PRAT Model

It describes the maximum growth rate a business can experience

What is the PRAT Model?

The PRAT model describes the maximum growth rate a business can experience without taking on additional debt or decreasing its equity. This model is also known as the sustainable growth rate (SGR) model, with interchangeable terms.

This model aims to help a company grow sustainably and increase its revenues and sales without raising its financial leverage. As a result, companies can avoid being over-leveraged and entering sticky financial situations by ensuring sustainable growth.

Leverage is a general term that refers to a company's borrowing and, more specifically, its amount of debt. Financial leverage refers to borrowing money to finance the purchase of assets in the hopes that the benefits will exceed the costs.

Being over-leveraged indicates that the company has a high debt-to-asset or debt-to-equity ratio. Simply put, it suggests that the company has too much debt.

Similarly, the sustainable growth rate indicates how much growth a company can expect in the future and where it is in its life cycle. By knowing this information, a company can make informed decisions on what sources of finances to use and strategize for the future.

Key Takeaways

- PRAT Model, or Sustainable Growth Rate (SGR), assesses a company's ability to grow without added debt or decreased equity.

- PRAT Model stands for "Profit Margin", which gauges profitability; "Retention Rate" determines retained earnings; "Asset Turnover" measures asset efficiency; "Financial Leverage" evaluates debt usage.

- Companies can use PRAT/SGR to manage operations and make strategic growth decisions, ensuring they don't exceed their growth potential.

- Calculating SGR involves these components: Profit Margin, Retention Rate, Asset Turnover, and Financial Leverage.

Understanding the PRAT Model

This model was developed by Robert C. Higgins, an American professor. It considers four variables to calculate the company's optimal growth rate.

The four variables that form the acronym are:

1. P – Profit Margin

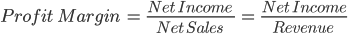

This variable measures the profitability of a company by considering income and revenue. It indicates, as a percentage, how much money is netted on each dollar of revenue. For instance, a 30% profit margin means that for every dollar made, 30 cents arere retained.

Profit margin can be calculated using net income and net sales or revenue.

2. R – Retention Rate

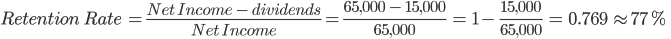

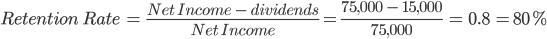

The retention rate also referred to as the retention ratio, is the percentage of net income a company keeps to grow its business rather than paying dividends. It is how much of its profits the company retains.

For instance, a 40% retention rate indicates that the company keeps 40% of profits and pays 60% out as dividends.

The retention rate can be calculated using net income and retained earnings or the dividend payout ratio, which is the percentage of a company's profits paid out to shareholders in the form of dividends.

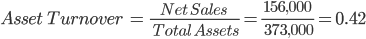

3. A – Asset Turnover

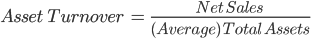

Asset turnover is a ratio that measures how effectively a company uses its assets. It indicates how valuable a company's assets are at generating sales and profits. The higher the ratio, the better. This is because a higher rate demonstrates that a company uses its assets more efficiently.

Asset turnover can be calculated using net sales and average total assets.

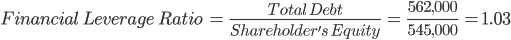

4. T – Financial Leverage

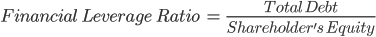

As noted previously, financial leverage is purchasing assets with borrowed debt with the expectation that it will provide a net benefit.

Financial leverage is calculated using total debt and shareholder's equity (SE).

The model also makes some assumptions about the company. These assumptions include:

- The company would like to have a fixed capital structure (no-issuance of equity or borrowing of debt)

- The company retains a specific dividend ratio (keeps a target payout to shareholders)

- The company can increase sales quickly with market conditions in mind

Understanding Sustainable Growth Rate

The sustainable growth rate, often referred to as G, uses two variables to determine the long-term rate of growth a company can expect. First, it can be calculated using historical data and then averaged to determine the company's average growth rate for a predetermined period.

The two variables involved in the calculation of SGR are:

- Retention Rate

- Return on Equity

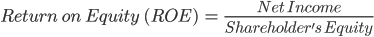

Return on Equity (ROE) measures a company's profitability compared to the equity shareholders have.

A higher ROE is better, as it indicates that a company is more effective and efficient at converting the financing they receive from equity into profits. Having a higher ROE can attract investors.

Return on equity is calculated using net income and shareholder's equity.

Both internal and external stakeholders can use the sustainable growth rate. Internally, it can be used to develop financial goals and objectives concerning financing, dividends, etc.

Externally, this information can help creditors determine how risky it is to lend to a company and the probability of a company defaulting on its loans.

A high SGR can show that a company is focused on growing and investing in research & development (R&D), which can prolong the time it takes a company to repay debt.

Banks and other creditors consider companies with higher growth rates riskier due to the greater earnings volatility, which means they may not have cash left over to make payments.

Since a high growth rate can deter creditors from loaning money, a growing company should look to finance operations by issuing shares.

Interpreting the PRAT and SGR

Using the model can help companies see how well they manage their daily operations, including paying debts and making money. For example, ensuring debts are paid off efficiently can help with having a consistent cash flow.

The model highlights two main categories that are important to the growth of a company: (1) performance (asset turnover and profit margin) and (2) financing decisions (retention rate and financial leverage).

The SGR or PRAT gives a company the optimal growth rate it can sustain with its current operations and financing. This metric should then be compared to their actual growth rate to inform decisions and help the company make a strategic plan.

If a company's actual growth rate exceeds the model or SGR, it must adjust its operations or capital structure to sustain this level of growth.

Some ways the company can do this is to issue equity, increase leverage (take on debt), reduce dividend payouts, and increase the profit margin or asset turnover ratio. However, this is not easy and can be risky for a company.

Issuing equity is very expensive, while borrowing debt requires companies to have collateral. Furthermore, cutting dividend payments can agitate shareholders and drop share prices.

Thus, most companies do not usually grow at a rate greater than their SGR and try to be below it. However, companies also have to ensure that they are not growing at a rate that is too low and risks becoming stagnant.

Generally, companies with high SGRs or PRATs are good at maximizing their sales and managing their operations efficiently, including accounts receivable, accounts payable, and inventory.

Calculating the Sustainable Growth Rate (SGR) or PRAT

While the sustainable growth rate and PRAT use different variables and are calculated differently, they tell the same story. To summarize, sustainable growth rate = PRAT.

This is because both of the equations consider the retention rate. Furthermore, the ROE in the SGR formula represents the profit margin, asset turnover, and financial leverage portion of the formula.

PRAT = Profit Margin (PM) × Retention Rate (RR) × Asset Turnover (AT) × Financial Leverage (FL)

OR

Sustainable Growth Rate (SGR)=Retention Rate (RR) × Return on Equity (ROE)

Let's explore an example that goes through calculating the model or SGR. Note that the numbers used are just for the sake of the example.

ABC Inc. wants to ensure its actual growth rate is not exceeding its SGR because the company does not want to take on more debt or issue equity. As a result, the company's growth rate was 15% in 2021 and 14% in 2022.

Here are some of the company's data to calculate its sustainable growth rate.

| ABC Inc. 2021 (in USD where applicable) | |||

|---|---|---|---|

| Dividends per share | 1.50 | Net Income | 65,000 |

| Shares outstanding | 10,000 | Shareholder's Equity | 545,000 |

| Dividend Payout | 15,000 (1.50 x 10,000) | Return on Equity | 12% |

| Net Income | 65,000 | ||

| Retention Rate | 77% | ||

Sustainable Growth Rate (SGR)=Retention Rate (RR) × Return on Equity (ROE) = 0.77 × 0.12 =0.0924

Therefore, ABC's optimal growth rate is approximately 9% using the SGR formula. This means the company can grow its sales or earnings by 9% in the future without borrowing money or financing growth with equity.

Since the company's actual growth rate is much higher, at 15%, they need to take action by increasing its financing. However, with the current capital structure and level of dividend payouts, the company can't sustain this growth rate.

The following year, ABC Inc. decided to use the model. Here is some of the data they collected.

| ABC Inc. 2022 (in USD where applicable) | |||

|---|---|---|---|

| Dividends per share | 1.50 | Net Sales | 156,000 |

| Shares outstanding | 10,000 | Total Assets | 373,000 |

| Dividend Payout | 15,000 (1.50 x 10,000) | Total Liabilities | 562,000 |

| Net Income | 75,000 | Shareholder's Equity | 545,000 |

PRAT = Profit Margin (PM) × Retention Rate (RR) × Asset Turnover (AT) × Financial Leverage (FL)

= 0.48 × 0.8 ×0.42 ×1.03 = 0.166

Therefore, using the model, ABC's optimal growth rate is approximately 17%, and the company's actual growth rate is 14%.

This is a better growth rate than the previous year as the company is not exceeding its optimal growth rate and can sustain it with its current capital structure and dividend payouts.

FAQs

There is no logical difference between the PRAT and the sustainable growth rate model. They both gauge a company’s optimal growth rate assuming no changes in the financial structure and dividends.

The SGR is calculated by multiplying the retention rate by the return on equity.

It is calculated by multiplying the profit margin, retention rate, asset turnover, and financial leverage together.

There is no definite answer to this, as it’s on a case-by-case basis. High growth rates can be hard to maintain and may worry creditors. However, low growth rates are also worrisome as a company does not want to become stagnant.

Depending on the stage a company is in within its life cycle, it may want to aim for a certain rate. A new company may target a higher growth rate than an established company.

or Want to Sign up with your social account?