Cap Table

Represents the ownership position and structure via a spreadsheet. It monitors the equity ownership position of the company's shareholders, including founders, investors, and other owners.

What Is a Capitalization Table?

A capitalization table, or a cap table, represents the ownership position and structure via a spreadsheet. It monitors the equity ownership position of the company's shareholders, including founders, investors, and other owners.

Every startup needs funds at its initial stage. During the funding stage, startups can attract the attention of different investors, and multiple of them might contribute funds for the business's growth.

The startup founders must establish a structure where they can show their ownership split and the percentage given to the investors. This is one of the core reasons you should invest time in creating a Capitalization Table and making it clear and understandable for investors.

It is a very important part of a company’s structure and valuation. But, even so, this would be one of the first steps a company or a start-up venture should focus on at the beginning.

It is usually created in a spreadsheet or table displaying the company’s equity ownership. But exactly what is this capitalization table, and why is it so important? Let us know.

Key Takeaways

- A capitalization table, often referred to as a cap table, is a spreadsheet or document that provides a detailed breakdown of a company's equity ownership structure.

- The capitalization table lists all the securities issued by the company, including common stock, preferred stock, options, warrants, convertible securities, and any other equity or debt instruments.

- The cap table includes details of all securities issued by the company, such as the type of security (common stock, preferred stock, options, etc.), the number of shares issued, and the price per share.

- The cap table helps in determining the valuation of the company and assessing the impact of future financing rounds or equity issuances on existing shareholders' ownership percentages and dilution.

Understanding a Capitalization Table

A capitalization table or cap table is a chart or spreadsheet that lists a company’s securities, including shares, options, convertible notes, warrants, etc. It lists all the shareholders and their corresponding assigned stocks. It is a summary that an investor would want to know about the company's ownership.

Here, public companies have transfer agents and different types of technologies to keep track of their shareholders. Still, private companies typically have a much simpler capital structure and more limited stakeholder accounting requirements, so they use a cap table for better understanding.

It is used by venture capitalists, investment analysts, entrepreneurs, and stakeholders to make important financial decisions and judgments to determine the company's market value.

This is one of the first documents created by a company in a startup phase, which details the financial commitments made by each partner or investor, the number and type of shares they own, and their commitments towards the company, thereby showing the ownership split between different investors.

Anyone who invests in a startup officially becomes a part of the cap table, and someone with high investment values needs to have a deep understanding of this document.

How is a cap table made?

Most startups use spreadsheet software to establish the table at the beginning. However, since it is a high-value document, it should be made in a clear and easy-to-understand format, showing who owns the share, how many, and no outstanding shares.

Typical formats include types of shares and percentages in the row of the table and the name of the investors in the column. Depending on the users of the information, the investor's name can be listed in different formats.

The capitalization table categorizes investors as founders, executives, important personnel with equity shares, angel investors, venture capitalists, and other parties. Investors can also be listed in descending order as the percentage of company ownership.

Before creating the cap tables, companies like to represent their valuations, which include all the types of shares, the number of shares of each type, the price per share, and the percentage of each type of share in the company’s valuation.

Every capitalization table should contain the following details:

- Authorized shares: Authorized shares are the total no of shares that the company has authorized for issuance.

- Unissued shares: The total number of shares left to be issued. It includes all types of securities.

- Outstanding shares: The number of shares that have been issued but do not include:

- Stock options that have not been granted

- Granted options that have not been exercised.

- Valuation details: Valuation details include pre-money valuations, the amount of new equity raised, per-share price, and the number of shares.

- Price per share: This is the price for one share of the stock in the startup.

- Complete list of shareholders: It includes all the types of shares investors own, the total number of shares, and the percentage ownership stake.

Note

Other categories of information may be included in our capitalization table as per the requirements, such as warrants, restricted stocks, etc.

The table created will provide information about the whole spectrum of ownership details. For example, the capitalization table will show the amount of capital owned by each investor, the different types of shares owned by them and their current market value, and the ownership percentage as a whole.

The table should also provide the information and track each type of share of a similar kind. For example, there may be different types of preference share capital the company has received as investment capital.

These preferred shares have clauses allowing investors’ approval rights, which entails approving future rounds of finance. Therefore, a cap table should always contain the percentage of outstanding shares.

Because businesses are ever-changing, the table should also go hand in hand with the change, implying that it is not a fixed table. In and out, investors are also involved in the table’s fluctuating nature.

Example of a Cap table

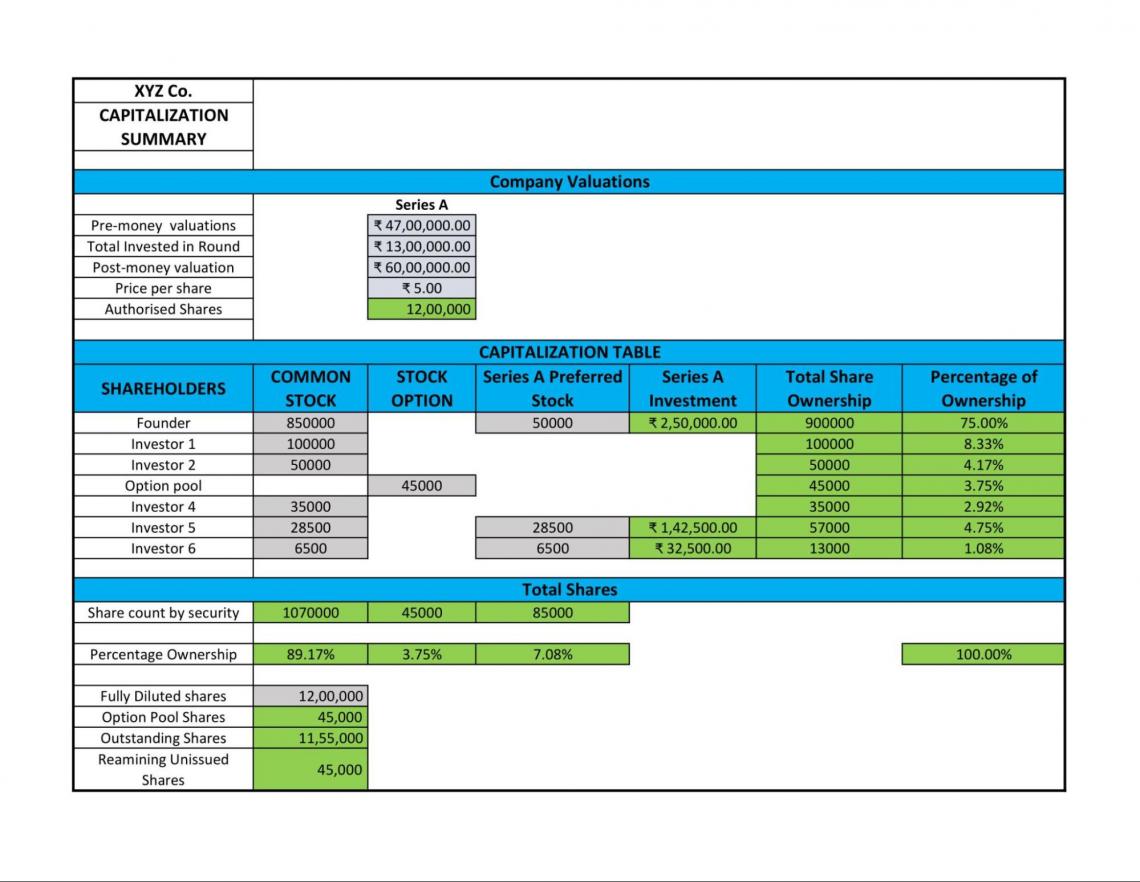

Below is an example of the table called a cap table template.

The spreadsheet shown below has two tables: one containing the company’s valuation and the other containing the ownership of the valuation, the capitalization table.

All the numbers taken below are assumed. Formulas used for basic calculations are the SUM and other basic mathematical functions.

Remember, companies can have their own methodology for calculating. This is just a template of how it may look:

In the above image, the gray-ish areas are the assumptions made, and the green-ish areas are removed through logical formulas.

The company’s valuation section assumes the pre-money valuations, the investment in the round, post-money valuations, and the price per share.

The values are rupees 47lakhs, 13lakhs, and 60lakhs, respectively, and the share price is assumed to be 5 per share. With this information, we can take out the authorized shares, rupees 60lakhs divided by 5, giving us 12lakhs shares. Here we assumed “ Series A’’ as the share.

Now, in the Capitalization table, we can find the Shareholders involved, common stock, stock options, Series A preferred stock, Series A investment, the Total Shares Invested, and the amount of the shares to the authorized shares.

Here we can find how many shares are owned by different investors and how much the shares are as a percentage of the ownership.

For Example, Investor 1 has 1,00,000 shares, therefore, out of 12,00,000 shares investor 1 owns 1,00,000, which is 8.33% {(1,00,000/12,00,000)*100}%. Similarly, all the percentage ownership adds up to 100%.

Next, at the Total Share, we find out how many shares are invested as a number or percentage and how many shares remain to be issued.

Why are Cap Tables important?

Many different companies and personnel use information from the Capitalization Table. Therefore, an accurate capitalization table affects several users of the information. Also, it helps in different follow-ups of the authorities that use the table to gain potential future insights into investment opportunities for the company.

Some of the uses of cap table are as follows:

1. For start-ups

The founders can use the cap tables to understand how the valuations will affect the ones who own and the one who controls the company. It also facilitates a quick decision-making process.

2. Investors

They want to know how the capital and ownership have been distributed and what changes have been made after rounds of finance for acquiring investments.

For example, new investors in the company may want to know how their investment would affect the share of the other investors.

They want to be out of any legal dispute with other investors, and also, they would want to know how they will be paid back, that is, the return on their investment.

3. Tax authorities

They use the cap table to determine whether the company and its stakeholders are paying timely and necessary taxes.

Note

Tax authorities may charge hefty penalties if the taxes are not paid duly or the table is not updated regularly for a proper calculation to avoid paying more or fewer taxes.

4. Shareholders

The cap table specifies the amount the shareholders will receive on their investments. When the company sells itself to another company, the proceeds from the sales are distributed among them, thereby reducing any disparity between the business owners.

Why is a cap table important for start-ups?

A cap table is important for various reasons (some of which are mentioned above), especially for start-ups.

It is very important for the founder to understand the full spectrum of the table and why the execution of it is so crucial. They are important because they act as the health measure of a start-up for investors.

Ownership Split

The founders should be aware of the company's ownership, which can be understood through a cap table. Understanding the table is important since it helps a company grow and continue developing.

A cap table can only understand the ownership split, helping current investors see who controls how much. They also want the ability to forecast potential dilutes and payouts based on the ownership split.

The split can affect the company’s future fundraising rounds and who is involved in controlling and decision-making processes.

Raising Funds

Raising funds in the investment rounds is very important in forecasting the dilution and payouts on their investments. Therefore, it is very much affected by the tables.

By viewing a cap table, interested investors can evaluate the table to understand and determine how much control and leverage could be maintained during negotiations.

Note

An existing shareholder can easily determine what percentage of the equity to give up in exchange for the capital contributed.

Tracking The Value

For tracking the value of a start-up, it has to be updated regularly and contain information in detail. The employers also find the information provided by the table to be very useful.

An updated and detailed cap table is helpful for employers to access if they have options or equity stakes in the startup they work for.

To draw in top talents, equity is offered appealingly. Tracking the information by viewing the table is very important to other users.

For Audits Related

During auditing, a well-updated and detail-oriented cap can allow the company’s legal team to present the ownerships accurately and in a well-organized form using the cap table.

Note

Generally, the cap table must be well-managed, detailed, and organized because it affects the health and growth of the company in financial situations.

How to keep a cap table updated?

After running the company for some time, you must regularly update the table. Therefore, updating your cap table using spreadsheet software is very important.

Since we have to be careful about consistent names and regularly record whenever something new occurs, this could include the issuance of new options for employees, the sale of shares from a shareholder, or any other investor who retires or joins in.

If the table is not updated regularly, it could become a costly mistake as you would require different professionals to correct the mistakes.

Updating the table helps the organization and investors, prospective investors, tax authorities, and venture capitalists, who require such information to understand when to invest in the company.

Note

The table would work as a piece of confident information for investing and recognizing potential payouts.

It is highly recommended that if the startup wants ease in creating and updating spreadsheets, different software programs are available to manage and update our cap table.

There are countless options available. Two such websites are Pulley and Carta. They automatically update and create changes on the table whenever something occurs.

Everything You Need To Break into Venture Capital

Sign Up to The Insider's Guide by Elite Venture Capitalists with Proven Track Records.

Researched and authored by Swagatam Ghosh | LinkedIn

Free resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?