|

CPI — JPow is doing his transitory dance right now, as he may be in the early innings of being proved right on inflation. CPI numbers from the last month show inflation growing at a slower clip than expected but still faster than years past. The price of the “basket of goods” increased 0.3% from July and 5.3% from the same time last year. Most other years, this would not be good news, but as we know 2021 is special, and while 5.3% annual cost increases is still not close to ideal, it's surprisingly low to most economists. However, as the Fed has made clear, they target an average inflation rate of 2%. For the last several years, we have purportedly been quite below that figure, so prices running a bit hot to achieve the average is seen as a positive. Let’s just hope JPow is right.

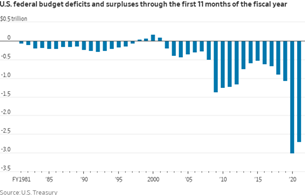

Budget, $hmudget — Strike up the band, it’s time to celebrate - U.S federal deficit clocked in at just $2.7tn through the first 11 months of FY’21!! Now, of course this doesn’t include the $1.2tn infrastructure package or any other big expenses. What it does include however, is a drain for your tax dollars to be thrown down. With that said, it’s not all doom and gloom. The pandemic and all of its ancillary issues almost certainly warranted a dramatic increase in spending. Revenue through the first 11 months hit a record $3.6tn, as tax payments increased on the back of the economic recovery. We’ll see how the final month of the fiscal year goes, as the aforementioned infrastructure bill, $3.5tn budget proposal, tax hikes, and debt ceiling all still loom large in Washington. At least they burned less money than last year...so far...

|

Quo rerum ipsam et voluptate assumenda a voluptatem. Quo consequatur omnis voluptatem sed non explicabo. Et necessitatibus ullam quae id earum eum. Est similique consequatur accusantium ea. Architecto quas veritatis et ab quod necessitatibus veritatis. Provident accusamus esse illo dicta blanditiis.

Eaque veniam reiciendis eaque perspiciatis reiciendis quia nisi sint. Veritatis cumque ut earum occaecati et fugiat porro veritatis.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...