Diversified Company

A diversified company is one that manages multiple business segments, the majority of which are unrelated to one another.

What Is a Diversified Company?

A diversified company is one that manages multiple business segments, the majority of which are unrelated to one another. Establishing a diverse firm is advantageous since it offers multiple product lines and clientele, protecting the enterprise from business fluctuations and downturns in the economy.

Diversified companies are crucial due to their ability to mitigate risks. By operating in multiple industries or markets, they reduce reliance on a single sector, thus minimizing the impact of market fluctuations, regulatory changes, or economic downturns.

Companies that adopt diversification by offering a broad range of products, services, or operating units have emerged as strategic entities that effectively mitigate risks, enhance competitiveness, and secure their long-term viability.

If one business unit faces a decline, other units can compensate for the losses, providing a buffer against volatility. This risk diversification strategy enhances a company's stability and resilience, enabling it to navigate uncertainties and sustain growth effectively.

Diversification is a strategic decision that requires careful analysis and planning. Diversified companies need to consider the following:

- The benefits and costs of diversifying

- The optimal level and type of diversification

- The potential sources of competitive advantage and value creation

- The best way to manage and integrate their diverse businesses

Diversified companies also need to communicate their vision and goals clearly to their shareholders, employees, customers, and partners.

Key Takeaways

- Diversified companies reduce reliance on a single sector, minimizing the impact of market fluctuations, regulatory changes, or economic downturns.

- Diversified companies can cater to diverse customer needs, capturing a larger market share.

- Diversification creates a balanced and diversified revenue stream, reducing vulnerability to disruptions in specific sectors.

- Diversified companies are key players in the dynamic business landscape. Embracing diversification as a fundamental strategy enables them to adapt to changing market conditions, mitigate risks, and seize new growth avenues.

- Diversification is essential for companies aiming to thrive in today's complex and fast-paced business environment.

Understanding Diversified Companies

Diversified companies possess a competitive edge in the modern business landscape. With their wide range of offerings, they can cater to diverse customer needs, capturing a larger market share.

This adaptability enables them to respond to changing trends and consumer preferences more effectively than their more specialized counterparts.

Additionally, diversification allows companies to leverage synergies among their business units, fostering innovation, knowledge sharing, and operational efficiencies.

Such collaborative efforts enhance their competitive position and open doors to new growth opportunities that may not be accessible to narrowly focused companies.

Investing in different industries or markets creates a balanced and diversified revenue stream. This diversification of income sources reduces vulnerability to disruptions or declines in specific sectors, ensuring a more stable and sustainable financial performance.

Furthermore, diversified companies possess the ability to utilize their knowledge and resources across various sectors to gain an advantage over emerging prospects, making them more flexible in adapting to changing market conditions.

The ability to explore new markets, technologies, and customer segments not only enhances their growth prospects but also safeguards their future viability.

In the present dynamic and interconnected global scenario, diversified companies have emerged as prominent entities in the contemporary business environment.

Their capacity to manage risks, attain a competitive edge, and ensure enduring viability distinguishes them from their more specialized counterparts.

By embracing diversification as a fundamental business strategy, companies can strategically position themselves, adapt to changing market conditions, and seize new avenues for growth.

Why do companies diversify?

Diversification is a strategic decision taken by companies to expand their operations into different markets, industries, or service offerings. Although it comes with inherent risks, it is pursued for various reasons that can ultimately benefit the company.

Let's take a look at why exactly companies decide to diversify below are some listed reasons why a company would choose to diversify.

1. Risk Management

Companies choose this strategy primarily as a means of risk management. By engaging in various industries or markets, companies reduce their vulnerability to risks associated with a single sector.

This approach assists in minimizing the effects of market fluctuations, regulatory modifications, or economic downturns. In the event of a decline in one business unit, other units can offset the losses, thereby offering a safeguard against volatility.

Note

By adopting this strategy of risk reduction, companies enhance their stability and resilience, enabling them to navigate uncertainties and sustain steady growth.

2. Growth Opportunities

Through venturing into different markets or introducing novel product or service lines, companies can tap into previously untapped customer segments, take advantage of emerging trends, and explore fresh avenues for generating revenue.

This approach enables companies to broaden their customer base and decrease dependence on a single market or product, thereby minimizing the risks associated with market saturation or challenges specific to an industry.

Note

Diversifying empowers companies to capitalize on growth opportunities that may be absent in their current markets, fostering expansion and bolstering their market share.

3. Competitive Advantage

Companies strive for diversification to attain a competitive advantage in the market. By providing a broad array of products, services, or business divisions, diversified companies can meet the varied needs of customers, thereby capturing a larger portion of the market.

This versatility equips them with the ability to adapt more efficiently to evolving trends and consumer preferences compared to specialized competitors.

Furthermore, it enables companies to leverage synergies among their diverse business units, promoting innovation, the exchange of knowledge, and operational effectiveness.

These collaborations strengthen their competitive stance by enabling the development of complementary offerings and integrated solutions that set them apart from rivals.

4. Synergy Creation

Diversification plays a vital role in fostering synergies within a company. By engaging in multiple industries or sectors, companies can capitalize on shared resources, technologies, capabilities, and expertise across their various business units.

These synergies can emerge from factors such as economies of scale, shared distribution networks, collaborative research, and development endeavors, or even joint branding and marketing strategies.

The combined knowledge and resources within a diversified company establish a robust foundation for growth, augmenting the overall value of the organization.

Companies opt for this strategic approach for various reasons, as it provides benefits in terms of risk management, growth opportunities, competitive advantage, and the creation of synergies.

It enables companies to mitigate the risks associated with reliance on a single industry or market while opening avenues for expansion into new markets or product lines.

Moreover, it fortifies its competitive position by catering to diverse customer needs and leveraging synergies among its business units.

Note

When implemented effectively, diversification positions companies for long-term success and sustainability in a dynamic and ever-changing business environment.

Examples of successful diversification of companies

Numerous companies have effectively diversified their operations by entering new markets, industries, or product lines.

Here are a few notable instances:

1. Amazon

Originally an online bookstore, Amazon has expanded its offerings into various industries. It diversified its product range and included electronics, home goods, apparel, and more.

After expanding into different product categories, Amazon also entered into cloud computing services with Amazon Web Services, establishing itself as a leading player in the industry.

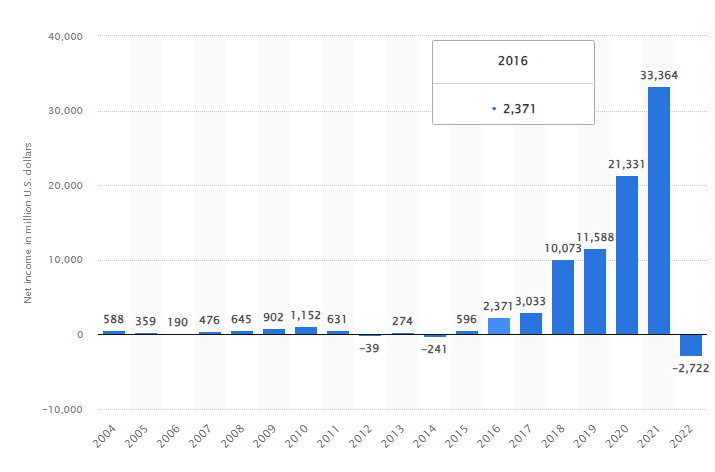

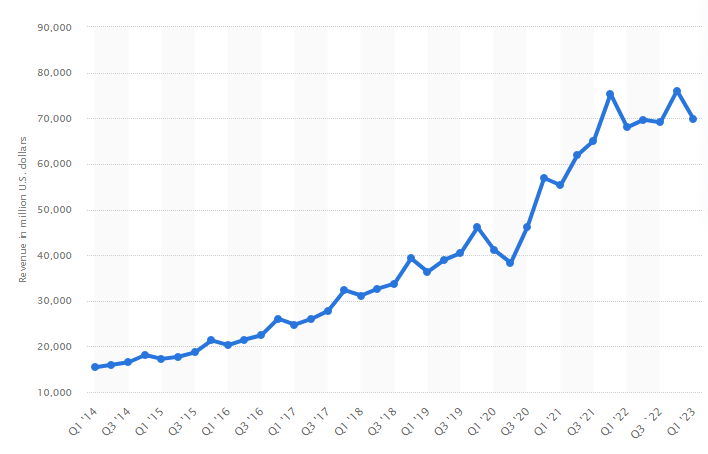

Source: Statistica

The graph shows an increase in annual income of amazon’s annual net income from 2015; one of the reasons may include diversification, and other reasons may include factors such as an increase in sales because of the pandemic.

Through the application of such strategies, Amazon has achieved remarkable growth and established a dominant presence in multiple sectors.

2. Disney

Starting as an animation studio, Disney expanded their portfolio into various entertainment sectors. It opened various theme parks, television networks, movie production, and streaming services.

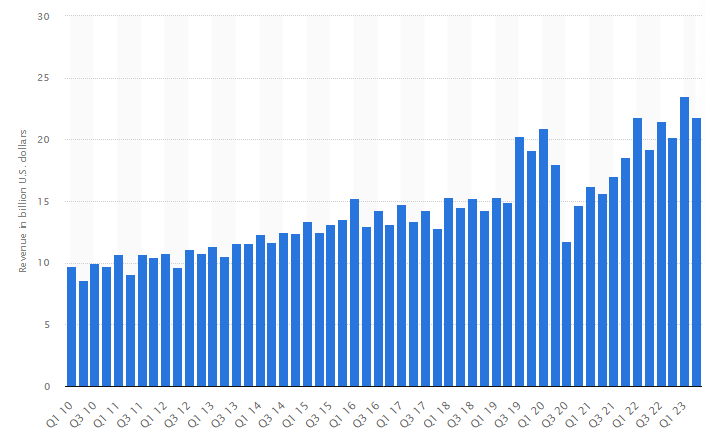

Source: Statistica

The data shows that the company’s revenue has fluctuated over time, depending on the performance of its different segments and the impact of external factors, such as the COVID-19 pandemic. Some of the main trends and insights from the data are:

The company’s revenue reached its highest point in the first quarter of 2023, with 23.51 billion U.S. dollars.

This was mainly driven by the strong growth of its media and entertainment segment, which includes its streaming services, such as Disney+, Hulu, and ESPN+.

The company’s revenue suffered a sharp decline in the third and fourth quarters of 2020, due to the closure of its theme parks, resorts, and cruise lines, as well as the disruption of its film and television production and distribution, because of the COVID-19 pandemic.

The company’s revenue started to recover in 2021 and 2022 as it reopened some of its parks and experiences, resumed some of its film and television activities, and continued to expand its streaming services globally.

Note

The company’s revenue showed a seasonal pattern, with higher revenues in the first and third quarters of each fiscal year, which correspond to the holiday seasons in North America and other regions.

This technique enabled Disney to capture audiences across different platforms and generate revenue from multiple sources, making it one of the most successful and globally recognized entertainment conglomerates.

3. General Electric (GE)

Initially focused on electrical and lighting products, GE increased its portfolio into several industries over time.

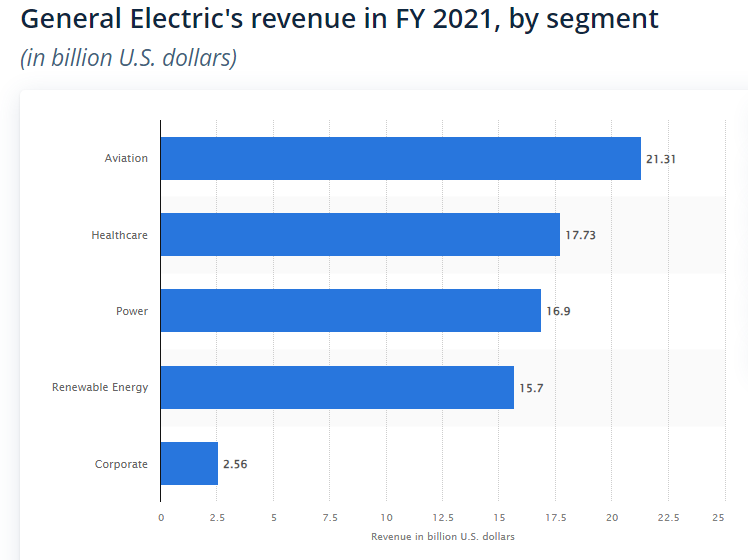

Source: Statistica

GE’s largest product segment by revenue in 2021 was aviation, which accounted for 32% of the total revenue, followed by healthcare with 28%, and power with 18%.

This shows that GE has a strong presence and competitive advantage in the aviation and healthcare sectors, which are expected to grow in the future due to the increasing demand for air travel, medical equipment, and services.

It expanded into aviation, healthcare, renewable energy, and more. GE's expansion allowed it to leverage technological advancements across different sectors, ensuring consistent growth and resilience even during challenging economic periods.

4. Samsung

Originally renowned for consumer electronics, Samsung opened its operations into multiple industries. It expanded into semiconductor manufacturing, display technologies, home appliances, telecommunications, and more.

Source: History of Samsung

By expanding its product portfolio, Samsung became a global leader in multiple sectors, earning a reputation for innovation and quality.

5. Alphabet (Google)

Alphabet, the parent company of Google, successfully expanded its operations beyond its core search engine business. Alphabet has invested in ventures such as autonomous vehicles (Waymo), life sciences (Verily), smart home technology (Nest), and more.

Source: Statistica

Alphabet’s revenue is mainly driven by its Google segment, which accounts for more than 90% of its total revenue. The Google segment includes various products and services such as search, YouTube, Gmail, Google Cloud, Google Play, hardware, and others.

Alphabet’s other bets segment, which includes its non-Google businesses such as Waymo, Verily, Calico, Loon, Wing, and others, has a much smaller revenue share, but has shown a significant growth rate in recent years.

The other bets segment generated $2.38 billion in revenue in 2022, up 46% from 2021. However, the segment also incurred a large operating loss of $4.48 billion in 2022

These examples demonstrate how successful expansion can lead to expanded market reach, revenue increase, and the ability to adapt to changing market dynamics.

Note

It is crucial to acknowledge that such strategies can differ based on a company's objectives, available resources, and market circumstances, and not all attempts at It assure favorable outcomes.

Examples of failed diversification strategy

While diversification can bring substantial advantages, not all attempts have proven successful.

Here are a few notable instances:

1. Kodak

Once a dominant force in the photography industry, Kodak struggled to expand its portfolio amidst the advent of digital disruption. Despite early involvement in digital imaging technologies, the company faced challenges transitioning from traditional film to digital photography.

Kodak's inability to effectively expand its product offerings and adapt to the evolving market landscape ultimately led to its decline and bankruptcy.

Note

If Kodak had adapted and moved its business into the digital photography space, it might have survived the turmoil of the industry.

2. Blockbuster

Blockbuster, a renowned video rental company, failed to seize the opportunity presented by the shift to online streaming and video-on-demand services.

Despite efforts to diversify its business model through online rentals and acquisitions of streaming services, Blockbuster couldn't compete with emerging platforms like Netflix.

By not embracing digital technology and failing to adapt to evolving consumer preferences, Blockbuster succumbed while Netflix emerged as a dominant player in the entertainment industry.

Note

Netflix realized the potential of internet streaming services; if Blockbuster had followed, it would have survived the storm brought by Netflix in the industry.

3. Borders Group

Borders, a prominent bookstore chain, struggled to diversify its operations amidst increasing competition from online retailers like Amazon.

The company attempted to expand into e-commerce and digital content but faced difficulties in executing its diversification strategy effectively.

Borders' failure to adapt to the changing retail landscape and the growing popularity of e-books resulted in bankruptcy and store closures.

4. Nokia

Once a leading mobile phone manufacturer, Nokia failed to anticipate the rise of smartphones and the shift towards touchscreen devices.

Nokia, despite its efforts to broaden its product range and adopt new operating systems, experienced substantial market share loss to rivals such as Apple and Samsung.

The company's sluggish response to evolving consumer preferences and insufficient innovation in the smartphone market caused a decline in its market standing, ultimately leading to the sale of its phone business to Microsoft.

Note

Nokia could have achieved much larger heights because of the market share it controlled, but the inability to keep up with technology became a major reason for its collapse. Had it done that, it would have survived the test of industry.

A simple and general solution would be that companies can adapt to changes by incorporating them into their business model with changing external environments and be flexible in adapting to change.

Failing to accurately assess market dynamics, anticipate shifts in consumer behavior, and execute diversification strategies effectively can lead to missed opportunities and significant setbacks for companies.

Disadvantages of diversification

While diversification may sound like a good idea, it also has some disadvantages that you should be aware of.

Here are some of the main drawbacks of diversification:

- Losing focus and diluting brand identity: Diversifying into too many different businesses or markets can make it hard for a company to maintain a clear and consistent vision, mission, and values. It can also weaken the company’s brand image and reputation among customers and stakeholders.

- Increasing costs and complexity of operations: Diversifying into new businesses or industries can require a lot of resources, such as capital, human, and technological. It can also increase the complexity of managing multiple products, markets, and organizational structures.

- Facing more competition and customer expectations: Diversifying into new businesses or industries can expose a company to more competitors and challenges.

- Losing money or quality due to over-diversification or inferior investments: Diversifying into too many businesses or industries can result in spreading the resources too thin and losing focus on the core competencies. It can also lead to investing in unprofitable or low-quality businesses that may not generate enough returns or value.

- Having unexpected tax complications or political and legal influences: Diversifying into different countries or regions can create tax issues or liabilities for a company. It can also expose the company to different political and legal environments that may affect its operations or profitability.

These are some of the disadvantages of diversifying that one should consider before adopting this strategy.

Summary

In today's expanding business environment, diversification has become essential for mitigating risks, enhancing competitiveness, and ensuring the long-term survival of businesses.

These companies operate in multiple industries or markets, reducing the impact of market fluctuations and economic downturns. They can offset declines in one business unit by gaining in others, thereby maintaining stability and resilience.

Additionally, it creates a well-balanced and varied revenue stream, reducing vulnerability to disruptions in specific sectors.

It enables companies to access untapped growth opportunities and explore new markets, technologies, and customer segments, securing their long-term viability.

However, there have been instances of failed expansion attempts, such as Kodak's struggle to adapt to digital photography and Blockbuster's inability to compete with online streaming platforms.

By embracing diversification strategically, companies can position themselves for success, mitigate risks, and seize new avenues for growth.

Adopting such strategies allows companies to leverage economies of scale by sharing resources, infrastructure, and operational capabilities across different business units.

Streamlining operations and eliminating redundancies contribute to the overall competitiveness of the company.

They possess a competitive advantage in highly contested markets. Their broader market reach helps them withstand competitive pressures, maintain market share, and adapt to changing customer demands more effectively.

Furthermore, adopting such strategies enables companies to strategically balance their portfolio of businesses, products, or services to optimize risk and return.

By allocating resources to different sectors or markets, they can capitalize on high-growth opportunities while mitigating risks in slower-growing or cyclical industries.

or Want to Sign up with your social account?