Dollar-Cost Averaging (DCA)

A strategy of investing a defined dollar amount at consistent intervals over time.

What Is Dollar-Cost Averaging?

Dollar-cost averaging is a strategy of investing a defined dollar amount at consistent intervals over time. In theory, it is an investment strategy that lowers the average cost of a security and decreases the potential risk of market volatility.

The term was first coined by the father of value investing, Benjamin Graham, who also is widely regarded as one of the best investors ever.

This strategy revolves around investing a fixed amount of capital consistently over time. It is an alternative to other methods like lump sum investing, which involves deploying one's money at once.

While confident investors may like to invest in securities all at once (lump sum) due to the benefitting from the greater compounded interest, the investment is also more prone to pricing risk and greater volatility. As such, other investors prefer the DCA approach.

For example, an investor purchases $1,000 worth of shares at the start of every month for the year. This helps mitigate any short-term price fluctuations and the emotional aspect when the stock price increases/decreases and promotes a more extended holding period.

This strategy, coupled with investing in broad market ETFs, tends to be recommended for beginner investors, as even seasoned veterans can't time the market, much fewer rookies. This also helps them to remain invested for an extended period without doing too much research.

However, this approach certainly isn't limited to beginners, for any investor can successfully enjoy the benefits of this simple yet effective method. Even the famed Warren Buffet himself proactively encourages investors to DCA into a broad market S&P index fund.

As such, dollar cost averaging has emerged as a popular investment strategy among passive investors. This strategy favors beginner to intermediate investors because it can be accomplished with minimal investing experience and doesn't require much effort.

Many brokerages these days also make it easy to set up a monthly purchase of a fixed amount of investment, so you do not have to do it yourself physically. In addition, every month, a portion of one's salary can be deducted automatically to fulfill the purposes of DCA-ing.

The most popular and utilized method of DCA in the US is done using a 401(k) contribution. However, unknowingly, many Americans utilize dollar cost averaging by contributing to their 401 (k).

As such, the 401 (k) has allowed contributors to mitigate the price and volatility risk of investing in the stock market. We will explore the 401 (k) plan more in a later section of the article.

However, due to the plan being stretched across an investor's working life, one potential downside is that the contributor will miss out on many compounding periods.

Key Takeaways

- Dollar-Cost Averaging (DCA) is an investment approach where a fixed amount is consistently invested at regular intervals, reducing the impact of market volatility and lowering average investment costs.

- DCA is recommended for beginners and passive investors, offering a simple and systematic way to invest over time without the need for market timing or extensive research.

- DCA helps mitigate risks associated with market fluctuations by spreading investments over time, reducing the impact of short-term price movements and emotional decision-making.

- DCA promotes a long-term investing mindset, allowing investors to benefit from compounded returns and minimizing the impact of short-term market fluctuations.

- DCA is versatile and suitable for various market conditions, making it effective for both bullish and bearish markets, and aligns well with retirement plans like the 401(k) due to its tax advantages and compound interest benefits.

Dollar-cost averaging Vs. lump sum investing

Lump sum investing mainly relies on timing the market and is a strategy typically utilized by amateur and expert investors who may lack understanding of the market or solid confidence in their skills (though some may tend to overestimate their ability).

This is simply because nobody can predict the market and be right every time (or even most of the time for the matter); if one is investing in the short run (where trading would be a better term), it is almost guaranteed to lose money.

Lump sum "investing,", especially in the short-term, aims to profit from buying low and selling high. This is extraordinarily difficult, for not only does the buyer need to time the lows of an investment accurately, but they also need to get the timing correct to sell it.

In a world where all kinds of events can happen and affect markets significantly, in addition to its inherent volatility, it is doubtful one can be a successful trader without much time, blood, sweat, and tears.

Even if one invests for the long term, one may be unable to time the lows and highs of an investment well, and putting all your capital into the market at one specific point can also entail significant risk.

Think of it as putting all your money into a share of ABC Company on Apr 1 2021. However, barely 10 days later, an evil earnings report was released, and the stock plunged 23% after hours.

Even if the business fundamentals may not have deteriorated, and it may have been due to extenuating one-off circumstances, close to a quarter of your investment is already "gone." So while it may be unrealized losses, much time is needed for it to grow to break even.

Meanwhile, dollar cost averaging is much more resilient to such risks. This is because the average price of your investment would consist of the amount you invested before and after the 23% drop, making your overall losses less significant.

However, in the long term, lump sum investors will be able to benefit from the additional compounding interest starting from when the cash is invested, in addition to the dividends issued, so that is a trade-off when one is using the DCA method.

An active, wise investor could utilize both strategies to maximize returns while minimizing unnecessary risk. Such may include avoiding larger purchases when valuations are hitting all-time highs while purchasing more when stocks are in a bear market/downturn.

However, since many investors may not have the capacity or desire to manage a portfolio actively, dollar cost averaging is recommended as a long-term and fuss-free strategy for the average investor.

Even with minimal research and time, it can derive significant long-term value, for dollar cost averaging has historically been proven to be one of the most successful passive investing strategies for the average investor.

In contrast, an actively managed portfolio by professionals usually consists of intensive buying and selling with hours of research—but still, more often than not—fails even to outperform the S&P 500 index.

By embracing market volatility and the emotional aspect of investing, DCA-ing helps ensure investors stay vested for the long run and at reasonable prices to enable future returns better.

Who Should Use Dollar-Cost Averaging?

DCA is a strategy intended for the average or starting investor who does not want to manage a portfolio actively. While recommended for a passive investor, it can and should be utilized by any investor with no accurate read on the open market.

For some investors, this strategy may be practiced without intention by individuals who contribute to their Roth IRA or 401 (k) without knowing much about investing.

Many experienced investors utilize DCA when the markets are specifically volatile. DCA has proven to be the best method when the future is projected to be volatile, or the investor is unknowledgeable about the current state of the market.

This will guarantee the highest statistical highest chance of a low average share price. Timing the market is controversially an impossible task, or at least one that the average investor certainly can't consistently perform.

Even the best quant firms in the industry are not able to do so 100% of the time despite that being their bread and butter. Most experienced and seasoned investors/traders leverage the DCA strategy when conducting long-term-oriented trades.

While intended for passive investors, this strategy can be used by any investor to succeed in the market.

How Often Should You Invest With Dollar-Cost Averaging?

Stock market securities can be highly volatile because of high liquidity. As such, dollar cost averaging can eliminate the downsides of attempting to time the market, which has historically shown to be extremely difficult to accomplish.

DCA requires a strict, consistent stock purchasing schedule and, if done correctly, has historically and statistically proven to outperform an investor trying to "time the market." This is one of the essential aspects, and failing to adhere to it may result in lower returns.

After all, utilizing DCA to enter the market eliminates any personal bias that may lead to an irrational, high-cost entry point.

If one stops buying due to the stock trending lower (which is a crucial mistake as a lower cost allows one to accumulate more stock), it defeats the point of dollar cost averaging in the first place.

A critical factor in the strategy's success is the consistency involved, which allows for the statistically best probability of the lowest market entry point.

Investors with a long-term focus who do not seek to open new positions or close existing ones frequently should use the dollar cost average when investing to maximize profitability and decrease price risk.

One of the most attractive features of the strategy is its versatility in any market. Because the future is impossible to forecast, recessions and downturns are typically difficult to predict. As a result, it should be utilized everywhere, from bull markets to bear markets.

How does Dollar-cost averaging shield risk?

The sole objective of utilizing DCA is to minimize short-term risk by spreading capital along a scheduled, consistent deployment calendar. By doing so, an investor avoids a common regret among investors: overpaying because the market takes a dip the following week.

This is significant as a 10% loss is not recovered by a 10% gain; an investor would need an 11.11% gain to recover a 10% loss. This results in the loss figure compounding quickly; for a 30% loss in an investment, a 42.9% gain is required to make up for it.

When an investor spreads their capital instead of deploying at one entry point, DCA can reduce the average cost an investor pays per share and avoid minor hiccups within the market that can play a crucial role in the long-term gains of a portfolio.

As a result of this strategy to minimize price risk, it may be wise for an investor to utilize this strategy who wants to invest passively without actively managing their portfolio. This investor should be long-term-oriented with little concern for short-term losses if any.

DCA is used in an attempt to minimize the average share price. Sometimes DCA will increase the average share price, but this is a downside that the investor should accept as a means to reduce risk.

Example of Dollar-Cost Averaging

| Date | Amount | Price | Shares Purchased |

|---|---|---|---|

| Jan 1 | $10,000 | $92 | 108 |

| Feb 1 | $10,000 | $85 | 117 |

| Mar 1 | $10,000 | $90 | 111 |

| Apr 1 | $10,000 | $95 | 105 |

| May 1 | $10,000 | $83 | 120 |

| Jun 1 | $10,000 | $84 | 119 |

The amount specified to be invested is $60,000. Opting for a lump sum investment, we would invest the whole $60,000 on January 1 at a share price of $92. This would result in the acquisition of a total of 652 shares.

However, through Dollar Cost Averaging (DCA), instead of investing it all at once, we choose to spread it out over a span of 6 weeks, allocating $10,000 each week. When we sum the total number of shares acquired over this 6-week period, it amounts to 680 shares. As a result, the average price per share under this DCA approach stands at $88.2, which is lower than the $92 per share we would have paid if we had opted for the lump-sum investment on January 1st.

Average Price Paid per Share = Amount Invested / Number of shares owned

Average Price Paid per Share = $60000 / 680

Average Price Paid per Share = $88.2

In the example, while the monthly amount invested remains consistent, the amount of shares purchased varies due to the fluctuations in stock prices. As prices increase and decrease, the amount of shares $10,000 can buy will change accordingly.

The number of shares you purchase through dollar cost averaging will be a variable that is dependent on the state of the current market. However, this can be beneficial in some cases, as you can purchase shares when the share price is below your average cost.

For example, if you previously bought the stock at $92 per share in January and it is $85 per share in February, it will lower the average price you paid for each share. This results in more upside potential and greater long-term gains.

The DCA strategy allows for multiple strategic entry points that minimize the unnecessary risks that come with a single entry point. In the above example, if one fully invests all their capital in January, much of the investment would have lost value in the next few months.

While this may not matter in the long run, DCA-ing helps avoid such a dramatic drop in your portfolio's value in the short term and gives the investor valuable peace of mind.

Disadvantages of Dollar-cost averaging

One point would be that a single transaction would incur lower commission fees than many transactions over time, but with the low commission rates from modern brokers, it is not as large of a concern compared to a decade ago when each trade cost $15.

The critical point is that while dollar cost averaging tends to lower the average purchased share price, it forgoes a key concept: additional compounding. Assuming capital is available to deploy, it may be in an investor's best interest to invest all in to take advantage of compound interest.

Not only does one miss out on compound interest, but the purchasing power of your cash will also be eroded by inflation at ~3.8% every year. If one is sitting on a windfall, one may be better off doing lump-sum investing rather than spreading the investment over months/years.

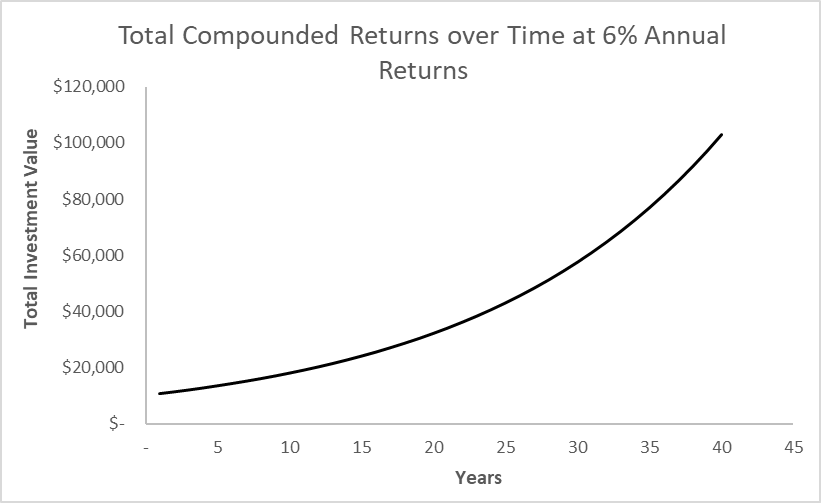

The power of compounding interest is essential to the growth of a sustainable portfolio. Ignoring these compounding periods may result in a significantly smaller portfolio in the long term as the returns increase exponentially with every added year.

To better illustrate this example:

-

An initial investment of $10,000, after 10 years of compounding at 6% returns, will give you $17,908 and a total return of 79.08%.

-

However, letting it compound a year more will get you $18,983 and a total return of 89.8%, while the difference is 10.72%. The 4.72% edge over the 6% mentioned above return rate is due to the magic of compound interest.

-

The below graph shows the exponential increase in your investment by letting compound interest do its work.

On top of this, sometimes it may be better to deploy capital simultaneously. For example, if the market is in a recession or downturn, it could be a better strategy to invest all at once to take advantage of the relatively low share price.

Using lump sum investing could result in more considerable long-term gains. Still, it requires a certain level of research and understanding of the current state of the stock market and economy, in addition to taking on more risk.

On the contrary, DCA could be utilized if a downturn is expected, as dollar cost averaging during a bear market or in extreme uncertainty allows one to achieve better-purchased prices.

It is also possible to mitigate some of the shortfalls as mentioned above, even when using DCA, for one can make adjustments such as investing a more significant amount ($10,000 instead of $1,000 every month) and/or sponsoring at a higher frequency (twice a month instead of once).

The main objective of DCA is to minimize the risk of share price volatility; as such, one needs to weigh its pros and cons objectively and decide on what kind of investment style suits you.

Pros vs. Cons of Dollar-cost averaging

As with all investment strategies, they all come with their pros and cons. In the summarized list below, you will understand both the upsides and downsides better too, and come to make your own investment decisions.

Always remember to keep in mind that what may work for some people may not work for you, so knowing your own priorities will help you decide if dollar-cost averaging is suitable for you too!

Pros of Dollar Cost Averaging:

1. Beginner Friendly: Dollar cost averaging (DCA) is straightforward and doesn't require in-depth market timing knowledge, making it suitable for beginners.

2. Better Entry Points for Investments: DCA allows investors to buy into a position at various price levels, potentially lowering the average cost per share over time.

3. Minimizes Short-term Risk: Investing smaller, consistent amounts over time can help mitigate the impact of market volatility on overall investment performance.

4. Fuss-free Process: DCA is relatively easy to implement and doesn't demand constant monitoring or decision-making.

5. Automation: DCA can be automated through brokerage platforms, simplifying the investment process.

6. Investor Mindset and Saving Culture: DCA encourages regular saving and investing, fostering a disciplined financial approach.

7. Time in the Market: DCA aligns with the principle that staying invested in the market over the long term is generally more profitable than trying to time market movements.

8. Rule-based Investing: The automated nature of DCA follows a set rule, removing emotional biases from investment decisions.

9. Peace of Mind: DCA reduces the stress associated with making precise market timing decisions.

Cons of Dollar Cost Averaging:

1. Opportunity Cost of Holding Cash: Funds invested through DCA might have been better utilized elsewhere, potentially resulting in missed investment opportunities.

2. Inflation Impact: The returns generated through DCA might not outpace inflation, leading to decreased purchasing power over time.

3. Missing Lower Entry Points: DCA may result in missing out on buying during market downturns, when asset prices are low.

4. Missed Compounding Periods: Not investing a lump sum upfront means missing out on potential compounded growth over a longer period.

5. Suitability for Windfalls: DCA might not be the best strategy for those who come into a large sum of money at once.

6. Commission Fees: Although minor, frequent small purchases can accumulate commission costs over time.

7. Not Suitable for Traders: DCA doesn't cater to short-term traders seeking quick profits from market fluctuations.

8. Veteran Investor Disinclination: Experienced investors might opt for other strategies that align more closely with their market knowledge.

9. Lack of Diversification: If DCA is concentrated into a single stock, there's a risk of lacking diversification and over-concentration.

10. Prefer Wide-market ETFs: For broader market exposure, using wide-market exchange-traded funds (ETFs) could be more appropriate than DCA into individual stocks.

401 (k) Retirement Plan

This retirement vehicle is a forced utilization of dollar cost averaging. Every time an individual receives a paycheck, they can dedicate a contribution that is non-taxable and is an additional investment into one's portfolio for retirement.

401 (k) 's are often the most optimal method of using dollar cost averaging because of the beneficial tax implications. Once the maximum contribution is reached, one can continue using DCA in their brokerage account.

401 (k) 's can be an extremely promising method to achieve one's dream retirement, for they serve as tax-free accounts that offer a wide array of investment classes. It would be wise to maximize the 401 (k) contribution limits each year if one's budget allows it.

However, do keep in mind that there are certain monetary consequences if withdrawn earlier than the age of 55, such as a 10% tax penalty.

Thus your 401 (k) serves as a double-edged sword; for a while, one may not be able to access their funds; leaving it untouched can better enable the magic of compound interest to take place without it being hindered by any tax implications.

What are DCA Intervals?

The dollar cost-averaging strategy is successful when the investor follows a strict purchasing schedule. Whether this is once a day, week, or month is dependent on the investor's needs, but it plays a crucial role in the success of this investment strategy.

Investors can determine their purchasing schedule or interval periods based on their aggressiveness and investing goals. For example, if the investor wants to reduce price risk, they can do so via buying more frequently, a weekly buying schedule in contrast to a monthly one.

A more passive approach correlates with a less frequent buying schedule. While the returns can vary depending on the length between frequency periods, in the long run, such may be negligible if one can purchase at reasonable price points using DCA.

The interval periods may also vary depending on the investor's access to capital that is both liquid and investable. Some investors may choose an investment schedule that revolves around the frequency of their paychecks, while others may opt to use their bonuses for it.

In conclusion, it is a worthy and efficient strategy to implement—one that rookies and veterans alike can make use of—for it negates poor investment decisions out of greed or fear and allows investors to remain vested for the long run.

or Want to Sign up with your social account?