Excess Reserves

It is the surplus cash and deposits held by a financial institution.

What Are Excess Reserves?

Excess reserves refer to additional capital reserves that a bank or financial institution holds beyond what is mandated by regulatory authorities, creditors, or internal operational controls.

They are calculated by subtracting the required reserves from the total reserves. Commercial banks measure excess reserves based on the reserve requirement ratios established by central banks.

These required reserve ratios determine the minimum amount of cash a bank is required to maintain in reserve; any additional amount is seen as an excess. Holding these reserves means missing out on the opportunity to invest the funds for potentially greater returns.

They are also known as secondary reserves. A US bank in the Federal Reserve System can temporarily increase its excess reserves by engaging in short-term lending on the federal funds market to another bank lacking the required reserves, usually through overnight loans.

Banks may retain these reserves to simplify upcoming transactions or fulfill contractual clearing balance requirements.

Key Takeaways

- Excess reserves represent the surplus cash and deposits held by a financial institution, such as a commercial bank, which exceed the reserve requirement determined by a regulatory authority like the central bank.

- Excess reserves provide an additional layer of security to the banking system by offering extra liquidity buffers.

- A positive excess reserve occurs when a bank holds reserves exceeding the required level.

- A negative excess reserve arises when a bank holds an amount below the required reserve.

- The Federal Reserve uses interest on these reserves as a tool to regulate the amount of excess reserves held by banks.

Understanding Excess Reserves

Excess reserves refer to the surplus funds held by a bank or financial institution exceeding the minimum reserve mandated by law.

They are like a safety net for banks, serving as a protective measure in case they fail to anticipate the necessity for extra capital in their day-to-day functioning.

They were introduced alongside the incentive called interest on excess reserves, wherein the Federal Reserve rewarded banks with interest on funds exceeding the mandatory reserve levels.

Banks must maintain a minimum reserve to ensure an adequate fund reserve for customer withdrawals under normal conditions. The central bank determines this reserve requirement as a percentage of commercial banks' deposits.

A bank can achieve a higher credit rating by increasing the amount of excess reserves it holds. This comes with the drawback of increased opportunity costs, as the funds held in cash or deposits are not utilized for investments that could yield higher returns, particularly over an extended period.

Interest on Excess Reserves (IOER)

Following the economic downturn of 1837, state laws were enacted, necessitating reserves due to a real estate bubble and problematic banking practices.

Over the years, these criteria evolved to address various financial industry and economic conditions, ultimately contributing to the formulation of monetary policies in the late 20th and early 21st centuries.

After the 2008 Global Financial Crisis, there was a growing consensus to permit the Federal Reserve to pay interest rates to banks on the extra funds they held. Interest on Excess Reserves (IOER) incentivized banks to boost their holdings of easily accessible assets.

The central bank may choose an expansionary monetary strategy by reducing the IOER rate. This is expected to encourage commercial banks to lower their surplus reserves.

History of Excess Reserves in the US

In the US, banking reserves have been around since the 1800s, initially enacted by state laws after a financial crisis in 1837. These reserve requirements evolved to address various economic challenges.

The Financial Services Regulatory Relief Act enabled the Federal Reserve to introduce an interest payment system for banks, marking a significant change.

The Federal Reserve provided funds to banks through Quantitative Easing in the form of reserves, not actual cash.

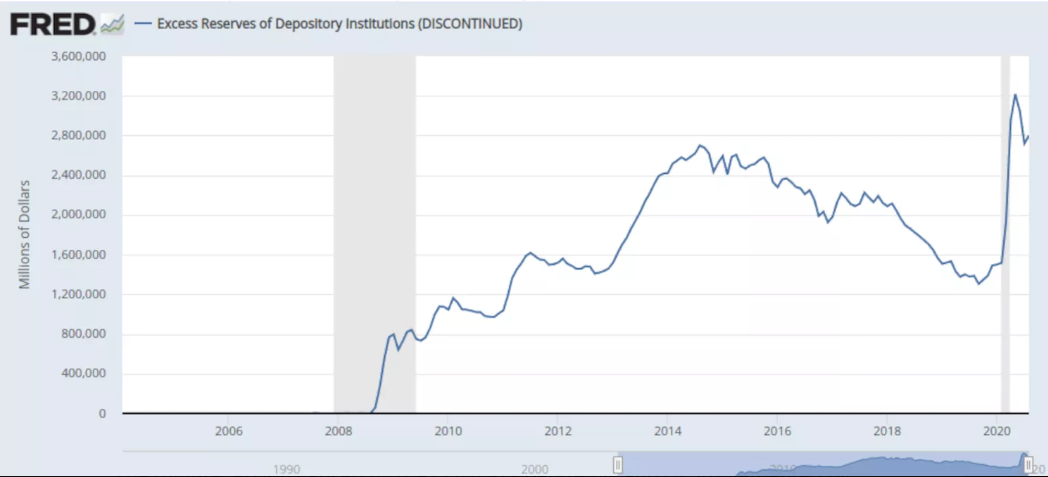

Banks held onto these reserves to earn interest. The chart below shows how reserve balances went up when QE and Interest on Excess Reserves (IOER) were implemented.

Notice the sharp rise in the reserves during the shaded period, indicating a recession when the Federal Reserve implemented quantitative easing.

Even after QE ended in 2014, excess reserves remained high, suggesting that banks continued to take advantage of the interest offered by the Fed on excess reserves.

Factors That Affected Excess Reserve Balances

Excess reserve balances were influenced by various factors, including monetary policy shifts, financial crises, regulatory changes, the interest rate environment, economic conditions, and central bank communication.

- Monetary Policy Shifts: Changes in the monetary policy, such as the introduction of Interest on Excess Reserves (IOER) by the Federal Reserve, played a significant role. This strategy aimed to reduce banks' interest expenses, encouraging them to maintain funds in reserves.

- Financial Crises and Economic Downturns: During financial crises and economic downturns, banks tended to hold excess reserves as a financial buffer instead of extending loans. The injection of funds into the economy through quantitative easing was a response to these crises, impacting banks' decision-making.

- Regulatory Changes: Regulatory adjustments influenced how banks managed their reserves. Meeting required reserves was essential, but banks also considered the financial advantages of holding amounts beyond the mandated minimum, reflecting changes in regulatory frameworks.

- Interest Rate Environment: The interest rate environment was crucial in banks' decisions regarding excess reserves. The interest paid on reserves affected banks' interest expenses and their incentive to hold funds in reserves rather than lending to consumers and businesses.

- Economic Conditions: Strategic reserve management by banks was influenced by prevailing economic conditions. Ensuring liquidity and meeting short-term transactional needs were priorities, especially during periods of economic uncertainty.

- Central Bank Communication: Communication from central banks, including their guidance on monetary policy and economic outlook, impacted banks' decisions regarding excess reserves. Clear communication regarding the central bank's intentions influenced how banks positioned their reserves in response to economic conditions and policy expectations.

Impact on inflation of excess reserve balances

Researchers associated with the Federal Reserve have argued that the provision of interest on reserves contributes to mitigating inflationary pressures.

In a traditional operational framework where the central bank influences interest rates by adjusting reserve levels and does not provide interest on excess reserves, the need to substantially reduce surplus reserves would arise to raise market interest rates.

Currently, when the central bank provides interest on these reserves, it disrupts the connection between the reserve level and the inclination of commercial banks to lend.

This setup enables the central bank to elevate market interest rates by adjusting the interest rate on reserves without altering the reserve quantity. Consequently, this approach diminishes lending expansion and moderates economic activity.

Economist Eugene Fama, a recipient of the Nobel Prize, argues that implementing interest payments on reserves has, in practice, augmented the availability of short-term debt.

According to standard principles of supply and demand, this increase in the supply of short-term debt should theoretically elevate bond yields.

How To Calculate Excess Reserves?

The following steps can be used for calculating excess reserves:

To compute the mandated reserves accurately, apply the following formula:

Minimum Requirement = (The Rate of Minimum Requirement) x (The Total Amount subject to the rate)

Determine the funds maintained by the bank in accordance with statutory reserve mandates. Aggregate the total of all deposits made during the year into the reserve account monitored by the regulatory entity.

Compute the difference between the legal reserves determined in the second step and the reserves required calculated in the initial step. Express this mathematically as

Excess Reserves = Legal Reserves (Deposited Amount) – Reserves Required

On Regulation and Excess Reserves: The Case of Basel III

In 1988, the Basel Accords set global rules for how much capital banks should have compared to their risky assets. Supervisors in the US added a simple "leverage ratio," measuring capital against all assets.

Over time, these rules were updated, and in 2013, after the 2007–2009 crisis, Basel III introduced more changes. Big banks now have an extra requirement called the "supplementary leverage ratio," demanding even more capital.

The Basel rules may lead to unintended consequences, particularly with Basel III. The calculation of capital requirements provides banks with an opportunity to enhance their capital ratio.

They can meet the standards by increasing capital, lowering their business and personal loan holdings (which need more capital), and increasing their reserves and US Treasuries (which need less capital).

Before Congress allowed banks to earn interest on reserves, they kept the minimum needed for withdrawals.

During the 2008 crisis, major banks expanded their reserves when interest payments were permitted, driven by rules on required money, interest rates, and profit-making strategies.

If banks earn higher interest on extra reserves than alternatives like US Treasuries, they may prefer holding more excess reserves. This allows them to strengthen their capital ratio without adding more capital, especially with the increased Basel III guidelines for capital requirements in large banks.

Before the implementation of Basel III in 2013, large banks like JPMorgan Chase and Goldman Sachs had about $400 billion in excess reserves. By 2015, it reached $1 trillion, with half the increase due to mentioned capital regulations.

Advantages and Disadvantages of Excess Reserves

The following are some of its advantages and disadvantages:

Advantages are:

- These reserves function as a protective measure in times of economic instability. Banks with secondary reserves can withstand unexpected shocks or disruptions in the financial system.

- Maintaining these reserves offers banks extra liquidity, proving vital for overseeing daily activities and fulfilling withdrawal requests from account holders.

- They can be a cushion against unexpected loan losses or sudden deposit withdrawal increases. This function helps banks maintain a stable financial position and prevents potential insolvency.

- Banks with these reserves are less dependent on short-term interbank borrowing, reducing the risks of interbank lending rate fluctuations.

Disadvantages are:

- Banks generally earn less interest on excess reserves than investing those funds in higher-yielding assets, which may reduce overall profitability for banks.

- These reserves represent an opportunity cost for banks. Instead of earning returns through loans or investments, the funds are held in low-earning reserve accounts.

- Having reserves exceeding the stipulated requirement suggests that the funds are inactive, which is considered unfavorable. These resources could have been employed for productive investments or issued as loans.

- Central banks may implement negative interest rates on these reserves to encourage banks to lend rather than keep funds. This can affect the overall financial system and affect bank behavior.

Excess Reserves vs Required Reserves

Let’s understand how both of them differ:

| Feature | Excess Reserves | Required Reserves |

|---|---|---|

| Definition | The reserves held by a bank which are more than the required | The minimum reserves that a bank is required to hold. |

| Source | From deposits exceeding the reserve requirements or borrowing from the central bank. | Primarily from customer deposits and certain other liabilities. |

| Purpose | Acts as a buffer for unexpected withdrawals and provides liquidity. | Ensures that banks have a minimum level of reserves to maintain stability in the financial system. |

| Availability for Lending | Can be used by the bank to make loans and investments. | Generally not available for lending; reserved for regulatory compliance. |

| Relationship to Free Reserves | Free reserves are part of them, excluding reserves borrowed from the central bank. | Free reserves are not part of them. |

| Impact on Money Supply | Impact it by affecting a bank's ability to make loans. | Impact it indirectly by affecting the bank's lending capacity. |

Free Reserves

Free reserves are the portion of excess reserves excluding reserves borrowed from the central bank.

Free Reserves = Excess Reserves - Borrowed Reserves

It represents the amount a bank can lend to businesses and individuals.

An increase in free reserves implies a higher credit availability, resulting in reduced financing costs for businesses and individuals. An increase in free reserves may lead to inflation as it provides more money supply in the economy.

Excess Reserve FAQs

The surplus reserve ratio evaluates the proportion of a bank's additional reserves in relation to its overall deposits. This is computed by dividing the additional reserves by the total deposits.

Banks maintain these reserves to address unforeseen withdrawal requests, navigate liquidity risks, and ensure they possess ample funds to meet daily operational requirements.

Central banks can impact them through open market operations, adjusting the reserve requirements, and setting interest rates on reserves.

They are computed by subtracting the required reserves from the total reserves.

or Want to Sign up with your social account?