|

Energized Oil — To quote the great American poet Flo Rida, “It’s goin’ down for real.” The nuclear-powered stare down between U.S. President Joe Biden and President / Owner of Russia Vladimir Putin intensified on Friday with American national security officials warning that an invasion of Ukraine by the Red Army seems imminent. Oh, and happy Monday.

Now, this isn’t great for a lot of reasons. We’re not geopolitical analysts here at The Daily Peel, so we can’t speculate on what may or may not turn into World War Three. We’re here to make money, apes, and one thing this conflict has been great for is oil prices.

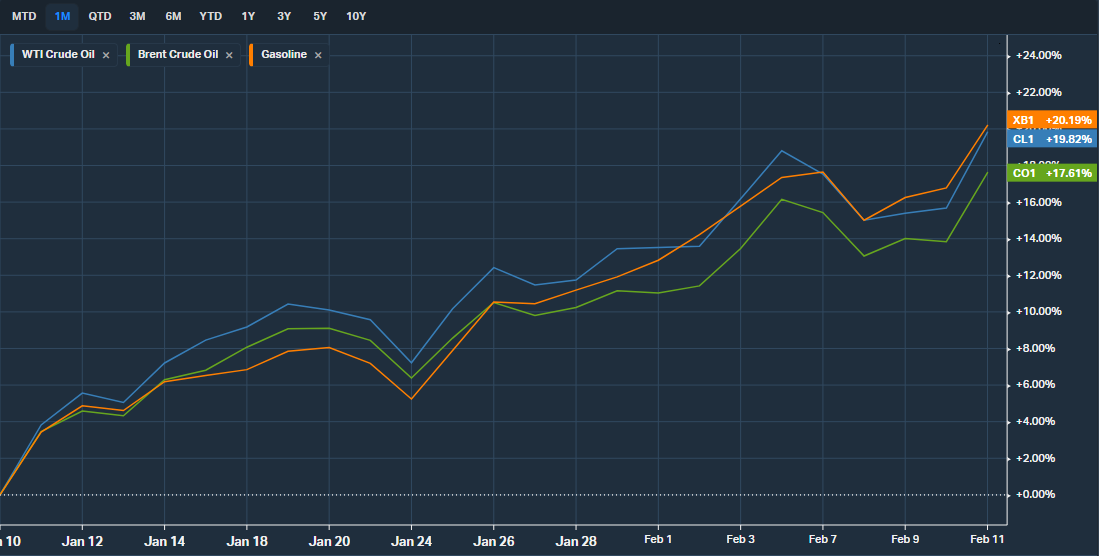

On Friday, global oil and gas prices spiked even more than they’d already spiked over the past few months. U.S. crude, aka West Texas Intermediate, sits at $93.90 while the U.K.’s crude benchmark, known as Brent, closed at $95.10. Both benchmarks have gained >53% in the past year and sit at +7-year highs, making the S&P’s returns look like that of the average Robinhood trader who just discovered Dogecoin.

Meanwhile, gasoline prices have gained even more in the past year, shooting up 66%, which is almost as much as my stress levels when I see the price per gallon at the Mobil down the street. But it takes more than just a potential skirmish at a 199-mile eastern European border to drive gains like that. We can’t forget about the IEA and OPEC.

Amid the egomaniacal brouhaha boiling between Russia, Ukraine, the U.S., and the E.U., the International Energy Agency threw yet another wrench into the calculus of oil prices. “Incredibly tight” is how one IEA official described conditions in the global market.

Basically, even without the Russia-Ukraine conflict, oil supplies were already precipitously low, largely thanks to an estimated one billion barrel shortfall between what OPEC was supposed to produce and what the cartel actually produced since the start of 2021.

Of course, many countries hold sizable stockpiles of oil that could ease prices if released en masse. However, we’ve just been using way more of that black gold than anticipated.

At the end of the day, anything can happen. WTI did go negative back in 2020, so really nothing should surprise us at this point.

The Week Ahead — We’ve got another fun week of degeneracy ahead of us, apes. Let’s take a look at what we can expect.

Monday: While you’re busy eating heart-shaped candy from your mom and watching your friends post cringe-a** love quotes on Instagram, the treasury will be auctioning off both 3- and 6-month bills, and we’ll get a reading on consumer inflation expectations.

Tuesday: After recovering from your Valentine’s day hangover, Tuesday brings a lot of fun as well. Macro nerds will flock to read the latest PPI and Empire State Manufacturing Index. Meanwhile, firms including Roblox, Airbnb, and Wynn Resorts report their latest earnings.

Wednesday: On Wednesday, details about import and export prices over the last year will drop along with the latest retail sales data. Earnings will be the real fun. Nvidia, Shopify, and Cisco will update us on their latest quarter, and given the state of the semi-market, it’s gonna be exciting.

Thursday: Housing data will take over the minds of economists on Thursday, along with the Philly Fed Manufacturing Index. On the earnings side, Walmart, Palantir, Roku, and Dropbox will steal the limelight.

Friday: Friday’s gonna be boring from the data side for economists, but maybe speeches from the Fed’s Lael Brainard and governors Wallard and William will cheer them up. Meanwhile, DraftKings and John Deere will dazzle us with their latest numbers.

As I said, it’s gonna be fun. We'll see you there!

|

Laudantium est quis voluptatem quia. Ab mollitia rerum aperiam impedit. Porro velit placeat ut inventore reprehenderit laboriosam. Doloribus reiciendis nobis soluta.

Recusandae perspiciatis eos dolorum. Omnis rerum ut officiis voluptates veniam harum eos. Inventore et quisquam praesentium dignissimos totam provident quam. Architecto voluptas doloremque aut omnis eos.

Sunt maxime pariatur unde eius. Voluptas et eos enim inventore sit. Enim quam iure laboriosam. Totam voluptatem inventore accusantium blanditiis deserunt autem non.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...