Supermajority Voting Provision

It necessitates a vote of more than a majority of shareholders to approve specific corporate activities.

What Is a Supermajority Voting Provision?

A clause known as a supermajority voting provision, which is an addition to a company's corporate charter, specifies that certain corporate activities need far more than a simple majority - often 67% to 90% - of shareholder support to be approved.

In other words, a supermajority voting clause necessitates a vote of more than a majority of shareholders to approve specific corporate activities.

A supermajority clause in a contract specifies that a supermajority vote is required for specific business decisions, in contrast to a mere majority.

The most frequent use of a supermajority provision is in merger and acquisition agreements. For instance, when a target firm considers finalizing a merger, the combination typically requires a supermajority of votes in favor of proceeding.

A supermajority is typically two-thirds of the vote; however, it might change depending on the situation.

Decisions that have the potential to alter the path of a large organization significantly require the support of all (or the majority of) shareholders. A vote with a mere majority could leave too many shareholders feeling dissatisfied.

This is referred to as a "supermajority amendment" at times. Frequently, a company's charter states that actions of this nature must be approved by a majority (greater than 50%).

In politics, a supermajority is regularly employed and is necessary to pass some measures.

Supermajority amendment is sometimes also called a defensive tactic.

- A supermajority voting provision requires a higher threshold of shareholder support, typically between 67% to 90%, for specific corporate decisions compared to a simple majority vote.

- Supermajority clauses are often utilized in merger and acquisition agreements, where major strategic decisions necessitate broader consensus among shareholders.

- Supermajority voting can lead to more robust decision-making processes and significant corporate actions have widespread support that reduces the likelihood of decisions being opposed by a large minority of shareholders.

- Factors such as a company's historical background, shareholding structure, and alignment with shareholder interests should be carefully evaluated when assessing the suitability of a supermajority voting provision for a corporation's governance framework.

How the Supermajority Voting Provision Works

Supermajorities have their origins in the deliberations of jurors in antique Rome. The medieval church eventually adopted the two-thirds supermajority norm for its elections.

The supermajority criterion still applies to choosing a pope, notwithstanding Pope John Paul II's attempt to modify it in 1996.

It is much more challenging to decide and move forward when a supermajority of stakeholders must vote on a corporate issue.

However, those issues that make it through such a heated discussion pass with much more support and may ultimately be more long-lasting, given that more team members favor its success.

At a company's shareholder meeting, votes are normally tallied with a supermajority. Depending on the significance and urgency of the issue up for voting, this may be a yearly meeting or a one-time event during the year.

Supermajority voting may involve more complex procedures and negotiations to secure approval compared to simple majority voting.

Shareholder meetings are often administrative gatherings that adhere to a predetermined structure. A parliamentary process is typically used for the format, with designated blocks of time for each speaker and rules for shareholders who want to make statements.

A corporation secretary, an attorney, or another professional frequently oversees the procedure. The official minutes are taken down when the meeting is over.

A simple majority, which requires 51% of votes to pass, is the reverse of a supermajority. When a supermajority is used and passed, a more significant percentage of shareholders approve of the choice and think it should be carried out.

When a supermajority vote is successful, it can be beneficial; Nevertheless, the contrary is also possible.

A supermajority vote might result in a deadlock where no decision is taken, which would be bad for the business. This is also valid when just one person or a small group owns a sizable portion of the business.

This implies that even while a particular action can be beneficial to the corporation, a person or small group can stop it from happening if they believe it is not in their best interests.

Supermajority vs. Simple Majority

| Comparison Terms | Supermajority | Simple Majority |

|---|---|---|

| Threshold Requirement | Refers to a higher threshold of support, often ranging between 67% to 90% of votes. | Requires a basic majority, typically at least 51% of members present and voting. |

| Usage and Context | Commonly used for significant corporate actions such as mergers, acquisitions, or amendments to corporate bylaws. | Employed for routine decisions or actions that do not have a significant impact on the organization's operations. |

| Significance of Decisions | Governs decisions of substantial importance or those with long-term implications for the organization. | Applicable to decisions that are relatively less significant or routine in nature. |

| Consensus and Dissatisfaction | Facilitates broader consensus among stakeholders and reduces the likelihood of significant dissatisfaction or opposition. | May result in decisions that are opposed by a significant minority, potentially leading to dissatisfaction or contention. |

| Confidence in Decision-Making | Instills higher confidence in decision-making processes, as decisions are supported by a larger portion of shareholders. | Management may have concerns about decisions being opposed by a substantial minority, impacting confidence in decision-making. |

Considerations for a Supermajority Voting Provision

For any company, the way forward is the only way. However, sometimes what restricts this way forward are not outside factors or the economic environment but the owner itself.

Yes! You read that right; Equity shareholders often hurt a company’s growth prospect by not having commercial reasoning backing their votes, which often leads to decisions that are not in line with the company's growth.

Here are a few points to consider while evaluating the Supermajority voting provision.

1. Company’s historical background

What is the company's supermajority voting threshold's history, and when was it put into place? Does it still fulfill the original intent?

Consider that corporations like Tesla, which in some instances require a supermajority vote, have had trouble obtaining enough votes to advance management-supported initiatives like requesting that the business submit a yearly report on its efforts to combat sexual harassment and racial discrimination.

The shareholder representative remarked about the several black Tesla employees in California who have been subjected to racist remarks, unequal treatment, and a lack of concern on the part of the Human Resources Department.

Note

For deep dive, refer to insights shared by ISS Analytics' Kosmas Papadopoulos on corporate governance on July 6, 2019, at the Harvard Law School Forum.

2. Company’s shareholding

Is the business controlled by a select group of stockholders exercising control? Results from prior proxy seasons indicate that, given the requirement for minority shareholder support, controlled corporations may find it more challenging to pass significant proposals.

To guarantee that critical decisions are not made unilaterally by the controlling shareholder(s) based on the shareholding of the controlling corporation, minority investors, nevertheless, may prefer a supermajority voting requirement.

3. What is best in our interest?

Examine if the supermajority requirement is impeding your ability to make future Bylaw or Charter adjustments that may be required.

It may be required to perform a costly investor outreach to secure the requisite votes if the firm has considered updating or modernizing these agreements. Still, the structure of investor ownership will make it challenging.

Conclusion

The supermajority voting provision serves as a crucial mechanism for ensuring broad shareholder support and consensus on significant corporate decisions.

By requiring a higher threshold of approval, typically between 67% to 90% of shareholders, it helps prevent decisions from being made solely based on a simple majority, which may leave a significant portion of shareholders dissatisfied.

This provision fosters stability and confidence in decision-making processes within the organization, ultimately contributing to its long-term success and sustainability.

A supermajority vote reduces the likelihood that many shareholders will be unhappy with the result of a vote.

Understanding the company's voting threshold history and whether it aligns with its original intent is crucial for determining its relevance in the current corporate landscape.

While it aims to ensure broad support for significant corporate actions, it must not impede the company's ability to adapt to changing circumstances or make necessary adjustments to its bylaws or charters.

Careful consideration of these factors can help optimize the use of supermajority voting provisions to promote transparency, accountability, and shareholder value in corporate governance practices.

Supermajority Voting Provision FAQs

A supermajority voting provision, which is an amendment to a company's corporate charter, stipulates that certain corporate operations must get approval from 67% to 90% of shareholders, or more, to be accepted.

The majority vote is typically required for corporate decisions such as executive changes, mergers and acquisitions, and going public.

Supermajority choices are viewed as the best option for the organization in crucial decision-making compared to simple majority despite their difficulties since it requires more people and consideration to reach an agreement.

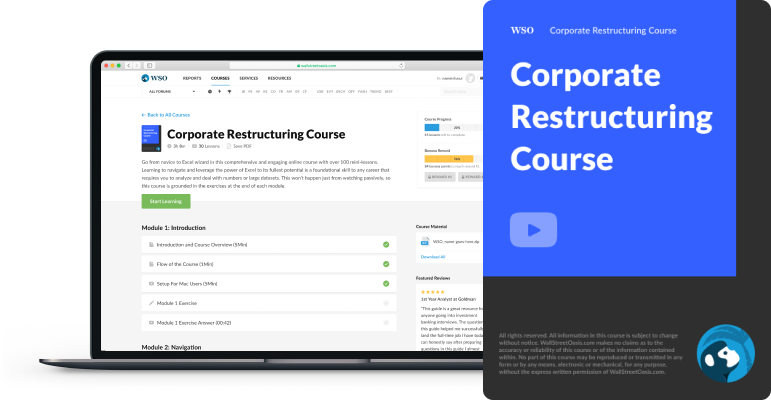

Everything You Need To Understand Restructuring

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?