Bond Ratings

It represents the creditworthiness of corporate or government bonds

What are Bond Ratings?

Bond ratings are evaluations of the credit quality and creditworthiness of bonds issued by entities such as corporations, governments, or other institutions.

A bond is essentially a loan from an investor (bondholder) to a borrower, which can be a company, government, or other entities. Bonds are commonly used by investors to diversify their portfolios, providing protection against severe stock market corrections. Thus, a bond rating is a grade assigned to bonds to assess their credit quality.

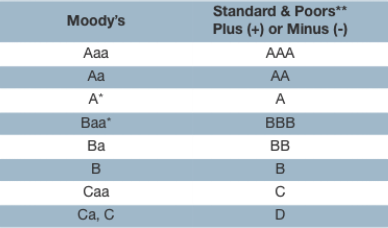

Standard & Poor's and Moody's are independent rating agencies that usually evaluate a bond issuer's financial strength or ability to pay a bond's principal and interest on time. Bond ratings go from the highest grade, "AAA," to the lowest rate, "D."

It is important to note that different rating services use the same letter grades but various combinations of upper and lower case letters and modifiers to differentiate themselves.

Key Takeaways

- Bond ratings indicate the creditworthiness of bond issuers, such as companies or governments. Ratings range from "AAA" (strongest) to "D" (lowest), helping investors gauge risk.

- Independent agencies like Moody's, Standard & Poor's, and Fitch assess bonds based on financial health, influencing interest rates and investor appetite. Ratings impact global capital markets.

- Investment-grade bonds (rated Baa3 or better) are considered safer, while lower-rated bonds ("junk" bonds) offer higher yields but come with higher risk.

- Upgrades and downgrades impact a bond's performance, affecting its attractiveness to investors. Higher ratings lead to lower yields, while downgrades can raise capital costs.

- While bond ratings are valuable indicators, they're based on historical data. Investors should analyze various aspects, such as maturity, interest rates, tax status, and defaults when making investment decisions.

Bond Rating Agencies

Just as individuals have their credit reports and rating issued by rating bureaus, bond issuers are generally evaluated by their rating agencies to assess their creditworthiness. Three major rating agencies evaluate the creditworthiness of bonds:

- Moody's

- Standard & Poor's

- Fitch

It is worth noting that these are not the only firms evaluating debt instruments. However, their evaluation is considered close to accurate and high quality because of their stellar reputation.

These agencies use several metrics to determine their rating score for a specific issuer's bonds. Their opinions of that creditworthiness determine the bond's rating and affect the yield the issuer must pay to attract investors.

Lower-rated bonds generally offer higher yields to compensate for the additional risk investors are exposed to.

How do bond rating work? Rating agencies research the financial health of each bond issuer and then assign ratings to the bonds. Each agency has a similar hierarchy to help investors assess the bond's credit quality compared to other bonds.

| Moody’s | Standard & Poor’s | Fitch |

|---|---|---|

| Aaa | AAA | AAA |

| Aa1 | AA+ | AA+ |

| Aa2 | AA | AA |

| Aa3 | AA- | AA- |

| A1 | A+ | A+ |

| A2 | A | A |

| A3 | A- | A- |

| Baa1 | BBB+ | BBB+ |

| Baa2 | BBB | BBB |

| Baa3 | BBB- | BBB- |

The Aaa (Moody's) and AAA (S&P and Fitch) rating is considered the strongest and highest of all ratings.

- Bonds with a rating of BBB- as known as Baa3 or better are considered "investment-grade."

- Bonds with lower ratings are considered "speculative" and often referred to as "high-yield" or "junk" bonds.

Junk bonds can be further broken down into two categories:

- Fallen Angels: a bond that was once investment grade but has been reduced to junk due to the issuing company's poor credit quality.

- Rising Stars: a bond with an increased rating due to the improving credit quality of the company.

A Rising Star may still be a junk bond, but it's paving its way into becoming one of investment quality.

| Moody’s | Standard & Poor’s | Fitch |

|---|---|---|

| Ba1 | BB+ | BB+ |

| Ba2 | BB | BB |

| Ba3 | BB- | BB- |

| B1 | B+ | B+ |

| B2 | B | B |

| B3 | B- | B- |

| Caa1 | CCC+ | CCC+ |

| Caa2 | CCC | CCC |

| Caa3 | CCC- | CCC- |

| Ca | CC | CC |

These three rating agencies append their ratings with an indicator to show a bond's ranking within a category. Moody's uses a numerical indicator; meanwhile, S&P and Fitch use a plus or minus indicator.

| Moody’s | Standard & Poor’s | Fitch |

|---|---|---|

| C | C | C |

| / | D | D |

Both C and D ratings are considered the weakest of all ratings. However, it is essential to remember that ratings aren't perfect and can't tell whether or not your investment will go up or down in value.

They only provide a basic framework that helps stakeholders identify the risk involved in various investment opportunities.

In your investment selection process, learning about methodologies and criteria used by each agency is not only important but also considered an essential factor.

Importance of Rating Bonds

Bonds are a crucial component of the financial market, providing investors with an avenue for relatively safe investment and organizations with a means to raise capital.

Agencies rating bonds, whether corporate or government bonds, play an important role in credit laws and regulations in the United States and a majority of European countries.

A high rating typically indicates a lower risk of default, making it easier for investors to assess the safety of their investments. Conversely, a lower rating signifies higher risk but might offer a higher return.

Moreover, bond rating is an important process as the rating informs investors about the quality and stability of a bond. A high rating typically indicates a lower risk of default, making it easier for investors to assess the safety of their investments. Conversely, a lower rating signifies higher risk but might offer a higher return.

The rating also influences:

- Interest rates

- Risk appetite

- Bond pricing

As a matter of fact, rating agencies affect global capital markets by assessing investors' securities. Credit ratings remain one of the investors' main sources of information regarding credit analysis and credit risk.

Issuers with higher ratings can often borrow at lower interest rates, reflecting the reduced risk perceived by investors. Conversely, those with lower ratings may face higher borrowing costs.

How are bonds rated?

The rating process is a fairly detailed exercise involving different steps to achieve an appropriate and fair rating. Bond ratings are calculated using processes developed by the rating agencies mentioned before.

A financial institution typically develops ratings based on intrinsic and external influences.

Internal factors consist of the overall financial strength of a bank: it is a risk measure that illustrates the probability of that institution requiring external monetary support.

Thus, the rating depends on the firm's financial statements and the corresponding financial ratios. However, external factors include networks with other involved parties, such as parent corporations or local government agencies.

It is also essential for these parties' credit quality to be assessed and researched, so a comprehensive score can be given.

So how does it work? In the case of a corporate bond issue, these agencies will look at the company's cash flow, growth rate, and current debt load.

Companies with large free cash flow, profits, and few debt obligations will most likely gain higher ratings. For government entities, similar metrics are used, even if the specifics are different.

For example, the US government holds an AAA rating and likely always will, as it is considered extremely unlikely to default on its debt. Default happens when a certain government is not able or does not want to meet its debt payments to concerned creditors.

On the other hand, a municipality will be evaluated based on its current revenue and spending and the overall financial condition of the community concerned.

In addition to raw financial data, these agencies will look at various additional sources of information to provide the rating.

Analysts will usually read through published reports on the financial health of bond issuers and will also interview the management of the concerned company.

Can bond ratings change?

The rating of a specific bond is not a static assessment that sticks with a bond over the course of its life. Instead, when a rating agency raises a bond's rating, this action is identified as an "upgrade."

However, a lowered rating is called a "downgrade."

As a matter of fact, upgrades and downgrades can be key drivers of a bond's performance. This is because rating agencies base their ratings on several factors, one of the most important being the risk of default.

There are also many factors leading to a downgrade:

- A deterioration in the balance sheet of the issuer

- The issuer's declining ability to service its debt

- Deteriorating business conditions

On the other hand, the factors that lead to an upgrade are:

- Improvement in the issuer's balance sheet

- Improving the ability of the issuer to service its debt

- Improving business conditions

It is important to note that the prices of individual bonds respond to both upgrades and downgrades, and more specifically, the anticipation of an upgrade/downgrade.

When a bond is upgraded, investors will be willing to pay a higher price and accept a lower yield. On the contrary, a downgraded bond won't be that attractive to investors.

For example, if Moody's downgrades, it could mean higher capital costs for issuers, a portfolio turnover, and losses for investors.

Sometimes, it could even terminate an issuer's access to capital, possibly leading to default. Moreover, let's not forget that the market often moves ahead of a bond's upgrade or downgrade.

Thus, announcing a rating change won't be that significant on the performance of the bond as the market would have already reacted to the official announcement.

Let us understand it by taking an example of a rating change.

Due to many factors, J.C. Penney's credit rating went deeper into junk territory (from B- to CCC+). This downgrade was based on "continued market share losses and declining EBITDA, with lack of visibility for a material turnaround," analysts said in an emailed report.

Analysts also described Penny's capital structure as "unsustainable over the long-term." They also said that macroeconomic factors would be more challenging for Penney over the years.

But why would someone invest in a bond with a low rating? Bonds would be rated BB or lower by S&P and Ba or Moody's. These lower-rated bonds pay a higher yield to investors, as their buyers get a bigger reward for taking a greater risk.

Analyzing a bond's safety

Bonds can contribute as an element of stability to almost any diversified portfolio: they are safe and add a conservative element to a risky basket of investments.

U.S. Treasury securities (issued by the federal government) are considered to be among the safest types of investments any investor could make, as all treasury securities are backed by the "full faith and credit" of the U.S. government.

Investors usually rely on a bond's ratings to determine its safety. Individual and even institutional investors do not have the needed resources or expertise to accurately perform the analysis required to determine the bond's safety.

Rating a bond allows the investors to easily and quickly identify the issuer's creditworthiness.

What should you look for when buying a bond? Adding bonds to your portfolio can make it more balanced by adding diversification and calming volatility. However, the bond market might still not be familiar enough, even for the most experienced investors.

Thus, there are essential features to look for when considering a bond:

- Maturity

- Tax Status

- Interest Rate Risk

- Default Risk

- Coupon

- Callability

A bond's coupon is the periodic return that an investor will receive for loaning the value of the bond to the borrower. Since investors depend on the ratings of a bond to assess its quality, the yield that a bond pays may also be influenced by the rating.

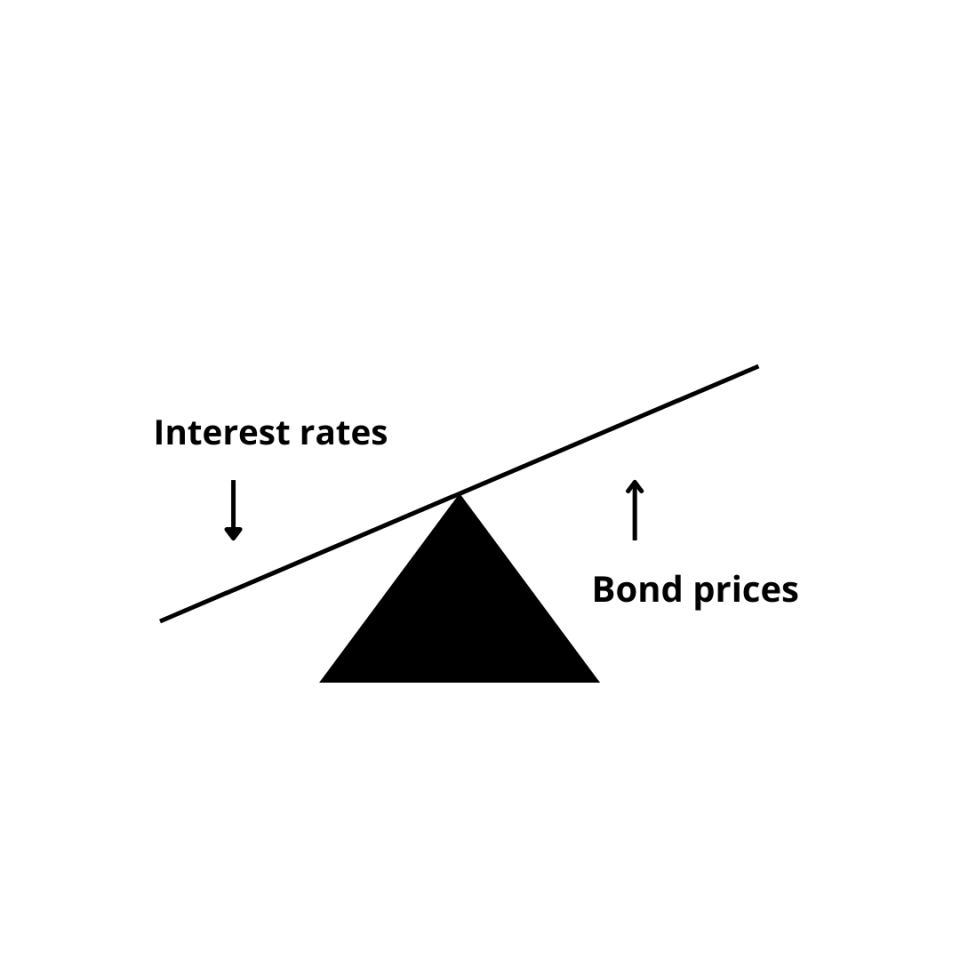

A yield represents the relationship between a bond's current price and its coupon: as market conditions affect a bond's price, its output is also subject to change.

Moreover, the higher the rating grade, such as AAA, AA, etc., the lower will be the interest rate due to the higher level of safety for the investors.

Therefore, we can notice an inverse relationship between the rating of the bond and the interest rates applicable to the financial instrument.

If new bonds are issued with a higher interest rate than those currently in the market, the existing bond's prices will decline as demand for those bonds falls.

Rating agencies and conflicts of interest

All ratings can tell you is the amount of risk confident investors see in an investment. Ratings have been used for over a century, and their application has continuously expanded to newer types of financial securities and contracts.

These agencies produce one of the critical pillars of the financial system. However, the expanded use of ratings has been without difficulties or setbacks.

It is crucial to remember that rating agencies such as Fitch, Moody's, and Standard & Poor's might have a conflict of interest.

The primary concern regarding rating different financial instruments is that these rating agencies derive their revenue from the very same companies they rate.

William Harrington (former senior president at Moody's) claims the organization's senior management interferes with analysts' independent assessments.

He also stated that these agencies suffer from a conflict of interest because they are paid by the banks and companies they are supposed to rate objectively.

Harrington also claims that Moody's uses a long-standing culture of "intimidation and harassment" to convince its analysts to ensure rating matches as wanted by the company's clients.

Moody's and other rating agencies were placed at the heart of the U.S. subprime mortgage crisis because they overrated complex financial products based on worthless mortgages.

When the issuer asks and pays money for a rating agency to evaluate its creditworthiness, a conflict of interest arises. This compensation system leads such agencies to put the investor's interest first, which doesn't sound too ethical.

The flow of money from issuers to rating agencies leads to a conflict of interest between these firms and the users of their information. This is why, in this context, any commercial relationship between raters and clients is potentially significant.

Summary

To summarize, every bond is rated by at least one bond rating company. A bond rating gives investors important information about a bond and its issuer, allowing them to make relevant investment decisions.

In modern-day finance, bond ratings have become an essential component of an investor's checklist while analyzing bonds and other financial instruments.

Nonetheless, there is no way to determine exactly how a bond will perform based solely on its rating because the ratings are primarily based on historical financial data.

Any financial instrument's actual future performance depends on several macroeconomic factors.

Investors must also keep in mind that past performance does not necessarily indicate what the future financial performance or investment returns are going to be. Instead, they merely serve as a data point for analyzing investment instruments.

Researched and Authored by Céline Khattar

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?