FAANG Stocks

An acronym for defining the stocks of the five biggest and best technology companies in the US.

What Are FAANG Stocks?

"FAANG" is an acronym for defining the stocks of the US's five biggest and best technology companies.

It consists of the following stocks:

- Meta Platforms (formerly Facebook) (FB).

- Amazon (AMZN).

- Apple (APPL).

- Netflix (NFLX).

- Alphabet (formerly Google) (GOOG).

These are the largest and most influential tech companies in the world.

Key Takeaways

- FAANG stocks are five of the most prominent and influential technology companies in the United States. They have shown high growth in the past and are considered high-quality businesses.

- These stocks include: Meta Platforms (Facebook), Apple Inc, Amazon Inc, Netflix, and Alphabet (Google)

- FANGMA is considered an alternative list of stocks in place of the original. It includes Microsoft Corp and replaces Netflix with Nvidia Corp.

- The reason for replacing Netflix with Nvidia is that it doesn't have the same competitive advantages as its FANGMA peers.

- Nvidia is among the world's largest semiconductor manufacturers and has the lion's share in industries like gaming, GPUs, and consumer electronics, and it also possesses very good tailwinds.

- Microsoft has been a dominant presence in personal computing and operating system services; it has also successfully ventured into cloud computing and has successfully acquired many businesses.

- Microsoft has established a strong brand presence over many years, increasing revenues and margins constantly. As a result, it is one of the most profitable companies in the world.

Understanding FAANG Stocks

The term "FANG" was first coined by CNBC host Jim Cramer in 2013 while giving accolades to the companies for their dominance in the market and growth. Apple was added later in 2017 to the mix, making it 'FAANG.'

These stocks are popular with investors globally because of their sheer size, business model, competitive advantages, and the moats these businesses have built.

These stocks trade on the Nasdaq and the S&P 500 index. The combined market capitalization of these stocks stands at $6.7 Trillion.

| Stocks | Initial Investment | Investment Value | Holding Period Return 5y (HPR) | CAGR |

|---|---|---|---|---|

| Meta Platforms | $2000 | $2820 | 41% | 7.11% |

| Amazon | $2000 | $3320 | 166% | 10.66% |

| Apple | $2000 | $6560 | 328% | 26.81% |

| Netflix | $2000 | $2420 | 21% | 3.88% |

| $2000 | $3020 | 154% | 8.61% | |

| Total | $10000 | $18140 | 142% | 12.65% |

An equally weighted FAANG portfolio has a CAGR of 12.65% in comparison, and the S&P 500 has 11.71%. The difference may not look significant, but these stocks have corrected 20 - 70% since the end of 2021.

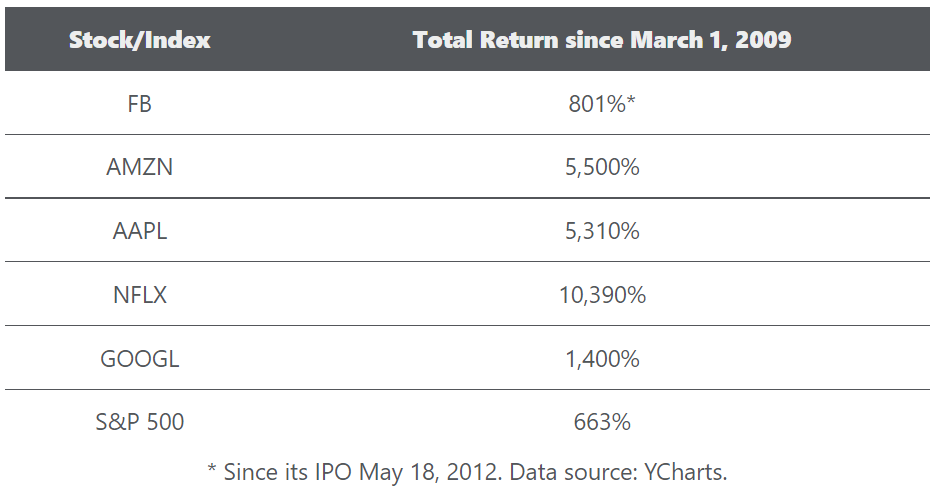

Since 2009, it has beaten the S&P 500 by a huge margin.

These stocks have about 15.5% weightage in the S&P 500 and a 30% weightage in the Nasdaq 100 Index. This means that these stocks heavily influence the broader markets as well.

Since their inclusion in the American indices, these stocks have performed much better than their competitors and the overall market due to their strong business fundamentals. This is why these companies hold such a large chunk of the indices today.

These stocks always trade at higher valuations than the broader market and their peers. This is because of the quality of the business and the growth they can achieve owing to strong demand for their services and high-quality business models.

Value investors have consistently criticized these stocks for unsustainable valuations, while on the other hand, FAANG is the favorite stock for growth investors.

Example of FAANG Stocks

FAANG has become popular among the global investment community because they are great businesses about to become trillion-dollar franchises.

These companies started as free cash flow negative cash-burning start-ups a little over two decades ago.

There are a few competitive advantages and unique business models these businesses have used to achieve a level of growth that has not been witnessed in the past.

Let us try to understand each of these companies in a little more detail to understand their dominant market position.

Meta Platforms

Founded by Mark Zuckerberg in 2004, Meta Platforms (FB) is the youngest FAANG stock.

Previously known as Facebook, Meta Platforms is a social media company that owns some of the most popular social media platforms like Facebook, Instagram, Whatsapp, and Messenger. Meta right now sits at a giant $500 billion market capitalization.

Facebook is the world's most popular social networking site, with around 3 billion users globally, followed by Whatsapp, Instagram, and Messenger, with a user base of 2 and 1.3 billion users, respectively. Meta has a combined total of 7.5 billion users across all its platforms.

The moat Meta has built is known as 'Network Effects'; under a network effect moat, the product or service's value rises as the number of users grows.

Meta uses these network effects to run ad spaces on their platforms like Facebook, Instagram, etc. Due to the sheer number of meta users, there is a constant demand for their ad spaces among companies. Ad spaces contribute the majority of Meta's revenues.

This has allowed Meta to post record sales, profits, and margin growth numbers over its operational history.

Due to its asset-light business model, which has almost zero onboarding costs and minimal capital spending, Facebook can sustain very high margins and profitability.

Meta has consistently had a gross margin of over 75% and a net margin of over 25% since the past decade. In addition, the free cash flow margins have also been sustained by over 30% for the past 5 - 7 years.

Meta, now using its cash cow ads business, has created a Metaverse, which is a virtual world that could revolutionize the fields of education, advertisement, gaming, art, etc.

Amazon.com

Jeff Bezos founded Amazon (AMZN) in 1994 in Bellevue, Washington. Amazon started as a marketplace for books and has now transformed into an e-commerce giant and technology firm.

Amazon's business operations include e-commerce, cloud computing, digital streaming platforms, artificial intelligence, etc.

Amazon's market capitalization currently stands at $1.2 Trillion, making it the 5th largest company in the world by market cap and the 3rd largest by revenue.

E-commerce contributes to the company's revenues; in 2021, e-commerce accounted for 50% of the total sales.

Amazon has a unique business model with customer satisfaction at the core of it. They have built three moats around their business; the first being cost advantages.

More often than not, Amazon ensures it is selling the lowest costing product in the market, even if they lose money on it to take away the competitor's market share.

The cost advantage moat pays dividends when economies of scale are established. The second moat is the network effects; the company has a global presence and one of the best distribution models in the world.

These two moats allow Amazon to maintain a very low cost in its e-commerce platform while still earning sufficient profits on the other side; simultaneously, the incremental expenses for onboarding new customers and sellers on their marketplace are close to zero.

Amazon also has several other business verticals like cloud computing & SaaS, which are provided through its subsidiary Amazon Web Services (AWS).

The third economic moat of amazon is of switching costs. Switching costs moat is when the cost of switching from one service provider to another outweighs the benefits of switching. Again, this creates stable and constant revenues.

AWS is a very high-margin business that contributes only 15% of the total revenues but around 50% of the profits. This is because AWS runs on an asset-light model and has achieved significant network effects reducing the onboarding expense.

These businesses generate huge cash flow for the company, which is then reinvested into Amazon's other, more experimental businesses like AI & ML development and other private & start-up investments.

AMZN has given a compounded annual return of 30% over the past decade, making it one of the best-performing stocks.

Apple Inc

Apple Inc (AAPL) was founded by Steve Jobs, Steve Wozniak, and Ronald Wayne. Apple is primarily engaged in manufacturing and selling personal computers; it started in 1976, making them the oldest FAANG stock.

Apple sold personal computers under the brand Macintosh (later renamed iMac), and the portable music player:iPod was released in 2001; 2007 was when Apple introduced the iPhone, the company's most successful product and the world's most popular mobile phone currently.

Apple has a market capitalization of $2.6 trillion, making it the largest company in the world by market cap, 6th largest in revenue, and the largest in profits, with a net income of $95 billion.

Apple has a fairly straightforward business model. It is a high-end consumer electronics company. Its strength lies in its branding and product quality which customers have found to be better than some of its competitors. This makes Apple so popular amongst the investment community.

Its business model is easy to understand, and its management has established strong frameworks around its operations, making it a free cash flow-generating machine.

The iPhone contributes 52% of the company's overall revenue, followed by the services business, including AppleCare, after-sales services, cloud, and digital content, contributing 18% of the total revenue.

The other three products, the iMac, iPad, and wearables, contribute 10%,9%, and 11% to the revenue.

The moat Apple has is intangible assets: the brand it has built over so many years. Its brand allows it to market the product at a premium price and enables them to pass on any additional raw material costs to its customers.

Therefore, Apple has a very healthy margin, which it has maintained consistently over the years.

Apple currently has a net margin of 26%. ROIC stands at 32% and has been above 30% for the past decade.

Netflix

Founded by Marc Randolph and Reed Hastings in 1997, Netflix (NFLX) is a subscription streaming service and production company. It has over 220 million subscribers worldwide.

Netflix was founded as a DVD subscription service, delivering DVDs straight to customers for viewing; it transitioned to a streaming services platform in 2007, looking at the growing demand and changing landscapes.

Netflix's business model relies on viewer volume, the number of IPs they hold, and what new content they can produce. In its essence, Netflix is a media company.

The media streaming business has witnessed heavy industry tailwinds, and with Netflix at the forefront of those tailwinds, it has benefitted massively.

The company is worth $90 billion with annual revenues of $20 Billion. As the business model is asset-light, it has net profit margins in the high 20s; the current financial year saw Netflix's net profit margin at 26%.

Netflix has delivered an impressive ROE of 33% and ROIC of 13%. However, due to the industry's highly competitive nature, it is still reinvesting most of its capital into the business.

The lack of free cash flow has made Netflix undergo a lot of criticism as other FAANG stocks are cash cow businesses generating very high free cash flows.

Netflix has no real moat, which is evident by the number of streaming services available in the market, like Amazon Prime, HBO Go, and Disney Plus, which have taken away Netflix's market share.

For the first time in a decade, Netflix has shown a drop in subscriber count. The reason for this is a highly-competitive market and the lifting of covid restrictions, which redirected its traffic to other sources of entertainment.

This caused the stock price to drop by 50% since 2022.

Alphabet Inc.

Alphabet Inc. was created through a restructuring of Google (GOOGL) in 2015, where they consolidated Google and its subsidiaries making Alphabet the parent company of Google.

Founded in 1998 by Larry Page and Sergey Brin. Google has remained one of the most influential companies over the past several decades. It is the most used search engine in the world, with an almost monopolistic market share of 93%.

Alphabet has subsidiaries in many industries like media, search, private equity, AI & ML, health care, autonomous driving, drone research, etc.

Its market cap stands at $1.6 Trillion, making it the 4th largest company in the world by market capitalization.

The majority of Alphabet's revenue comes from Google. Google's sales are majorly made by selling ad space on its various platforms like its search engine, youtube, maps, etc.

Net margins have always been over 20% in the past decade, currently standing at 27% as of 2022. The ROIC is at 36%.

Due to its network effect moat, Google has very low incremental costs, as it essentially is a monopoly in search engines, media platforms, and mapping. Most of its operating costs are incurred by its subsidiaries which are still in their cash-burning stages.

One huge advantage Google has is that its ads business has very low expenses and capital requirements while generating very high cash flows, margins, and returns. This allows Google to allocate cash to more ambitious projects without drastically affecting the margins.

Android is a great example of how Google can divert its excess cash to other projects, which can grow to become some of the most successful innovations of the century.

Alternatives of FAANG Stocks

Certain alternatives add, update, or remove a few of the stocks included to fit more relevant stocks.

We'll take a look at the FAANGM / FANGMA. This variation adds Microsoft Corporation and replaces Nvidia with Netflix from the original five FAANG stocks.

The addition of Microsoft (MSFT) is essentially a no-brainer as it has shown growth and influence, as seen in other FAANG stocks.

Currently valued at just over $2 Trillion, Microsoft is the 3rd largest company in the world by market capitalization and 2nd largest by profit, with 2021 profits at $61 billion.

Microsoft's business is built around selling and providing cloud-based services and operating service platforms, which is Microsoft Windows. They also have ventured into selling consumer electronics, including laptops, mobile phones, tablets, etc.

Windows is the world's most popular OS, with over 1.5 billion active users worldwide. It has one of the strongest brands and network effects of any business worldwide.

The business inherently is very capital-light, which has allowed for very high free cash flow generation.

Microsoft has also grown a lot through mergers and acquisitions; some of the most popular mergers include the gaming platform Mojang and the social media platform LinkedIn.

Nvidia (NVDA) is the world's largest GPU manufacturer with diversified business operations in cloud computing, semiconductors, AI, graphic cards, consumer electronics, gaming, etc.

Currently, at a valuation of $470 Billion, Nvidia also enjoys very high margins and profitability like its FAANGM peers.

The reason for replacing Netflix with Nvidia is that Netflix has no significant competitive advantage and is currently competing in a highly competitive market; In contrast, Nvidia still has to face significant competition; its diversified portfolio, huge market size, and growth make it a better choice for some investors.

Researched and authored by Aditya Salunke I LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?