PIK Loan

A debt structure that allows a borrower to defer interest payments to the lender conditional on the remaining interest balance being accrued until the bond matures.

What Is Payment-In-Kind (PIK)?

A PIK loan, payment-in-kind debt, or a PIK toggle note is a debt structure that allows a borrower to defer interest payments to the lender conditional on the remaining interest balance being accrued until the bond matures.

Hence, the debt instrument is structured so that the deferred interest is rolled up, or deferred to the future, until maturity. Such debt allows borrowers to push interest payments into the future if they choose to do so. Usually, this type of debt is used to create a favorable buyout situation.

Payment-in-kind debt is structured such that the borrower can avoid accruing unpaid interest payments by compensating the lender with more securities or debt obligations. This means that the borrower promises to pay the interest to the lender later but with a higher return.

Therefore, payment-in-kind notes allow the borrower to pay the interest "in kind" by adding the unpaid amounts onto the principal of the loan. Effectively, debt is being delayed, and the borrower, in compensation to the lender, accepts a larger debt.

The "balloon payment," or a lump-sum payment, to be paid by the borrower at maturity continuously compounds if interest payments are made with more debt obligations. Hence, such notes can create attractive yields for investors as long as the borrower does not default.

Usually, for most loan structures, if a borrower is unable to meet a scheduled payment in full, they are considered to have automatically defaulted. However, this is not the case with PIK debt, as the payments can be deferred up to and until the maturity date.

Due to the flexibility in deferring payments, PIK debt is much riskier and is, thus, offered at much higher interest rates by lenders to compensate. Lenders can use such debt to take on more risk, leading to more lucrative returns compared to traditional financing.

PIK debt is a type of mezzanine financing, meaning it is a hybrid of debt and equity financing. Such debt sits between senior debt and equity (common shares) in payment priority.

Key Takeaways

- A PIK loan allows borrowers to defer interest payments to the lender, with the interest balance being accrued until the loan matures.

- Payment-in-kind debt enables borrowers to push interest payments into the future and pay them "in kind" by adding the unpaid amounts onto the principal of the loan.

- PIK loans are considered riskier and are offered at higher interest rates due to the flexibility in deferring payments and the potential for increased debt obligations.

- PIK loans have been used in various real-life scenarios, such as funding acquisitions, providing dividends to owners, and compensating private equity investors.

- Analyzing the volume of PIK deals can provide insights into market sentiment and indicate investor appetite for higher-risk investments. However, increased PIK activity may also signal an overheating credit market.

PIK Loan History

The idea behind payment-in-kind debt goes back to the days when there was a lack of a monetary currency or exchange method for humans to compensate each other for the purchase of goods or services.

Therefore, without a way to quickly compensate the other party, payment in kind was common. To understand, imagine that a farmer works hard all day to grow crops, compensated for his effort with food and a house for his family by his landlord.

In such a scenario, the landlord has not given the farmer money but a payment in a different form. From the farmers' perspective, they are being compensated for their efforts with something that they find valuable.

Today, payment-in-kind compensation is much less common because there are now many currencies with clear values. However, it is still used to this day.

For instance, a plumber may be compensated for his time spent fixing some issues in a house with groceries that last for a few days. As you can imagine, such compensation is up for negotiation, as parties value the same things differently based on their circumstances.

Real-Life Applications of Payment-In-Kind (PIK)

There are many examples where payment-in-kind debt has been used to create value for investors and lenders. This section will highlight some of the cases where such debt has been used to achieve the underlying objective of investors.

Here are a few use cases for payment-in-kind debt:

-

In 2005, the Glazer Family used PIK notes to fund its £790m takeover of Manchester United, an English Premier League football club. The loan amount was borrowed from three U.S. hedge funds.

-

Platinum Equity, a popular private equity firm, backed a rising packaging firm called Husky Technologies, which sold $460m of PIK notes to fund a dividend to its owner. This case shows the vast applicability of payment-in-kind notes.

-

In 2013, a car chassis manufacturer named Chassix completed a $150m PIK payout to Platinum Equity to provide compensation to private-equity investors. Unfortunately, the firm slipped into bankruptcy just two years later.

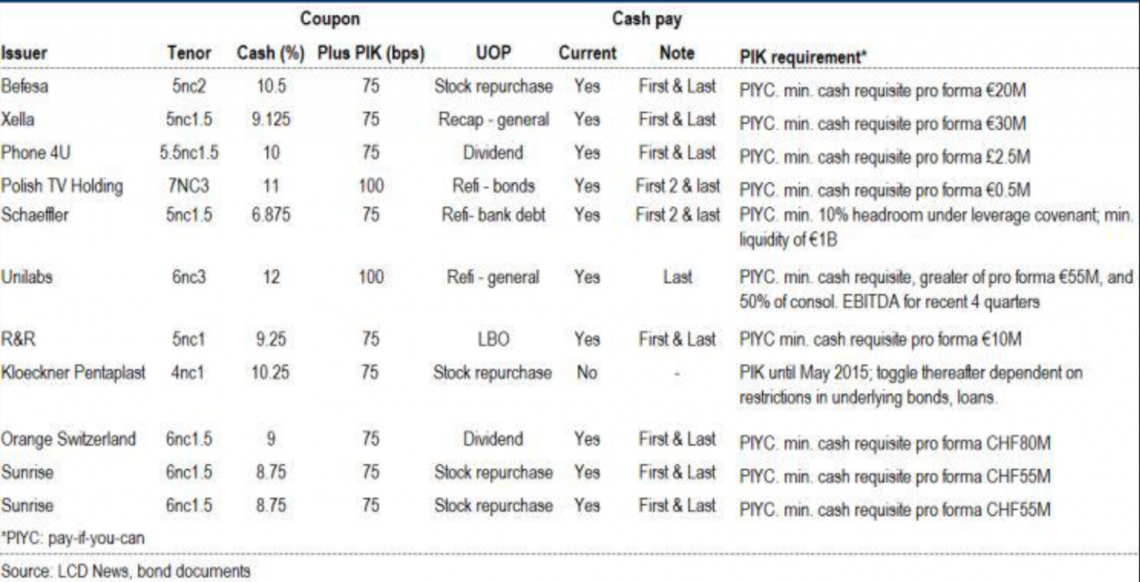

If you are interested in the specifications of some of the payment-in-kind toggle notes, you can refer to the table below, which shows toggle notes issued in Europe during 2012-2013:

The table shows that rates offered on PIK debt are high, except for Schaeffer, which offered 6.875%.

Notice that the structure of a payment-in-kind debt's coupon and cash payments vary significantly from issuer to issuer. This is because lenders attempt to adjust their risk-return metrics as best they can for these complex instruments.

Applying (PIK) Payment-In-Kind Loans to Judge Market Sentiment

One can recognize the market's overall risk sentiment by analyzing the number and volume of PIK deals. Given that such debt is risky, an increase in the volume of PIK notes indicates that the market is filled with yield-hungry investors, a "risk-on" market.

Moreover, a rise in payment-in-kind notes may indicate an overheating credit market, which can help investors make further inferences for informed decision-making.

For instance, an investor may decide to change the risk sentiment of their investments based on the market direction.

A high-inflation environment can cause an increase in payment-in-kind deals because investors are trying to make investments that beat inflation. Thus, investors can use their understanding of the market sentiment to make informed decisions.

Therefore, there is much insight that investors can gain from analyzing the niche PIK market. This knowledge can be applied to the broader credit market to judge the sentiment of the overall credit market.

PIK Loan Example

This section will run through an example that may help illustrate the usefulness and procedure involved with a PIK loan. Assume that you are a new business owner who requires funding to grow your company.

Given that your firm is a startup, you are focusing all your efforts on growth. Therefore, you wish to avoid any and all cash outlays on paying back debt in the immediate to short term, if possible.

Here are the factors associated with your firm:

- You project your firm to grow at a phenomenal rate over the next five years. Thus, you wish to reinvest as much as possible.

- You require financing worth $1m to start and build the infrastructure required to produce profits.

- You consider payment-in-kind debt and approach your lender with your information. Assume that you are a creditworthy individual.

Thus, although you may be eligible for a traditional loan, you like the idea of deferring monthly payments to the future so you can maximize growth.

Hence, the lender offers you a PIK loan at 8% interest for the next five years. The loan has the following characteristics:

- Loan amount: $1,000,000

- Interest: 8%

- Time until maturity: 5 years

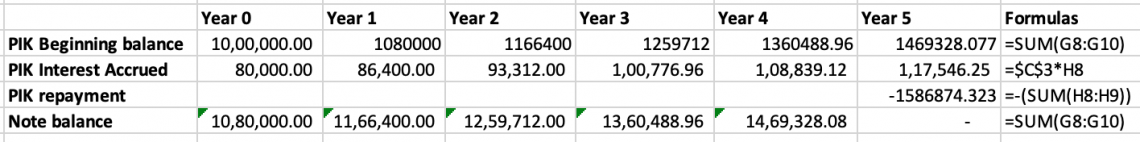

We can use the following excel sheet to show what the repayment of such a loan would look like, given completely deferred interest payments until maturity:

You may refer to the formulas listed for clarification to understand the calculations. Notice that the loan amount paid back at maturity amounts to more than $1.5m.

Hence, the interest's compounding is evident because there is interest being paid on interest due to deferment.

Advantages and Disadvantages of PIK Loans

Lenders and borrowers should be aware of the benefits and drawbacks associated with a debt instrument as complex as a PIK loan. This section serves to highlight these factors.

The table below summarizes the key pros and cons of PIK debt:

| Advantages | Disadvantages |

|---|---|

| Can serve to meet capital requirements for firms in temporarily difficult situations. | A risky instrument for lenders and borrowers. |

| Borrowers can defer payments until maturity at no consequence. | Expensive for borrowers as it is issued at high rates. |

| Terms and structure of debt can be customized heavily to borrowers' needs. | Not easy to refinance. |

| Works well for high-growth firms that are confident in repaying much higher debt in the future for low cash outflows in the immediate to short term. | Availability and loan options are heavily restricted and specialized for the lender's desired risk. |

| Usually available as a loan option for firms that are not eligible for traditional financing. | Large balloon payment at maturity. |

| Firms facing temporary financial difficulties can use the instrument to meet capital needs to alter their course. | Interest payments compound; thus, over time, the debt burden can become substantial. |

The major disadvantage of payment-in-kind debt is that the loan comes at a hefty cost. The structure of the loan is usually associated with high-interest payments, and, given that most borrowers are using such debt defer payments, the interest compounds.

Therefore, the borrower needs to be prepared to meet the hefty lump-sum payment at maturity.

However, such a debt instrument can provide significant value to a specific category of firms that are not eligible for traditional loan options and need quick financing.

For instance, a financially distressed firm can defer interest payments to buy time to recover; this may or may not work out.

Of course, such a move from the borrowing firm creates difficulty, as the firm is creating more liability. Hence, usually, the borrowing firm is unable to meet its obligations, especially at maturity.

Even so, a borrower can negotiate with a lender based on their financial situation to set out favorable terms for the debt amount, reducing their chance of default.

or Want to Sign up with your social account?