|

U.S. Trade Deficit — Despite knowing exactly how much money they’re owed by you and all the other 330m Americans down to the penny every single year, it turns out the U.S. government isn’t the most financially responsible.

Total Federal debt is chilling just a hair over $30.02tn, while GDP last year came in at just under $23tn. Along with that record-high GDP reading from last year came another record high, this time in the U.S. trade deficit.

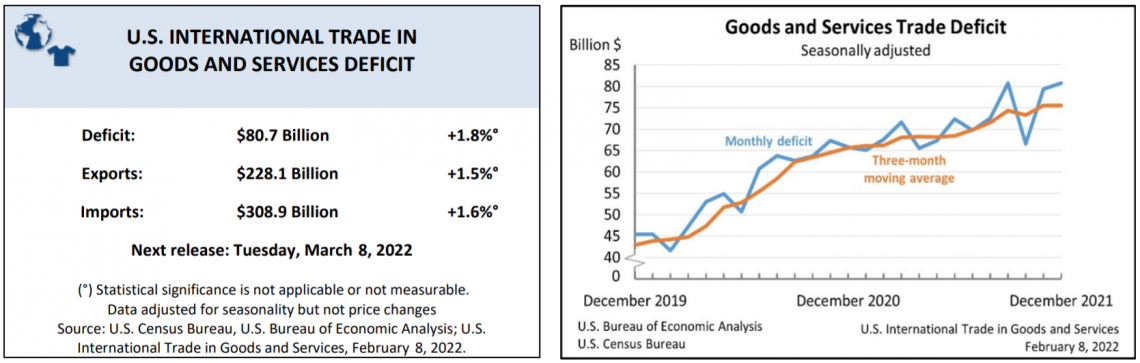

Outperforming the S&P 500, Nasdaq, Dow, Russell 2000, and many more important benchmarks in 2021 was the growth in the U.S. trade deficit. Gaining 27%, the deficit ran all the way up to a massive $859.1bn in 2021. We weren’t even aware numbers went that high.

But, if you take a step back off the ledge for a moment, it kinda makes sense. Exports still boomed, but imports boomed wayyyyy more. In 2021, the pandemic largely caused the U.S. to pivot from the longstanding trend of higher spending on services as consumers turned their attention to goods.

Fortunately, the U.S. produces most of the services we consume. Unfortunately, the U.S. does not produce many of the goods we consume, hence our reliance on manufactured goods from regions like China, China, and China. With pandemic-induced increased spending on goods over services, it makes sense the deficit spiked.

But what does that mean for the U.S. economy? I’m so glad you asked. No one really knows. Trade deficits, at face value, are neither inherently good nor inherently bad for an economy. When a trade shortfall occurs, a country’s economy has to cover it, generally through investments abroad or foreign investments in domestic assets. But, the link between a deficit and economic growth is about as unclear as it gets in macro.

The main takeaway here is likely to be the increased emphasis on the need for the U.S. to domesticate crucial parts of our supply chain. Think semiconductors, pharmaceuticals, PPE, and all that others stuff we have shortages on. If anything, the deficit highlights America’s reliance on foreign nations to provide some of our most necessary goods.

So don’t be surprised if you start hearing politicians from Joey B and AOC to Rand Paul and Mitch McConnell talking about the need to reshore crucial supply components. For once, they might actually agree on something.

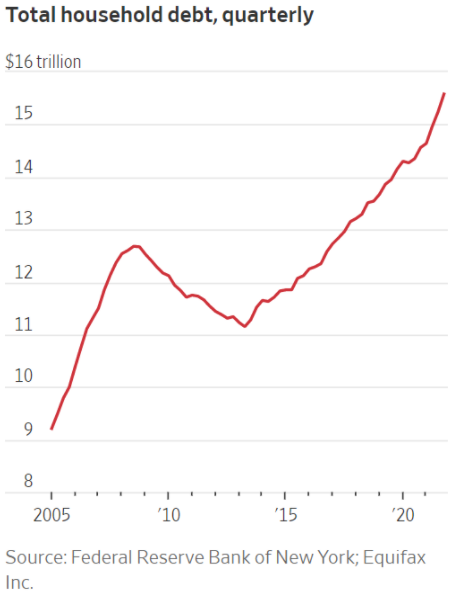

More Records — I’ll admit — taking on $1tn in debt isn’t great for anyone. But hear me out. U.S. households took on more debt in 2021 than in any year since the GFC. No, please don’t freak out yet.

As you can see by the WSJ chart below, Americans have definitely gotten over their fear of debt. So much so that in 2021, we broke the $1tn mark and brought total U.S. household debt up to a cool $15.6tn.

Cars and homes are largely to thank for that, as their massive price increases since the start of the pandemic have induced much more of a need for debt financing. But again, please don’t freak out yet.

Consumers are, in a word, healthy. Debt delinquency rates are just about at an all-time low while JPow, Joey B, and ol’ Donnie T fattened wallets all across the land. Keep in mind consumers, while holding a ton of debt, hold right around the most cash they ever have at the same time. Moreover, 87% of newly created debt financing in 2021 is tied to home purchases, which tend to increase in value over time, thus building more wealth.

So yeah scary number, but not super much to worry about yet. I just really hope I don’t regret saying that anytime soon.

|

Quod quia quia aut perspiciatis aut minima eligendi. Voluptatem voluptas cumque consequatur. Eaque ad officiis vitae.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...