Harvest Strategy

The business, investing, and marketing decision that involves maximizing short-term cash inflows by a significant reduction in research & development, marketing costs, and other miscellaneous expenses

What Is A Harvest Strategy?

The word "Harvest" or "Harvesting" generally has two to three definitions. And, all of them would amount to the meaning of collecting resources for future use.

Harvesting strategy refers to the business, investing, and marketing decision that involves maximizing short-term cash inflows by a significant reduction in research & development, marketing costs, and other miscellaneous expenses that are depleting the organization's financial resources.

This decision is usually taken to divert the valuable resources elsewhere to a more productive and profitable sector/department. The harvesting strategy is typically used in the case of weak cash cows, question marks, and pets, as defined by the BCG growth-share matrix.

In finance and business, harvesting is an organized practice by which the organization recovers value gained by the entity through the selling of assets or the entire firm as a whole.

The Strategy could be defined as the plan of action. A plan that is designed to achieve the long-term/overall aims of the organization. These collective goals represent the collective soul of the firm.

There are some strategies that an organization can take upon the products and their life cycles.

In marketing, product, and business strategies, the organization can choose to go with the Hold, Build, Harvest, and Divest Strategy, depending upon the performance of the product in the market.

To take these decisions, the management should analyze the product in the light of the BCG Growth-Share Matrix to have a better understanding of the product's growth rate and market share.

The BCG Growth-Share Matrix

The growth-share matrix is a portfolio analysis tool developed to aid management in making decisions related to resource allocation.

This helps a great deal in the analysis of new business startups, acquisitions, downsizing, and divestitures. The matrix is divided into a vertical and horizontal axis into four quadrants.

Each quadrant significantly explains the market and growth position of the organization.

The vertical axis is the Market Growth Rate (MGR) which is stated in the currency units. It reflects the maturity and attractiveness of the industry and market. This axis explains if the product needs cash.

The cash here is for future expansion needs and to answer the competitive forces with a sound strategy.

The horizontal axis is for the Relative Market Share (RMS), which shows the competitive position in the market. Market share can be calculated by dividing the business unit's market share by the market share of the leading competitor.

The four quadrants include the Pet, Question Mark, Star, and Cash Cow segments.

The pet has low RMS and low MGR. The products or business units in this category are weak competitors in low-growth markets.

The question mark has low RMS and high MGR. Products or business units under this section are weak competitors and poor generators of cash in a high-growth industry.

The cash cows have high RMS but low MGR. Products here are strong competitors and cash generators. They have attractive cash flows. Products under cash cows make the firms enjoy high-profit margins and economies of scale.

Lastly, the Star products have high RMS and high MGR. The star products are strong competitors and high-growth markets. The products are highly profitable. Great and attractive financial statements and cash flows.

The portfolio should have a balance between these four types of products. There shouldn't be too many cash cows and stars, and also not too many question marks and pets.

Understanding The Harvest Strategy

The decision to Harvest is taken to maximize the short-term net cash inflows. Generally, the decision is taken for weak cash cows, question marks, and pets.

Harvesting means zero budgeting for research & development, reducing marketing costs, and not replacing the products and facilities.

The reduction in marketing and R&D costs is made to maximize profits. Implementing the harvesting strategy to a product or product line will help in maximizing profits.

Planning and execution of the harvesting strategy should be done before the end of the product's life cycle. Assuming that every product has its life cycle. A cycle that starts from the idea to warranty and sales services.

When the product is in the "Cash Cow" quadrant, it is safe to say that the product is at the end its life cycle. Making additional investments and pumping funds into marketing at this stage won't be fruitful for the firm.

Thus, decreasing the investments and decreasing the funds in marketing will help the firm save money and maximize profits. In other words, the firm can milk the product to the maximum.

These funds can be used by the firm in the development of new products and different profitable product lines.

There are three important reasons why an organization may employ a harvesting strategy for its product or product lines. But definitely isn't limited to:

- Primarily, the product or product line is considered to be discontinuation. This means that discontinuing a product line will help a great deal in saving costs. Money saved is money earned.

- Secondly, the organization may have identified more important and profitable products or product lines. This will help the firm divert saved resources to this new product line.

- Due to the advent of the latest technology, the product or service is to be considered as obsolete. And the firm needs resources to recalibrate the business process.

Types Of Harvesting Strategies

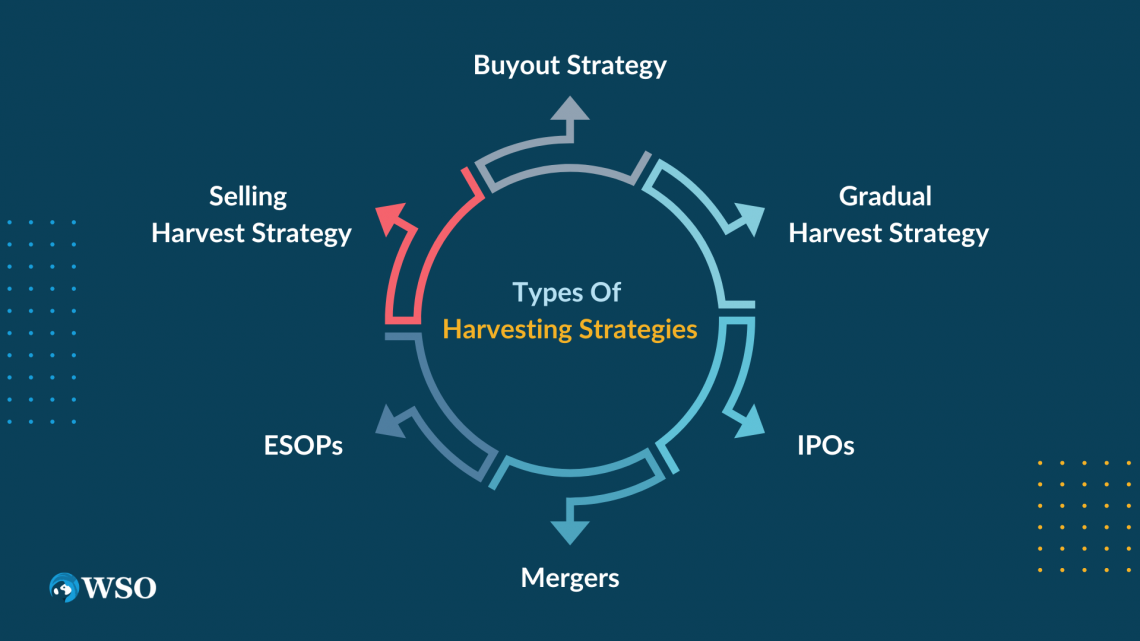

There are several options for the way organizations can utilize the harvesting strategy. Or, can use the following techniques to take advantage of the situation to convert such sinking ships into profitable ones.

The organization may choose the strategy that would fit the need and corporate goals and objectives. Each of the strategies has its benefits and limitations.

1. Selling Harvest Strategy

Often referred to as the "exit strategy" is the selling of the firm or the product or service line to another entity. The business owners may ask for a price, and perhaps parties interested in the acquisition may offer a price.

2. Gradual Harvest Strategy

This strategy involves getting rid of all the expenses and costs associated with the product or service line. This is done to focus more on profitable and growth-oriented product lines. The gradual harvest strategy involves the creation of profits or increasing profits through heavy cutting on costs involved.

3. Buyout Strategy

A buyout is a financial condition involving the acquisition of controlling interests in the targeted company. This involves buying/acquiring more than 50% of the firm itself.

The buyout includes the following types:

- Leveraged Buyout

- Management Buyout

- Management Buy-ing

- Institutional Buyout

- Leveraged Buildup

4. Mergers

A merger is the coming of two different companies together to form a new company to share a synergistic bond to expand its horizon of expertise.

The expansion of reach, market share, and acquisition of resources might be helpful in future long-term growth. Most of the time, a merger is proven to be beneficial and executed to enhance shareholders' value.

Note

Business mergers are of different types. Some of them are conglomerate, congeneric, and vertical.

5. ESOPs

ESOP, also known as an employee stock ownership plan, is a type of employee benefit scheme with an option to have an ownership interest in the firm.

6. IPOs

IPOs, also known as Initial Public Offering the process of offering shares of a private firm to a public firm in a new stock issuance that facilitates the company to raise capital from public investors.

To execute an IPO, the firm has to be listed on the public stock exchange to trade its share publicly.

or Want to Sign up with your social account?