Vice Fund

A mutual fund that invests in companies involved in, or derive a significant portion of their revenue from, the tobacco, gambling, defense/aerospace, and alcohol industries.

What is the Vice Fund?

The Vice Fund (MUTF: VICEX), formerly the Barrier Fund, is a mutual fund that invests in companies that are involved in, or derive a significant portion of their revenue from, the tobacco, gambling, defense/aerospace, and alcohol industries.

To be specific, it invests in companies that engage in behaviors that are traditionally regarded as morally questionable vices.

Now, this fund is known as Vitium Global Fund. Casinos, gaming equipment makers, defense equipment manufacturers, alcohol producers, and cigarette producers are all included.

These funds, as the word "vice" implies, invest in dubious commercial ventures, such as tobacco and alcohol products, guns, drones used to target or kill political opponents overseas, and marijuana clinics in states where they've been proclaimed legal.

The word "vice" funds can also apply to money used to fund casinos in Las Vegas, online (or elsewhere), and other significantly "darker" activities or products.

Some investors do invest in online gambling and pornographic sites. They enjoy the fact that, once people become hooked on specific activities, they are unlikely to stop, allowing earnings to remain relatively stable, regardless of economic conditions.

Key Takeaways

- Strict government control, economies of scale, limited access to distribution channels, and strong brand loyalty all generate high hurdles to entry.

- Due to cheap production costs, considerable pricing power, and the typical oligopolies seen within these industries, these companies have excellent and long-term profitability.

- There is strong free cash flow generation, which can be reinvested in the business at high rates of return or paid to shareholders in the form of large dividends.

- With over 40% of assets invested in foreign companies, the Fund's global orientation allows it to diversify across worldwide markets.

- Governments benefit greatly from these enterprises, receiving billions of dollars in tax income, settlement payments, and access to the best military technology in the world, so they are motivated to see them succeed.

- The Fund looks for high-quality dividend-paying stocks in the vice industries, believing that these businesses have high entry barriers, making successful companies a steady source of stock returns.

- The Fund also thinks that its investments are generally market-neutral, which means that they perform well in both up and down markets due to a consistent demand for vice industry goods across all market cycles.

- The Fund is also internationally well-diversified, which helps it to avoid broad market volatility. It also prioritizes dividend-paying companies with good cash flow, which allows investors to receive income.

Origins and Philosophy of the Vice Fund

The Vice Fund invests in both domestic and international shares, with small-cap to mega-cap corporations among its holdings. It's been up and running since 2002.

It was established in 2001 to provide investors with long-term, risk-adjusted returns. Because of more predictable customer behavior and lower entry hurdles, the fund focused on the alcoholic beverages, cigarette, gambling, and defense industries.

It was also known as the Barrier Fund because of the high admission restrictions.

In addition, technology has little or no impact on the industry. Technology is less likely to revolutionize the alcohol or tobacco businesses than it is to revolutionize other conventional industries, like food and apparel.

As a result of the industries' features, the Vice Fund is a generally safe investment option.

The fund was established by USA Mutuals, which was then known as Mutuals.com, on August 30, 2002. The Vice Fund was renamed the Vitium Global Fund on October 1, 2019, by USA Mutuals.

At least 40% of the assets of the newly named fund will be invested in overseas enterprises.

Vice Fund Investment Approach

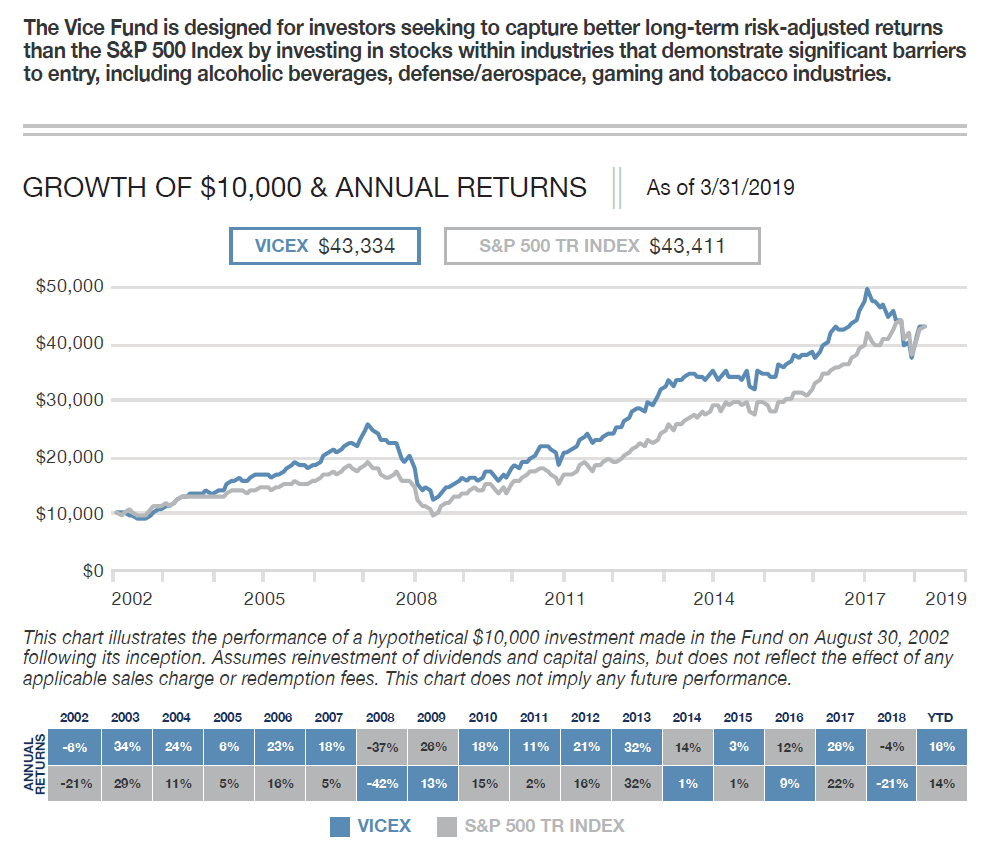

Let us discuss the Vice Fund investment approach. The Vice Fund's investing aim is long-term capital growth. Since inception, the cumulative total return is equal to 3.33%, while the S&P returned 357.59

The main management philosophy behind is:

-

Dividend-paying enterprises with positive cash flow and acceptable debt service coverage are prioritized.

-

Dividend-paying companies with the ability to increase dividends in the future are preferred.

-

Financial analysis is emphasized to avoid corporations with "red flags" in their financials, such as burdensome pension commitments and/or periodic write-offs.

Apart from that, some of the investment strategy adopted are:

-

Maintain an equity investment portfolio in the tobacco, alcoholic drinks, gaming, and aerospace/defense businesses, which management has assessed as having higher entry barriers and more predictable clients than the market as a whole.

-

Each industry should receive a 20% allotment.

-

Individual company exposure should be kept to less than 5% of the whole portfolio.

-

Using a disciplined portfolio strategy, reallocate funds on a monthly basis.

-

To create premium income, strategically use options to rebalance the portfolio and take advantage of volatility pricing.

Vice Fund Performance

The Vice Fund was established to serve investors' best interests. Investors, on the other hand, are looking for more than just monetary gains. According to numerous studies, shareholders value social and environmental performance as well.

As a result, some morally aware investors prefer to put their money into the Virtue Fund, which invests in socially responsible and ethical firms. Some say that the Virtue Fund is guilt-free and that it pays at least as much as the Vice Fund.

Changes in social, environmental, and ethical factors can have a significant impact on how people consume certain items. In the long run, the vice industries may alter as society moves toward a more ethical economic development.

As a result, the Vice Fund's investing philosophy and approach will need to change.

Vice Fund Outlook

The efficacy of investing in vice funds has been studied extensively. While the industries featured in vice funds are typically quite profitable, the funds' performance is typically not that much better than other types of funds that do not invest in vice equities.

As a result, many people have questioned whether or not having vice funds is a good idea. The advantage of investing in vice stocks is that they are usually highly reliable. Because the enterprises are already well-established, they are unlikely to experience significant growth.

They normally do not, however, lose much of their worth. These industries tend to thrive, independent of the state of the economy or the performance of other industries.

Many people who gamble, drink, or smoke, for example, will do so regardless of their disposable money. They will find ways to pay for these addictions, and the industries will keep being profitable.

The fund has returned -16.06% over the past year, -0.91% over the past three years, and 1.24% over the past five years.

Reviewed and edited by James Fazeli-Sinaki | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?