Farmland

Any land that is used for the purpose of farming.

What is Farmland?

Farmland refers to any land that is used for the purpose of farming, be it agriculture or horticulture.

It is classified as an alternative investment, i.e., those investments that are not focused on investing in traditional assets like common stock, bonds, etc.

India has the largest cultivated land of any country at 1.7 million square kilometers, which accounts for 53% of the country's total land area. It is followed by the United States, Russia, and China.

Farmland investments can be made in several ways.

- Directly Buying

- Through Hedge Funds and Investment Managers

- ETFs & REITs

- Farming-related listed companies

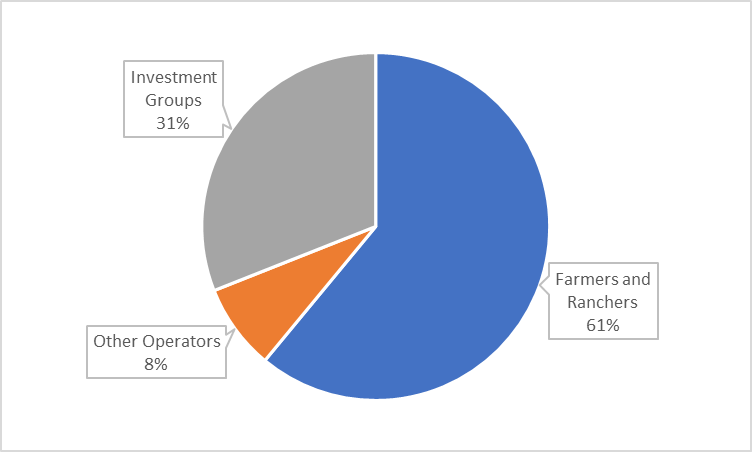

The majority of the farmland is individually owned. In the US, 61% of the farms are owned and operated by farmers and ranchers, and other operators own 8%. The remaining 31% is owned by investment groups (data from The Motley Fool).

In recent decades, demand for more farms has been on the rise as the global per capita consumption is on the rise, the majority due to the rising middle class of developing nations. As the per capita income goes up, demand for healthier, less processed food also goes up.

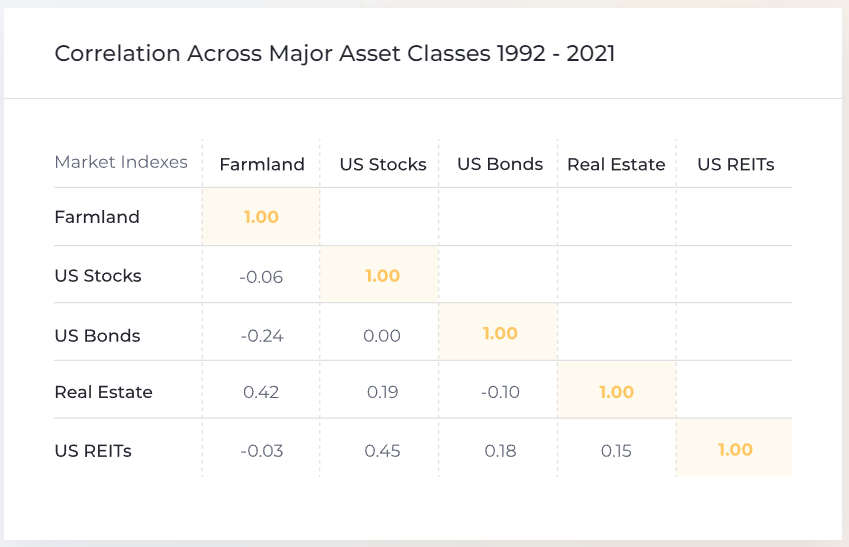

This asset class has historically shown a very low correlation to capital markets and even real estate and gold prices. This makes it a great vehicle for diversification as it lowers the portfolio's volatility and correlation.

By directly investing, the returns are obtained in 2 ways.

- Increase in land values

- Cash/Rental or Crop Yields

Farmland as Investment

The reason it is so popular as an asset class and why in the recent past, the demand for farms as an investment is growing can be understood by looking at the investment’s risk profile.

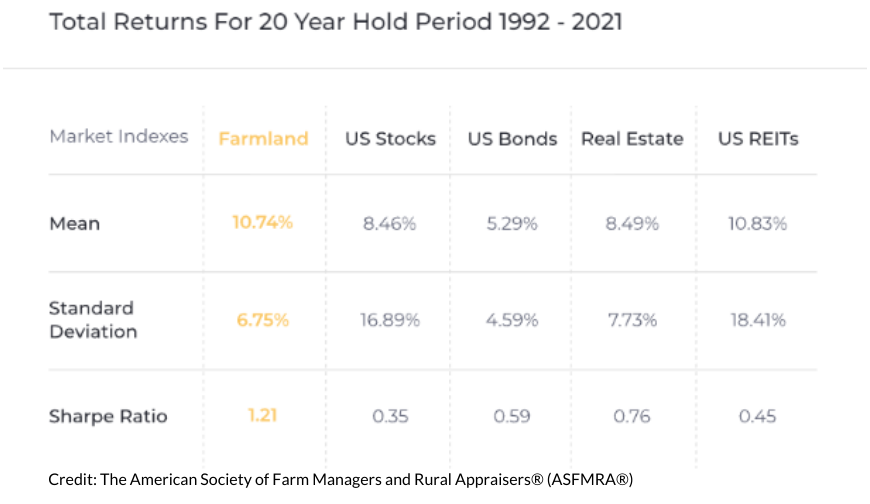

It has shown lower volatility compared with other investable asset classes.

It has shown a higher mean return to almost all asset classes except REITs for almost three decades.

A low standard deviation means the asset has lower volatility; the only asset having lower volatility is bonds. While the Sharpe ratio is the highest, meaning farmyards have the best risk-adjusted returns.

It is not correlated to any asset, which means it can provide diversification to the portfolio. Correlation is essentially the strength in the relationship between two variables. A higher correlation means the two variables will move in tandem with each other and vice-versa.

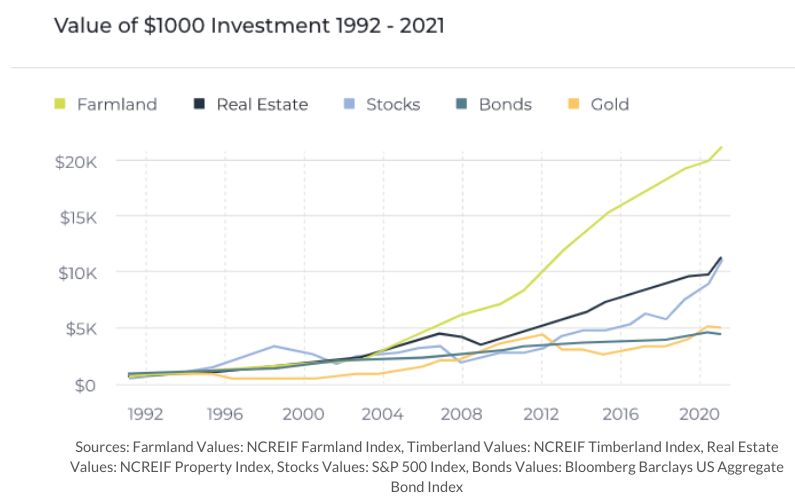

At the same time, it has outperformed every major asset class in the US since 1992.

This asset class can give market-beating returns with very low volatility because of the demand for the product.

It usually consists of agricultural and horticultural land. The demand for food will constantly be rising due to a rising population, which is majorly unaffected by economic and credit cycles.

The yield is directly related to demand and efficiency. With farming being more technological, the margins also increase, increasing the yield. There are also rental yields on the farm that goes up with the land prices.

Land prices also have gone up at a rate of almost 5 - 6% per year for the past few decades now. So the yields and the land appreciation equally contribute to the total appreciation of the asset class.

The institutional allocation towards the asset has been steadily on the increase for the past few years; this shows the power of the asset to provide meaningful diversification and still provide very attractive returns.

Currently, they can be bought in very diverse locations like the US, Canada, parts of South America, and Europe. This will provide further diversification and allow investments into different food products as well.

Types of Investments in Farmlands

There are more than a few ways for investors to invest in this asset class; in recent years, it has been made possible due to investment funds focusing more on farms as an investment. There are several ways one can invest in this asset class.

- Direct buying

- Investing through an investment fund/hedge fund

- REITs

- Buying equity in farming-related companies

There are a few drawbacks and advantages to each different investment method. Direct buying is the most straightforward way to invest; you can directly get the yield benefits and the appreciation benefits and can diversify a lot. But there is very low liquidity.

When moving towards other assets that act as an investment vehicle to invest in farms, the liquidity increases but still retains the diversification benefits; the drawback here is that you are dependent upon the fund manager of the investment fund or REIT for managing the portfolio.

Buying through equity is a little different because you cannot own farms through that; you can only own common stock / ETF of farming-related companies. This has different risk and returns profiles but can still help reduce the overall volatility of the portfolio.

Direct Buying

The most direct way to invest is to straightway buy actual farms.

| Country | Per Hectare Rate | 10y CAGR (USD) |

|---|---|---|

| USA | $10,131 | 4.50% |

| Canada | $6,092 | 8.00% |

| Country | Per Hectare Rate | 10y CAGR (USD) |

|---|---|---|

| Argentina | $5,558 | 1.90% |

| Brazil | $4,138 | -1.70% |

| Uruguay | $3,342 | 3.70% |

| Country | Per Hectare Rate | 10y CAGR (USD) |

|---|---|---|

| Germany | $29,611 | 6.90% |

| Ireland | $24,907 | -3.40% |

| United Kingdom | $22,996 | 2.20% |

| Denmark | $22,295 | -4.40% |

| Poland | $12,237 | 8.40% |

| France | $7,302 | 0.50% |

| Romania | $6,079 | 2.20% |

| Hungary | $5,511 | 5.60% |

Poland has the highest land appreciation rates in the past decade growing at 8.4%, compounded followed by Canada at 8% and Germany at 6.9%.

Directly buying comes with high costs as all the expenses and operations are to be looked over by the owner.

Usually, new investors rarely directly buy farmyard; even now, most of it is held by individuals passed down over generations.

The most recent direct buy instance was Bill Gates, who acquired more than 269,000 acres over the past decade. Making him the single biggest farmyard holder in the US, buying about $520 worth in 2017.

According to the American Farmland Trust, it is projected that about 370 million acres of farmland are going to change ownership from family/individually owned to institutional in the US alone.

There are a lot of advantages to buying direct; you can customize the type of land, the region, etc., which gives you a better understanding of the yields and land appreciation.

The only barrier is the capital; it requires a significant amount of capital to have a well-diversified portfolio when buying direct.

Investing through Hedge Funds / Investment Funds

There are investment funds that specifically specialize in farm investments. This is a great way to buy this asset class with a lesser amount of capital and get significant diversification in the holdings.

The funds can be categorized into two types: There are hedge funds that specifically focus on farmland investments and funds that have a part of their portfolio in farms for diversification purposes.

Investing through hedge funds add diversification benefits, as it is very difficult for an individual to achieve geographical diversification, but an investment fund can diversify locally as well as globally and at a fraction of the cost for the investor.

Some obvious advantages come with investing through a fund rather than investing directly, namely the quality of the investments i.e. the farms they buy/acquire.

These are professionally managed by individuals with years of experience behind them, so they are qualified to pick a well-diversified portfolio with higher yields.

Investment funds are expected to pick out superior assets for their portfolio as they have a lot of research backing, which allows them to understand the asset more clearly and thus are able to make an overall better portfolio.

You can also check past performance, and there are a lot of regulations put in place for hedge funds that ensure that professionally qualified individuals are handling your money.

But empirical data come with survival bias which means you can only see the data of funds that are operating, the data for closed or failed funds is rarely available, which can hamper your research.

A lot of other funds that are not primarily focused on this asset class are also moving here for diversification benefits and higher yields.

There is a certain level of risk also associated with this, as you are completely reliant on the fund manager's ability to pick good investments. So unlike direct buying, you have lesser control here.

REITs

A real estate investment trust (REIT) is structured similarly to a mutual fund, where investors pool money into a fund, and the fund invests it into asset classes that are pre-defined in the fund's investment objectives.

The only difference is that REITs invest in real estate, majorly commercial. But there are also a lot that focuses on buying farms.

REITs provide appreciation in two ways; one is the yield which is higher than the average common stock yield dividend, and also the risk-free rate. The second type is through the rise in the net asset value (NAV).

Example 1: Gladstone Land

Gladstone Land is a REIT that currently owns 113,000 acres of land across the United States and has an asset value of $1.5 Billion.

The trust earns by leasing the land to third-party tenants, which is the cash yield. They also offer several other options to farmers.

Like long-term sale-leasebacks, rent the land, and purchase the land from the farmers.

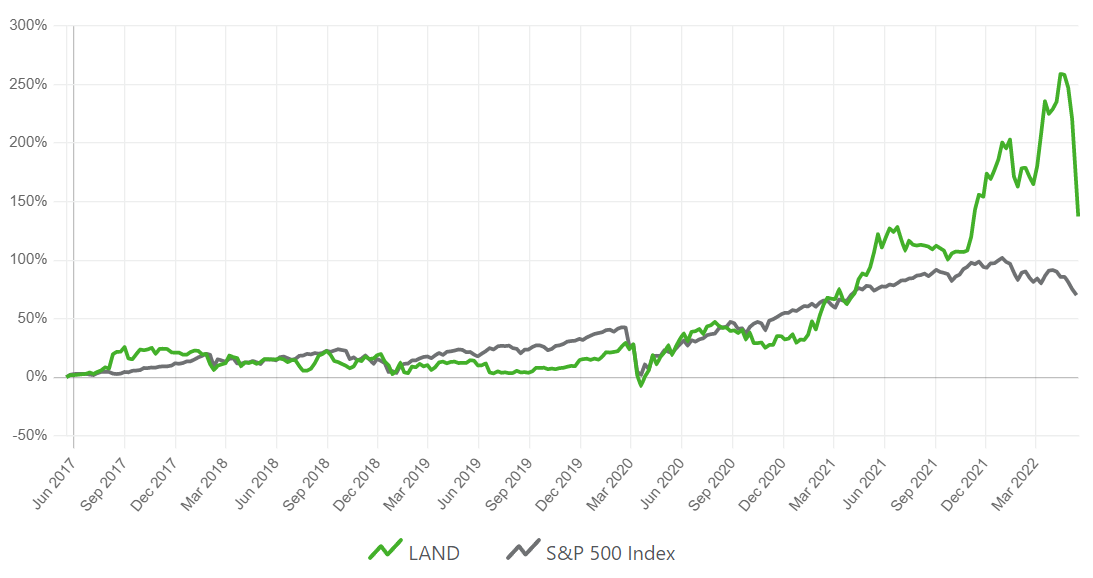

LAND has been able to outperform the S&P 500 over the past five years

Gladstone Land has a yield of 2.06%.

Example 2: Farmland LP

LP owns over 15,000 acres which convert to $175 Million worth of assets managed. They own farms across 3 US states, California, Oregon, and Washington.

Unlike Gladstone, which gives land on rent to farmers,LP takes an active part in farming; this makes it less scalable but is more focused and controlled.

They actively manage the farms helping with business management, legal backing, etc. The fund focuses on investing in infrastructure and increasing crop diversity.

They are focusing on more organic produce, which is growing in very high demand, so much so that the supply cannot keep up.

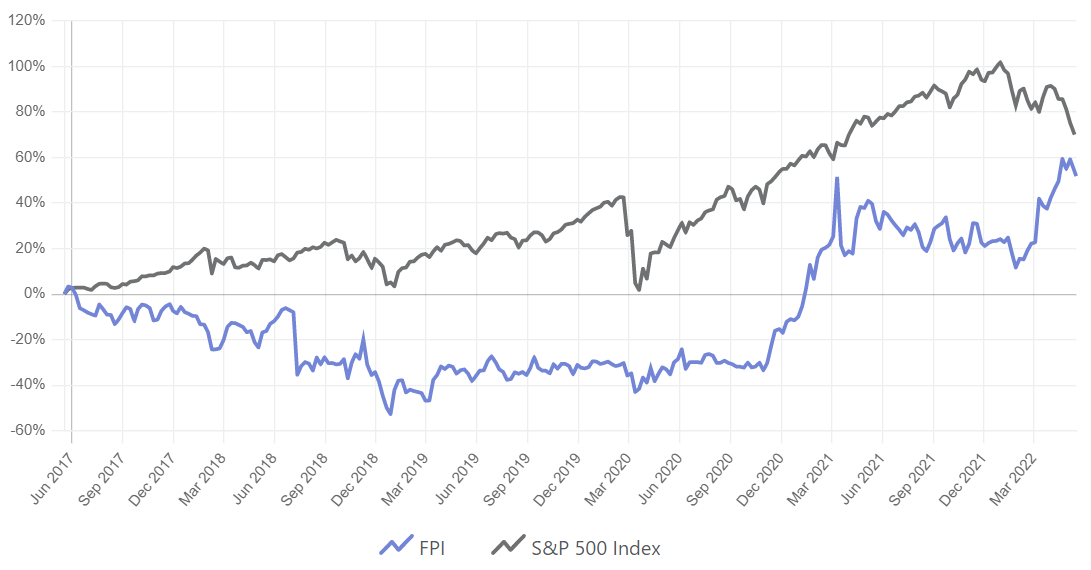

FPI has failed to beat the S&P 500 as they are more focused on the crop yield rather than the cash/rental yields, which are much more stable.

Equity

One can also invest in farmyard through equity, which can either be investing in funds and ETFs that have a portfolio of farming and related companies or buying direct stocks in companies that are into farming-related activities.

ETFs and mutual funds are the best way to diversify, unlike individual stocks.

Example 1: iShares MSCI Global Agriculture Producers ETF(VEGI)

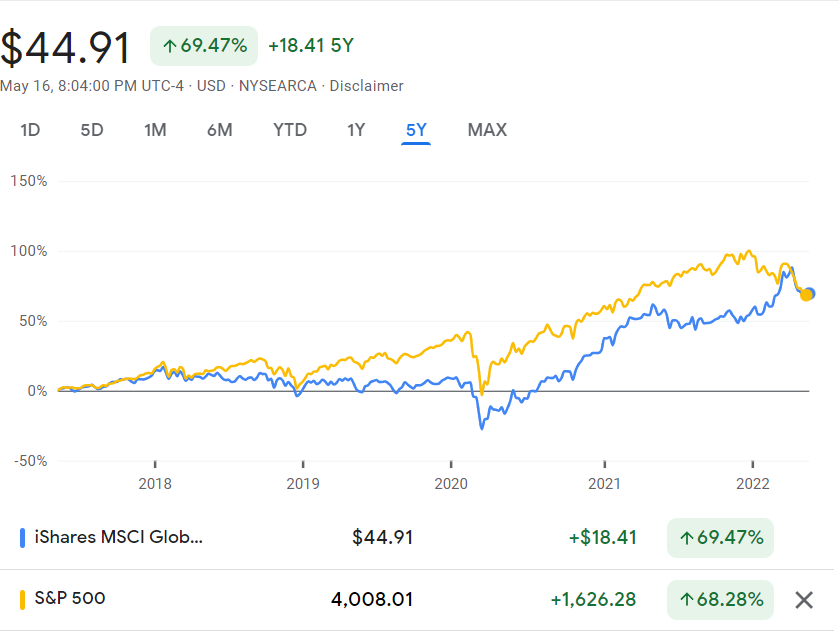

VEGI’s investment objective is to track the investment results of an index composed of global equity companies primarily engaged in the business of agriculture.

The top 5 holdings of the ETF account for more than 45% of the entire portfolio, with John Deere (DE) having 18% weight.

The holdings comprise over 150 companies, with a majority of them focusing on industrials and materials related to farming and consumer staples.

VEGI has managed to track the S&P 500 for the past year but has given a higher standard deviation compared to the S&P 500

| Beta | Sharpe | Standard Deviation | |

|---|---|---|---|

| VEGI | 0.94 | 0.52 | 20.20% |

| S&P 500 | 1.00 | 0.37 | 18.16% |

VEGI has managed to deliver a lower beta and a higher Sharpe ratio to the S&P 500 though the Sd is higher but not significantly.

Example 2: Teucrium Agriculture Fund (TAGS)

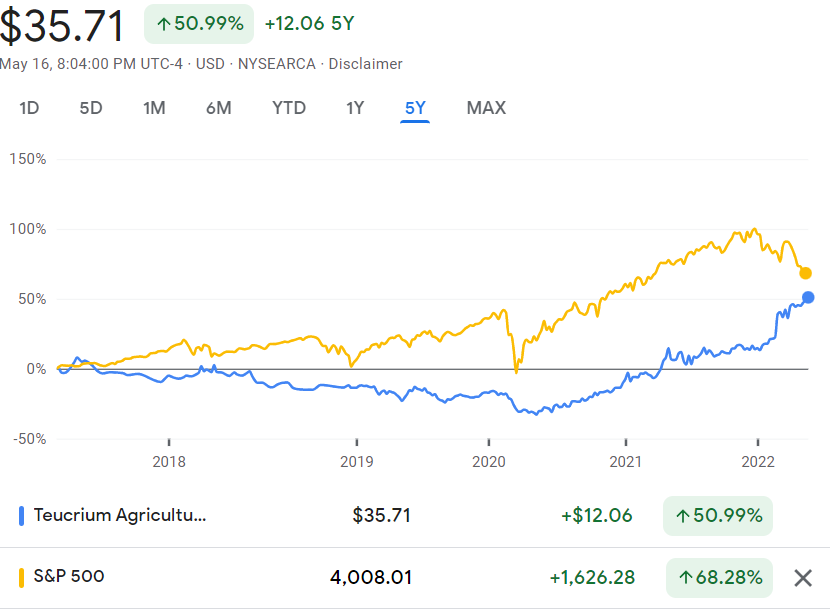

TAGS is focused specifically on buying commodity futures rather than direct equity. An advantage of this is that it completely eliminates external factors of a company like management competency, legal issues, tax environments, etc, and directly focuses on commodities.

The holdings are divided equally into 4 commodity futures, Sugar (CANE), Corn (CORN), Soybean (SOYB), and Wheat (WEAT). All of these are ETFs that have exposures to several futures contracts at a lot of different strike prices and expiration dates.

The issue with this kind of fund is that not all commodities are listed and liquid which limits its exposure.

TAGS has not been able to beat the S&P 500 and has lagged significantly by about 18%.

The risk profile compared to the S&P 500

| Beta | Sharpe | Standard Deviation | |

|---|---|---|---|

| TAGS | 0.61 | 0.94 | 15.17% |

| S&P 500 | 1.00 | 0.37 | 18.16% |

Even though it did not manage to beat the index it was able to give lower volatility and risk-adjusted returns.

The above data shows that even though, you can invest through ETFs the returns and risk profile of that investment is different than that of direct buying. But it will still provide a certain level of diversification and stability to the portfolio.

Risks of Farmland Investments

There are certain risks associated with every type of investment. Though it is a fairly stable asset class that has good yields, there still are certain risks that come along with the investment.

The most noticeable and frequent risks faced by this asset class are

- Liquidity Risk

- Climate Risk

- Currency Risk

Most risks like climate and currency are based on external economic or ecological factors because the asset is risk-averse.

More risks are associated with this investment, but a lot of them differ from country to country as each socio-political and socio-economic environment comes with its own unique type of risks and challenges.

The aforementioned risks are general risks that will occur agnostic of the geographical and economical climate.

Below we'll take a look at how these risks affect the investment or some specific aspect of the investment and then look at ways to mitigate those risks.

Liquidity Risk

Farmlands are mostly family-owned and are passed down from generation to generation. So there was never a lot of velocity in its transactions.

Even though now there is a splurge of institutional investment in this asset class, it still has very low liquidity. It is majorly due to its high capital requirements.

It is projected that in the next 20 years farmlands will pass ownership from family-owned to investment corporations owned. That will create liquidity in the asset.

Naturally, any asset with low liquidity compensates for the lack of it with high yields; farmland is no different. The cash/crop yields on this asset class can easily go north of 5%.

The yields entirely depend upon the type of product that the farm is focusing on. Traditionally horticulture has had the highest yield.

The way to mitigate liquidity risk is through generating more cash flow, which can be achieved through investing in different kinds of products, which yield at different times throughout the year, which will lead to steadier cash flows.

Climate Risk

Climate is the major source of risk for this asset class, the crop yields are entirely dependent on the type of climate, amount of expected rainfall, etc.

This asset class is heavily reliant on climate and extremely accurate weather data from the meteorological department. Too high or too low rainfall, temperatures, wind factor, etc of them affect this asset class.

This is the most volatile aspect of this investment.

There are several ways to hedge against climate risks. First is geographical and product diversifications.

Clustering farms in a certain area is a huge risk as if the climate takes a sudden turn, it can destroy yields.

The same goes for the product portfolio. Having different kinds of crops, fruits, etc will make sure the yields are protected.

Having that diversification will assure that a calamity in one area will not completely destroy the portfolio yields. This diversification can also be done globally.

Insurance is another way to mitigate climate risk. It gives a degree of surety that even if something happens, the insurer will bear the majority of the damages.

Currency Risk

This is a factor when the produce is exported out to other countries. Currency risk is fairly easy to mitigate.

Usually, currency risk is mitigated through a forward contract, which will set a specific price, date, and quantity of the product to be bought. This contract gives the buyer an obligation to fulfill their end of the contract.

Forward contracts, unlike futures contracts which are regulated by the exchange commission, forwards are not regulated. Hence, there another risk called counterparty risk arises where if one party refuses to fulfill their end of the contract.

But a forward contract is still a legal document so it can be taken to court.

The currency itself can also be hedged against by taking a long or short position in a currency swap contract.

For example, if a contract is set between two parties from the UK and Canada, the seller is from the UK, and the buyer is from Canada.

So to hedge against currency risk, the buyer has a risk is the pound grows stronger compared to CAD, so the buyer will need long a CAD/GBP swap, so if the price goes up, the contract becomes profitable, and the losses in the transaction are covered and vice versa with the UK seller.

or Want to Sign up with your social account?