Critique my budget

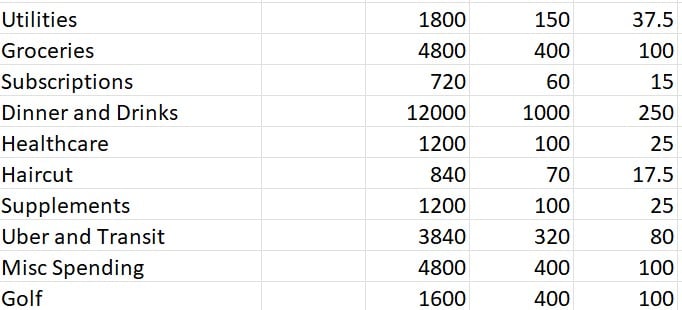

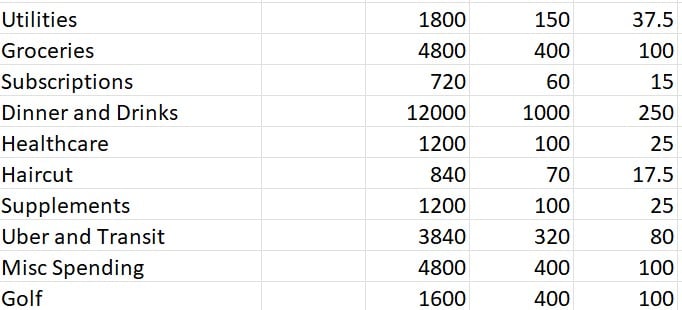

Title says it all. Incoming analyst. Trying to figure out where to cut back and where to splurge. Hoping to save about 15% after tax and 401k as seen here. In NY for reference. Column 1 is yearly, 2 is monthly and 3 is weekly.

Title says it all. Incoming analyst. Trying to figure out where to cut back and where to splurge. Hoping to save about 15% after tax and 401k as seen here. In NY for reference. Column 1 is yearly, 2 is monthly and 3 is weekly.

Career Resources

Paying for utilities, but not rent... got it.

It’s just over 2. Kinda standard if staying in Manhattan

what are the columns? can you clarify?? why so much on dinner? pls fix

Dinner line item includes drinks/bars and cover fees etc. Brunch, a nice meal a week, and tip.

-

If healthcare includes the gym that will be low (unless your firm subsidizes or you have a gym in your building). For the nicer gyms in Manhattan you are looking at $250-300 a month.

Do you need to buy anything for your apartment? Mattress/bed? Other furniture? Plates, etc?

Are you planning on taking any trips? I would make sure to include those in your budget

Other than that, the numbers mostly seem fine (dinners are high but I actually think pretty accurate if you like to go out and have nice meals, drinks, etc). I recommend you track them for the first few months. It can be very easy to get off track (dinners get more expensive, friends ask you to join a trip to ski, hamptons, etc, you go on a few dates and pickup the tab, you get the picture).

Great points thank you. Broke it down to weekly to not be surprised by the end of the month when the bills hit.

need to bump that golf budget up. should be roughly 40-50% pretax comp

Supposing you're on 110k base salary, and contribute 5% personally to your 401k, that leaves ~$71,000 post-tax income to spend in NYC, or $5900 per month.

Your expenses total 3000 USD per month plus 2250 USD for rent. In other words, 5250 USD per month. That means you're saving 11% of your take-home, and even that's assuming the low healthcare #s as someone above mentioned.

You can probably use your sign-on to pay for all furniture, so you can forget about that; similarly, pay for trips with your EOY bonus. I'd personally cut down the dinner costs, $1000 per month seems like a lot for an A1. And misc spending, try to caution yourself with buying nonsense items. My take at least on how to get the number up to 15%.

Any recs on what a more reasonable dining/going out budget would look like from your experience?

Just live life and see where you land. Then start tweaking from there. Things don’t really pan out like you expect. There are some big things like rent which you need to get right, the rest will sort of naturally fall into place

dawg this budget really shows how privileged y'all are wtf man, i save way more of my money, wtf you dropping $60 a month on in subscriptions bruh? $70 a month for a haircut, wtf???? Supplements? You got a disease or smthn???

you don't get haircut twice a month? $70 with tips is good a month

No lol? Most people get a hair cut once a month.

what does this even mean? everyone on this site knows what a first year analyst makes. Nobody says it's a poverty wage

Commentor is probably AN1 at Tobin

That’s a lot to spend without even considering rent. A lot of those seem reasonable except for the bottom four plus dinners. If you’re trying to trim back, that’s where the excess is.

I never did the spend the salary, bank the bonus thing. Every year, I roughly use the first paycheck of the month on rent / expenses and save the second. I think it’s good to treat yourself and do things to keep you sane. But that doesn’t have to mean balling out on very expensive dinners all the time. It blew my mind when a VP told me he spent 100k in a year on Ubers and dinner alone…

This is BS. You have to assume he went out every Friday and Saturday without fail and spent $1,000 every day. Not possible

maybe he went everyday?

I agree that there might be a little "rounding up" on the part of the VP, but I think 100k (or close to it) is very much possible. If you assume they eat alone (or just with SO) and take UberX, sure, 100K is tough to believe. But you throw in Uber Black and a couple friends (and the extra bottles of wine that come with that) I think 100K becomes much, much more likely, maybe even easy.

Where's the total ?????? pls fixxxx

$1000 for drinks. Who tf are you taking out?

Typical weekend:

Nice dinner or date - 120 w/ tip

Cover - 20/night (Friday and Saturday)

Drinks - 50 w/ tip

Sunday brunch/breakfast - roughly 30

Granted that's a assuming all of the above, you get the idea

That’s living lavishly

Ok I can’t tell if you have a gf or not. Either those numbers make sense or ur just a fat fuk.

Est tempore beatae velit sed. Fugiat nisi quasi similique quae. Placeat assumenda velit voluptatibus officiis fugiat. Corrupti iure rerum id quibusdam reprehenderit temporibus amet.

Eum aliquam assumenda aut similique tempora et et officia. Et qui voluptas exercitationem id maiores eos. Dolores consequatur delectus illum sit sequi voluptatem excepturi. Quia sunt officiis ut est in dolores. Suscipit at consequuntur dicta. Quam doloribus in quidem ipsam suscipit omnis.

Dignissimos quos eius perspiciatis harum consectetur et. Culpa soluta facere nesciunt dolores. Impedit vero tempora dolorum sed illo. Accusamus modi temporibus sunt non repudiandae est. Et eum officiis totam odit labore sequi et laboriosam. Dolor iste est dignissimos qui. Saepe qui ut dolorem accusamus tenetur sed.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Eos officiis harum quidem nulla consequatur repellendus. Sapiente voluptatum perspiciatis vitae necessitatibus modi id recusandae. Sit et vero pariatur ut culpa sequi quas. Dolorum et sit exercitationem et culpa similique et. Aliquam modi assumenda consequatur sit odit quasi dolores totam. Recusandae aut ea unde quo debitis qui.

Non omnis et totam ex corporis. Nihil expedita maiores deserunt fugit aut. Sit laboriosam optio dignissimos debitis ea. Eveniet doloremque possimus aut.

Natus qui veritatis voluptas quo nihil ut. Alias aperiam et suscipit eum. Vitae recusandae placeat rerum voluptatibus iusto. Dignissimos harum nulla voluptatem aut et. Excepturi praesentium et esse atque.