Top Banks in UAE

The more recent developments of the country started after European control over the region perished.

The United Arab Emirates is a country located on the eastern side of the Arabian Peninsula. It shares borders with Saudi Arabia and Oman. Its rich history goes back to 630 C.E., when the geographical location was well known, especially for its pearl trading.

Pearl diving was a significant force in the countries to become the UAE. There were, in total, eight spots recorded in Arabian Gulf where pearling was possible. However, the pearl industry began to decline in the 1920s when Japan found a way to make flawless artificial pearls.

During its history, several European countries colonized the region of the future UAE:

- Portugal (16th -17th century).

- Netherlands (17th century).

- Great Britain (until 1971 as British protectorates).

The more recent developments of the country started after European control over the region perished. The six emirates were united in 1971, following the seventh emirate to join in 1973. The capital of the UAE is Abu Dhabi city, and the country's area is 71 ts. Sq. Km.

Since the last seventh emirate joined the UAE, the government has been an independent elective monarchy comprised of seven emirates:

- Abu Dhabi.

- Dubai.

- Sharjah.

- Ajman.

- Fujairah.

- Ras al Khaimah.

- Umm, Al Quwain.

The current population of the country is 10 mil. People in 2022 grew from 270 ts. in 1971. It is an international hub, and there are people of more than 200 nationalities living and working in the country. The expatriates outnumber the UAE nationals.

Economic developments of the UAE,

The United Arab Emirates belongs to the Gulf Cooperation Council (GCC) countries. The GDP in 2019 was 421.1 billion USD, and GDP per capita was 43 t. USD. Moody's outlook for the country was stable in 2022.

The most important driver of the UAE's economy is oil. The UAE has crude oil of around 10% of the world's reserves. The oil is concentrated in Abu Dhabi and the country's natural gas reserves (over 4 % of the world's reserves).

Except for the oil industry, the UAE is becoming an important financial center of the Middle East and the world, predominantly Dubai. It is also well known for the tallest building in the world, Burj Khalifa, and is a popular tourist destination. Moreover, to further support its non-energy growth, it is developing itself into an important business hub.

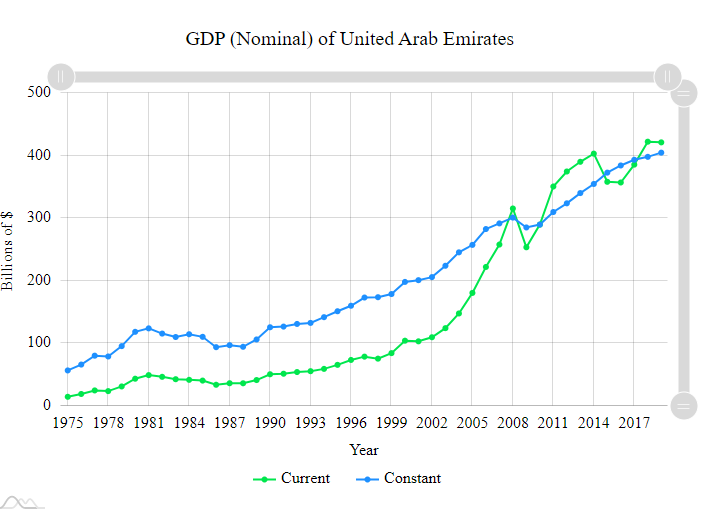

The UAE's GDP has been growing since 1971. From below 100 billion dollars in 1975, it increased to 400 billion dollars in 2018. Below is a chart showing the country's GDP development between 1975 and 2018.

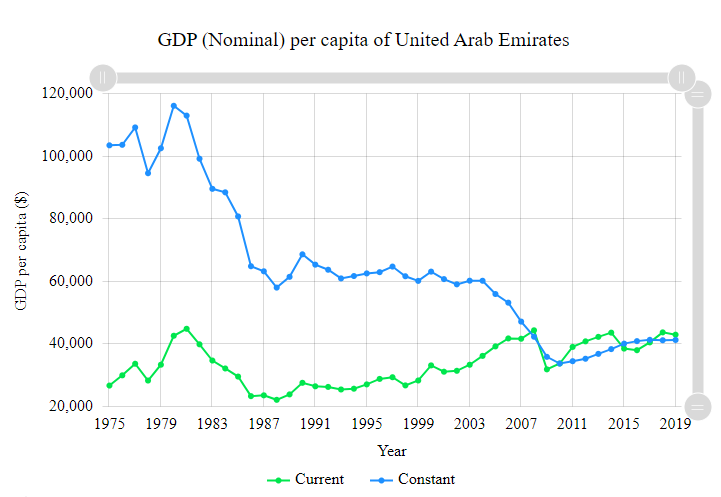

Although the GDP has a stable growing trend, the GDP per capita has declined since 2011. This is primarily due to the rapid growth of inhabitants that came to the country.

The GDP per capita started to have a growing trend in 2011 and continued until 2019. However, during the Covid-19 pandemic and the oil price shocks (the twin shocks) in 2020, the whole region of GCC countries faced significant economic challenges.

Although many people left the country, the population is still rising and expected to rise. The chart below shows the development of the GDP per capita between 1987 and 2020 (with estimated GDP per capita until 2027.

The banking system of the UAE was affected by the recent crisis in 2020. The pandemic caused many residents to leave the country, which resulted in many customers leaving banks and generated a higher percentage of default loans.

The oil price collapse put pressure on the bank's liquidity.

However, the IMF stated that the regional banks operated with capital and liquidity buffers. According to Moody, the UAE banks have liquid assets at 38 percent of total assets as of December 2021, up from 36 percent as of December 2020.

Also, the twin shocks have strengthened the links between sovereigns, banks, and real economies.

On the other hand, the higher oil prices caused by the military conflict between Russia and Ukraine supported the banks' liquidity and funding.

What is the banking system of the UAE?

The banking sector in the UAE is two-tier, with the UAE Central Bank monitoring all banking activities in the country.

According to the central bank, there are two types of banks in the UAE:

- Locally incorporated banks (national banks)

- Branches of foreign banks.

The locally incorporated banks are public shareholding companies licensed following the local law. The branches of foreign banks obtained the central bank's license to operate in the country.

Interestingly, the national banks and the branches of foreign banks existed in the UAE long before the central bank was established.

There was an uncontrolled entry of banks into the market, creating a high number of banks in the country proportional to the number of inhabitants.

Therefore, the central bank decided to reduce the number of branches of a foreign bank to a maximum of eight branches per bank.

Also, the merger and acquisitions of banks in the region helped reduce the number of banks on the market. However, the banking system is still quite fragmented, with many branches per capita.

In providing statistics about the overall number of banks in the country, the central bank distinguishes between retail and wholesale banks.

In 2021 there were 58 banks on the market. In addition, there were 10 wholesale banks in the UAE in September 2021, such as the Industrial & Commercial Bank of China, Deutsche Bank, KEB Hana Bank, Intesa Sanpaolo, and others.

Retail banks usually spread their branches across the geographical locations of the different emirates. Some banks are also introducing automatized branches that operate without a teller. Also, retail banks can be divided into four types:

- Commercial banks.

- Investment banks

- Industrial banks

- Islamic banks

The number of foreign banks in the country in September 2021 was 27. Banks such as the National Bank of Bahrain, BNP Paribas, HSBC, Habib Bank, CitiBank, The Saudi National Bank, and others established 123 branches together.

There were 21 national banks in the UAE as of September 2021. Banks such as First Abu Dhabi Bank, Dubai Islamic Bank, Emirates NBD Bank, Noor Bank, and Bank of Sharjah have established 589 branches (plus 12 automated branches without a teller).

A significant market share has banks based in Abu Dhabi and Dubai.

Due to the ease of banking in the country, the UAE is also called the Switzerland of the Middle East. There are other reasons why the UAE's banks services are highly demanded:

- Ease in the business establishment.

- UAE is the 8th tax haven country worldwide.

- UAE is the country with the 8th best financial secrecy worldwide.

- An increasing number of ultra-high-net-worth individuals (38 % increase in 2021).

What is the central bank of the United Arab Emirates?

The history of the Central bank of the UAE started in 1973 after the last emirate joined the monarchy. This year the "Currency Board" was established. This board created a new currency, Dirhams, used in the UAE until today.

Previously, other currencies, such as Bahraini Dinar, Qatar, and Dubai Riyal, were used in the region. Afterward, a statistical institution and banking supervision was established. In 2002 the UAE's Dirham (AED) was officially pegged to the US dollar.

In 1980, the public institution of the Central bank of the UAE was created. New departments, such as anti-money laundering and financial stability, were established. Most recently, an insurance authority was merged with the central bank in 2021.

The head office of the Central bank is in Abu Dhabi. However, it has its presence and branches in the other emirates, Dubai, Sharjah, Fujairah, Al Ain, and Ras al Khaimah.

The core departments of the bank are

- Banking Operations

- Banking Supervision

- Consumer Protection

- Financial Intelligence

- Financial Stability

- Monetary Management

- Reserve Management

- Research and Statistics

The Central Bank of the UAE is the country's primary financial regulator. Its central role is to promote financial and monetary stability and the efficiency and resilience of the financial system. It also protects consumer rights and supports the country's economic growth.

The other regulator of the UAE's financial market is the Securities and Commodities Authority, which supervises companies operating in the securities field.

Some of its objectives are to pioneer the Islamic capital market, ensure a sustainable financial market, and provide public finance to SMEs.

The Central bank issues the local currency licenses for the retail and wholesale banks to operate in the country and monitors the credit condition of the country.

It also manages the foreign reserves and regulates the financial infrastructure systems. The bank is also looking into the developments of digital currency.

What is the history of the banking sector in the UAE?

The new monarchy of the UAE was established with an already existing and functioning banking sector. The first bank in Dubai, the Imperial bank, was established in 1946 by Frank Johnson.

It was later renamed the British Bank of Iran and the Middle East and The British Bank of the Middle East. It was acquired by HSBC in 1959 and used its name until 1999.

The Imperial Bank, and later HSBC, had an essential role in developing the UAE's banking system and economy. From offering jobs to Dubai citizens first, installing the first ATM, and financing some of the most important construction and development projects.

The first UAE national bank, the National Bank of Dubai (NBD), was launched in 1963. NBD merged in 2007 with Emirates Bank International and formed Emirates NBD, which is present on the market today. The bank currently has the highest number of branches on the market.

Afterward, the National Bank of Abu Dhabi, First Abu Dhabi Bank (FAB), was founded in 1968. FAB is the UAE's largest bank, with the highest total assets.

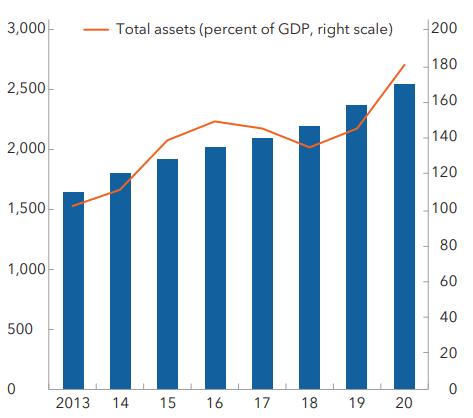

The total assets of the banking sector of the UAE have a relatively stable growth trend. The growth between 2013 and 2020 is illustrated in the chart below.

Even though the number of branches decreased over the last few years, the total assets of the retail banks in the UAE have a growing trend. The development of the total assets is demonstrated in the chart below.

Total assets of the commercial banks in the UAE (2013-2020)

What are the top banks in UAE?

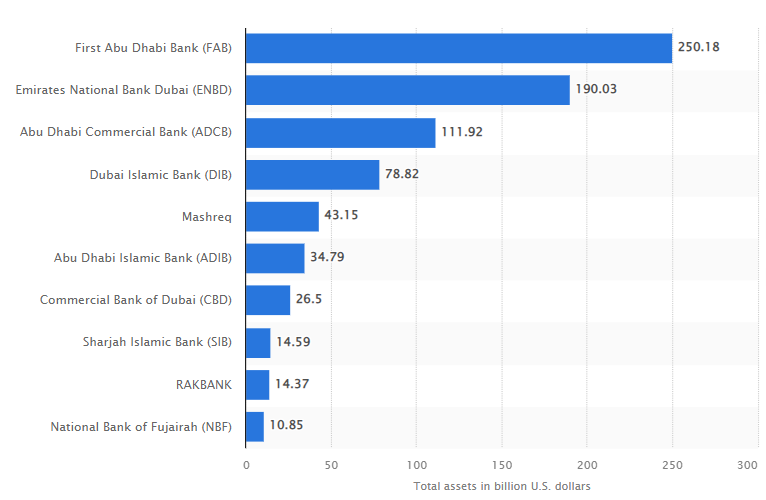

The banking sector of the UAE is fragmented. However, there are the top 10 banks that are leading the market. The ten largest banks by total asset value were in 2020 the following:

- First Abu Dhabi Bank (FAB)

- Emirates National Bank Dubai (ENBD)

- Abu Dhabi Commercial Bank (ADCB)

- Dubai Islamic Bank (DIB)

- Mashreq

- Abu Dhabi Islamic Bank (ADIB)

- Commercial Bank of Dubai (CBD)

- Sharjah Islamic Bank (SIB)

- RAKBANK (RAK)

- National Bank of Fujairah (NBF)

The top 10 banks in the UAE by total assets in 2020 are shown in the chart below:

The biggest bank in the UAE is the First Abu Dhabi Bank (FAB), with total assets of 250 billion dollars in 2020. Another bank with a total of nearly 200 billion dollars is Emirates National Bank Dubai (ENBD).

The second group of biggest banks comprises two banks with total assets close to 100 billion dollars, the Abu Dhabi Commercial Bank (ADCB) and the Dubai Islamic Bank (DIB), with total assets of 78 billion dollars.

The assets of the third group of the biggest banks have total assets above 20 billion dollars and the last group below 20 billion dollars. The top ten biggest banks are dominated by banks established in Abu Dhabi and Dubai.

According to the number of branches in the country, the top ten banks are (in 2022):

- Emirates NBD Bank with 79 branches

- First Abu Dhabi Bank (FAB) with 68 branches

- Abu Dhabi Islamic Bank (ADIB) with 66 branches

- Abu Dhabi Commercial Bank (ADCB), with 63 branches

- Dubai Islamic Bank (DIB) with 58 branches

- Emirates Islamic Bank (EIB) with 52 branches

- Sharjah Islamic Bank (SIB) with 33 branches

- RAKBANK with 28 branches

- National Bank of Umm Al Quwain with 27 branches

- Mashreq Bank with 26 branches

The top banks in the UAE are healthy and highly rated by rating agencies. They overcame challenges brought by the recent Covid-19 crisis and are adapting to a new, more resilient business mechanism. The credit rating of the ten biggest banks in the UAE is in the table below:

| Bank Name | Moody’s Long-Term Issuer | Moody’s Outlook | Fitch Long term issuer | Fitch Outlook |

|---|---|---|---|---|

| FAB | Aa2 | Stable | AA- | Stable |

| ENBD | A2 | Stable | A+ | Stable |

| ADCB | Aa3 | Stable | A+ | Stable |

| DIB | A2 | Stable | A | Stable |

| Mashreq | A3 | Stable | A | Stable |

| ADIB | A1 | Stable | A+ | Stable |

| CBD | A3 | Stable | A- | Stable |

| SIB | A3u | Negative | BBB+ | Stable |

| RAK | A3 | Stable | BBB+ | Stable |

| NBF | A3 | Stable | N/A | N/A |

The UAE banks and security, technological innovations, and sustainability

The banks in the UAE are, in general, safe. However, the FAB is not only the largest bank and the leader in the market but also the safest bank in the UAE and the Middle East.

As the only bank in the Middle East, it has appeared in the Global Finance Magazine's list of the Top 50 safest banks since 2017. In 2021 it held 32nd place, the same as in 2020. This is an improvement from 39th place in 2019. In 2018 FAB appeared in 36th place and 31st in 2017.

Technological advancements and the UAE's banks

The UAE banking system is developing along the global trends. There are already two mobile-based banks offering services through a smartphone app. Those are Liv, created by Emirates NBD, and Neo, powered by Mashreq bank.

The top banks in the UAE are also benefiting from new technological innovations, such as artificial intelligence (AI) and machine learning (ML) or Blockchain technology.

Banks mostly use these technologies to improve their data analysis and management and boost their trade finance systems.

The largest bank, FAB, launched 2019 an analytical platform powered by AI and ML to retrieve more efficiently actionable insights from customer data.

Similarly, in 2019, ADCB provided its clients access to a trade finance platform based on the Singaporean dltledgers Blockchain system.

Following the example of the biggest bank, in 2020, ADIB successfully launched a finance distribution transaction mechanism based on Blockchain technology. It is the first Islamic bank to undertake such a project.

The UAE banks and sustainability

Like the banks in other regions, also UAE banks are following sustainability-related trends. There is pressure from the stakeholders on the banks to be aligned with various local and international sustainability and ESG reporting guidelines and frameworks.

As a leader in the industry, the largest bank, FAB, became a signatory of the UN Principles of Responsible Banking in October 2021.

Key takeaways

The United Arab Emirates is a country with a long history of trading and business, even before oil was discovered in the region. Its banking system developed long before all seven Emirates were united in 1973.

The banking system consists of the Central bank of the UAE, which oversees the retail and wholesale banks.

In 2021 there were 58 banks on the market. In particular, there were 10 wholesale banks, 27 foreign banks with 123 branches, and 21 national banks with 589 branches all over the country. The market is fragmented, and some analysts consider it overcrowded.

The first three banks with the most significant total assets are First Abu Dhabi Bank (FAB), Emirates National Bank Dubai (ENBD), and Abu Dhabi Commercial Bank (ADCB).

The total assets of the banking sector of the UAE have a growing trend. As a result, all the banks on the market are financially strong and have a good investment rating.

Banks in the UAE are also leaders in innovation in financial technologies and are joining the worldwide movement towards more sustainable and responsible banking.

Researched & Authored by Katarina Gajdosova | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?