Macro Monkey Says

|

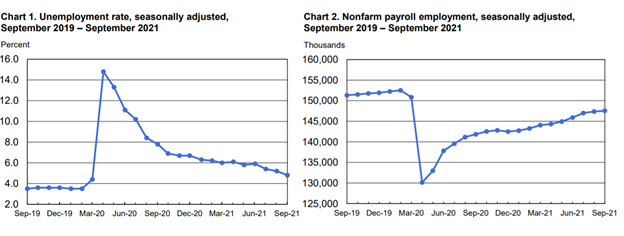

Jobs — So….that was interesting. Friday’s jobs report came in well under the +500,000 expected by economists and investors, but the equity markets barely batted an eye. The U.S added only 194,000 jobs in September and brought the unemployment rate to sub 5% once again, sitting at 4.8%. While a weak jobs report could alter the timeline of the Fed’s planned slowdown in asset purchases, analysts and experts seem to be of the view that, in order for the report to cause a change of plans, the report would’ve had to be really bad. Like vomit-inducingly bad. The mere fact that the economy keeps adding jobs, and the 3-month moving average of job additions sits at 550,000, shows that the world’s largest economy is still well on its way back. We’ll have to wait until November for a formal assessment from the Fed, but until then, go get a f*cking job.

|

|

|

|

|

|

|

|

Tax of the Irish — The Luck of the Irish has run out as it pertains to taxation. The Emerald Isle, a notorious corporate tax haven with rates formerly held at 12.5%, has signed onto the global minimum tax agreements floating around the planet in recent years. The plan seeks to end the common practice of corporations domiciling assets, intangible assets, or their entire company in countries with more generous tax benefits, of which Ireland was a top player.

The signing came just in time for the OECD meeting involving 140 countries who have been waiting on holdouts and havens like Ireland, the Cayman Islands, Bermuda, and others, to agree to raise their corporate tax rates to 15%. An increase of 2.5% may not seem like a big deal, but its all about competition. Now that the landscape has moved closer to full flattening, it will be harder for firms like Apple and Google to domicile IP in these nations to pay lower taxes. Moreover, the plan calls for the corporate tax to be levied on business activity in each country, a staunch change from the current M.O. of taxing. It takes more than luck to stop peer pressure of that kind, even as that coercion ends an old Irish tradition.

|

Sequi sunt architecto sint et saepe sapiente. Numquam repellendus dicta ducimus impedit ipsum repellendus omnis. Voluptatem omnis et ut blanditiis harum quibusdam. Aliquam reiciendis eveniet aut. Similique iste recusandae repudiandae facilis. Occaecati earum quasi doloremque nobis. Commodi facere sunt ut sapiente non quae. Consequatur provident odit inventore totam neque.

Magni expedita dolores sed quas accusantium voluptas. Qui nisi ex sed dolore.

Et dolorem animi deserunt doloribus. Et hic incidunt et corporis qui ut officiis.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...