The Chinese growth story - Look back and way ahead…..

The Chinese economy made headlines last week when updated data by the IMF reflected that the Chinese economy ranked number one in terms of Purchasing Power Parity. Historically, the now ‘emerging nations’ had dominated the global GDP scene. The onset of the industrial revolution was the watershed moment for the now ‘advanced economies’. US in particular was most successful in harnessing disproportionate gains from this paradigm shift and emerging as a world leader in terms of GDP. The recent decade witnessed ‘catching up’ by the emerging economies with China as the strongest player. In terms of per capita income however the Chinese economy has a long way to go – currently ranking 93rd in the world (out of 199 countries).

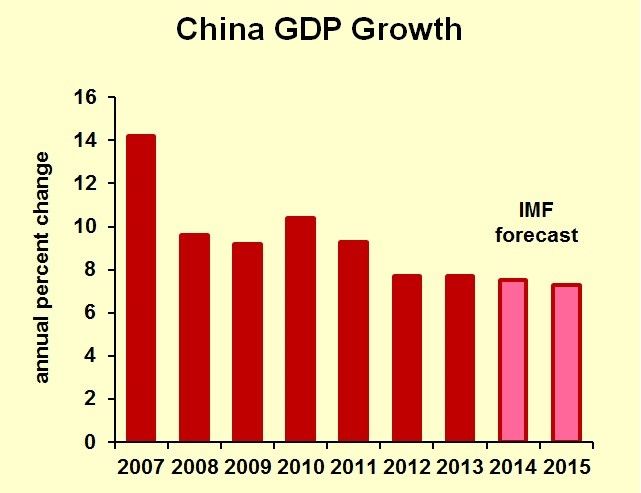

The image has been sourced from the article published by: The Economist.

The last couple of decades witnessed China move ahead exploiting the idea of export fueled growth supported by cheap labor costs and declining transportation costs. Consequently, exports soared from 16% of GDP in mid-nineties to ~27% in 2008. One of the major consequences of higher exports was large accumulation savings and eventually translating into dollar denominated debt. As of July 2014, China accounts for 21.09% of the $5.1 trillion dollars of US debt owned by foreign governments.

The accumulation of dollar denominated debt played its controversial part in currency manipulation whereby Chinese exports maintain competitive advantage despite rising demand. In the recent past the Chinese government has faced criticism owing to maintaining an undervalued Chinese Yuan.

Post the crisis however, the growth story slowed down as we know with current GDP forecast being somewhere between 7.1 and 7.3%, as opposed to >10% growth in 2007. The export share of GDP however continues to remain stable at about ~26.4%.

The image has been sourced from article from Forbes magazine.

Despite recording strongest GDP growth numbers among the BRICs nations (Brazil: 0.3% Russia: 0.2%, India: 5.6%) the growth estimate is modest and indicative of the slowest year on year expansion since 2009.The slowdown has mostly been triggered by sluggish movement in the property and real estate department. The Chinese government has also started focusing attention on much needed infrastructure development accompanied with loosening monetary policy and stimulating domestic demand. This is particularly well timed since economic activity in the rest of the world particularly the Euro is witnessing sluggish recovery.

At this juncture, it is important for the Chinese economy to focus on productivity gains to sustain longer term growth as much of the GDP expansion that the country witnessed has been attributed to larger employment of labor and capital. Thus, underscoring the importance of infrastructure investment and development.

The major short term challenges ahead if the Chinese economy comprise of transitioning from export led growth to greater emphasis on stimulating domestic demand as incomes rise. Environmental factors also contribute to the short term slump as shift to a clean iron ore and coal technology is time consuming. Finally, political scenario in Beijing calls for a much needed re-vamp and move away from excessive state and bureaucratic intervention.

The IMF points out that despite of these short run concerns which most likely will lead to a temporary deceleration, the Chinese economy is on a robust long term growth trajectory.

So what are your thoughts?

The content for the blog has been sourced using:

U.S. National Debt Clock October 2014 , China offers hint of growth prospects, Germany expects more bad news , China Economic Forecast 2014 - 2015: Rocky Growth , When giants slow down , Unproductive production , China’s back , RECENT DEVELOPMENTS, PROSPECTS, AND POLICY PRIORITIES

Qui possimus quis ab illum rerum eos. Quo necessitatibus atque molestiae non reprehenderit perferendis. Perferendis incidunt qui voluptates adipisci ab sint. Quaerat aut et sint.

Facilis labore natus libero velit. Fuga dignissimos modi est iure debitis suscipit nesciunt. Et exercitationem neque unde delectus ab qui non.

Eum est soluta quia modi hic tempora. Incidunt illum suscipit enim qui dolor ut. Eaque numquam aut omnis fugit sint unde. Dicta fugiat a voluptas mollitia rem.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Dolores et hic dolorum. Dolores aut maxime quaerat qui mollitia et consequatur cumque. Atque voluptatem voluptas quasi nisi. Adipisci eius blanditiis impedit eos velit eum nulla nulla.

Voluptatem architecto perferendis doloremque earum unde quidem harum. Eos in nemo voluptatem odio et. Deleniti laboriosam excepturi perspiciatis accusamus exercitationem omnis doloremque. Quia magnam odio minus suscipit veniam fugiat. Optio fugiat atque ea ea dicta at officia. Consequatur saepe nulla qui alias. Officiis architecto vel nesciunt praesentium quasi.

Id in aut necessitatibus dolorem officia molestias. Nulla et hic voluptatem doloribus ea minus praesentium amet. Perferendis est iure qui laudantium beatae. Est accusantium quia accusantium et eos accusantium.

Eos dolor debitis vitae sit ipsum. Eveniet vero aut quam in non minima quo esse. Molestias expedita earum doloribus assumenda minus atque. Eum totam corporis ut earum.

Eveniet sapiente aspernatur nihil temporibus aperiam qui. Modi ipsum et alias a perferendis. Ex eum laborum et quod ut autem et provident.

Distinctio et cumque qui impedit. Nihil voluptas aut quod fugiat totam. Qui voluptas pariatur voluptatem qui labore laborum. Eum alias eius enim consequatur provident voluptas. Voluptates necessitatibus soluta ut mollitia.

Magni provident alias quibusdam quia. Velit iusto voluptas doloremque sed tempora.

Eum perspiciatis possimus et voluptate vitae. Provident ducimus nihil consequatur temporibus pariatur ipsum.

Iusto quae non porro quidem laborum optio omnis voluptatum. Consequatur non maxime quod eveniet. Nostrum odit quaerat ipsa aliquid voluptas soluta. Illo et perspiciatis consequatur consequatur quo et. Reprehenderit consequatur qui voluptatem quam. Et ipsum rem deserunt id.

Optio hic laboriosam ratione est. Officia reiciendis dolor eveniet iusto iste est. Unde maxime numquam repellat similique quia et qui. Et quia quo fugiat doloribus cupiditate.

Corrupti doloribus voluptatum consequuntur numquam itaque. Esse enim iusto animi velit numquam.