Oprah Winfrey’s Job Market

Someone must’ve given Oprah the keys to the economy because, in 2022, everyone’s getting a job.

Compared to the cars she usually gives away, getting a job is pretty lame, but it is helpful with, you know, eating and living and sh*t like that.

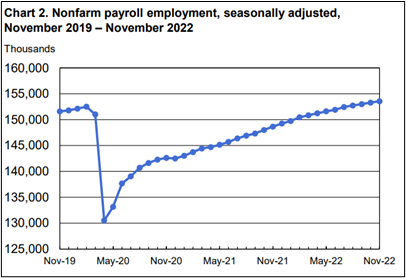

But still, despite a job’s ability to generally prevent starvation and homelessness, Fed Chair Jerome Powell wants Oprah and her free-wheeling labor market to settle down. The 263,000 jobs added in November is a tough scene in JPow’s eyes.

Moreover, economists were once again wildly wrong with their forecast for 200,000 jobs added last month, a >30% miss. We don’t expect much from these poor, sweet econ nerds, but are they even trying anymore??

Anyway, the market had a relatively muted reaction to November’s jobs report. In the “good news is bad news and bad news is good news” macro environment we’ve been living in since C-19 showed up, this report and reaction fit right in.

Adding more jobs than expected is usually a positive sign, but nowadays, all it does is give JPow more firepower to demolish your portfolio with another potential 75bp rate hike.

And that’s very likely why the market acted like nothing happened on Friday. Balancing the combination of solid job growth with a now-higher likelihood of a 75bp hike seems to have led to a flat day overall.

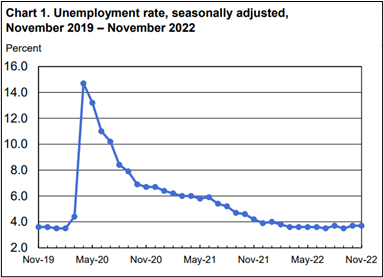

More broadly, this job report also showed basically no change in employment participation. The labor force participation rate of 62.1% and the employment-to-population ratio of 59.9% stayed basically unchanged, along with the 3.7% unemployment rate.

And like pretty much every month since May 2020, leisure and hospitality jobs led the way, racking up 88,000 additions in November.

However, there is one aspect of the 2022 labor market that’s a mild positive in JPow’s eyes. The average monthly job growth of 392,000 seen this year is a major step down from that of 562,000 observed in 2021. A win is a win, right?

Maybe, maybe not; who knows? Either way, getting back to the 63-64% range of labor force participation we had before 2020 ruined everyone’s lives for a bit is still a long way away. With that being JPow’s priority, don’t expect sunshine and rainbows to be bursting out of the Fed’s next meeting.

|

Accusantium libero dolores excepturi. Labore fugiat consequatur reiciendis amet qui. Adipisci architecto sint eum sed consequatur eum odio officiis. A consequatur iusto sed asperiores in reprehenderit consequatur. Veniam repellat aperiam enim consequuntur est illo.

Quibusdam voluptatum quaerat repellendus quidem. Ratione est delectus suscipit facilis illo aspernatur. Est sunt voluptas et excepturi aut.

Nihil fuga sit vitae esse. Eos quis voluptatem quisquam quod quis cupiditate error necessitatibus. Qui expedita veniam id veritatis fuga voluptas soluta voluptatum. Molestiae quaerat ut animi sint. Consequatur illo praesentium id est animi earum. Cumque temporibus non dolorem.

Non voluptatem doloribus dolorem sit expedita eius. Cum ratione vitae quibusdam corporis vel. Sunt ut et omnis dolores id ratione dolorem sint.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...