How To Relever Beta?

The process of removing the financial risk factor from a comparable company

What is Relever Beta?

Relevering Beta is the process of removing the financial risk factor from a comparable company and only considering the Beta with the business risk element so that we can use this Beta to value our company.

Why do we Relever Beta? Have you ever considered why you would face greater risk when investing in an individual stock (say Apple) as compared to a broader index like the Nasdaq Composite?

This is because the market is an aggregator and spreads out the risk posed by individual companies. Investing in one specific stock would mean you are exposed to the risk inherent in that stock and are unprotected through investments in other stocks.

Stocks carry two specific risks. The first type of risk is associated with the company’s operations.

- How niche is the industry the company caters to?

- How competitive is the market in which the company operates?

- How volatile are the revenues and costs of the organization?

- How strong is the company’s market share?

But, another risk pertains to a company’s capital structure. This is the risk posed by the company’s capital structure.

- How much debt does the company have compared to its equity?

- How expensive is it for the company to raise debt?

The beta that considers both operational risks and risks associated with the capital structure is known as Levered Beta. While a group of companies operating in an industry may face the same set of operational risks, each company would have a different capital structure.

Therefore, it becomes necessary to relever beta if we want to compare the risk of the two companies.

Key Takeaways

- The need to relever beta arises on account of a company’s capital structure.

- Companies carry two kinds of risk - operational and financial risk.

- Levered Beta includes a company's financial risk and must be adjusted for business risk to compare companies within an industry.

What is Beta, and why do we use it?

Beta is essentially a measure of volatility that measures how the stock moves with the market. Investors use the Beta for the following.

1. Risk assessment through Beta

Let us take an example to understand the concept of Beta. We will be comparing the broader market through an index (say the S&P 500) with an individual company's stock (say Google).

We will get to the calculation of Beta later. But let us first understand the interpretation. Let us say that Apple has a Beta of 1.3. This means that Apple moves 1.3 times faster than the market.

So, for example, if the S&P 500 increases by 10%, Apple stock will increase by 13%. Therefore, we can say that Apple is more volatile than the market. More volatility means more risk.

2. Beta’s use in portfolio diversification

Beta is a measure of systematic risk. Since beta only considers factors that affect the market as a whole, i.e., inflation, GDP, etc., it measures how sensitive a company is to these factors compared to the market.

This is how Beta helps in portfolio diversification. Stocks with greater volatility can be combined with low-volatility stocks to ensure that the portfolio has a risk similar to that of the market while generating superior returns.

Note

Gold is actually a negative Beta stock. It moves opposite to the market. Therefore, many people use gold as a safe haven stock.

How to calculate Beta?

Beta is measured using two factors.

- The covariance between the asset/security and the market.

- The variance of the market.

Here is a table depicting hypothetical returns of Apple stock and S&P 500.

| Year | Apple ( return in %) | S&P 500 (return in %) |

|---|---|---|

| 1 | 4.1 | 3.7 |

| 2 | 4.6 | 3.9 |

| 3 | 5.7 | 3.3 |

| 4 | 5.4 | 4.9 |

| Mean | 4.95 | 3.95 |

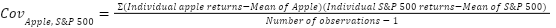

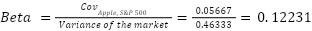

We then calculate the covariance between the stock and the index using the below formula.

We get the covariance as 0.05667.

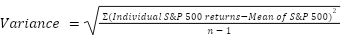

We get the variance as 0.46333.

Process of Relevering the Beta

To understand the process of relevering beta, let us take an example.

1. Gather the necessary data

The first step in gathering data is determining a peer company.

An investment analyst plans to value a company in the FMCG industry - P&G. To do this, he would need a comparable company, for which he chooses Unilever.

While these two companies are comparable in terms of the risks they face, they would definitely have a different capital structure.

Let us say that both companies fall under the same tax rate of 30%. Provided below are some additional details.

| Debt/equity ratio of P&G | 0.85 |

| Debt/equity ratio of Unilever | 1.18 |

| Levered Beta of Unilever | 1.10 |

| Corporate tax rate | 30% |

2. Estimating the tax rate

We have taken the tax rate as 30% in our example. While this figure is an assumption, analysts use various sources to figure out the tax rate.

For a public company, the tax rate can be found through the company’s SEC filings, investor relations page, or the financial statements in their annual reports.

For a private company, analysts could use industry reports where the average tax rate is given or private company databases like Crunchbase or Pitchbook.

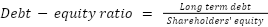

3. Estimating the Debt/equity ratio

In our example, we have taken the D/E ratio of our comparable company, Unilever, as 1.18. We will assume that Unilever is a public company and our company, P&G, is a private company. So, how do we get the D/E ratio for a private company?

The D/E ratio of a public company can be directly derived from its financial statements.

The process is not so simple for a private company, as there is no readily available information. Analysts might have to estimate this ratio on the basis of the risk profile of a similar company or may contact financial advisors who work with private companies.

They could also use private company databases, credit reports, or industry reports to get a fairly accurate estimate of the D/E ratio.

4. Calculate the unlevered Beta

Now that we have all the information, we can start our process.

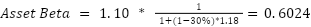

To measure the unlevered Beta of P&G, we need to remove the leverage factor from the comparable company.

The unlevered Beta of the comparable company (Unilever) is known as the Asset Beta, while the levered Beta of the comparable company is called the Equity Beta. We must remove the leverage factor from the equity Beta to get our company’s unlevered Beta.

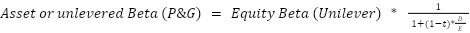

Therefore:

5. Relever the Beta

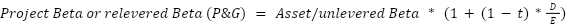

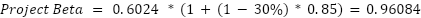

Once we have unlevered the Beta of the comparable company, we can now assess P&G’s Beta, including its leverage. This is known as the project or the relevered Beta.

Therefore:

The Beta of P&G is 0.96084

6. Use the relevered Beta

This Relevered Beta is then used for various calculations, such as the Capital Asset Pricing Model (CAPM) to measure the company’s cost of equity or the Discounted cash flow (DCF) analysis as a risk proxy to value a company.

Advantages of relevering Beta

Relevering Beta has various advantages.

1. Enhances the process of risk assessment

As an analyst, when comparing two companies, you should be more concerned about their operational structures rather than their financial risk. Operational risk is easier to compare when looking at two companies from similar industries.

For example, BCG and McKinsey operate in similar industries with similar operational risks. But, the two companies may have different levels of debt and equity in their capital structure. Relevering helps isolate this risk.

2. Valuation of private companies

Private companies do not have readily available market data to calculate or look up the Beta. Therefore, relevering Beta becomes even more important when we value private companies.

For this process, we would look at readily available data from a public company in a similar industry or undertake a project similar to our target company. We would then isolate the financial risk of the comparable company and calculate our target Beta.

3. Risk modification

Relevered Beta is an important metric used by executives and corporate decision-makers to modify their capital structure. Upon relevering the Beta, the executives can determine whether their debt-equity ratio is similar to or different from the comparable company.

With this information in hand, they can then modify their capital structure to bring their risk levels and Beta in line with the industry.

Disadvantages of relevering Beta

While relevering can provide valuable information, it also comes with certain disadvantages.

1. Assumptions about capital structure are subjective

Let us take the example of a private company, XYZ Inc. There is no market data as the company is not required to publish its financial reports. Since the analysts are unaware of the company’s capital structure, they are forced to make assumptions.

Different analysts would have different expectations of the capital structure based on the company’s risk profile. Even a small change in these assumptions across analysts would mean that the relevered Beta figures produced would be significantly different.

2. Outdated or unavailable data

When we have to obtain up-to-date market data for a private company, the process becomes tricky. If there is no data available for such a company, the analyst might use a figure that was available, say, five years ago.

But this time, market conditions and the company’s risk profile would have drastically changed. So, this figure would produce a relevered Beta that is inaccurate.

3. Limited applicability

Relevered Beta is only useful when considering industries with significant financial leverage, such as utilities and real estate. This process might not make much sense for industries like services where the leverage is low.

Conclusion

This article primarily talks about the process of re-levering Beta. But to understand why Beta needs to be relevered, and what it is composed of, we had to go through a few concepts.

We began by discussing that the need to relever Beta comes from two risks that a Beta is composed of - a company’s operational and financial risks.

The operational risk is associated with the company’s top line, i.e., its revenues and costs, while the financial risk focuses on leverage or capital structure. If we were to compare the Beta of two companies, it would be unwise to calculate the levered Beta.

Beta is used in various scenarios. It is used as a measure of systematic risk to measure the volatility of a stock against a market measure like an index. Using this figure, investors can then decide the ideal risk (Beta) for their portfolio.

To relever the Beta, we need to consider the asset Beta or the Beta of the comparable company we are using as a metric for our Beta calculations.

This asset Beta is then adjusted for our company's capital structure to arrive at the Beta figure.

or Want to Sign up with your social account?