|

Taper Talk — The moment everyone has been waiting for finally came yesterday. JPow and the rest of the FOMC spit some heat on the state of the economy, some coming in line with expectations, while other information was relatively unexpected.

First and foremost, while maintaining asset purchase tapering and rate hikes do not go hand in hand, the FOMC revealed plans to likely raise rates sooner than anticipated. At previous meetings, the phrase “not until at least 2024” was tossed around. Now, the so-called “dot plot” that allows FOMC members to predict rate hikes, has moved primarily to mid-2022. Similarly, JPow indicated tapering will come “soon” in his ever esoteric style, saying that while no decision was made, it was clear to members that tapering is not far away.

Financial markets had a mixed reaction to the meeting. Stocks were largely up on the day, but bond yields traded somewhat sideways, as timing of these incredibly impactful events remains unclear. In short, the money printer will slow down and the cost of money will go up sooner than expected. Still think stocks will only go up?

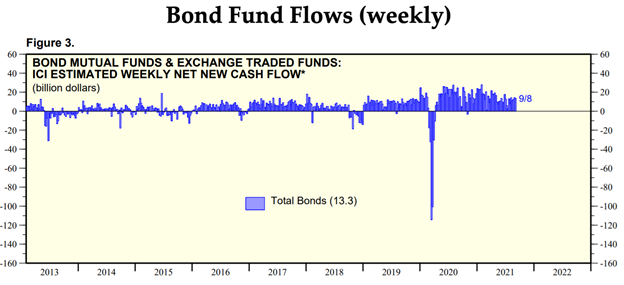

BFFs — Don’t get too excited, we’re still not friends - the only BFFs we need are Bond Fund Flows. Contrary to popular belief, fixed income is not dead. The graph below shows weekly flows into ETFs and mutual funds that hold fixed income securities, and things are looking up. In fact, things have been looking up since mid-2020 despite ridiculously low interest rates, indicating that aggregate demand for these products and investment products in general remains very high by historical measures.

Don’t get me wrong, bonds are still for nerds, but these nerds make money. The equity market has come under fire for its huge runup, scaring some into using the scary “bubble” word, but it appears stocks are not alone in their sizable gains. Demand for financial assets is elevated across the board, so things may not be as insane as they seem.

|

Perspiciatis ratione sint consequatur autem. Eos dolor pariatur quaerat sunt. Maxime enim culpa quia sit qui sit deleniti unde. Sapiente accusamus autem laudantium quisquam ut aut fuga. Totam animi ducimus blanditiis qui sequi illo voluptatem numquam. Provident eos omnis itaque nemo occaecati non tempore. Vel inventore et modi sit repudiandae suscipit.

Ut cumque impedit quod dignissimos. At facilis et aut. Temporibus ullam et ut modi aut illo aut.

Deserunt voluptatum sed sapiente cumque eaque voluptate. Aut enim quod ratione et officia voluptatem nam. Quam eius dolores sed deleniti. Voluptatem quis reiciendis aliquid soluta est asperiores. Est libero labore quod quo perspiciatis et veniam veritatis. Eos cum rerum minus nesciunt facilis.

Nobis fuga repudiandae nulla fuga voluptates. Autem atque quisquam necessitatibus possimus. Rerum eos expedita inventore autem aut. Sint eos error deleniti.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...