How Much Money the Government Collects in Taxes

Taxes are mandatory contributions we make to the government yearly for various things collected annually or quarterly.

How Does the Government Make Money?

It is no secret that the United States Government rakes in a lot of money over one fiscal year. About 90% of all revenues the government takes in are tax-related. This is a big deal, as these taxes mostly come from the state or local level.

No matter where the taxes come from, it is a requirement you have to pay. You can get in trouble federally for avoiding paying your taxes.

Taxes are imperative, as much as they are annoying. They provide a big revenue boost for the government and allow our country to function in a specific way.

People will always complain about taxes, as nobody wants to give up any portion of their deserved money. In terms of a whole financial system, multiple people must play their parts to keep it afloat.

There are many different streams of revenue from a tax standpoint for the United States government, many of which we will get into today.

Key Takeaways

- The aftermath of the years before the pandemic remains to be seen, as we are still slowly coming out of the depths of it, and it can take years to readjust as a society.

- The idea of revenue growth, especially from the government's perspective, is evident as the economy returns to normalcy. No country or government within one wants periods of sustained economic loss, as the goal is always to see a profit.

- Over the years since about 1950, the individual income tax portion has made up about 50% of the government's revenue from taxes. As discussed in disparity, the other half makes up the other half and fluctuates yearly.

- As people make more or lose more money, the individual income tax portion may go up or down slightly, but balancing out the poor and rich seems to stabilize the overall fluctuation yearly.

What are taxes?

It is important to highlight what taxes are, why we need them, and why we even have them.

For those unaware, taxes are mandatory contributions we make to the government every year for various things. These are collected every year or every quarter continually.

The main problem with taxes is that they take away from an individual's revenue out of their control, who needs it more and go to the government, which has more control and needs it less. This is a problem today and has been a problem since the dawn of our country.

The war over taxes declared on Great Britain was one of the main reasons the United States became a country and felt so strongly about choosing to fight for its independence. The war was predicated on taxes being too high for items not deserving.

Taxes are not specific to the United States, as almost every country around the world has them in its way. While they are annoying, the foundational principle of taxes will always be something many people can relate to and their frustration over them.

At the end of the day, before we even think about going down that route, taxes are necessary for specific reasons and are a primary source of revenue for the United States government. In totality, the United States collected over 4.05 trillion in revenues from taxes in 2021 alone.

While many taxes go unnoticed in society, some main ones either collect the most money for the government or take away the most from us. There are multiple types of taxes, all of which generate government revenue.

What Is Income Tax

Income tax, as it is pretty self-explanatory, is a tax one makes on the income in which they earn. This is the largest chunk that we, as consumers, pay in terms of taxes and the government's most significant chunk of revenue.

According to the Tax Policy Center, the income tax chunk amounts to approximately 8 percent of the overall GDP. As one of the government's main goals is to ensure people are employed, there is also a catch to that with their taxable income.

There are different income tax brackets that people can fall into. Subsequently, the more you make, the more you get taxed.

There are also two different brackets, one for single filers and the other for married couples. For the sake of example, the single filers tax bracket is below, but picture the numbers approximately doubled for married couples for reference.

| Taxable Income (Over) | Single Filers (But Not Over) | (%) |

|---|---|---|

| $0 | $9,875 | 10% |

| $9,875 | $40,125 | 12% |

| $40,125 | $85,525 | 22% |

| $85,525 | $163,300 | 24% |

| $163,300 | $207,350 | 32% |

| $207,350 | $518,400 | 35% |

| $518,400 | And Over | 37% |

These tax brackets are adjusted annually, always accounting for inflation. The common concern with these tax brackets that many people have is that the more you make, the more the government taxes away. It is a valid argument and one that deserves to be discussed more.

While individual income taxes make up the majority of the collected funds the government takes in, it is true these taxes can hurt the economy.

The idea that the government is taking money away from people who worked for it and could be spending that money by investing or spending it back into the economy does slow down the economy.

What Is Corporate Income Tax

Corporate Income Tax, which corporations pay on their profits, is another revenue stream for the United States government. It accounts for approximately 7% of the government's overall GDP.

Over the past couple of years, the trend has been downward, as the rise in LLCs and partnerships has ways of getting around some of these taxes.

There is the belief that a business's customers and consumers bear the burden, as they are affected by these taxes as well for the goods they consume.

Some businesses can get around the Corporate Income Tax, or CIT, by being labeled a pass-through business.

Pass-through businesses such as LLCs, partnerships, and sole proprietorships were touched on. This is why many people feel there is a more significant benefit to working for yourself, as you can pass by some of these annoying taxes that bigger corporations have to take on annually.

Instead of paying the Corporate Income Tax, these companies report their income on individual tax returns of the people in charge at their own individual income tax rates within the brackets in which they fall.

What Is Social Insurance

Another way the government collects funds associated with taxes is through social insurance, otherwise known as social security.

The social insurance or security system has been in place since August 14th, 1935, when President Franklin D. Roosevelt signed the Social Security Act to give retirees an income after they retire.

On every single paycheck we make, there is a slight deduction for social security. Think of social security as a giant pool of money, which is then paid back to people when they reach the age of 62 to start collecting back this money.

You must buy into it to reap the benefits of getting paid back later in life.

According to the Social Security Administration, over 65 million Americans filed for social security, totaling over a trillion dollars in benefits for the 2021 year alone. Yet, as the years have gone on, the system's foundation has had its ups and downs.

The problem many people have been talking about for years is the idea of this social security pool running dry.

As more and more people start to retire, along with unstable job market patterns and fewer people paying into the system each year, it may be a short time before we can see the system's downfall as a whole.

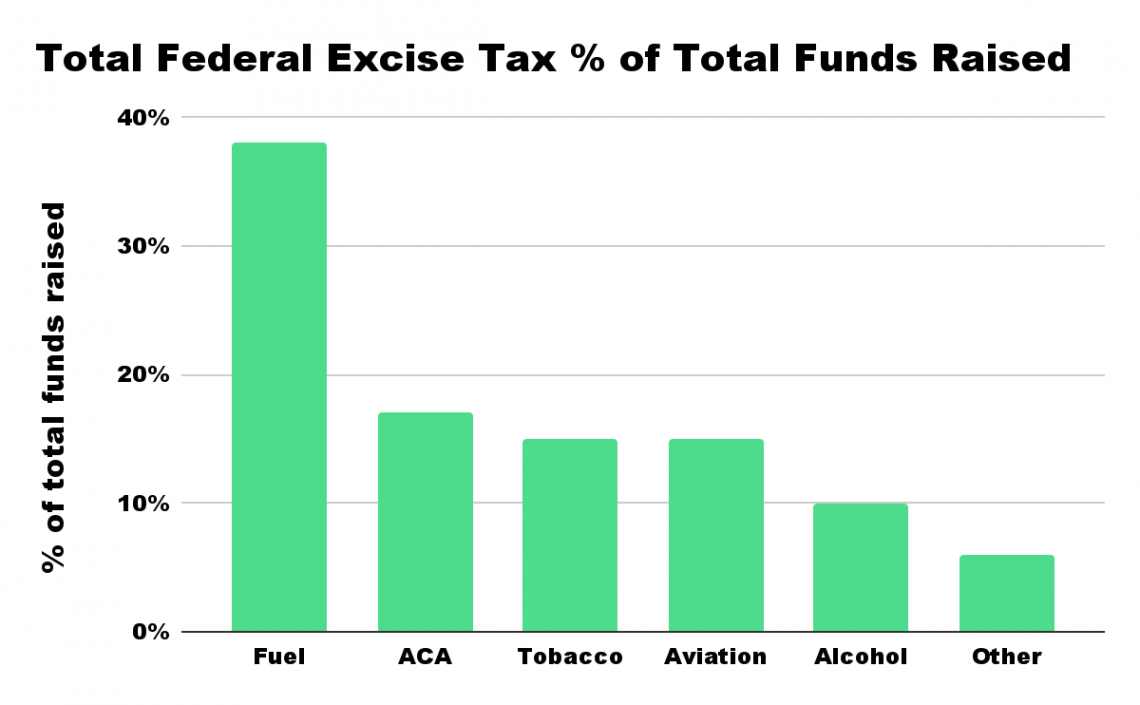

Federal Excise Taxes

Federal Excise Taxes make up a large chunk of collected funds for the government in terms of taxes. The Federal Excise Tax is a tax on various goods, such as tobacco and alcohol, health care insurance, and the medical field, which is usually very high.

The main point of the federal excise tax is to discourage consumers from buying products that could be detrimental to our health. In medicine, it is to discourage us from wanting to resell certain drugs or to provide a premium for the importance of the rarity of certain drugs. The ACA, or Affordable Care Act, accounted for much of this for many years.

Other consumption areas, such as airlines, gasoline, and diesel, are taxable.

Here is a breakdown of the percentage of items most taxed due to the federal excise tax and the revenue the government brings in from imposing this tax every single year.

Federal excise taxes in the year 2020 alone raised $86.8 billion, which accounts for about 2.5% of the overall income tax revenue the government brings in every year.

These numbers have been on the decline over recent years.

While these numbers may seem small for the whole pie, these are large amounts of money at the end of the day, and all play a role in the taxes our government imposes on us.

State and Property Tax

There are taxes people pay for living in certain states or no taxes. If you live in highly populated or demanded places, such as New Jersey or New York, the state tax due to the demand to live there will be higher than in a place like Wyoming, Delaware, or Montana, where the state tax is very minimal.

Likewise, from state to state, you have to pay for the property in which you reside. Places such as New York and New Jersey have imposed a “Millionaire's” tax on any home over a million dollars.

These individual nuances from state to state can get confusing but are important to understand from a tax standpoint if you have any plans to move to one of them any time soon.

Different states have different rules in terms of property and state taxes, but also in terms of income tax as well.

The states that pay higher taxes generally pay higher income taxes. Reversely, some states pay no income tax, which is why people are inclined to move there. The states are

- Wyoming

- Alaska

- Nevada

- Florida

- Tennessee

- New Hampshire

- South Dakota

- Washington,

- Texas.

Other Revenue Sources For The Government

There are other revenues that the United States Government collects every year, such as duties from consumers, gifts, taxes on homes and estates, and other various charges and subsequent fees collected.

According to the TPC, “These sources generated 5.0 percent of federal revenue in 2019. They have ranged between 0.6 and 1.0 percent of GDP since 1965.”

In recent years, the number has been on the high end of that range because of unusually high profits of the Federal Reserve Board related to its efforts to stimulate the economy since 2008.”

This idea makes sense, as the 2008 recession and housing market crash was certainly a time of great downfall, but also good from an upside perspective as those down times are some of the best times to grow your revenue in the previous years.

The same idea goes for the COVID-19 Pandemic, as the labor market was at an all-time low, with very little growth.

The economy needs people to work for it to see results. Like with the income taxes, those would be irrelevant if nobody went to work and made an income.

or Want to Sign up with your social account?