Earned Premium

It is the portion of the total premium recognized as revenue

Earned premium is the portion of the total premium recognized as revenue. Insurance is the protection given to individuals or corporations for subject matters by insurance companies. These companies earn their primary income from premium payments.

Insurance policies are essential to safeguard an asset from losing value due to any unprecedented event. The subject matter could be life, health, property, or liability.

The interested party must pay an insurance premium to obtain an insurance contract. The insurance premium is classified as a liability for the seeker and an income for the insurance provider.

The frequency of insurance premiums depends on the contract and could be monthly, quarterly, semi-annually, or annually.

Some insurance contracts demand an upfront payment at the beginning of the contract. The revenue cannot be classified as earned income since the cost is transferred before the insurance coverage begins.

The accrual basis of accounting stipulates a critical accounting principle known as revenue recognition. Under this, revenue should only be recognized once earned.

Receipts can be classified as revenue only once the service or sale is completed. Similarly, the premium would be classified as revenue once earned.

Key Takeaways

- Earned premium is the amount an insurance company earns for the period the contract was active, and a coverage service was provided to the insured.

- It determines the profitability of the insurance companies and is critical to estimate for financial reporting.

- There are several methods for calculating earned premiums, including accounting, pro-rata, and exposure.

- Insurance companies include a minimum earned premium clause so that they earn a portion of the premium even if the contract is canceled or claimed prematurely.

Understanding The Earned Premium

The earned premium is the payment earned when the contract was active and expired. While the remainder of the agreement is active, the premium is considered unearned.

The earned premium is a popular term used in the insurance sector. The profitability of the insurance company can be determined using this key metric.

The service provided by an insurance company is to cover the risk and expenses that could be incurred from any damages or losses to an asset. Once the contract begins, the policy insures the asset, so the premium should be treated as income.

When the premium is demanded upfront, the offered service is not yet delivered to the seeker. Thus, the receipt should be treated as a liability as it was paid in advance. It is unearned revenue.

Separating the earned portion from the total is vital as it is used to determine their income and financial position. Likewise, the unearned premium is treated as a liability, so it must be estimated to compute the liabilities section of the financial statements.

Suppose a car insurance contract has a one-year term that begins on 1st January. When the insurance provider has to compute the earned premium to specify it in their annual financial report, they will proportion the premium received.

The earned premium should be calculated for the January to March duration only. This amount will be reflected in the income statement, while the balance will be reflected in the liability section of the balance sheet.

The policyholder is the party that undertakes the insurance contract and must ensure the premiums are paid. If a default, the insurance policy could be terminated, and the coverage has lapsed.

Earned Vs. Unearned Premium

The paid-up premium can be divided into two categories - earned and unearned. The unearned portion relates to the time remaining in the contract, while the earned amount is for the expired time.

The unearned premium is the portion of the total premium recognized as a liability. There is a possibility that the premium could be returned to the insured. In some companies, the advance is held in a reserve account.

The unearned premium should not be recorded as revenue. This is because the insurance company still needs to provide coverage for its duration. Instead, it should be recorded as a liability.

For example, an individual participates in a one-year home insurance policy with ABC Insurance Company for $500, beginning on 1st January 2024. The client paid the whole premium upfront on 15th December 2023.

Since the contract has not started, the premium is regarded as an advance or pre-paid. The company must record the $500 as a current liability on the balance sheet under the header - unearned premium.

Once the contract begins, the protective service is actively provided for the client. This would convert the unearned portion into earnings for the duration of the contract. The income statement should reflect the earned amount so the liability reduces and income is generated.

Furthermore, the insurer must reimburse the policyholder for the unearned premium if the policy is prematurely terminated. That is the value of the remaining days in the insurance contract.

Let us understand this better with an example. If the individual wishes to terminate the contract after nine months, ABC should repay them with the paid-up premium for three months. Thus, the earned premium is $375 (500 * (9/12)), and the unearned premium is $125 (500 * (3/12)).

| Earned Premium | Unearned Premium |

|---|---|

| Amount relating to the expired part of the contract. | Amount relating to the remaining portion of the contract. |

| Recognized as a revenue. | Recognized as a liability. |

| Upon a claim or premature termination, the amount should not be reimbursed. | Upon a claim or premature termination, the amount should be reimbursed. |

How To Calculate And Account For The Earned Premium

Calculating the earned premium is essential in reporting financial statements for an insurance company. The income statement displays the earned amount, while the unearned premium is shown in the liabilities section.

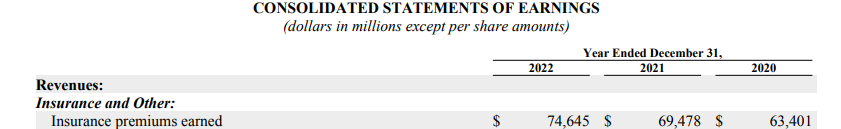

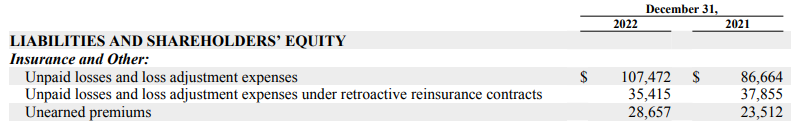

Berkshire Hathaway is a well-known insurance company headquartered in Nebraska, USA. Below is their 2022 Annual Financial Report statement regarding the computation of the earned premiums.

"Premiums are generally earned in proportion to the coverage provided, which in most cases is ratably over the term of the contract with unearned premiums computed on a monthly or daily pro-rata basis."

Below is a snippet of the Income Statement for earned premiums.

Below is a snippet of the Balance Sheet Liabilities section for unearned premiums.

The earned premium can be estimated using the methods listed below.

1. Accounting method - Pro-rata method

It is the most common and straightforward technique to calculate the earned premium. It accurately estimates the premium earned by multiplying the premium amount by the number of days the contract was active, divided by 365.

The duration when the contract was active could be in months as well. In that case, the premium should be multiplied by the number of months divided by 12.

NOTE

If the contract term is over a year, the number of days and months should be estimated correctly.

For example, 35 days have passed since an annual car insurance contract began. The premium paid by the insured was $400. The earned premium for 35 days equals $38 (400 * (35/365)).

If the contract was active for 2 months instead, the earned premium would be $66 (400 * (2/12)).

Even though it's the easiest method, it's likely to be cumbersome if you have to manage this calculation for multiple contracts. In light of this, accounting software has been developed to ease computations.

2. Exposure method

This method aims to determine the level of risk associated with a policy. A policy's value is calculated by analyzing historical data of policies with similar risk exposures.

The premium date is irrelevant in this method, and only the risk exposure is determined for a specific period. It is a tedious procedure that requires more data and judgment.

To finalize the judgment, the risk of loss is estimated. The potential risk is that the subject matter could be damaged, and the insurance company would be liable for reimbursement.

Additionally, the probability and credibility of the insured are inspected. The company would scrutinize whether the insured can pay their premiums timely.

NOTE

We can account for earned premiums based on the payment frequency.

3. Lump-sum premium

The liability account is credited first when the premium is paid at the beginning of the contract. Once the income is earned, the income account gets credited.

For example, an individual signs a six-month contract for a $200 premium commencing on 1st January 2023. The lump sum payment was received on 31st December 2022. The following entry is passed.

| Particulars | Debit ($) | Credit ($) |

|---|---|---|

| Cash A/C | 200 | |

| To Unearned Premium Liability A/C | 200 |

The following entry can be passed after a month, on 1st February 2023.

| Particulars | Debit ($) | Credit ($) |

|---|---|---|

| Unearned Premium Liability A/C | 33* | |

| To Earned Premium A/C | 33* |

* $200 * (1/6) = $33

4. Premiums in installments

There are no specific guidelines stipulating the accounting for installment-based premiums. As premiums are received periodically, insurers create an account for premiums receivable.

This account includes the sum of payable premiums from the insured, regardless of whether it is earned or not. Once the amount is earned, the premium is transferred to the earned account.

For example, an individual signs a one-year auto insurance contract for a $500 premium, payable in quarterly installments, commencing on 1st October 2023. The insured must pay the first installment on the contract date.

On 1st October 2023, the following journal entry will be passed into the insurance company's books.

| Particulars | Debit ($) | Credit ($) |

|---|---|---|

| Cash A/C | 125 | |

| Premium Receivable A/C | 375 | |

| To Unearned Premium Liability A/C | 500 |

On 31st December 2023, the following journal entry will be passed to compute the quarterly results.

| Particulars | Debit ($) | Credit ($) |

|---|---|---|

| Unearned Premium Liability A/C | 125 | |

| To Earned Premium A/C | 125 |

Minimum Earned Premium

An insurance company may also include a clause requiring a minimum earned premium. It is the minimum amount the company would earn when they draw up a policy and is non-refundable.

It is part of the initial premium and is only required if the policy is prematurely terminated. Mainly, companies express the minimum premium amount as a percentage. For example, the percentage can range from 0% to 100% of the premium.

Incorporating this clause into the insurance policy does not affect the terms or duration. The clause only becomes operational when the contract is canceled before the end of the policy term.

For example, an annual auto insurance contract could specify that 25% or $150, out of the total premium of $600, should be retained as the minimum earned premium. Therefore, even if the contract is terminated prematurely, the company keeps $150.

Suppose the $600 premium is paid in monthly installments. Thus, the individual would be required to pay $50 per month. Upon termination, the individual's obligation depends on the months remaining in the contract.

If the contract were canceled after 2 months, the client would receive $450 as he is still obligated to pay $50 more as they have only paid $100 previously.

If the contract were canceled after 3 months, the client would be eligible for a refund of $450 (600 - 150) as they have compensated the company with the minimum earned premium, i.e., $150.

If the contract were canceled after 6 months, the client would have paid the minimum premium already. They have completed their obligation and will only receive a partial refund of $300, which is the unearned amount.

NOTE

Insurance companies commonly include this clause in insurance contracts as it protects them if the client wishes to cancel the contract or the insurance policy is claimed.

Furthermore, each new written policy can cover the minimum costs involved in drafting the policy, such as administrative costs.

The system can also assist them in retaining clients, regardless of whether a client cancels early. The client is thus incentivized to continue with the policy until the minimum premium is paid.

or Want to Sign up with your social account?