Asset-Backed Securities (ABS)

What are Asset-Backed Securities (ABS)?

What are Asset-Backed Securities (ABS)?

Asset-Backed Securities (ABS) are pools of loans that are collateralized (or"backed") by an underlying pool of illiquid assets, which are then sold to investors as securities (a process known as securitization).

The interest and principal payments from the underlying pool asset pool are passed on to the institutional investors that purchase the securities. However, the investors also take on the risks of the underlying assets. Probably the most well-known type of ABS is a Mortgage-Backed Security (MBS).

Types of Asset-Backed Securities

There are many different kinds of ABS across different asset classes. The only real requirement for a group of assets to be potentially securitized is that it typically needs to generate cash flow from debt. The most common types of ABS are:

Home-equity Loans

Securities backed by home equity loans remain the largest asset class in the ABS market. A home equity loan is a type of mortgage that allows homeowners to borrow against the equity in their home.

For example, if you have a $500,000 loan outstanding on a $900,000 house, you are able to take out an additional loan, using the $400,000 of equity you currently hold as collateral.

Home equity loans are typically taken out by mortgage borrowers that have a low credit score and are often second priority or second lien behind the original mortgage on the house. Because of this additional risk, home equity loans often carry higher interest rates than a traditional mortgage.

Credit Card Receivables

Credit Card Receivables that are used as collateral for securities are backed by the cash flow from credit cards, which includes interest payments, principal repayments, and fees (annual fees and late payment fees).

Because credit card loans only have minimum monthly payments and do not have an actual maturity date, they are considered a non-amortizing loan, which is a loan with no payment schedule and no concept of prepayment.

Because credit card receivables do not have a maturity date, a lock-out period may be established, where no principal will be paid by borrowers. Any principal that is paid during the lock-out period will be loaned out to the ABS in order to maintain the size of the credit card receivables pool.

Student Loans (SLABS)

Student Loans that are being securitized as asset-backed securities are known as SLABS, and are one of the main asset classes that are used for securitization.

Student loans can be broken up into two main categories; federal loans and private loans.

Federal Loans remain the most common type of loan for students, with 42.9 million Americans possessing some type of federal loan, according to the U.S Department of Education.

Private Loans are usually more difficult for students to obtain, as they require a very good credit score and usually have higher interest rates than regular federal loans.

Asset-backed securities on student loans are based on outstanding debt from student loans, which are packaged into securities and sold to investors. SLABS allow lenders to gain more liquidity and provide another viable option for institutional investors. As with all ABS, however, investors still do carry risks that come with student loans should the default rate be much higher than anticipated.

Auto Loan ABSs

Auto Loan ABSs are a type of amortizing asset that is based on the cash flow from customer payments from a pool of auto-related loans, which include interest payments, prepayments, and principal repayments.

They are the second-largest sector in the ABS market and can be put into 3 different categories;

- Prime Auto Loan ABSs are backed by loans made to borrowers with a strong credit score, which is greater than 680

- Non-Prime Auto Loans are made to borrowers with a slightly lower credit score, between 600 and 680

- Subprime Auto Loan ABSs are backed by loans made to borrowers that have a poor credit history, which is typically lower than a score of 600

As an aside, auto loans are rarely refinanced even when interest rates fall due to the fast depreciation rate of vehicles. The value of the vehicle falls faster than the balance on the loan, and so lenders are often unwilling to refinance.

How do Asset-Backed Securities work?

When consumers like you and I decide to take out a loan, our debt becomes an asset on the balance sheet of the lender. This lender may arrange to sell these assets to a financial institution, who then sets up a Special Purpose Vehicle (SPV), an entity that acquires these assets, packages them into an Asset Backed Security, and then sells them to institutional investors, such as Hedge Funds and Investment Banks.

The following video uploaded by WSO provides a brief explanation of what an SPV is

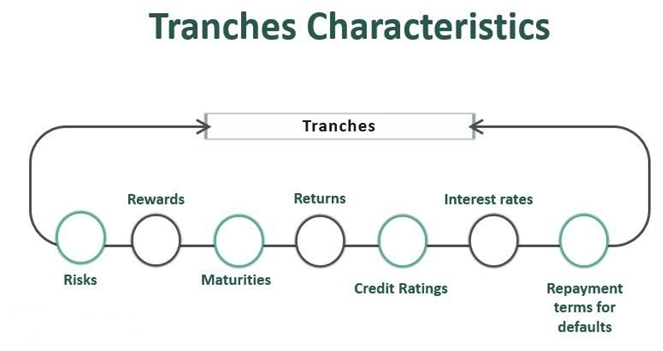

Typically, individual securities are issued as separate tranches, which are slices created from a pool of securities to subsequently sell to investors that have different characteristics, such as their risks, yields, and time to maturity.

An Asset Backed Security will usually have 3 tranches, class A, B, and C.

The video below provides a detailed explanation of what a tranche is

The Class A tranche, or the senior tranche, is the largest tranche of them all and has the highest credit rating, and is structured this way so it can be attractive to institutional investors, as it would have an investment grade rating.

Class B and C tranches have a lower credit rating, meaning they pay a higher yield, due to the increased risk.

In fact, the class C tranche might have such a weak credit rating that they aren't able to be offered to investors. In this case, the issuer of the Asset-Based Security retains the class C tranche and absorbs the losses.

Asset Backed Securities Advantages

ASBs provide investors with a plethora of advantages, and some of these advantages will be listed below.

- Issuing ABSs provide lenders the benefit of gaining new sources of funding through securitization, which may also remove risky loans from the institution's balance sheet

- ABSs provides great investment diversification for investors, as investing in the ABS market exposes you to many business sectors, such as home equity, student, and auto loans, as well as credit card receivables

- The senior tranche for ABSs have a very high credit quality, providing secure investment vehicles for institutional investors

- Asset Backed Securities offer higher yields than government bonds and mortgage-backed securities of comparable credit quality

- ABSs do not rely on the financial wellbeing of the intermediaries that issue these securities. Even if the financial institution that issued the ASBs were to go bankrupt, the investors would still receive payments, as the loans consist of a massive number of borrowers consistently making payments

Asset Backed Securities disadvantages

Investing in ASBs, like any other financial instrument, carries certain risks that investors must address and align with their risk tolerance. Some of these risks include

- Prepayment risk, which occurs when borrowers choose to accelerate the payments for their loan and pay it off early by adding extra payments to reduce the outstanding principal on the loan. This can result in a lower yield for investors, shrinking the size of the assets held in the securities

- Repayment risk, which occurs when borrowers decide to refinance their loans at lower and more attractive rates that reduce the amount they need to repay, resulting in a lower yield for investors

- Non-payment risk, which occurs when borrowers are unable to meet their financial obligations and are no longer able to make payments on their loan. This risk may result in losing the outstanding balance on the loan due to bankruptcy, and lowers the yield for investors, significantly shrinking the assets held in the securities issued

Check out the video below for a great explanation on Asset-Backed Securities

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?