Compound Interest

Learn compounding and its importance to build wealth

What is Compound Interest?

Compound Interest is essentially the money you earn not just on the initial amount you put in (the principal), but also on the interest that accumulates over time. It's like interest on top of interest.

This method of computing interest accelerates the expansion of a total sum more rapidly than simple interest, solely based on the initial principal amount.

Due to the compounding effect, money expands faster, and with more compounding periods, the resulting interest increases correspondingly.

It aims to determine the overall interest accrued over a given duration, factoring in the compounding frequency. It enables investors to gain interest on the initial principal sum and the interest that builds up as time passes.

As a result, there is a rapid increase in the worth of an investment or, when it comes to loans, the outstanding balance.

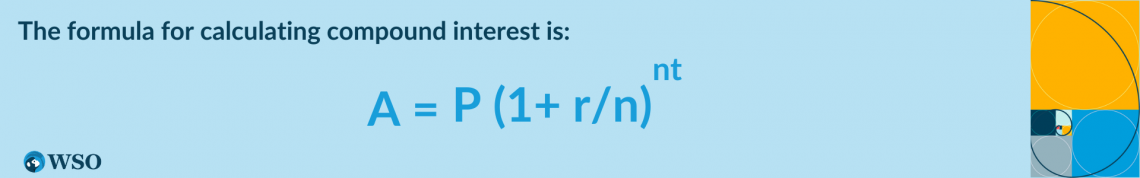

The formula for calculating compound interest is:

A = P(1 + r/n)^(nt)

Where:

- A = the final amount, including interest

- P = the principal amount

- r = the annual interest rate

- n = the number of times the interest is compounded per year

- t = the number of years

Key Takeaways

- Compound Interest is the accumulation of interest not only on the initial principal amount but also on the interest that accumulates over time, leading to accelerated growth.

- Due to compounding, investments grow rapidly over time, with more compounding periods resulting in increased interest. This leads to a significant increase in the overall value of an investment.

- Compound interest has a profound impact on savings, investments, debt management, and financial planning. It allows for the exponential growth of assets and liabilities over time, emphasizing the importance of timely repayments and strategic financial decisions.

Compound Interest - Practical Example

The concept of accumulating interest considerably impacts our day-to-day existence, especially in monetary matters. In individual and corporate fiscal contexts, this principle is often employed to aid people and institutions in expanding their financial assets over an extended period.

1. Investment Example

Imagine placing $10,000 into a deposit account that offers a 5% yearly interest rate, with interest compounded annually. The following demonstrates the progression of your invested funds over time:

| Year 1 | Principal = $10,000 | Interest = 5% of $10,000 = $500 | Total = $10,000 + $500 = $10,500 |

|---|---|---|---|

| Year 2 | Principal = $10,500 | Interest = 5% of $10,000 = $500 | Total = $10,500 + $525 = $11,025 |

| Year 3 | Principal = $11,025 | Interest = 5% of $11,025 = $551.25 | Total = $11,025 + $551.25 = $11,576.25 |

The procedure persists, and a decade later, your original $10,000 contribution would have expanded to around $16,386.16. Moreover, as you allow the funds to remain undisturbed for an extended period, the influence of interest compounding intensifies since the accrued interest generates additional interest.

2. Debt Example

Imagine a credit card with a $5,000 debt and an 18% yearly interest rate compounded monthly. In the absence of further expenses or repayments, this is how your outstanding balance will increase:

| Year 1 | Principal = $5,000 | Interest = (18%/12) of $5,000 = $75 | Total = $5,000 + $75 = $5,075 |

|---|---|---|---|

| Year 2 | Principal = $5,075 | Interest = (18%/12) of $5,075 = $76.13 | Total = $5,075 + $76.13 = $5,151.13 |

| Year 3 | Principal = $5,151.13 | Interest = (18%/12) of $5,151.13 = $77.27 | Total = $5,151.13 + $77.27 = $5,228.40 |

The progression continues, and following one year, your original $5,000 credit card debt would have escalated to around $5,940.12. As evident, the compounding effect can lead to a swift expansion of liabilities, further complicating settling the principal amount.

The Impact of Compounding Interest

The powerful financial concept of compound interest, which enables assets or loans to appreciate more quickly over time, greatly impacts finances and investing plans.

Compound interest works by not only adding interest to the original principal but also to any interest that has accumulated throughout preceding periods. The exponential increase that follows from this ongoing accumulation of interest is very advantageous to investors and borrowers.

It is a tool people can use to grow their savings, retirement funds, and investments in various financial products like stocks, bonds, and mutual funds.

By consistently reinvesting the interest earned, one can witness the remarkable power of compounding, which can significantly boost the overall value of their portfolio in the long run. On the other hand, it is equally important in the context of loans, including credit card debt, student loans, and mortgages.

If timely repayments are not made, the compounding impact can quickly escalate the outstanding debt. Thus borrowers must be aware of this possibility.

Financial organizations and lenders frequently use compound interest to guarantee a consistent cash flow from interest payments. This allows them to extend more credit and offer customers various financial services.

Because interest is essentially generated on both the principal and the interest that has been added to it, this causes exponential growth.

Here are some ways compound interest affects different aspects of finance:

- Savings and investments

- Debt management

- Time value of money

- Financial planning

Compound interest significantly impacts finances and investment, affecting how assets and obligations increase over time. However, it can be used to create money more quickly, control debt more successfully, and make wise financial decisions.

Note

Investors and borrowers can better manage the complexity of personal finance and accomplish their financial goals by comprehending the exponential increase the interest generates.

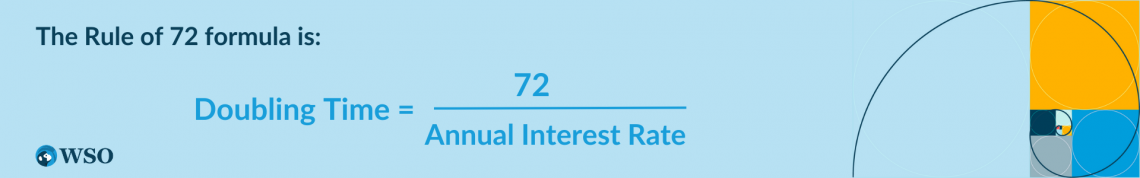

The Rule of 72: Estimating Compound Interest Growth

The Rule of 72 is a handy financial technique that enables investors to estimate the potential growth of their investments quickly. By giving an approximate duration for an investment to double in value, the Rule of 72 aids investors in making better-informed choices regarding their financial plans.

The Rule of 72 formula is:

Doubling time = 72 / Annual Interest Rate

Compound interest, which involves earning interest on the starting principal sum and the interest accumulated over time, underpins Rule 72. This exponential growth can result in significant wealth increases when assets are permitted to grow over extended durations.

To apply the formula, divide 72 by the annual interest rate (expressed as a percentage). The outcome will provide an estimated number of years for your investment to double in value.

For instance, suppose you have an investment with a 6% annual interest rate. To determine how long it would take for this investment to double in value, divide 72 by 6:

Doubling time = 72 / 6

Doubling Time = 12

In this example, the investment would take roughly 12 years to double in value.

It is essential to note that the Rule of 72 is a rough approximation and becomes less accurate with higher interest rates, especially when dealing with very large amounts. Nevertheless, it remains a useful tool for quickly assessing an investment's growth potential.

The Rule of 72 can also be employed in reverse to ascertain the necessary interest rate to reach a specific investment objective. For example, if you know the number of years you have to double your investment, you can calculate the approximate annual interest rate needed:

Annual Interest Rate = 72 / Doubling Time

For example, if you want to double your investment in 9 years, you would need an annual interest rate of:

Annual Interest Rate = 72 / 9

Annual Interest Rate = 8%

In this situation, you would need an annual interest rate of approximately 8% to double your investment in 9 years.

Power of Compounding Periods

The influence of multiplying interest intervals on a financial venture's cumulative expansion is called the "Potency of Compounding Cycles." Besides the primary capital quantity, complex interest is likewise obtained on interest that has amassed over a duration.

The complete sum of interest gained rises with the number of multiplying cycles. Exponential escalation resulting from interest received on a constantly growing amount causes this phenomenon.

Let's explore the differences between various compounding frequencies, such as yearly, quarterly, monthly, and daily:

1. Yearly compounding

When you perform annual compounding, interest is incorporated into the principal following every 12-month cycle.

This signifies the interest accumulated in the initial year is combined with the primary sum, and during the subsequent year, interest is obtained on the updated expanded principal amount. This procedure endures throughout the length of the investment timeframe.

2. Quarterly compounding

When using a method of compounding interest that occurs quarterly, the interest is added to the principal amount every three months or four times within a year.

Following the initial quarter, the interest earned is combined with the principal, and then, in the next quarter, interest is accumulated on the updated and more substantial principal amount.

This cycle persists throughout the investment duration. Due to the more frequent interest compounding, the overall amount of interest earned will be greater than if the compounding was done annually.

3. Monthly compounding

When you compound interest monthly, the core sum accrues interest a dozen times within a single rotation of the Earth around the Sun.

As with other recurrence patterns, the profit accumulated during a given 30-day span is combined with the foundational sum, creating a more sizable quantity to generate revenue.

This process perpetuates throughout the designated investment phase. The outcome of this monthly accumulation method yields superior financial growth when juxtaposed with annual or tri-monthly approaches.

4. Daily compounding

Daily compounding adds interest to the principal every day or 365 times per year (or 366 in a leap year). The interest earned is added to the principal each day, and on the following day, interest is earned on the new, larger principal amount.

Note

Daily compounding continues for the duration of the investment period. It results in the highest total interest earned among the various compounding frequencies.

Relationship Between Compound Interest and Inflation

Inflation embodies the progressive increase in the aggregate pricing of products and amenities within a specific economy over a certain duration.

This occurrence reduces the buying capacity of money, as a steady quantity of funds will ultimately secure fewer items and resources in the future compared to the present.

Conversely, compound interest pertains to the mechanism by which interest accrues on the primary sum and any interest earned beforehand. This approach to computing interest can notably enhance the expansion of investments over an extended period.

When devising long-range financial plans, it is vital to recognize and factor in the interconnection between compound interest and inflation, as it can profoundly affect the genuine value of your fiscal earnings. Inflation can incrementally wear down the buying power of your investment yields, making them less precious in tangible terms.

To protect against this devaluation, investors should strive for a return on investment that exceeds the inflation rate. By achieving this, they can guarantee the conservation and growth of their assets while sustaining their capability to procure products and services at a stable or enhanced pace.

Compound interest can help investors protect their investments from the eroding effects of inflation in several ways:

- Outpacing Inflation

- Reinvesting Interest

- Diversification

- Long- Term Investing

Investors need to grasp the link between compound interest and inflation. Compound interest is a protective measure for investments by generating returns surpassing inflation, reinvesting earned interest, diversifying investment portfolios, and emphasizing long-term investment strategies.

Inflation steadily erodes the buying capacity of currency as time progresses. By considering these elements and implementing appropriate measures, investors can maintain the real value of their investments and achieve their financial goals.

or Want to Sign up with your social account?