Stepping Away from Lending Club

Mod note: Blast from the Past - "Best of Eddie." This was originally posted in April 2013.

It's been awhile since I've done an update on the Lending Club WSO CDO and my Lending Club account in general, so I thought I'd knock one out this week. The fact is, I'm no longer investing with Lending Club and I'll explain why. Everyone's investment objectives and risk tolerances are different, so this change in strategy is just a reflection of my own personal preferences and is in no way meant to take away from the many great things Lending Club has accomplished. It's still the best P2P lending platform (in my opinion); it's just not for me anymore.

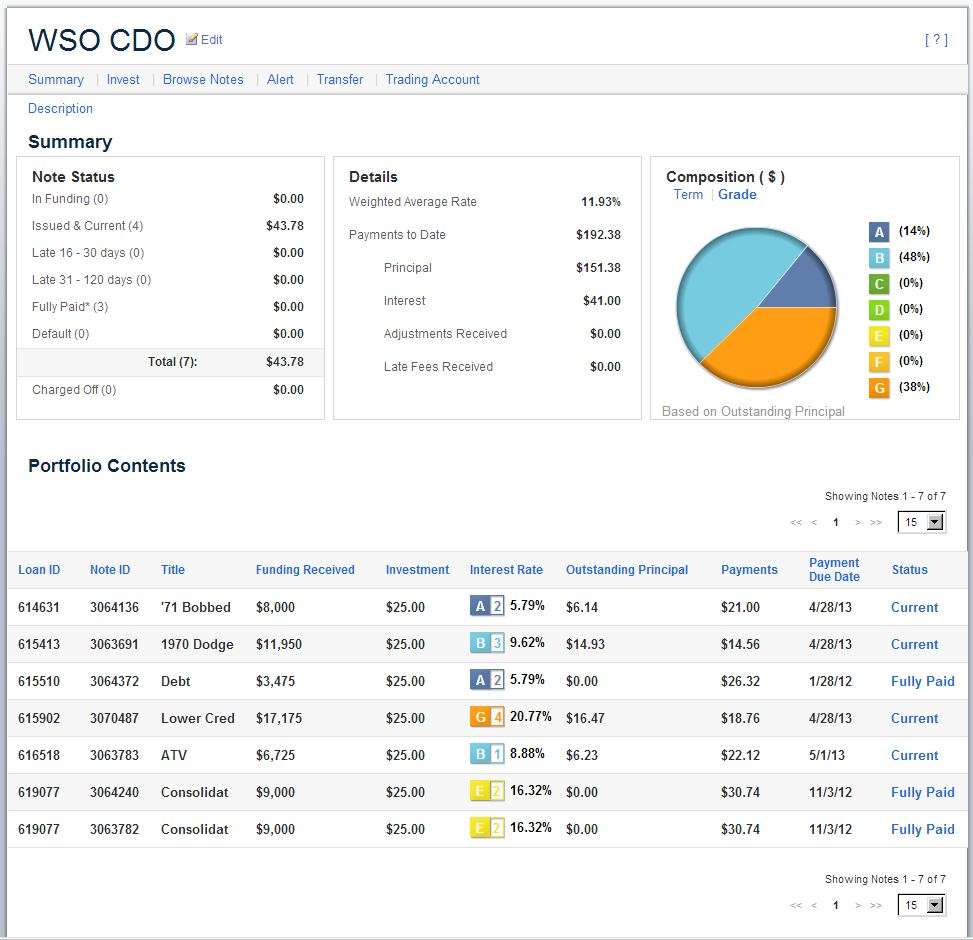

First things first. As of April 29, 2013 the WSO CDO is down to its last 4 notes (after beginning with 10). Three were sold and three have been fully paid (as shown after the jump). The weighted average rate is 11.93%, but that hasn't changed since day one. The Net Annualized Return on my broader Lending Club account is 14.89%. To date, I've had no defaults or charge-offs due to my aggressive aftermarket sales strategy.

At the present I'm just letting my account wind itself down. I haven't invested in any new notes in roughly five months. The notes I have remaining pay themselves off month by month and if a payment is missed I sell the note on the aftermarket immediately. I expect my account to take probably another 24 months to move completely to cash.

So why am I leaving Lending Club?

In a word, they've evolved. I got started with them in late 2010 when very few people knew about P2P lending and the company was still trying to gain traction. In the early days, Lending Club was extremely investor-centric. Underwriting was wide open, and investors had access to all kinds of information on borrowers. If an investor was considering a particular loan and he had a specific question of the borrower, he could just ask him and then invest if the answer was satisfactory.

Eventually, Lending Club moved away from this model. Investors were no longer allowed to interact freely with borrowers, and investors were limited to about a half dozen pre-approved canned questions they could ask a borrower. At the same time, P2P lending began to take off, so there were a lot more investors now. What that meant was that loans became fully subscribed more quickly and borrowers no longer felt any pressure to answer questions or make investors comfortable with them. Good for borrowers; not so good for lenders.

I suspect Lending Club lost a lot of investors when they made that change. I wasn't one of them. Perhaps it's my suspicious nature, but I always figured borrowers were lying anyway, so I never put much stock in the questions asked.

As an investor, it's important to keep an eye on your portfolio or you're going to deal with defaults. Lending Club has always been up front about this and even bakes a default rate into their expected rates of return. But for vigilant investors (like myself) defaults could be limited or even eliminated. That's because Lending Club always kept detailed notes on what was going on with individual loans.

For example, if someone missed a payment it was reflected on their note that day so the investor could see that the payment was missed. Also catalogued was all the attempts to reach the borrower and detailed notes on any conversations with the borrower. This kept the investor in the loop and helped make the decision to hold the note or sell it easier to make. In the early days, you could even call into Lending Club and talk to a customer service rep about the note and they'd tell you even more about the collection efforts.

Eventually, though, this changed too. Just like the ability to ask borrowers free form questions, the collection notes on the account became canned. Where there would have been detail before, now it just said Missed Payment, or Attempted to Contact Borrower, or Borrower Promised to Pay. But no real detail and now when I'd call in the customer service guys would tell me that they couldn't give any more information.

Now it's at the point where I have to use Excel to screen for missed payments, because Lending Club is no longer annotating a missed payment until the loan enters the 10-day Grace Period. Sometimes not even then. I sold two notes this month which are currently In Grace Period and neither of them even reflects a missed payment yet. They're both more than 10 days past due.

Where it becomes a real problem is when you go to sell a loan that appears set to default. Obviously you want top dollar when you sell a note in the aftermarket, and the only way you're going to get top dollar is if the note is current and has never been late. If a note slips into the Grace Period it no longer qualifies as Never Been Late even if the payment comes in a day later.

The only reason I've been able to invest for three years and achieve a near-15% annual return with no defaults or charge-offs is my aggressive selling strategy when someone misses a payment. I literally want that note sold the second a payment is missed, because I know that's when I'm going to get the most money for it. If Lending Club is no longer notifying me that a payment has been missed as soon as it is missed, they're putting me at a massive disadvantage in the aftermarket.

So that's why I'm slowly winding down my account. On average, I'm selling about six notes a month in the aftermarket and probably two more on average are paying themselves off.

I don't want to sound negative about Lending Club, because I think they're great people providing a vital service and leveraging technology to create a win-win environment for everyone. But I'm not as interested in a win-win as I am in a win for me, and now the table is tilted in favor of borrowers instead of lenders. It's time for me to find the next low hanging fruit.

Fire away with your questions.

Mod note: Blast from the Past - "Best of Eddie." This was originally posted in April 2013.

Great post. Are you stepping away from p2p lending in general or are there any viable alternatives around?

I'm actually pretty interested in some of the JOBS Act companies that are listed on Wefunder. It's not lending, though, it's equity.

I'd love to read a writeup about Wefunder if you ever find the time.

I'm actually in the same boat. I've had an account with them for a couple years, but recently I've been having the same issues that you outlined above.

Another thing worth mentioning is that the site has far more members than before, which makes it particularly difficult to buy notes that fit my specific criteria, since those notes would sell out quickly.

Eddie, what prompted the shift in the way they treat lenders vs. borrowers? Do they simply not need to cater as much to lenders because of the explosion in interest in P2P lending?

I think it's a combination of that and CYA. An argument could probably have been made that they were violating customer privacy, etc by allowing direct access from investors. I don't buy it, but you know how liability goes - better safe than sorry.

As to why they've grown lax in reporting missed payments and things like that I can only guess that they don't have the manpower to do it anymore (because the number of loans has gone parabolic). At least I hope that's the reason, even though that's still unacceptable. As it is, it's taking a week or more for on time payments to post. I'm still waiting for payments made on 4/23 to post to my account.

This post comes at an interesting time. I just took out a 0% APR, 0 fee balance transfer through Chase and funded my LC account with an additional 15k in debt this weekend.

Also just moved 10k of my Roth IRA dollars over to LC last week.

I'm still loving LC and believe that it can be effectively automated - both the investing and monitoring parts. I only spend about 15min per week actually looking at my account and have been pulling in upwards of a 18% cash on cash IRR (excluding taxes; but part of the tax problem is solved with the Roth).

I think it will be interesting to see how this asset class performs through the next market crash.

Wow, sounds like a bank. Short term debt to fund long term, illiquid credit risk, no?

Wow. I've heard of blending, but that's a serious high-octane blend there. Is that 0% balance transfer for the life of the transfer? If so, that's a ballsy move but you're probably in good shape. Just curious, though, why not buy a high-yield utility stock or something that is both more liquid and more stable?

I've been following a strategy of trying to recoup as much of my $25 investment from 'at risk' notes by immediately selling in the secondary market. Unfortunately, this is getting more and more difficult and time consuming (for what I was hoping would be a more passive investment & income). I sort of enjoy spending 10 minutes looking over my account each morning but if it starts taking too much more than that I may move in the same direction.

How much are you recouping on notes in the grace period? I've only had to so

@dwight The key is to sell them when they're still Current before they slip into In Grace Period. Lately, because of the increased number of notes for sale in the aftermarket, I generally price my note at a breakeven (so if they've made $7 worth of payments on a $25 note I'll price it at $18.50 to break even after fees) and that usually places my note in the top 3 notes for sale on the note buying home page (when filtered for Yield To Maturity). That usually gets it sold in a couple hours.

When I'm dealing with someone likely to default (and if you miss a payment for any reason, you're likely to default at some point in my book), I'm more concerned about return OF principal than I am return ON principal. So far I've been fortunate and haven't taken a loss.

It's funny, because right after I wrote that I put two notes up for sale and one of them sold in less than five minutes.

Eddie, I'd be interested to know - at what point do you sell a note? I usually check mine each morning, sort by 'payment due date' and list any notes in which the payment hasn't posted by 7-8 days after the due date (since it take LC some time to process the payment and post to my account).

I do the same thing, more or less. But I take note of how many notes were supposed to settle each day and any that didn't obviously missed a payment (before anything is even posted to indicate that). That's when I sell.

Second note I placed for sale just sold, so that's both of them in about 20 minutes. That's pretty fast.

Does anyone know if Prosper's secondary notes market is as liquid as LendingClub's? I'm trying to decide between the two and noticed that Prosper does pay a bit higher interest.

Apparently someone disagree's with you on Lending Club: http://dealbook.nytimes.com/2013/05/02/google-to-invest-in-lending-club/

"Lending Club plans to announce on Thursday that Google led a $125 million deal to buy a stake in the company from existing investors. Foundation Capital, a current shareholder, also participated in the transaction. The latest investment values Lending Club at $1.55 billion, nearly triple the valuation of the last fund-raising round that closed last summer."

Yeah, that actually reaffirms my decision. Like I said on Twitter this morning, once it becomes mainstream it attracts all the dead money.

I dont think it matters. LC needs people to buy into their piece of shit LCA program.

The few "great" notes will still be snapped up fast by people who know what they are doing. And the few people who are willing to go the extra mile to grab these particular notes (and sell all their losers before grace period hits) will continue to earn returns over 20% annually with minimal effort.

Cant wait til my banks increase my line of credit so I can draw more capital at 2-3% without burning my credit score any further (its already dropped from 810 to the low 700s, lol).

IIRC both Lending Club and Prosper pulled the ability for investors to question borrowers. I believe this was because the SEC required so according to LendAcademy, They do need to speed up some of their processes though.

The account I created on there I funded with 25k. I have done absolutely nothing to worry about the defaults, invested exclusively in the D E F G notes and have a NAR of 12.32%. While the yield curve has bent downwards due to some defaults and charge offs. In my opinion the effect of these is not worth the time spent culling them from the herd. Since LC made the automated investing process the required input is even less than before. Will charge offs rise because of this? It is yet to be seen.

I will say that my returns on my lower ranked loans have been much better then I would have thought, I invested in mostly B loans and my return as been okay, but not as high as it could have been.

Lending club is now filing for an IPO:

http://www.bloombergview.com/articles/2014-08-27/lending-club-can-be-a-…

My concern with lending club is pretty basic. Current credit card default rates are 2%. LC default rates on average amongst the various grades I believe is ~15%. Forget loss given default, that's rate of default. I wonder if that gets higher in a recession. 0 recovery is tough. You're clipping great coupons in the meantime though and it's short term debt so can't complain.

Lending Club (Originally Posted: 04/09/2010)

http://www.lendingclub.com/home.action

Anyone ever mess with this..opinions?

That's an interesting concept, and I'm starting to see similar things pop up all over the place. Ultimately, if banks are just middlemen, it's usually a good idea to eliminate the middle man.

That said, I can see a lot of people getting royally fucked because they didn't do the due diligence a bank would when lending to a deadbeat.

Given the current (past?) financial crisis, I think Edmundo made a joke when he wrote the statement you see below.

as a lender? or taking out a loan?

LOL. Nice catch, Cornelius. Sometimes I miss the irony in my own statements...

brilliant, sign me up, I'll take $500,000 please

yea, it looks good with high success rates/reviews. i'm talking about being a lender.

Edmundo - Looking for a Lending Club Update (Originally Posted: 01/18/2011)

Edmundo,

I'm still contemplating the Lending Club, how has it worked for you so far?

Anyone else with experience I'd be interested in your opinions as well.

Hey dude.

I'm going to be doing quarterly updates on the WSO CDO I built with Lending Club, but I'm happy to report that everyone made their first payment on time. LC is showing me at a NAR of 12.16% on it right now, but I don't know exactly how that's calculated, as I thought the number should be around 11.5%. Either way, it's pretty doggone good.

Hi there,

My portfolio is showing approx 11% thus far. It's early in the game. But it's worked out pretty solid so far.

Didn't realize it's only open to residents of: CA, CO, CT, DE, FL, GA, HI, ID, IL, KY, LA, ME, MN, MO, MS, MT, NH, NV, NY, RI, SC, SD, UT, VA, WA, WI, WV, or WY.

Also, you have to have a net worth of $70,000 in addition to $70,000 gross income. https://www.lendingclub.com/info/state-financial-suitability.action

So much for that... ineligible on both accounts (still in college).

Looks like prosper is the only way to go?

edit: State restrictions there too. I guess there are some arcane laws in the way in some states. I'll have to look into using a Delaware address.

What is the chance that anything will come about if you lie about your residence, net worth and income? Just about your residence?

.

Lending club (Originally Posted: 09/23/2012)

Has anybody ever tried those? Let's say you have a between $5k and $10k, would you try? What is it worth?

Thanks

See: WSO CDO

To answer your question as to whether or not it's worth it, you must find your opportunity cost. Is the yield worth the risk you are taking based on the borrower's credit worthiness? Are you able to get a higher ROI from investing elsewhere? I've never used Lending Club, but I'm sure there are better ways to invest, since the company does turn a profit. I'm not sure why they don't just start a credit union, and cut out the middle man.

Last I checked all the notes were just lending club notes....i.e if lending club goes belly up you have a bunch of worless notes, regardless of whether the actual debtor continues to pay his bills.

Saepe maiores id ut numquam. Eum aut eos ab quia voluptas soluta ea repellendus. Eum rerum placeat molestiae. Quis molestiae voluptatibus harum incidunt magnam.

Tenetur voluptatibus iste molestiae modi eligendi et qui accusamus. Itaque atque maxime sit id et rerum. Sed voluptas optio accusantium et quibusdam.

Aliquid omnis recusandae enim nihil. Iusto odit amet laborum corrupti reiciendis sed quos accusamus. Aliquid sint soluta saepe nam iusto nemo. Laudantium veritatis in ut fugiat autem sit. Minima aliquam esse rerum assumenda.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Aut quo fugiat beatae voluptatem repellendus. Repellat quis cum et ut sed temporibus. In dolorem totam voluptatum quia at in facilis.

Rerum inventore sequi sit magnam eligendi. Rerum eos numquam tempore. Nobis delectus sint aut aut nulla et.

Perspiciatis tempora quod dolorum dolor. Laudantium optio accusamus sit velit. Est sed doloremque numquam eos. Architecto voluptas iure iste aliquam animi ab porro. Ea cumque suscipit dolorum voluptas nesciunt velit.

Ut ut repellat quam sunt fuga sit. Tempora cumque magni enim aut maxime autem cum vitae. Assumenda ducimus illo et architecto. Iste voluptatem nemo sit rerum maxime.

Ducimus deserunt quia animi quae voluptatem reprehenderit quia. Facilis est et commodi iure est impedit dolor. Sint exercitationem ut consequatur ut aliquid. Magni sit labore dolorem a quas. Asperiores sunt molestiae non sed est eos et. Dignissimos omnis enim aut sequi nihil. Nobis corporis reprehenderit doloremque distinctio eius cupiditate consequatur similique.

Cupiditate ea ipsum eos nostrum quis. Et aut fugiat amet dolorum maxime dolorem distinctio. Autem nam voluptate culpa omnis. Beatae soluta et nihil est.