|

Tired of Hearing About Inflation Yet? — I know, I know. The Daily Peel probably sounds like the Daily Inflation lately.

The numbers are in: 8.5% year-over-year inflation. Higher than expected and worse for the middle class than expected. Monthly core inflation was slightly better than expected, but it still doesn’t sound like good news.

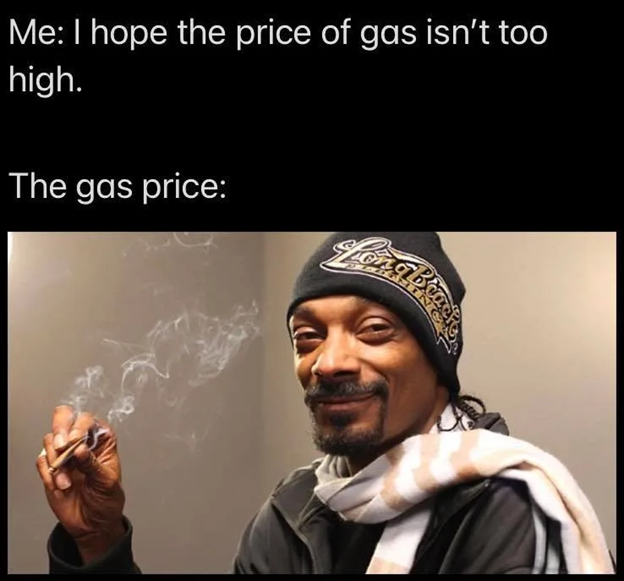

Yesterday, we saw the markets react favorably to inflation news, probably because the core CPI number was slightly better than expected and is showing that inflation for a stable basket of goods is slowing. It still exists, but it’s not to the moon right now.

If you’ve lived through the last decade here in the States, hearing whispers about over 8% inflation numbers is as wild as a Cardi B concert. And when the White House said that it expects the inflation print to be extraordinarily elevated, we decided to dive a bit deeper into what this number means for us all.

China released its year-over-year inflation numbers last week: also 8.5%. Inflation isn’t an isolated issue. It’s a global challenge, which can become massively problematic for the world’s economy.

The IMF and its band of merry men have predicted that the US GDP will expand by 4.4%. Not bad for an economy that still, in our eyes, doesn’t have its feet under it in the digital marketplace of the 21st century. At the same time, ask any analyst on the Street: earnings are going to grow in 2022 after a blockbuster year in 2021.

All of these pretty little predictions for 2022 growth in corporate earnings and GDP were slapped together when Daddy JPow was whispering sweet nothings into our ears: transitory, baby…

The question is: will March’s inflation numbers be the peak? Or will inflation really, really get out of hand?

With the return of inflation to the US economy, we have watched the rise of inflation politics. While goods and services creep up in cost, economists with certain political affiliations have debated the difference between “good” inflation and “bad” inflation.

Another hot take: in election years, there sometimes manifests what I’d like to call an uncertainty bias, an increase in expected inflation. Looking into poll numbers and the yield curve, we aren’t there yet, but when we get there, we will see the yield curve adjust to take into account expected future inflation while watching other economic indicators of consumer sentiment decline.

This isn’t a political newsletter, so we’re sorry if you expected us to saddle ourselves to a particular ideology or set of candidates. But inflation is the ultimate tax, and it steals from the middle class and the poor while crushing the financially illiterate.

|

Tempore optio occaecati voluptas et. Voluptatem laudantium quaerat voluptas possimus dolorem deserunt odit.

Est ut necessitatibus quidem error. At possimus fugiat est aut minima temporibus. Dolor consequatur culpa vero eligendi. Nesciunt ad id similique quis.

Numquam rerum quas rerum ut at velit voluptatem. Rerum et iste amet necessitatibus modi. Harum vero et soluta corporis dicta.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...