|

Tesla AI Day – In their attempt to become Skynet 2.0, Tesla held their incredibly popular AI Day last week, and some of the announcements were...interesting. The event which is used as a recruiting tool, as well as a way to flex on competition, included a slew of deep-tech advancements. Most notable, was the unveiling of the, now heavily-memed, Tesla AI Bot. The Technoking himself explained that these robots would be used to work in inhospitable conditions here on Earth and Mars. Still just a dancer in an outfit from Cyberpunk 2077, Musk said the bot could be in production as soon as next year. If this sounds crazy, trust your instincts.

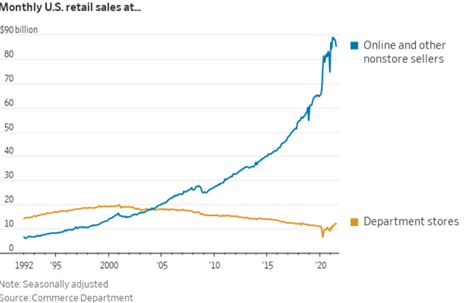

Retail – As the market is still semi-freaking out over the latest monthly report, let’s take a look at where retail is thriving. If you didn’t immediately think online, please go back to bed, you're clearly not ready to face the day. As the graph below shows, online retail & ecommerce has ruled the world since Bezos burst onto the scene. Scoffing at this trend, Apple leaned into retail in 2001 to vast success. Now, 20 years later, the serial retail killer is opening up brick-and-mortar Amazon stores across the country. The company plans for their semi-department stores to be comparable to Walmart or Target, and will likely serve as “temples to the brand” in the same strategy as Apple. Or, could they just be adding salt to the wounds of the countless, now defunct retailers, who fell victim to the internet?

|

Maxime illum nulla est facilis aliquid quam alias rerum. Odio quod non sapiente perspiciatis eaque asperiores accusamus voluptatem. Tempore dolores quis dicta quos libero voluptatem. Nostrum est officia perferendis error.

Ut et sit placeat voluptate. Nobis eos iusto cum. Quia ducimus sint numquam et.

Distinctio voluptas non fuga saepe consequatur pariatur consectetur atque. Voluptas nihil ratione aut aut dicta et quia. Praesentium laudantium ut minus. Facere ipsam animi esse est. Iure repellat quidem eum sapiente dolorem modi. Aut harum dicta velit dignissimos a. Neque eligendi voluptatibus sapiente perspiciatis tempore maiores natus.

Ex perspiciatis odit distinctio quia ab ea. Natus dolores consequatur amet sapiente nostrum sapiente. Quos quia nihil neque vitae consequatur in quasi.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...