What is the difference between an index price, a fair price, and a most recent transaction price?

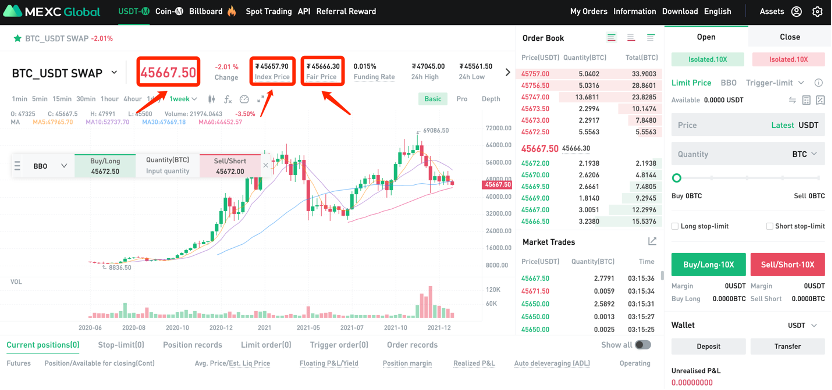

On the futures trading page, users can see the three different prices: Index Price, Fair Price, and Latest Transaction Price. So, how can we figure out what those three prices mean and how they differ?

Looking for different price ranges

On the futures trading page, you can look at three different prices. And, in most cases, there won't be much of a difference in specific figures.

Example:

Price types in trading terminal

Three-Priced Definition

Index MEXC assigns varying weights to the spot prices from at least three separate exchanges, resulting in a weighted average price.

MEXC's Fair Price is the Index price multiplied by the capital cost base rate. The fair price marking method is designed to keep highly leveraged products from being liquidated prematurely. The fair price is primarily used to assess unrealized loss and position liquidation, implying that liquidation or automatic deleveraging is based on the fair price rather than the most recent transaction price.

Calculation of a Reasonable Price

Funding Rate * (Time Until Funding / Funding Interval) = Funding Basis

Index Price * (1+Funding Basis) = Fair Price

The most recent transaction price in MEXC Futures is the current market traded price.

Quasi dolores accusantium placeat sit. Rem natus quo quia maiores veritatis placeat sed. Repudiandae hic vitae velit dicta corrupti rerum odit.

Expedita quos molestias suscipit. In autem aut doloribus. Sit exercitationem neque omnis accusamus dicta molestiae.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...