures economic stability by preventing excessive government borrowing, which could otherwise result in inflation and financial instability. It helps maintain a stable economic environment for businesses and consumers.

- Lower Interest Rates: Governments that maintain a fiscal balance often enjoy lower interest rates. Reduced interest rates promote investment and consumer spending, thereby fueling economic growth.

- Prevention of Inflation: By controlling government spending, a fiscal balance prevents the excessive injection of money into the economy, which can cause inflation. Stable prices are essential for long-term economic health.

- Debt Reduction: A fiscal balance allows governments to allocate funds for paying off existing debts. This reduces the burden on future generations and allows resources to be used for essential public services instead.

- Fiscal Responsibility: Maintaining a fiscal balance enhances investor and consumer confidence. It shows that the government is financially responsible, which fosters a positive economic environment.

- Sustainable Development: This stability and balance enables governments to plan for the long term. It allows for strategic investments in infrastructure, education, and healthcare, promoting sustainable development.

Disadvantages of a Balanced Budget

Understanding the downsides of a balanced budget is crucial in making informed decisions. It helps individuals and policymakers navigate challenges like limited flexibility during economic downturns and constraints on vital public investments, ensuring a balanced approach to fiscal responsibility.

Below are the important disadvantages of a Balanced Budget:

- Limited Government Spending: Governments might have limited options during economic downturns. Strict adherence to a fiscal balance can limit the ability to use deficit spending, a common tool to stimulate economic activity during recessions.

- Reduced Economic Growth: A commitment to a fiscal balance might lead to reduced investments in crucial public sectors like infrastructure and education, hampering long-term economic growth.

- Potential for Austerity Measures: Governments may employ austerity measures to sustain a fiscal balance, potentially resulting in reductions in public spending. These cutbacks often impact social welfare programs, eliciting dissatisfaction among the public.

- Rigid Fiscal Policies: Strong commitment to a balanced budget can result in rigid fiscal plans, making it difficult for governments to respond quickly to changing economic conditions.

- Urgent economic downturns or unforeseen crises may necessitate immediate substantial assistance from the government and holding to a balanced budget may limit the government's ability to respond promptly and efficiently.

- Emergency Challenges: During emergencies, such as natural disasters or pandemics, governments might struggle to allocate necessary resources swiftly if strict adherence to a fiscal balance limits their flexibility.

- Limited Ability to Manage Public Debt: In certain situations, pursuing a balanced budget may result in issues managing public debt. To achieve their financial responsibilities, governments may turn to short-term actions, potentially increasing long-term debt problems.

Balanced Budget vs. Static Budget

The below comparison provides a comprehensive understanding of the differences between a Balanced and Static budget.

| Aspect | Balanced Budget | Static Budget |

|---|---|---|

| Definition | A financial plan where total expenditures match total revenues. Ensures no deficits. | A fixed budget is set in advance, regardless of actual income or expenditure variations. |

| Flexibility | Highly flexible. Can be adjusted based on real-time financial needs and circumstances. | Inflexible. Remains unchanged, even if actual financial situations deviate from projections. |

| Adaptability | Can adapt to economic fluctuations, allowing for adjustments during economic downturns. | Does not adapt. Stays constant, potentially leading to financial imbalances in real scenarios. |

| Purpose | Ensures fiscal responsibility by preventing deficits and managing government/organizational finances effectively | Primarily used for initial planning purposes, it lacks responsiveness to dynamic market changes. |

| Decision Making | Facilitates informed, real-time decision-making based on current financial realities. | This might lead to uninformed decisions due to misalignment with actual income and expenditure data. |

| Usage/Examples | Government budgets, corporate financial planning, ensuring fiscal discipline and stability. | Initial business planning, setting benchmarks, but less practical for adapting to changing markets. |

Applications: Budget Variance Analysis

Budget variance analysis is an important financial management tool used by organizations to assess the differences between actual financial outcomes and the projected figures outlined in the budget.

When the actual figures surpass the planned ones, resulting in higher revenues or lower expenses, it is termed a favorable variance. This scenario indicates that the organization has performed better than expected, showcasing efficient revenue generation or cost-saving measures.

Conversely, when actual revenues fall short or expenses exceed the budgeted amount, it results in a negative variance. Negative variances indicate areas where the company needs to improve, such as enhancing sales strategies or optimizing operational efficiencies.

In the corporate context, achieving a balanced budget often leads to favorable outcomes in budget variance analysis.

A fiscal balance signifies that the organization's financial planning and execution are in harmony, setting the stage for positive variances and indicating effective fiscal management.

Balanced Budget FAQs

A balanced budget happens when a government's total revenues equal its total expenditures for a given period, ensuring that neither a deficit nor a surplus exists.

It signifies fiscal responsibility, debt reduction, economic stability, lower interest rates, and sustainability of social programs.

It prohibits the government from overspending, encouraging fiscal discipline. Exceptions are often made for emergencies or times of war.

A budget surplus is a situation that happens when income exceeds expenses. Whereas in a budget deficit, expenses exceed income.

Everything You Need To Build Your Accounting Skills

To Help You Thrive in the Most Flexible Job in the World.

or Want to Sign up with your social account?