OMERS Overview

The Overall Ranking is a score from 1 star (very bad) to 5 stars (excellent) generated based on the Company Reviews of current and former employees at this company, taking everything into account.

The number you see in the middle of the donut pie chart is the simple average of these scores. If you hover over the various sections of the donut, you will see the % breakdown of each score given.

The percentile score in the title is calculated across the entire Company Database and uses an adjusted score based on Bayesian Estimates (to account for companies that have few reviews). Simply put, as a company gets more reviews, the confidence of a "true score" increases so it is pulled closer to its simple average and away from the average of the entire dataset.

- 5 Stars

- 4 Stars

- 3 Stars

- 2 Stars

- 1 Star

Company Details

Investment Philosophy

The foundation of our investing philosophy is focused on seeking high-quality investments to meet the pension promise. This requires us to maintain a long-term perspective on markets and, to help us better manage through short-term volatility, we seek investments that also generate stable income. To accomplish both, we are disciplined in our approach to portfolio management, embedding a culture of prudent risk management at every level of the organization. We continually strive to build an extraordinary and diverse organization. To this end, we are committed to talent development as we recognize the value of skilled and dedicated investment teams, with the common goal of meeting the pension promise.

Investment Approach

Our approach is to focus on high quality investments that can generate sustainable income and growth, which results in more consistent returns and lower volatility than what is found in broader market.

To accomplish this, we seek investments in companies with strong balance sheets and resilient business models. We partner with leading businesses, operators and best-in-class investors to access investment opportunities on a global basis.

Our objective is to construct a well-diversified portfolio across geographies, sectors, strategies and income streams which will deliver long-term, consistent, absolute returns to meet the pension promise.

Investment Strategy

Our diversified approach is managed through a number of programs and investment strategies:

Global Diversified: Focuses on consistent returns over the long-term by gaining exposure to a broadly diversified mix of asset classes. Characteristics include a balanced fund approach, global market exposure and dynamic asset allocation, with the ability to scale our investments up and down according to market conditions.

Global Equities: Focuses on equity exposure, which is achieved through a carefully selected portfolio of attractively valued securities. These securities are comprised of high-quality companies that are supported by strong balance sheets, which have a limited risk of permanent capital impairment. Characteristics include “blue chip” companies and industry leaders, with less volatility than broad markets.

Fixed Income: Focuses on a top-down approach to delivering multi-asset, balanced returns with an emphasis on lower duration and lower volatility.

Credit: Seeks to realize attractive risk-adjusted returns in global credit markets, based on disciplined fundamental bottom-up research. We engage in a wide range of partnerships with external expertise to source investment opportunities with attractive risk/return profiles. Characteristics include quality securities and credit instruments that are backed by secure and otherwise high-quality cash flows or income-generating assets.

Relationship Investing: We source opportunities leveraging our partnerships, and enter into investment transactions that are customized and designed to generate income which does not rely on public market participation. These are unique investments in which the terms of the transaction are structured to minimize risk while delivering consistent, long-term returns.

Locations

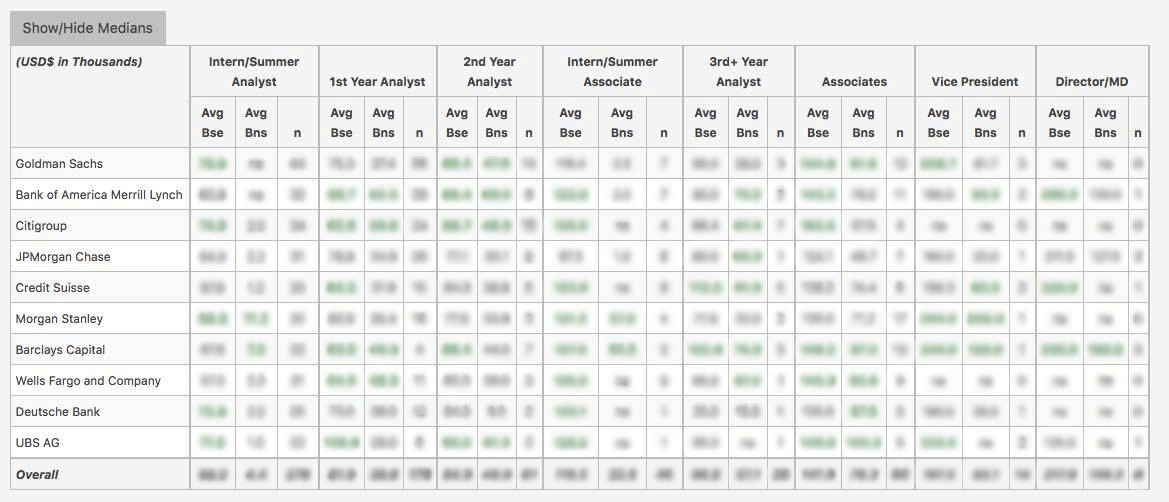

WSO Company Database Comparison Table

OMERS Interview Questions

or Want to Sign up with your social account?