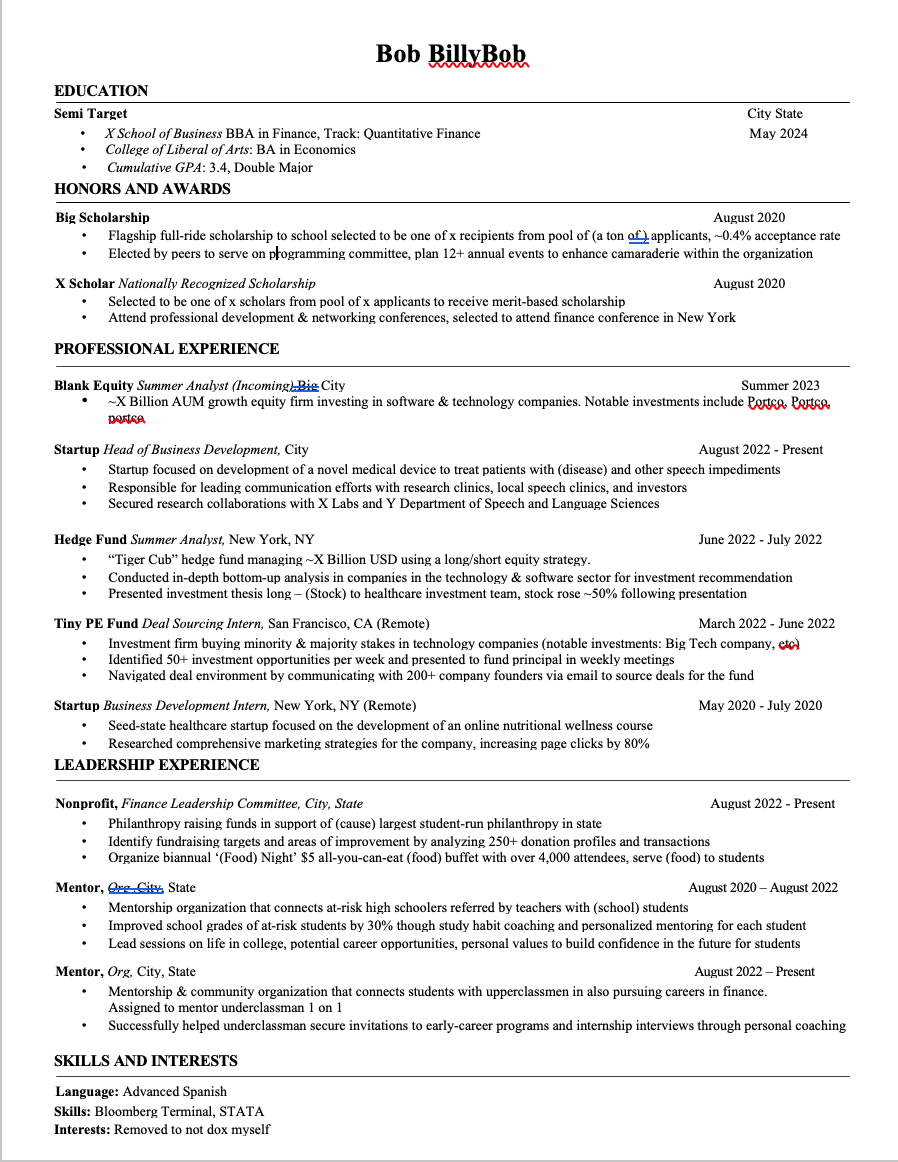

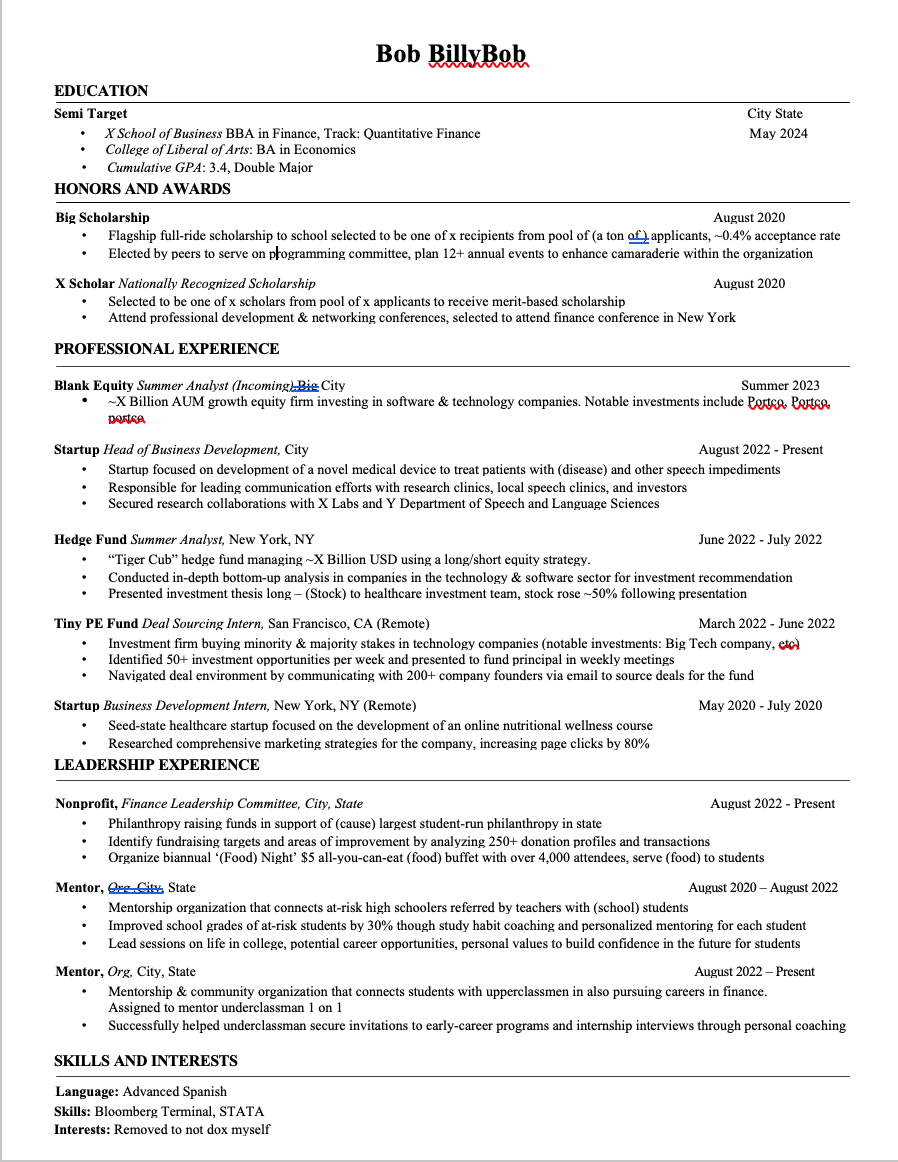

Can someone look at my resume? Worried my GPA (3.4) is a bit low to break in

Would be grateful for any feedback/advice.

Would be grateful for any feedback/advice.

| +49 | Pod Shop Regret | 16 | 3h | |

| +27 | Fastes PM progression ever seen? | 31 | 2d | |

| +17 | Why don't MMs do any activism? | 11 | 1d | |

| +17 | How extroverted is the junior MMHF job? | 5 | 5d | |

| +16 | Are you making money these days? | 9 | 1d | |

| +13 | Credit Pods | 6 | 1d | |

| +12 | Point72 Academy Case Study | 13 | 12h | |

| +12 | Mid to Low Frequency Quantamental | 1 | 2d | |

| +11 | Stephen Moyer- Distressed debt analysis | 5 | 4d | |

| +10 | Track record to start a small hedge fund? | 6 | 3d |

Career Resources

So, semi-target is already an edge over non-targets. Plus Quant finance is a relatively tough major, while there might be hardos who have 4.0 in it, your 3.4 should fare well. Add to that two scholarships, experience at two startups, two PE firms and one HF which is an L/S Tiger Cub, plus you know Spanish which I'm sure is an edge because you can filter through some LatAm markets with ease which are emerging markets where HFs have their eyes on and you can work with the terminal.

Almost thought you were flexing. Your experience is extremely relevant and that Tiger Cub experience alone puts you in the top 1% of applicants for all I know. Here's the problem with your post, you said "It's low to break in"; My brother in Christ, you are already in, just fine tune your resume a little bit and you will at the very least get an interview and that's the worst case scenario. While there is emphasis on GPA, your experience makes you too good a candidate to miss out on. If you network right with those Tiger Cub connections you'll have a job in a big name in no time. You'll be surprised to know how small the HF space actually is, everybody knows everybody, that's a good thing and a bad thing, suppose you fuck up, everyone knows and suppose you're exceptional, everyone knows too.

Networking got me a lot further in this space than my shit school.

Appreciate it man. Wasn't flexing it all, I've been pretty anxious about my GPA since it dropped a ton when I added the double major. Was worried especially cause of recent market downturn, and some funds having a hard time, but thanks for the advice.

I understood that, said I thought that because that's how good your experience is, the anxiety is real in the HF space. All the best.

Cumque quisquam quo necessitatibus libero laborum. Mollitia aut autem quae enim et. Earum suscipit quasi sint ipsam dolore vel vel.

Dolore occaecati rerum modi iste. Repellat corrupti ea asperiores harum molestiae voluptas alias aut. Vel sint tenetur et vel quisquam repellat. Sapiente porro non dolore rem dolor. Ad quod ratione animi omnis. Nemo labore aut cumque odio sunt rerum suscipit.

Sint repellendus laudantium et consectetur perspiciatis quia vel. Perferendis atque ut accusantium assumenda. Cupiditate doloremque nam veniam et ut recusandae doloribus repudiandae. In eligendi nostrum eum recusandae facere. Repellendus eius et nisi et.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...