High Net Worth Individual (HNWI)

Investor whose investable wealth or liquid assets exceed a certain amount

What is a High-Net-Worth Individual (HNWI)?

A high-net-worth individual is used in the financial industry to define an investor whose investable wealth or liquid assets exceed a certain amount. Generally, any individual with 1 million dollars in investable wealth or liquid assets is conceded a HNWI.

Investable wealth or liquid assets are cash or assets that an individual can easily convert into cash. This excludes the individual primary residence and any collectible assets like art pieces and antiques.

This means an individual should have at least 1 million dollars in cash or liquid marketable assets like stocks and bonds to be categorized as HNWI. In other words, HNWI has at least 1 million dollars in disposable assets, which they can use for investment purposes.

In most cases, HNWIs are mostly successful business people, entrepreneurs, successful investors, and even successful professionals like highly qualified doctors and lawyers or even individuals from any executive level of any big company like the CEO, Chairman, and Board of Directors.

HNWI primarily uses private wealth managers to manage their investments and task them with growing their wealth. They are given special banking and other financial services perks compared to general and affluent investors.

Affluent investors are those individuals who have more than $100,000 but less than $1,000,000 in investable wealth.

Key Takeaways

- High-net-worth individuals or HNWI is a designation given to individuals with a minimum investable wealth of 1 million dollars.

- An HNWI should have 1 million dollars in investable wealth or liquid assets that can be used for investment purposes.

- HNWI uses private wealth managers and gets special banking and financial services perks, allowing them to access exclusive and unique investment opportunities.

Types of High-Net-Worth Individuals

Individuals with more than 1 million dollars in investable assets are classified as HNWI. However, there are further divisions based on the value of their assets in this classification.

HNWIs are further divided into three categories.

- Individuals with inevitable assets valued between 1 million and 5 million dollars are categorized as high-net-worth individuals or HNWIs.

- Individuals with inevitable assets valued between 5 million and 30 million dollars are categorized as high-net-worth individuals or VHNWIs.

- Individuals with inevitable assets valued over 30 million dollars are categorized as Ultra-High-Net-Worth Individuals or UHNWIs.

The classifications above are broad divisions of HNWIs based on their wealth. There is no legal definition of VHNWIs and UHNWIs. Financial institutions mostly give these definitions to classify their client base based on their investable wealth.

Financial institutions may have different criteria for determining who qualifies as very high-net-worth individuals VHNWIs or ultra high-net-worth individuals UHNWIs.

High-Net-Worth Individual Privileges

Being a high-net-worth individual provides an individual with a wide set of benefits from banking and financial institutions. These benefits range from low interest on credit to special private investment opportunities.

Banking Benefits

An HNWI gets special treatment and perks when they do banking. These perks can be as little as 24/7 customer support to higher credit limits and personal financial advisers. HNWIs receive more attentive customer service in case of any problems.

They also get low-interest rate loans, and in most cases, they also have pre-approved loans. In case they need more credit lines for their venture, they can have it fast-tracked. Some UHNWIs also get a personal handler from the bank, who is available 24/7 to fulfill any client request.

Investment Benefits

It is the investment benefits that a high-net-worth individual gets that separates them from other investors. They get access to pre-IPO and private equity markets, and they can access the start-up funding market and other closed-off investment vehicles.

They also get access to top-performing VCs and private equity firms as, in most cases, these funds have minimum investment criteria, which can start from millions. They also have private wealth managers who manage all their investments.

High-Net-Worth Individual Challenges

Although being an HNWI has benefits, they also face many challenges that a regular investor might not face.

Regulatory Challenges

High-net-worth individuals face higher regulatory scrutiny due to their wealth and access to mostly unregulated private investment vehicles.

In the US, the SEC requires all registered investment advisers to report how many of their clients are HNWI in form ADV, and banks are also legally required to report on their clients if they see any unusual activity.

Operational Risk

As these wealthy individuals primarily invest in high-risk, high-growth private investment opportunities, they are also exposed to higher and more sophisticated levels of fraud or theft than regular investors who invest primarily in regulated markets.

Complexity

As an HNWI has access to more sophisticated investment vehicles, it can be challenging to understand how a particular investment product works due to its complex nature.

Taxation

As HNWI are mostly in higher tax slabs and their investments can be hard to quantify, it creates a situation where they have to spend more on record-keeping than a regular investor. Due to their wealth, they are more likely to be investigated for false taxation.

Statistics About High-Net-Worth Individuals

Let's look at some statistics about high-net-world individuals or HNWIs, which Credit Suisse published in their Global Wealth Report 2022.

The report found that amongst the global population, around 63 million individuals can be classified as high-net world individuals. Of these 63 million individuals, 7.9 million are from the North American region, and 7.2 million belong to the Asia Pacific region.

Europe is home to 5.72 million HNWIs, while the Middle East, Latin America, and Africa are home to 860,000, 590,000, and 190,000 HNWIs, respectively.

Comparing the population distribution of HNWIs based on countries, the USA by far has the largest share of HNWIs of any country, having 24.5 million or around 39.2% of the total global population of HNWIs.

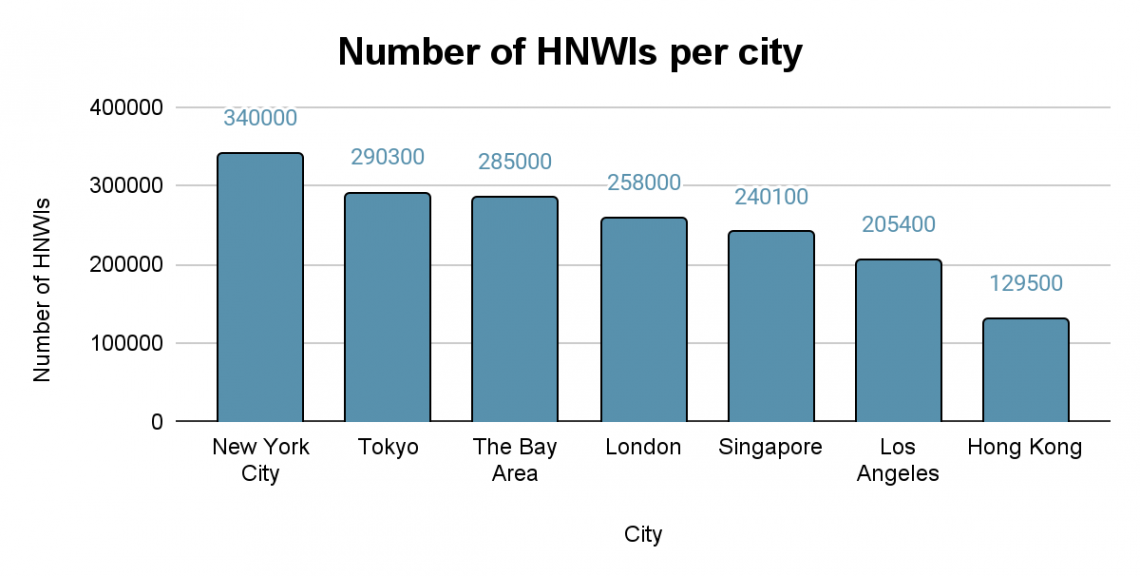

Looking into city-wise distribution, New York City has the most HNWI residences at 340,000, followed by Tokyo at 290,300.

Anyone classified as a high-net-worth individual will want to be in a country that suits their needs and provides adequate wealth protection.

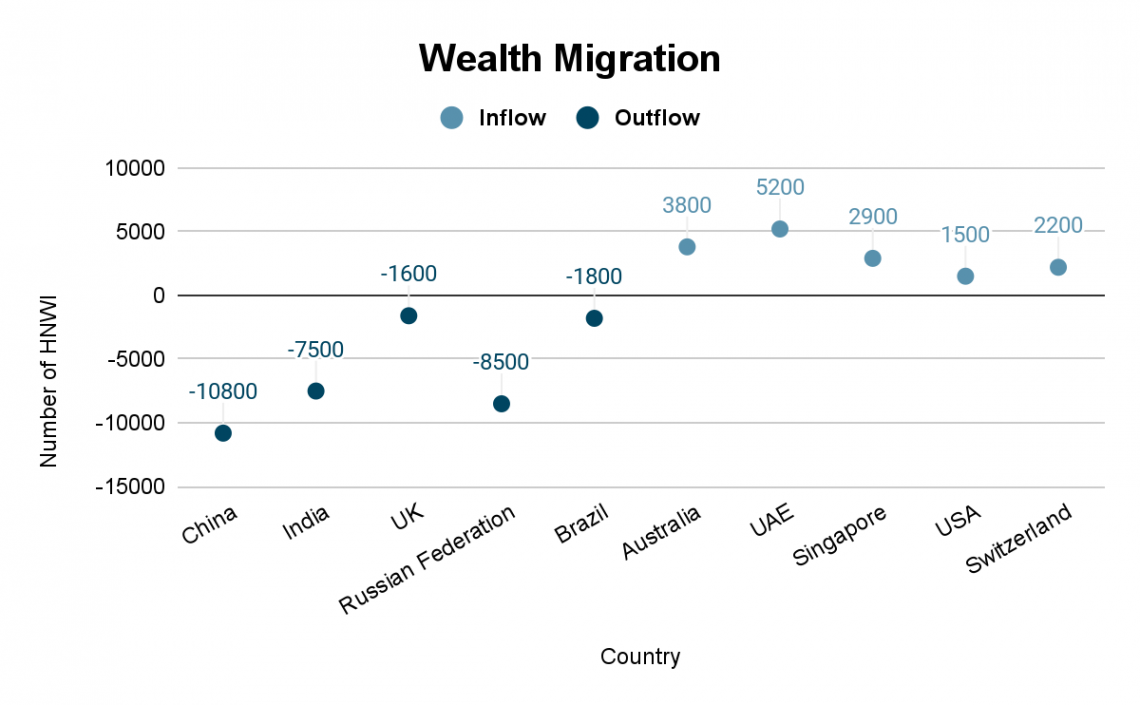

So, if we look at the wealth migration data by Henley & Partners, we can see that China (10,800), India (7,500), and the Russian Federation (8,500) had the largest HNWI outflow in 2022

Australia and the USA had the largest flow of HNWIs in 2022, attracting 3800 and 5200, respectively.

High-Net-Worth Individual (HNWI) FAQs

Any investors with at least 1 million dollars in investable or liquid assets are categorized as high-net-worth individuals.

There are various benefits that an HNWI enjoys while doing their banking and investment activities. They get special and exclusive services from banks like 27/7 personal customer service, private investment advice, per-approved loans, or low-interest loans, to name a few.

In the investment and finance world, a High-net-worth individual gets exclusive access to private investment vehicles, pre-IPO offerings, and some of the more complex investment strategies offered by large hedge funds and private equity.

HNWIs are divided into three categories based on their investable and liquid assets.

- Individuals with inevitable assets valued between 1 million and 5 million dollars are categorized as High-net-worth individuals or HNWIs.

- Individuals with inevitable assets valued between 5 million and 30 million dollars are categorized as Very High-net-worth individuals or VHNWIs.

- Individuals with inevitable assets valued over 30 million dollars are categorized as Ultra High-net-worth individuals or UHNWIs.

To calculate a person's wealth, subtract total liabilities from total assets.

Total liabilities will include all loans and obligations that the individual must pay. In contrast, total assets comprise all investments, savings, cash deposits, and equity in the individual's home, automobile, or other comparable assets.

As per data, the best way to become HNWI is to be a successful businessman or entrepreneur. But there are other ways by which one can grow their wealth and have a shot at being part of the HNWI category.

First, one has to achieve a stable source of income; working in a certified profession, such as a doctor or lawyer, will provide higher-than-average salaries.

Regardless of the field, achieving a higher managerial post in a successful company can also speed up achieving that 1 million dollar mark.

It is most important to know that one’s income is the most incredible tool for building wealth and being able to pay off debt.

Another important step in growing your wealth is saving and strategic investing. Doing this increases their chances of growing their wealth while simultaneously creating a reserve.

Next, one must carefully manage their debt. Debt is a powerful tool in wealth creation if used and managed properly.

Not everyone can achieve that 1 million dollar cut-off, but by doing these necessary steps, one can establish a secure future for themselves.

Everything You Need To Understand How PE Deals Work

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

or Want to Sign up with your social account?