Sukuk

A tradable trust certificate compatible with Islamic law, a plural of the Arabic word "sakk," which means a deed or a certificate.

What Is a Sukuk?

Sukuk is a tradable trust certificate compatible with Islamic law. Sukuk is a plural of the Arabic word "sakk," which means a deed or a certificate.

It refers to an investment certificate or note, which provides evidence of ownership of a particular asset or a project, that is in line with the requirements of Islamic finance.

Islamic finance is raising capital by businesses, individuals, or governments that comply with the Islamic law Sharia.

The Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) defines it as "certificates of equal value representing undivided shares in ownership of tangible assets, usufruct, and services or (in the ownership of) the assets of particular projects or special investment activity."

It is often referred to as an 'Islamic bond.' Indeed, it is an Islamic financial instrument that provides the exact commercial equivalent to a conventional bond. However, their legal form is very different.

It is a trusted certificate representing proportionate undivided ownership in the underlying tangible asset. Its return derives from the yield generated by the underlying asset or investment. The holders of this share lose and profit from the underlying asset in most of its structures.

On the other hand, a traditional bond is a fixed-income financial market instrument representing a loan from an investor to a borrower. The losses and profits are not shared—instead, variable or fixed interest payments from the borrower to the investor.

While the conventional bond is a debt instrument, the Islamic version has features of debt, equity, and a hybrid instrument. Their common feature is the maturity date and, in some structures, the regular income for the holder over the period and a final payment at the maturity date.

It is also similar to stocks. However, it represents ownership and no guarantee of a fixed return (for some structures).

The debate on whether it is a debt or equity instrument is ongoing primarily as this instrument exists in two different versions:

- Asset-based

- Asset-backed

The difference between the Asset-based and Asset-backed instruments is in how the returns and repayments to the holders are financed.

In the asset-based structure, the return and repayments are not directly financed by the asset. However, in the case of asset-backed instruments, the underlying assets directly fund both the return and repayments.

An asset-backed structure is based on a true sale transaction. Its fundamental principle is that the asset remains under the investor's ownership throughout the maturity period, and returns are linked to the asset's performance.

Therefore, instead of referring to Sukuk as an Islamic bond, it is more appropriate to refer to it as Islamic capital market securities, Islamic trust certificates, or simply Islamic securities.

The objectives of Islamic Investments

Islamic investors are not very different from traditional investors. They seek a return for their investment with the preferred risk level. However, the Islamically-themed investment has a few other features than the conventional one.

The Islamic investment strategy is not only based on financial criteria but also non-financial criteria related to religion and defined by Islamic law. Compared to traditional investments, Islamic investments, such as Sukuk, have the following distinctive objectives:

- Support sharia-compliant activities.

- No excessive risk, which is not allowed by Islamic law.

- Focus on reasonable long-term returns.

fundamental principles Of Sukuk

It is structured according to the rules stated in Islamic law (Shari'ah). Therefore, the basic principles relevant to its structure under the principles of Shari'ah are the same as those of other Islamic finance instruments.

In general, some activities are not allowed (haram) for the investors as per Islamic law, and others are permitted (halal).

There are three main rules to be followed:

- Prohibition of charging and receiving interest (in Arabic, ' riba').

- The underlying asset must comply with Islamic law and not be related to prohibited activities.

- Prohibition of certain types of trading related to uncertainty (gharar), speculation (maysir), and exploitation of ignorance (jahl).

Prohibition Of Charging And Receiving Interest

In Islamic finance, conventional interest is prohibited. Therefore, the Islamic trust certificate contract is focused on obtaining a profit. The holder has an ownership right in a particular asset and is entitled to the returns generated by the asset.

Prohibited Activities/Industries

In addition to banning interest, Islamic law prohibits Muslims from participating in certain unlawful activities or industries involved in such activities. Therefore, the underlying assets must not be related to those activities and industries.

These prohibited industries would vary based on how strictly Islamic law is interpreted in the respective jurisdiction. The prohibited industries are

- The adult entertainment industry

- Gambling and prostitution

- Food & Beverages industry

- Pork and pork-based products

- Alcohol and alcoholic beverages and products

- Tobacco

- Intoxicating drugs

- Any illegal activity

- Weapons of mass destruction.

Prohibited Types Of Financial Market Trading

According to Islamic law, Islamic investors should not engage in financial market trading transactions that involve interest, speculation, exploitation, the uncertainty of ignorance (jahl), and excessive risk without market knowledge. Identified transactions that are not allowed are Day trading and Options and Futures.

Most of these restrictions and rules have a character of additional non-financial (social) investment criteria. So, Islamic finance instruments are often considered Socially Responsible Investments.

Although the general restrictions in Islamic finance are precise, the actual implementation is more complicated. In some jurisdictions, Islamic law is interpreted more strictly than in others. For example, the music industry could also be considered a prohibited area.

What is the Sukuk market?

The use of Sukuk is not a new phenomenon. Islamic communities used so-called 'papers' to represent financial commitments from trade and other transitions. The first transaction is recorded from Syria in the 7th Century AD.

Structured and well-defined Islamic bonds in the market were introduced in 1983. However, the Jordan Islamic Bank issued the first Islamic bond, called "Muqarada," in 1978. Due to the lack of infrastructure and transparency, these first bonds were unsuccessful.

In 1983, Malaysia issued the first Sukuks valued at approximately 30 million dollars. It was issued based on structures developed by standard-setting organizations in the Islamic finance industry.

After that, the government of Bahrain issued the first international sovereign Islamic trust certificate in 2001.

The Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) is the most important Islamic finance standardization institution. It was established in 1991, and it is based in Bahrain.

Its main objectives are to develop, disseminate, and harmonize Islamic financial institutions' accounting policies and procedures by preparing and issuing accounting standards and interpretations.

In 2008 the issuance was highly standardized thanks to the Official Statement of AAOIFI, which provided some needed guidance concerning the various structures.

Since then, both domestic and international issuances have been a growing trend. The global issuance was 250 billion dollars in 2021, coming up from 180 billion in 2020 (IIF).

The most prominent Islamic capital market in Malaysia. The other core jurisdictions are the Gulf Cooperation Council Countries (GCC), Indonesia, Turkey, and Pakistan. In addition, non-core market sovereigns such as the UK, Maldives, and Nigeria also issued these instruments.

It is also an attractive alternative investment instrument and funding source in non-Muslim countries.

In 2014, the UK was the first non-Islamic country to issue a sovereign Islamic bond of around 3 billion dollars from global investors in the UK, the Middle East, and Asia. The UK's main goal was to establish London as a global Islamic finance hub.

The Government of Hong Kong also issued a sovereign trust certificate of 1 billion dollars in 2014, following ty Luxembourg with 2.5 billion dollars (Latham & Watkins).

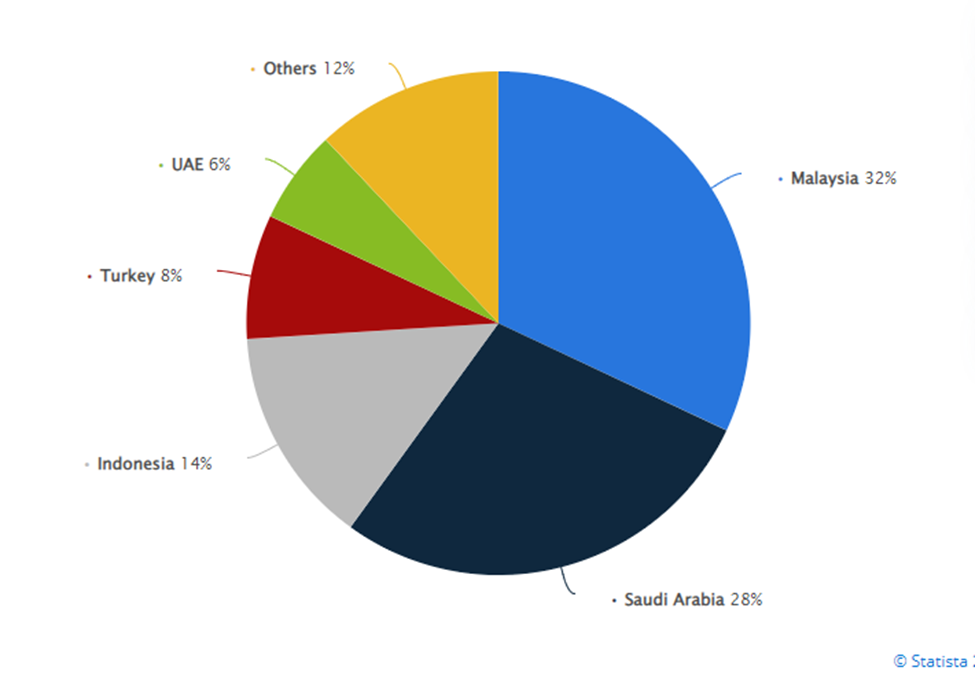

The chart below illustrates the distribution of total issuance worldwide in 2020.

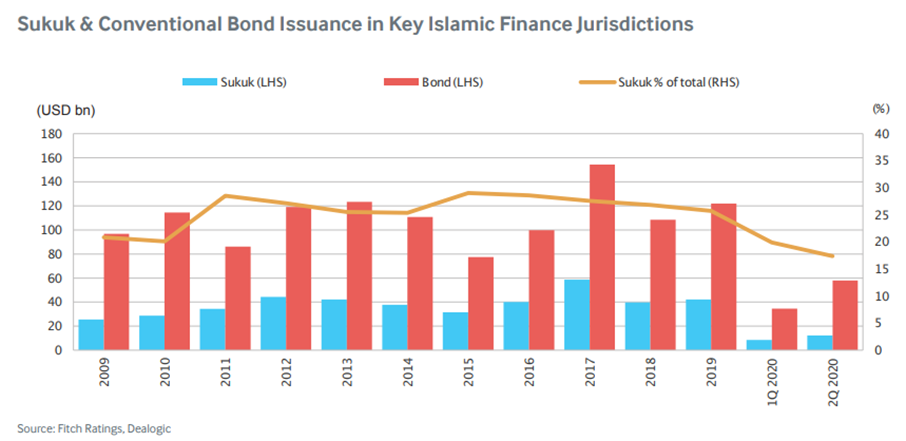

Comparing Islamic and conventional bond issuance, this has had a stable trend since 2009 in critical Islamic Finance Jurisdictions.

The slide decrease in 2020 is believed to be a result of further standardization of the international market. In addition, the issuers revised terms and added clauses to the new and existing documents to comply with the newly published AAOIFI standards update.

The chart below demonstrates the volumes of Islamic and conventional bond issuances in key Islamic Finance Jurisdictions between 2009 and 2020 and their proportions.

differences between the Sukuk and Conventional Bonds

The chart below summarizes various features of the Islamic trust certificate and conventional bond and their similarity or differences.

| Feature | Sukuk | Conventional Bonds |

|---|---|---|

| Ownership | Represents the investor's ownership of the underlying asset | Represents an interest-bearing debt note |

| Underlying asset | The asset is Islamic law-compliant | Any asset |

| Pricing | According to the value of the underlying asset | Based on the credit rating of the issuer |

| Returns | Share of profit | Fixed or variable interest |

| Re-sale | Re-selling the ownership | Re-selling the debt |

| Guarantees | No guarantees; the owner shares the risk | Guarantees the return of the nominal value at the maturity |

| Share of returns | Yes | No |

| Type of investment |

|

Debt instrument |

| Maturity dates | Yes | Yes |

| Tradable | Yes | Yes |

categories and types Of Sukuk

Since the establishment of the modern Islamic Capital Market, several categories and types of Islamic Trust Certificates have developed.

The main two categories distinguish whether the instrument is

- Product-based or

- Issuer-based (originator-based).

According to AAOIFI, in the category of product-based, there are 14 different types of structures. However, after the issuance of the AAOIFI's official statement, the market has become increasingly standardized around three types of forms:

- Ijara (Lease)

- Murabaha (Cost-plus-profit margin sale)

- Mudaraba-wakala (Profit sharing & Loss bearing Partnership)

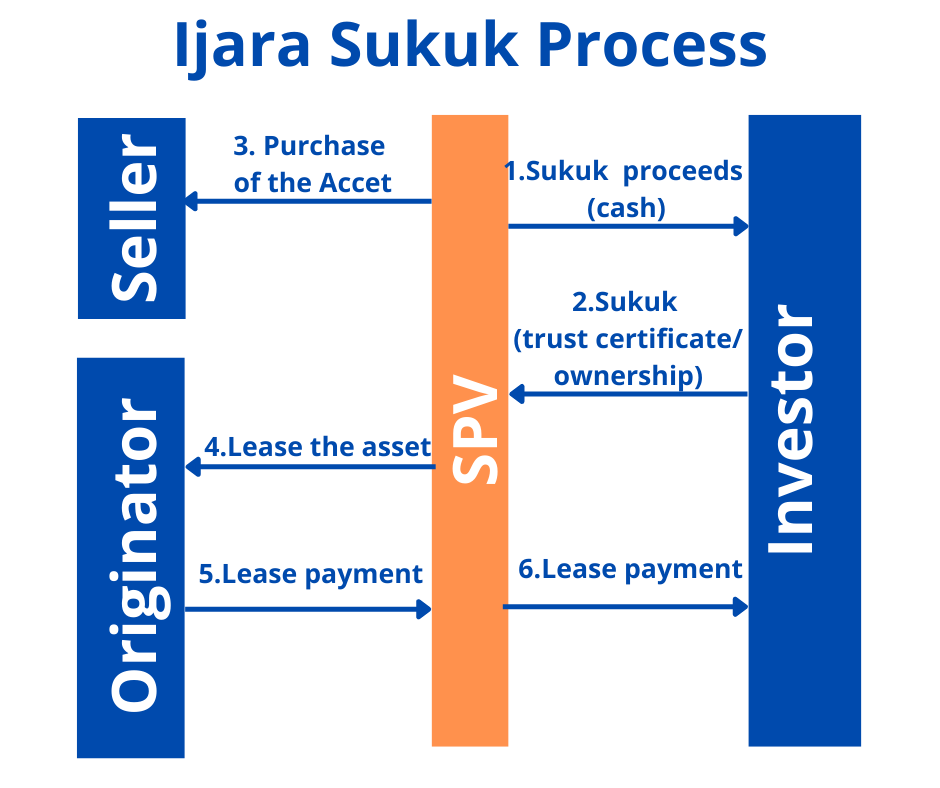

Most Islamic trust certificates are issued through a Special Purpose Vehicle (SPV) or an intermediary institution. It is established only for the transaction and does not have a physical location.

It has the same name as conventional finance. However, it has a different purpose. In the Islamic finance mode of securitization, the SPV services the cash flows for security holders, not the risk transfer.

The Islamic securitization method avoids transferring risk and distributes it between both parties. Instead, Islamic securitization sells the underlying assets pooled in SPV to investors and all of its risk.

Ijara (Lease)

Ijara is a contract where a party purchases and leases out a specific asset required by a client. The client pays the issuer a rental fee. The assets could be equipment, parcels of land, or buildings.

The ownership of the investment is not transferred. Ijara can be traded on the secondary market based on demand and supply. The rental payments can be fixed or calculated concerning a market rate, such as LIBOR or EIBOR.

Murabaha (Cost-plus-Profit Margin Sale)

The word Murabaha means a sales contract that includes the purchase price plus a profit margin agreed upon by both parties. The Murabaha structure is used when the originator does not own a real tangible asset to back the certificate.

The Murabaha Sukuk is a certificate of value issued to finance the purchase of goods through Murabaha so that the certificate holders become owners of the Murabaha commodity. Therefore, the most important criterion is the transparent disclosure of the profit margin.

Mudaraba-Wakala (Profit Sharing & Loss Bearing Partnership)

A wakala is an agreement between two parties whereby one party agrees to act on the other party's behalf in a manner akin to an agency arrangement (Latham & Watkins).

Mudaraba (trust financing) is a partnership contract between the capital provider and an entrepreneur. The capital provider would invest in an enterprise or activity to be managed by the entrepreneur.

On the other hand, entrepreneurs contribute time and expertise to generate profit.

Mudaraba is a partnership in profit whereby one party provides capital (rab al-maal), and the other includes labor (mudarib) (AAOIFI).

Profits generated by that enterprise or the activity are shared following the percentage specified in the contract. The losses are to be borne solely by the capital provider unless the failures are due to misconduct, negligence, or breach of contract terms.

Mudaraba structure

Mudaraba structure was the most widely used structure until AAOIFI criticized it for its limited share of losses. Other essential types are

- Musharaka (Profit & Loss Sharing Partnership),

- Istisna (Construction/Manufacturing Financing), and

- Salam (Sale with spot payment but deferred delivery).

Musharaka (Profit & Loss Sharing Partnership)

The word Musharaka means sharing and is used to participate in finance. Sukuk with Musharaka structure finances a project or a business activity that generates profits for investors. This structure is sound when the issuer does not own a real tangible asset.

Musharaka and Mudaraba differ in how the profits and losses are shared. Musharaka requires both profits and losses sharing, while the Mudaraba contract only shares profit.

Istisna (Construction/Manufacturing Financing)

The Istisna trust certificate mobilizes funds for real estate constructions and manufacturing significant assets, such as power plants. The proceeds are used to fund the contractor or manufacturer during the construction of the asset.

The manufacturer should hand the asset over on the agreed date, and the certificate is tradable only after this delivery.

Salam (Sale With Spot Payment But Deferred Delivery)

Salam means a sale of a specific commodity in specific quality and quantity. The item will be delivered to the person purchasing it on a fixed date against the payment in the present.

Salam Sukuk are certificates of equal value issued to mobilize salam capital so that the goods to be delivered based on salam come to the ownership of the certificate holders. It is most commonly used in the agricultural sector.

Based on the issuer or originator, they can be issued as

- Sovereign,

- Sub-national,

- Corporate, or

- Supranational.

An issuer or originator issues the sovereign trust certificate backed up by the Sovereign entity, such as a government or a ministry.

The sub-national or sub-sovereign certificate is issued by the authority that is hierarchically below the ultimate governing body of a nation. These bodies could be states, provinces, cities, or towns. Sub-national Sukuk is used to fund a municipal or local project.

A company issues Islamic corporate bonds. In addition, supranational institutions, such as the Islamic Development Bank, International Finance Institution for Immunization, and others, issue a Supranational Sukuk.

ESG Sukuk

The Islamic capital market has also reacted to the current market developments regarding the issuance of ESG or Sustainability-related instruments. For example, the ESG Sukuk offers a sustainability component to the Islamic capital market offering.

The Institute of International Finance (IIF) reported that only 2% of the issued Islamic trust certificates were ESG-linked in 2021, with Indonesia leading the green Islamic capital market. This 2%, however, only considers the certificates explicitly labeled as ESG.

It does not consider the implicit link between the social factor and the non-financial investment criteria compliant with Islamic law being applied in Islamic financial instruments.

What are the challenges in developing the Islamic capital market?

The biggest challenge in Islamic capital market development is standardization. Although the AAOIFI provides the relevant standards, not all the issued instruments comply.

The lack of standardization is shown mainly as

- Regional Islamic law differences.

- Lack of clarity on the risk level of the instrument.

- Legal regime differences.

Regional Islamic Law Differences

Shari'ah-compliant financing structures adopted in the Middle East differ considerably from those adopted in Asia. Many reasons account for these distinctions. An example is a difference in the interpretation of the Shari'ah between Middle Eastern and Asian scholars.

In the past, investors have viewed the Asian interpretation of Islamic Shari'ah as less conservative than that in the Middle East (Latham & Watkins).

Clarity On The Risk Level

Many early investors perceive Islamic investment instruments as secured instruments, benefiting from the security in the underlying asset. However, the investors' right to a claim against these assets depends on the structure in the case of default.

In some cases, the asset originator or the issuers can proceed with a nominal sale but not the true sale, which requires the completion of asset registration formalities. That means that the formal sale did not happen.

The structures not related to the true sale are, in most jurisdictions, considered not compliant with Islamic law. The AAOIFI appears to encourage a movement towards asset-backed forms, in which the investors have actual recourse to the assets in the event of a default.

However, most Sukuks in the market are designed to treat the holders the same as holders of conventional unsecured bonds would be treated in a case of restructuring or insolvency. Although asset-backed structures exist, they are comparatively rare (Latham & Watkins).

Legal Regime Differences

Differences in the legal regimes impacting the attractiveness of Islamic investments, including taxation, land transfer, and registration, might differ from country to country. Some jurisdictions can give an advantage to Islamic certificate issuances.

In other jurisdictions, the Islamic instrument could be disadvantaged. Malaysia Sukuk has a relatively better situation than conventional bond issuances in taxation and land transfer registration legislation.

Also, both regulations are comparable in Hong Kong, followed by Japan and Singapore.

or Want to Sign up with your social account?