Dirty Price

Such a price of a bond is its price which includes any accrued interest based on the coupon payment.

What Is Dirty Price?

The dirty price of a bond is its price which includes any accrued interest based on the coupon payment. It is also known as invoice price or total price. Usually, the price we pay for a bond is its dirty price.

The opposite or the counterpart of dirty price is called clean price. As its name suggests, it is called a “clean” price because it does not include any interest accrued between the coupon payments, contrary to the dirty price.

What does accrued interest mean? When discussing bonds, the amount of interest accumulated since the last coupon payment is called accrued interest. Therefore, a dirty-priced bond includes this interest in calculating bond prices.

To clarify more, coupons get paid periodically and not continuously. That is to say, fixed money is paid at the end of every period. The accrued interest is the amount that should be paid to you at any moment between two interest payment dates.

In other words, if we add all the accrued interest to the clean price of the bond, then we get its invoice price. Hence, the invoice price of a bond is always higher than its clean price. It is equal to the clean price if the last coupon payment was made just now.

This means no interest is accumulated because the interest payment was just made. However, after a day, for example, some interest gets accrued, which makes such a price slightly higher. Over time, accumulated interest increases, and the invoice price will increase.

Although the price we pay to buy a bond is its total price, prices in the market are usually quoted as clean. In other words, when buying bonds, we generally pay for more than what is quoted on financial websites like Bloomberg Terminal or Reuters.

Key takeaways

- The dirty price of a bond is its price which includes any accrued interest since the last coupon payment.

- Accrued interest is the amount of interest accumulated since the last coupon payment.

- A buyer will most likely pay a dirty price in the bond market.

- It can also be called the clean price plus any accrued interest.

- It will always be higher than the clean price since it also includes accumulated interest.

- TIt can only equal the clean price when coupons are just paid to the bondholders.

- A bond price quoted in bond markets is usually a clean price, so the accrued interest should be added to know the real market value of the debt security.

- To calculate the total price of a bond, we must first calculate the clean price of that bond (the same as its current value) and the accrued interest, and then together.

- To calculate the current value of a bond, we need to find the present value of both its face value and the stream of coupon payments.

Understanding Dirty Price

As mentioned, the dirty price of a bond is its price, including any accrued interest since the prior coupon payment. Also known as the full or invoice price, this price is the one we usually pay to buy the bonds in the market.

Because it includes some accrued interest since the last interest payment, this price is always higher than the clean price, which doesn't include accrued interest. That is why it's called the "dirty" pricing of bonds.

Most bonds have coupons paid to bondholders more than once a year. Whenever a coupon payment is made to bondholders, new interest accumulates incrementally until the next coupon payment date arrives, and that accrued interest is paid.

Usually, a potential buyer in the bond market buys bonds at a time between the two coupon payments. To purchase the bond, this buyer will have to pay the bond's price in addition to the amount of interest accrued since the latest interest payment.

If the accrued interest isn't included in the bond's current price, it would be referred to as the clean price, as mentioned. That is why the clean price is always equal to or less than the total price unless the buyer wants to purchase the bond on the same day as the coupon payment.

Therefore, we can infer that between two coupon payments, the total price of the bond gradually increases (because the interest is being accrued incrementally). In contrast, the clean price of the bond remains the same (because it excludes the accumulated interest), assuming a constant yield.

A bond with its clean price quoted in the market (such as in the United States) doesn't mirror the complete market value of the asset. However, once the accumulated interest is added to the clean price (forming the dirty price), it reflects its complete market value.

Overview on bonds

Issuing bonds is a common way for companies and governments to borrow money from the public over the long term. Bonds are sold as debt securities through which companies raise money in exchange for such bonds.

Bonds are usually a type of interest-only loan. This means that the principal, the amount borrowed initially, will not be repaid by the issuer until the bond's maturity. The issuer will only make periodic interest payments to the lender.

For example, suppose a tech company borrows $1,000 from you in the form of a bond for 25 years. The interest paid on such securities from tech companies is roughly 11 percent annually. This means that the company will pay you $110 annually as interest.

Only at the end of 15 years, when the bond matures, will you get paid back the principal of $1,000. This is the typical arrangement for most bonds. However, there is a multitude of terms that we should be familiar with surrounding bonds.

There is a particular vocabulary for everyone to know to understand bonds. These terms describe essential characteristics of bonds, such as the amount to be paid back when the bond matures, coupon rate, etc. The previous example is going to be used to introduce these terms.

1. Maturity

The time to maturity of a bond is the number of years till the par value of the bond is paid back. For example, when a corporate bond is initially issued, its maturity is usually 30 years. As time passes after the bond has been issued, fewer years remain until it matures.

In our previous example, the bond's term to maturity was 25 years. This means that you will get interested every year for 25 years. At the end of the 25 years, you will get paid back the initial amount you lent, which was $1,000.

2. Face value (par value)

A bond's face value - also referred to as par value - is the sum of money that the lender gets repaid when the bond matures. In our example, the bond had a face value of $1,000. That is because, at the end of the 25 years, the amount to be repaid equals $1,000.

Like in our example, corporate bonds usually have a face value of $1,000. If such a bond is sold for $1,000, it is known as a par value bond. However, other bonds, like government bonds, typically have large par values.

3. Coupons and the coupon rate

In finance, coupons are the annual (or semiannual) interest payments made to the lender. In the previous example, $110 paid to you every year is the coupon payment that the bond provides you with. Bonds that have equal periodic coupon payments are known as level coupon bonds.

Bonds that offer no coupon bonds are known as zero-coupon bonds. The most prominent zero-coupon bonds are US savings bonds and US treasury bills. Bonds are sometimes called bills whenever the maturity of the bonds is less than one year.

The coupon rate is the size of coupons received annually divided by the face value of the bond. In the above example, the annual coupon received equals $110. Therefore, the coupon rate is equal to $110 / $1,000 = 11% = 0.11.

The yield to maturity is crucial in calculating a bond's price or present value. Yield to maturity is the interest rate other bonds with similar natures and identical structures earn.

In our example, the YTM was mentioned to be 11%. In this case, the yield to maturity is equal to the coupon rate, but this is not always the case. YTM will only be similar to the coupon rate if the bond is sold at par value. If it is a discount bond, YTM will be greater than the coupon rate and vice-versa.

Formula of Dirty Price

As mentioned, a bond's invoice price equals its clean price plus any accrued interest since the last coupon payment.

We can translate this into a simple formula:

Dirty Price = Clean Price + Accrued Interest

This formula seems easy to implement if we have the clean price and the accrued interest figures. But, usually, we have to calculate and find the clean price and the accrued interest to calculate the dirty price of the bond.

Calculating the clean price is the same as calculating the current price or the current value of a bond. It is a straightforward exercise of discounting. To calculate the current value of a bond, we need to find the present value of both its face value and the stream of coupon payments.

Finally, we have to add both present values to find the clean price of the bond. The current price (or current value) of a bond depends on several factors:

- Its face value

- The yield to maturity

- The coupon

- Time to maturity

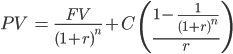

The formula for calculating the clean price of the bond is as follows:

- C represents the periodic coupon payments

- n is the number of periods until the bond matures

- r is the yield to maturity of the bond

- FV is the face value of the bond, usually $1,000

The first term of this equation

It represents the present value of the face value of the bond. The second term

It represents the present value of the stream of coupon payments. Upon adding the two terms together, we will find the clean price of the bond.

Now that we know how to find the clean price of the bond, we have to go over the formula for calculating the accrued interest on the bond. Calculating it depends on several factors:

- The coupon rate, the frequency of coupon payments per year, and the face value (these three are used to calculate the coupon payment per period)

- The number of days elapsed since the latest coupon payment and the number of days between two consecutive coupon payments (these two are used to calculate the portion of the interest being accrued).

The formula for calculating the accumulated interest is:

![]()

- FV is the face value of the bond, usually $1,000

- C is the coupon rate

- k is the frequency of coupon payments in a year

- D is the number of days that have passed since the last coupon payment

- A is the number of days between two consecutive coupon payments

Example Of Calculating the dirty price of a bond

Suppose you just bought a bond maturing in 10 years. The bond has a coupon rate of 5.3%, paid semiannually, and the interest rate for such bonds in the market is 6%. It has a face value of $1,000 when it matures. The next coupon payment is in 2 months.

With this information, we can calculate the invoice price of the bond. First, however, we must calculate the clean price of the bond and the amount of interest accrued during the first four months.

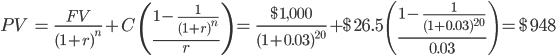

Let's start with calculating the clean price of the bond using the formula. However, r is replaced with 3% instead of 6% as coupons are paid semiannually. Likewise, n is replaced with 20 instead of 10, and C (the periodic coupon payment) is replaced with 26.5 instead of 53 for the same reason.

Hence, the present value or the clean price of the bond is $948. However, this bond will not be traded for $948 in the bond market. That is because four months' worth of interest payments are accrued on the day of the purchase.

To calculate the interest accrued, we also use the formula mentioned beforehand. One important thing to remember is that we assume there are 360 days in a year by convention. In other words, each month has exactly 30 days. Therefore, the accrued interest is equal to the following:

![]()

Therefore, the dirty price of the bond is equal to the:

![]()

or Want to Sign up with your social account?