Top Banks in Slovakia

A banking system consisting of one central bank and several commercial banks.

Slovakia is a small country located in the middle of Europe. Slovakia is well known for its monuments of high historical value. There are 180 castles and 425 chateaux scattered across the country.

Tourists also visit Slovakia for its natural beauty with the most important mountain High Tatras. The area of Slovakia is 49 ts. Sq. Km with a total of 5.5 million inhabitants in 2022. The total GDP of Slovakia in 2020 was 104.6 bil. US dollars, and per capita, almost 20 ts. US dollars.

Slovakia shares its borders with Poland, Ukraine, Hungary, Austria, and the Czech Republic. It belongs to the group of Central and Eastern European Countries and also to the more specific Visegrad Group countries. The capital is Bratislava.

As part of Czechoslovakia, Slovakia had a form of a communist economic system and a one-party government of the Communist Party until 1989. In 1993 Slovakia became an independent country.

After becoming independent, it underwent extreme decentralization and economic transformation from central planning to a market-based economy.

It is a significant production and service hub for many international companies, such as Dell, IBM, Siemens, Samsung, LG, Kia, and Hyundai.

Slovakia is active in the international community. It became a member of NATO and a member of the European Union in 2004. After five years of preparation and reforms, Slovakia also adopted Euro as its national currency in 2009.

The recent Covid-19 pandemic and the oil price fluctuation put pressure on the country's economic situation. Loss of jobs and decreased financial performance also impacted the banking sector, paired with the war conflict between Slovakia's neighbor Ukraine and Russia.

Due to the crisis, banks had to take several measures to preserve their financial health and the financial system's stability. The central bank also implemented several tools to support banks with liquidity and capital.

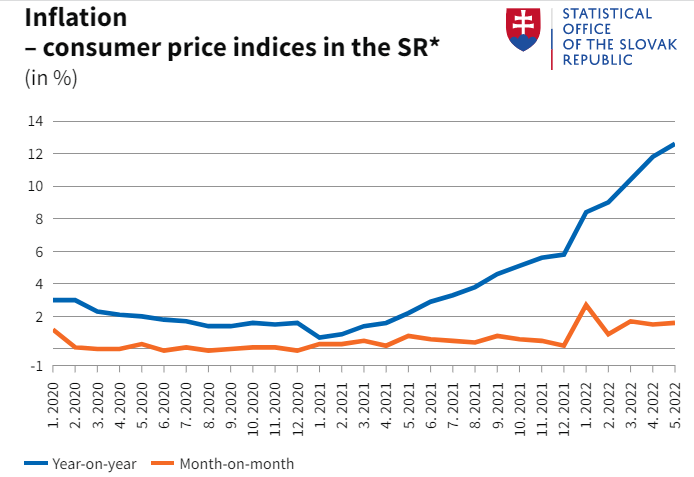

The most crucial economic issue in the country is growing inflation. Inflation is following the current development worldwide and has a dangerous growing trend.

It increased from 0.7% in 2021 to 12.3% in 2022. It is decreasing purchasing power and may negatively impact banks' liquidity buffers.

Source: Statistical Office of the Slovak Republic

What is the banking system in Slovakia?

Slovakia has a banking system consisting of one central bank and several commercial banks. However, not always the case, and the plan was highly centralized in the past.

The process of centralization started after the Second World War when the central bank took over the rights and obligations of all the existing commercial banks at that time.

The monopoly kind of banking system did not work and lasted only about a few years. Then, in the 1950s and 1960s, the more rational Czecho-slovakian financial system started to be formed.

The system went through a process of demonopolization, transforming into a two-tier banking system. Finally, after the Czech Republic and Slovakia's separation, the National bank of Slovakia was established in 1993.

The two-tier banking system represents a structure where the central bank is responsible for issuing licenses to the commercial banks and overlooking the banking system.

Although Slovakia is also a member of the European Monetary Union, the four central banks are supervised directly by the Single Supervisory Mechanism of the European Central Bank.

In total, 25 banks and branches of foreign banks own a banking license in Slovakia. In addition, the central bank authorizes several types of banks to provide banking operations on the territory of Slovakia. The number of authorized banks is in the table below.

| Types of Banks | Number |

|---|---|

| All the banks and branches of foreign banks | 25 |

| Banks entrusted to provide investment services | 15 |

| Home savings banks | 3 |

| Banks providing services related to the covered bonds' programs | 4 |

| Banks under direct European Central Bank (ECB) supervision | 4 |

Source: National Bank of Slovakia

There are 25 banks and branches of foreign banks, both universal and specialized, registered in Slovakia. Of these, 8 and 3 specialized home savings banks are in Slovakia.

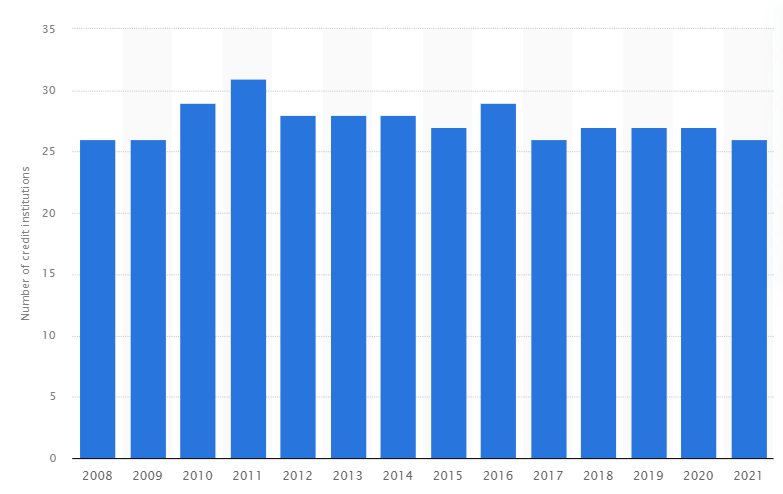

The number of banks in Slovakia has been stable over the last few years. The chart below illustrates the number of credit institutions in Slovakia between 2008 and 2011.

Source: Statista

The list of the ten biggest banks and branches of foreign banks that have operations on the Slovak market by total assets as of 2019 is below (Trend):

- Slovenská sporiteľňa, a.s.

- Všeobecná úverová banka, a.s.

- Tatra banka, a.s.

- Československá obchodná banka, a.s.

- UniCredit Bank Czech Republic and Slovakia, a.s.,

- Poštová banka, a.s.

- Prima banka Slovensko, a.s.

- Prvá stavebná sporiteľňa, a.s.

- OTP Banka Slovensko, a.s. (merged with the Ceskoslovenska obchodna banka in 2021)

- Komerční banka, a.s.

Foreign (European) financial groups own most banks operating in Slovakia. According to the National Bank of Slovakia, at the end of 1998, 63% of the banks' capital was in national ownership.

In 2001 it was 38%, and in 2018, only 5% of the banks' total capital was in Slovak ownership. Only the two specialized banks, the Slovak Guarantee and Development Bank (Slovenska zarucna a rozvojova banka) and Eximbanka, SR, are in 100% Slovak ownership.

However, Slovak clients can use the services of other banks with a banking license issued by any other central bank within the European Monetary Union. Therefore, a Slovak customer can open a bank account, for example, in a bank with a license from the Deutsche Bundesbank (German central bank).

What are the top banks in Slovakia?

Four banks qualified for the direct supervision of the ECB in Slovakia as they belong to the larger banking groups with an asset value above €30 billion. The names of the four banks under direct ECB supervision are

- Slovenska sporitelna, a.s, (part of Austrian banking group Erste Group)

- Vseobecna uverova banka a.s., (part of Italian banking group Intesa Sanpaolo)

- Tatra banka, a.s.,(part of Austrian Raiffeisen Bank International AG group)

- Československá obchodná banka, a.s., (part of Belgium financial group KBC)

These four banks are the most prominent banks established in Slovakia and are also considered the most important banks historically in the Slovak banking sector. Although, the first three banks dominate the industry, accounting for 50% of the total assets of all banks in Slovakia.

Slovenska sporitelna, a.s.

Slovenska sporitelna, a.s. is the largest commercial bank in Slovakia, established in 1825 as the first institution for household savings. However, the bank's history had roots already in the 19th century.

Its modern history started when it was functioning as a part of the Czechoslovak State Saving Bank in 1953.

In 1969, it began to work as an independent entity – a Slovak governmental savings bank. In 1990, after the banking sector liberalization, the bank obtained a universal banking license.

In 2001, as part of the privatization process, it became part of the Austrian banking Group Erste Bank. The Ministry of Finance of the Slovak Republic and Erste Bank agreed on the sale of the majority of shares.

In 2021 the bank's total assets were 23 bl. Euros. The bank achieved a profit of 228.1 ml. It has approximately 2.2 million clients and 4,110 employees. It has 271 branches across Slovakia. Moody's ranked the bank at A2 with a stable outlook.

Vseobecna uverova banka, a.s. (VUB)

VUB is the second-largest bank in Slovakia. The bank was founded in 1990 as part of the demonopolization and decentralization of the former State Bank in Czechoslovakia after the fall of the communist regime. It took over the commercial activities for private clients in the Slovak Republic.

Eleven years later, it became part of the Italian banking group Intesa Sanpaolo due to the privatization process in 2001. As a result, it is the only bank with a universal banking license offering the full range of banking services to households and commercial and institutional clients.

In 2021 its total assets were 23 bl. Euros and the bank's profit was 100 million Euros. It reached 1.2 million clients and 3,655 employees. It has almost 200 branches in Slovakia with a market share of 19.3%.

Moody's ranked the bank at A2 with a stable outlook in May 2021. The bank is also part of the more significant VUB Group that comprises subsidiaries and affiliates focused on other services such as leasing or insurance.

VUB bank has a long tradition in the Slovak market and is well known for its corporate responsibility and active community support. In addition, it provides financial aid to various cultural, educational, and environmental projects.

As a part of its financial group Intesa Sanpaolo, it became one of the signatories of the UN's Principles of Responsible Banking in September 2019. It also created its own Green Manifestum to pledge its further commitments toward a green and sustainable future.

VUB also offers a specialized loan, VUB ENVIRO, to support the circular economy and green projects. A corporate client that fulfills the criteria of circular and green projects can apply for this loan with a special decreased interest rate.

Tatra banka, a.s.

Tatra banka was founded in 1990. It took the name from a previous bank, established in 1885. The State bank of Czechoslovakia took its function and services in 1950.

It has a long history and was also the first bank to introduce everyday products to the Slovak banking market. As the first bank in Slovakia, Tatra banka made the Visa credit card available to the market in 1994. A year later, in 1995, they introduced MasterCard.

As the first bank in Slovakia, Tatra banka also allowed its clients to use internet and telephone banking services in 1997. Tatra banka is number 1 on the market in corporate business, with a market share of 20%. It is part of the Austrian banking group Raiffeisen.

In 2021, Tatra banka had total assets of 19 billion Euros and achieved a profit of 150 million Euros. It has around 3,600 employees and 930 thousand clients.

In Slovakia, it has 163 branches. Moody's ranking for Tatra banka is A2 with a stable outlook. Tatra banka also belongs to the Tatra banka Group.

The group comprises the related institutions providing other financial services. For example, this group belongs to an institution providing assets to management or pension asset management and leasing.

Ceskoslovenska obchodna banka, a.s. (CSOB)

This bank was founded in 1964 in former Czechoslovakia as part of the monopoly State bank of Czechoslovakia. It was responsible for financing foreign trade and overseeing the loans in foreign currencies from foreign markets.

After 1989, it focused on broader financial services and obtained a universal banking license. In 1997, as a part of the banking sector privatization process, the bank became part of the Belgium KBC financial group.

Since 2008, CSOB has been an independent legal entity in Slovakia. Before that, it was acting only as a foreign bank subsidiary.

CSOB had 2021 total assets of 11 billion Euros, and it achieved a profit of 70 million Euros. It had approximately 2,300 employees and 103 branches across Slovakia. In 2010 it had more than 380 ts. customers.

In Slovakia, CSOB bank belongs to the broader CSOB financial group. This group provides a wide spectrum of financial services to clients. It comprises institutions providing insurance, home savings, leasing, factoring, advisory, or asset management services.

In 2021 CSOB was joined by another vital bank in the Slovak banking market after its mother financial group KBC acquired the Hungarian OTP bank. As a result, the CSOB merged with the OTP bank Slovakia, the 9th biggest bank on the market with total assets of 1 billion Euros in 2020.

As a part of the KBC group, CSOB became a signatory of the UN's Principles of Responsible Banking in September 2019. It is also the only bank in Slovakia and only 1 of 5 Slovak companies participating in the UN Global Compact. CSOB has been committed to the Global Compact for over ten years.

It is a commitment to meet fundamental responsibilities in four areas:

- Human rights

- Labor

- Environment

- Anti-corruption

Which are the three online-based banks in Slovakia?

Even though the clients are used to the stone branches of banking, they are getting used to the new digital tools of online or internet banking. Most banks in Slovakia offer online banking through their website or mobile application.

However, some banks base their operations online with a minimal network of branches. These banks are popular mainly among the younger population and those who wish to minimize their expense on banking services.

Three such banks on the Slovak market have received banking licenses from the National bank of Slovakia so far:

- Fio banka (branch of a foreign bank)

- mbank (branch of a foreign bank)

- 365 bank (the youngest bank established in Slovakia in 2018)

Even though Fio banka does not claim to be an online-based bank, its services are primarily online-based. The bank offers minimal personal contact with a few branches, allowing them to provide essential banking services free of charge to its clients.

Fio banka entered the Slovak market in 2002 as a branch of a Czech bank Fio. It is well known for being the first to offer Slovak and Czech clients online trading on international financial markets through a web-based application in 1997.

The first online bank in Slovakia was mbank. Polish mother banking group BRE Bank SA established the mbank. It changed its name after its most popular brand mBank SA and is part of the Commerzbank financial group.

It joined the Slovak banking market in 2007 as the first bank with exclusively online-based banking operations for individual clients. The new model of online management of banking services allowed the bank to offer some of the most common services without charging any fees.

The bank has around 100 employees and total assets of 299 million Euros. It has 250,000 clients, and the banks achieved a loss for the years 2020 and 2021.

This mode of online-based banking became popular, and other players joined the local market. However, the standard fee for a current account in Slovakia is around 5 Euros per month, a high cost compared to the free-of-charge accounts offered by online banks.

As the next player in the online banking market in Slovakia, Postova banka (The post bank) established its online bank, 365 banks, in 2018. Postova banka is one of the most traditional banks in the Slovak market, preferred by the older population (primarily seniors).

In 1918 Postova banka was established. It has its branches, but its services are available anywhere in Slovakia where there is a post office.

Therefore, it is most popular among the older population. The bank established its daughter company - digital bank 365 bank- to attract younger customers.

The 365 bank is currently the only exclusively digital bank in Slovakia. Its total assets are 4 billion Euros, and it achieved a profit in 2021 of 58 million Euros. The bank also started to offer green banking products and is committed to becoming the first carbon-neutral bank in Slovakia by 2025.

Furthermore, banks with licenses received from other central European monetary systems central banks can offer services to Slovak clients. Foreign online banks, such as German digital bank startup N26 or Revolut from the UK, are becoming increasingly popular in the Slovak market.

What are the special banking institutions in Slovakia?

In the Slovakian banking market, two special banks obtained a license from the National Bank of Slovakia.

Those two banks are wholesale banks, Slovak Guarantee and Development Bank (Slovenska zarucna a rozvojova banka) and Eximbanka SR, offering products for small and medium enterprises and export.

The Slovak Ministry of Finance established the Slovak Guarantee and Development Bank in 1991 to support the small and medium enterprises in Slovakia. Since 2004, it has been a member of the Network of European Financial Institutions for SMEs.

The bank is offering loans for small and medium enterprises and big corporations. It also provides standard banking services such as accounts for individual entrepreneurs.

As a reaction to the current crisis, it started to offer loans to its clients to successfully overcome the rapid growth of agricultural product prices.

The total assets of the Slovak Guarantee and Development Bank are 526 million, and it achieved a profit of 6 million Euros in 2021. It has ten branches across Slovakia.

Eximbanka, also called Export-import bank of Slovakia (Export-Import Banka Slovenskej Republiky), was established in 1997. This financial institution offers banking and insurance services to support export areas without commercial banking interest.

In addition, it provides its clients with various educational and networking events. It also attends specialized cooperation events, presenting its financial and insurance solutions for the exporters.

Eximbanka supports projects with an export goal to the places where the risk involved is not attractive to commercial credit institutions. The main aim is to provide governmental support without disturbing the market and causing any deformations to the market economy.

Its total assets have a value of 448 million Euros, and it achieved a profit of 578,000. Euros in 2019. The bank operates only in its headquarters in Bratislava and has no other branches.

In 2020 it also supported the small and medium enterprises to overcome the harmful effects of the current crisis. With this aim in mind, it started to provide a particular COVID loan and Anticorona guarantees.

or Want to Sign up with your social account?