Mortgage-Backed Security (MBS)

A type of Asset-Backed Security (ABS) backed by a collection of mortgages or a mortgage

What Is A Mortgage-Backed Security (MBS)?

A Mortgage-Backed Security (MBS) or a Mortgage Bond is a type of Asset-Backed Security (ABS) backed by a collection of mortgages or a mortgage. These securities are packed together as a fund for investors to purchase and receive current income through mortgage payments.

Asset-backed securities (ABS) are financial instruments collateralized by an underlying pool of assets.

Usually, an ABS is popular among investments that generate consistent and predictable income, such as:

- Cash flows from credit card debt

- Loans

- Leases

- Other assets

Here are some characteristics of a Mortgage-Backed Security:

- Issuers of an MBS can be a federal government agency, government-sponsored enterprises (GSE), or private financial firms.

- The minimum investment required for such a financial instrument is generally $10,000 but can vary from fund to fund.

- Interest payments are generally paid monthly, with payments varying each month.

- Usually sold through a brokerage firm.

- The interest rate is determined at origination and thus is subject to interest rate risk.

Therefore, a Mortgage Bond is a financial instrument that makes the mortgage market accessible to investors as several debt agreements between lenders and borrowers to purchase real estate can be packed into a fund that generates regular cash flows for shareholders.

Hence, an MBS is similar to a traditional bond investment as there are periodic payments that the underlying entity is obligated to make. Most commonly, they are secured by residential loans.

However, an MBS can pool together several real estate loans, including:

- Commercial

- Industrial

- Agricultural

- Residential property

For instance, a lender, usually a bank, can issue several loans and then choose to pool the ones with similar characteristics together as an MBS.

This financial instrument can then be sold to a federal government agency such as Ginnie Mae, government-sponsored enterprises (GSE) such as Fannie Mae and Freddie Mac, and even private financial organizations.

These agencies can then sell these funds directly to investors through publicly traded or private funds.

As mentioned before, mortgage bonds are most commonly issued by government agencies. However, privately labeled mortgage bonds may be created by subsidiaries of investment banks and financial institutions.

In addition, private firms usually focus on issuing riskier mortgages as their credit quality and creditworthiness standards are much lower than traditional MBS. Thus, they can cover that market for mortgage bonds and offer their investors comparatively higher yields.

Key Takeaways

- Mortgage-Backed Securities are investment tools backed by groups of mortgages. Investors buy shares in these bundles to receive income from monthly mortgage payments. They can include different types of real estate loans and are often issued by government agencies or private financial firms.

- Pass-Throughs directly distribute mortgage payments to investors, either with specified mortgages or as a surprise (TBA). CMOs are more complex, made of different securities with varying payment terms.

- MBS diversification, reliable income from mortgage payments, and a history of competitive yields. MBS values often move differently from other assets, reducing risk. The market is liquid, allowing quick transactions.

- Investing in MBS has risks such as default (borrowers not paying), interest rate shifts impacting prices, general economic factors, and prepayments affecting cash flow expectations.

- MBS differs from traditional bonds with monthly coupons, variable coupon amounts, and estimated maturity. Despite its role in the 2008 crisis, MBS has evolved under stricter regulations, remaining relevant for investors seeking diversification and returns.

Types of Mortgage-Backed Securities

There are several different types with different purposes and specifications. However, they can be classified into two main categories, as mentioned below.

Pass-Throughs

The most basic and common type of MBS instrument. These instruments essentially pass through or distribute MBS payments (cash flow) to investors as they are received.

Therefore risk for such an instrument is entirely held by the underlying investor holding the security.

There are two types of pass-throughs:

1. To Be Announced (TBA's): In such a pass-through, the seller agrees on the instrument's price without specifying the individual mortgages until the day of the settlement. Therefore, this information is to be announced.

2. Specified Pools: A pass-through usually extremely specific to one theme or type of mortgage loans, thus providing investors with nuanced needs. For example, this type of MBS can focus on a specific mortgage loan aspect.

Collateralized Mortgage Obligations (CMOs)

A CMO is a complex type of pass-through security, unlike a regular pass-through that simply passes interest payments to investors. A CMO is a collection of a pool of securities, referred to as trenches and slices.

Further, the securities are governed by their terms of passing on interest and principal to investors. Therefore, as a collective financial instrument, each CMO is vastly different in how payments are made.

This complexity means that sophisticated investors usually show interest in such securities.

There are several types of CMOs, as mentioned below:

1. Planned Amortization Class (PAC) Bonds

These types of CMOs are planned and thus have a released specified payment schedule that answers how the income stream is governed.

Usually, there is a focus on principal pay downs over other bonds. Therefore, payments are considered to be set in a preordained range.

2. Sequential

The Tranches are predetermined in a particular order so that payments, when received, are used for a single tranche until it is paid off in full before moving over to the next one.

This means that the bonds are created in a sequence based on their maturity, which helps meet specific investor needs.

3. Principal Only/ Interest Only

Focused on generating cash flows through principle or interest only from a pool of mortgages.

4. Target Amortization Class (TAC) Bonds

Kind of similar to PAC bonds, the payment schedules are predetermined. TAC tranches, on average, yield more than PAC tranches but carries limited protection.

5. Floater

Coupon resets or updates regularly, usually monthly, thus hedging against interest rate risk.

6. Inverse Floater

It is similar to a floater, but the coupon is inversely proportional to the index used to determine rates. Therefore, it hedges against reinvestment risk.

The MBSs market is fairly complex, with a lot of jargon and financial instruments for both general and sophisticated investors.

Investors looking to purchase a mortgage bond need to consider several options and determine which type of investment fits best with their purpose and goals while considering individual risk tolerance.

benefits of investing in Mortgage-Backed Securities

Investors need to understand the underlying benefits and limitations associated with mortgage bonds. This section will highlight these factors and use data to back arguments.

There are several benefits that MBSs offer to investors. These major advantages apply to a large pool of individuals and funds that can utilize them to create robust portfolios that match expectations. For example, some major benefits include

1. Diversification

MBS allows investors to own a pool of fixed-income generating assets, thus averaging returns by owning a basket of securities.

Never before have investors had the opportunity to diversify at such a scale, thus reducing systematic risks to near-zero levels for AAA and AA trenches.

Moreover, there is data suggesting how mortgage bonds correlate with the S&P 500, which will be discussed further as it ties into managing risk.

2. Current Income

As established earlier, MBS is a financial instrument that pays out shareholders with consistent and predictable cash flows. Thus, such a fixed income source makes for convenience and practicality for many investors.

Hence, mortgage bonds fit well with large pension fund firms that create portfolios that create consistent cash flows for holders.

3. Correlation with S&P 500

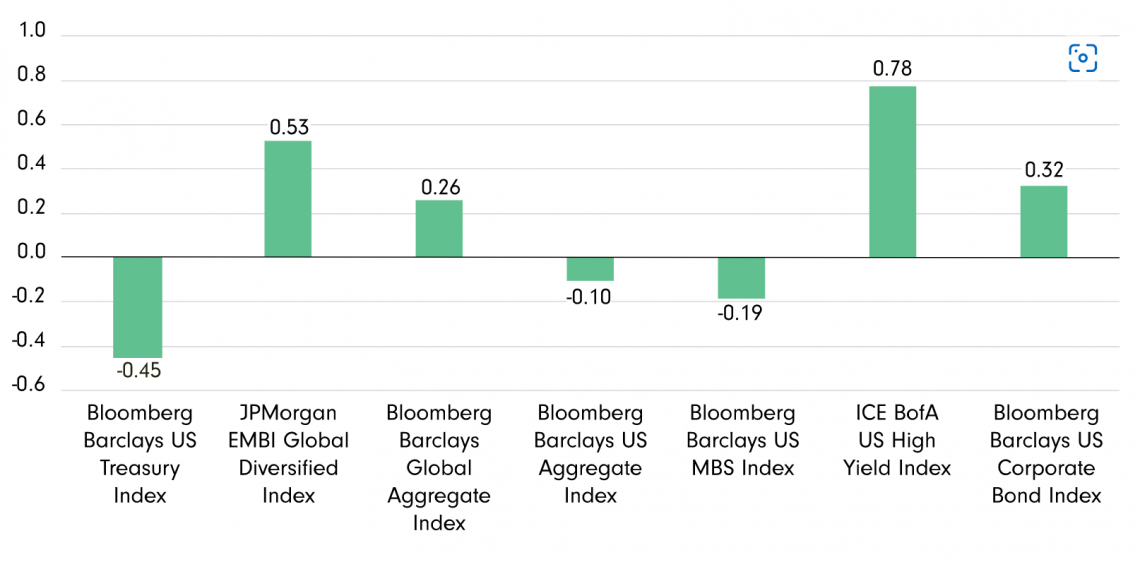

Data from Morningstar Direct as of 6/30/20 shows that an MBS portfolio is negatively correlated with many other fixed-income assets. This is represented in the chart above.

As interest rates rise, traditional bonds with fixed rates become attractive over newer bonds, thus creating downward pressure. This is the case with most fixed-income assets. However, in the case of agency MBS, prices tend to rise with interest rates.

Although this is impacted by several factors, such as borrower prepayments and mortgage terms, this general correlation means that an MBS asset fits well into most portfolios as it balances risk.

4. Competitive Yields

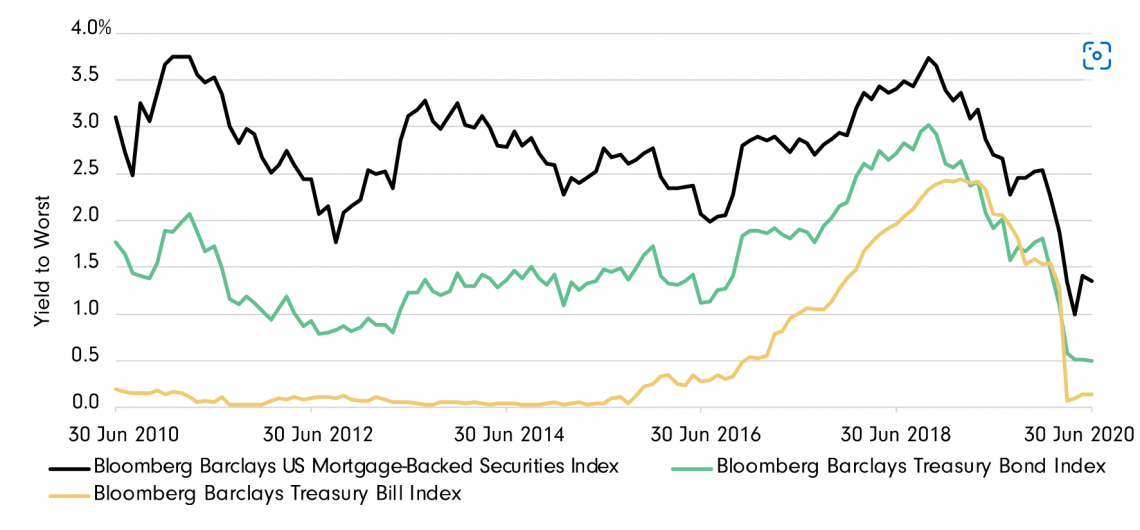

Consider a comparative yield chart that compares mortgage bonds with Treasury securities from Bloomberg Barclays live below.

The yield for mortgage bonds has historically been significantly better than treasury yields.

Although there are clear differences in the risk of both asset types, typically, mortgage bonds outperform by a whopping 2.17% on average over treasury bills. This is evidenced by the data below.

5. Attractive risk-adjusted returns

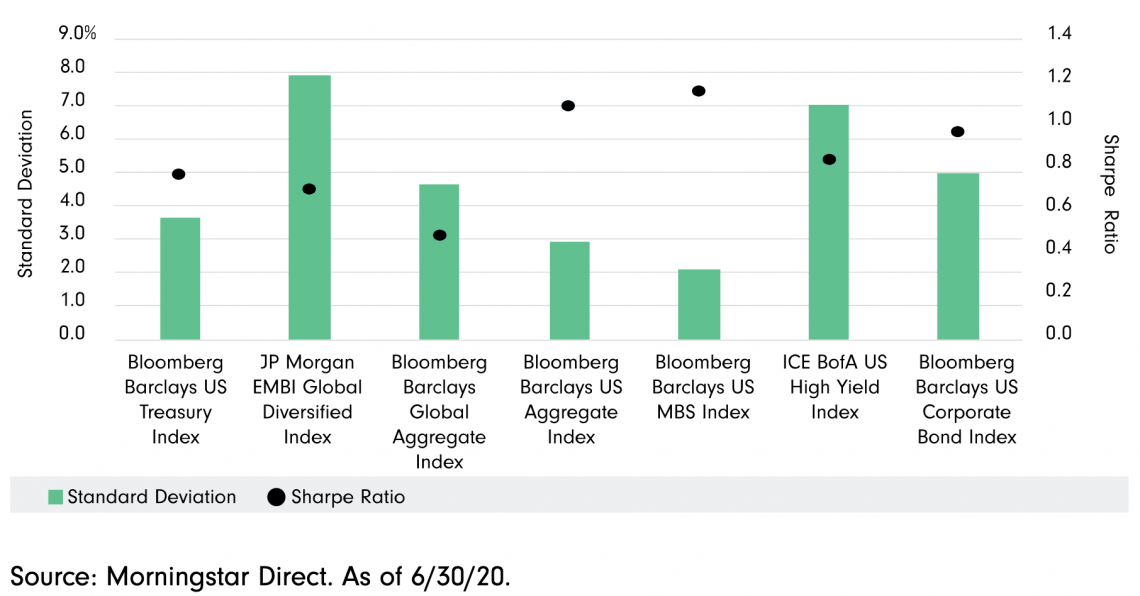

The chart below from Morningstar Direct as of 6/30/20 shows that MBS investments offer high risk-adjusted returns as MBS have relatively low volatility compared to other fixed-income assets. But, again, the competitively lower standard divisions back this.

Further, the MBS instruments also have a high Sharpe Ratio. This implies that the performance of mortgage bonds is excellent, considering the risk taken on by the investor.

6. Liquidity

The MBS market is highly liquid and thus allows market participants to act on decisions faster. Further, transaction costs are relatively low due to the sheer volume of transactions on the exchange.

Risks of investing in Mortgage-Backed Securities

The risks associated with MBS differ from securities such as treasuries or stocks. Therefore, some distinct risks are associated with this asset class, such as prepayment risk.

1. Default Risk

Borrowers can and have gone through periods where they struggle to make payments. This means there is always an underlying risk of a borrower defaulting on their payments.

In such a case, the lender would incur costs for the procedures that follow after default, such as reassessing credit quality and working with the borrower, before finally writing off the debt on the books.

2. Interest Rate Risk

The price of some MBS instruments, such as those on fixed terms, will fall as interest rates rise and more attractive yields are present in the market. Therefore, there is a risk for investors holding these securities in fluctuating interest rates.

3. Unsystematic risk

As with any investment, there is an economy-wide risk for mortgage bonds. This risk was highlighted well by the 2008 financial crisis when many supposedly sound firms in this space suddenly went bankrupt.

Therefore, as times change and the market has not corrected for a while, investors should judge whether the market is far from reality.

4. Prepayment risk

The pitch for an MBS instrument is often that the investor is entitled to fixed income for many years, thus making these securities attractive.

However, suppose a borrower decides to pay more than their monthly payments to pay off the debt faster. In that case, some investors may not prefer payment earlier than expected as they had plans to receive the cash flows regularly for a longer period.

Mortgage-Backed Securities vs traditional bonds

Several features overlap between mortgage bonds and traditional fixed-income investments such as treasury bonds which investors should be aware of. Moreover, some distinct qualities of both asset-backed securities stand out.

Mortgage Backed Securities versus traditional fixed income bonds

The table below summarizes some of the distinct characteristics of mortgage bonds over traditional fixed coupon bonds. This table was referenced from FINRA.

| Mortgage Bonds | Traditional Fixed Coupon Bonds |

|---|---|

| Usually Monthly Coupon | Usually semi-annual coupon |

| Coupon varies each month | Coupons are usually fixed at a certain amount, therefore more predictable |

| The coupon is interest and principle | Coupon is interest-only |

| Principle collected when incrementally each month | Principle collated when the bond reaches maturity |

| Maturity is based on an estimate of the “Average life” of security | The maturity date is set beforehand and is concise |

Perhaps one of the more important distinctions between both financial instruments is that, unlike most traditional bonds, which way semi-annual coupons, mortgage bonds pay out monthly payments of interest and principal.

Therefore, making such a distribution attractive for investors as they receive payments earlier and consistently.

Even so, some investors may view this characteristic of mortgage bonds as a negative because they might prefer to receive a lump sum of the principal at maturity. Therefore, individuals should evaluate the value they place in cash flows based on their goals and perceptions.

However, mortgage bonds do not have a set maturity date. Instead, the maturity date is estimated using a calculation that estimates when the debt is likely to be repaid, thus referring to it as the "average life."

As you can imagine, it is difficult for an MBS collectively holding several mortgage bonds to be evaluated using this method.

The Role of MBS in the 2008 Financial Crisis

MBSs played a vital role in the 2008 financial crisis. As the crisis began due to a housing bubble caused by banks issuing subprime loans, borrowers with poor credit histories and thus a more likelihood of default was issued loans.

Then, the banks bundled these mortgages into an MBS security, thus allowing them to make a quick sale to investors without any of the bank's skin in the game.

As you can imagine, such a scenario creates a situation where of moral hazard as investment banks are encouraged to bundle together subprime bonds without due diligence on whether the

How did Mortgage Backed securities cause the fall of the Lehman Brothers? Lehman Brothers, a firm once the most prominent investment bank on Wall Street collapsed among many of its peers due to the 2008 financial crisis.

Lehman's collapse was caused due to a combination of factors. However, unarguably, mortgage-backed securities were to blame. Lehman Brothers had heavily invested in MBS to provide products for their investors.

Therefore, when the real estate crash happened, Lehman saw much of their subprime mortgages default and thus lose everything.

Mortgage-Backed Securities today

You might wonder why a financial instrument that played a major role in the collapse still exists today. However, it is undeniable that an MBS is a financial innovation that has revolutionized the space, created a product of investors in diversity, and created returns.

Hence, the MBS Market continues to evolve to meet client-specific needs increasingly.

As the finance world shifts towards becoming data-driven and applying quantitative analysis, mortgage bonds as a financial instrument have become applicable to many large client portfolios that require such assets for diversification and risk-managing purposes.

Since the financial collapse of 2008, there have been several shifts and changes in the mortgage bonds industry due to the introduction of new government regulations and the insight that firms have after the disaster.

Today, MBSs are much "safer" due to regulations introduced to prevent firms' risk-taking actions in 2008. For example, underwriting standards have since become much more strict and transparent.

Movies on the 2008 Financial Crisis and MBS

The movie Margin Call, released in 2011, is a story about how the key people in an unnamed investment bank in New York City dealt with a demanding problem where the firm was highly exposed to Mortgage Backed Securities.

Therefore, the movie showed how the firm's higher-ups reacted to the devastating problem through boardroom discussions.

The movie titled "The Big Short" is a story based on a real-life event where a hedge fund manager from California called Michael Burry predicted the financial crisis in 2008 and thus bought large Credit Default Swaps for his investors, which meant that he took out a short position on the real estate market due to the introduction of mortgage-backed securities.

Thus, Michael Burry predicted the economy's collapse due to increased subprime loans partly caused by the introduction of MBS instruments, which allowed financial instruments to work in their self-interest. The prediction made Burry and his investors $700 million.

or Want to Sign up with your social account?