CMBS: B-Note versus B-Piece

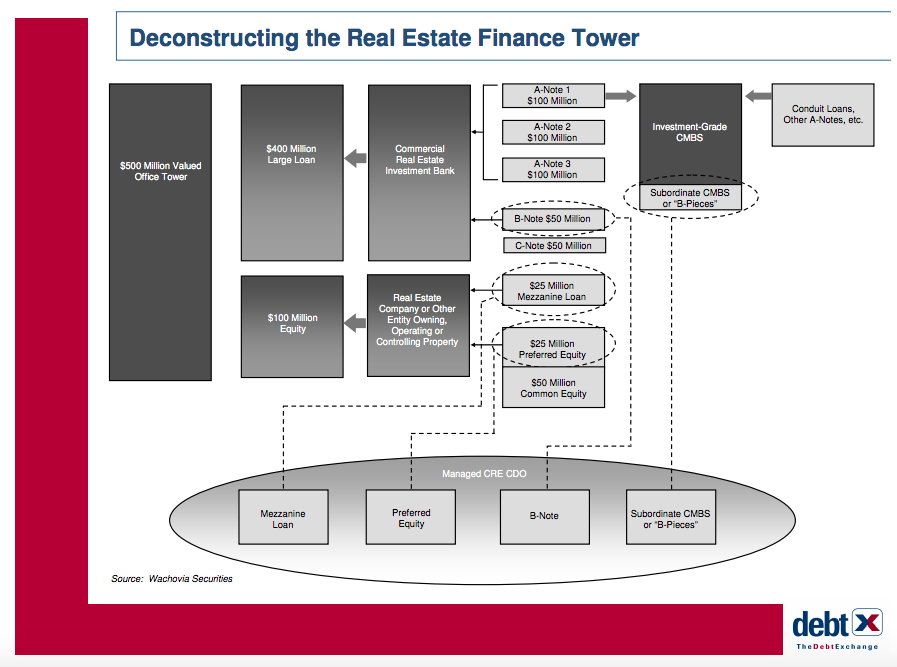

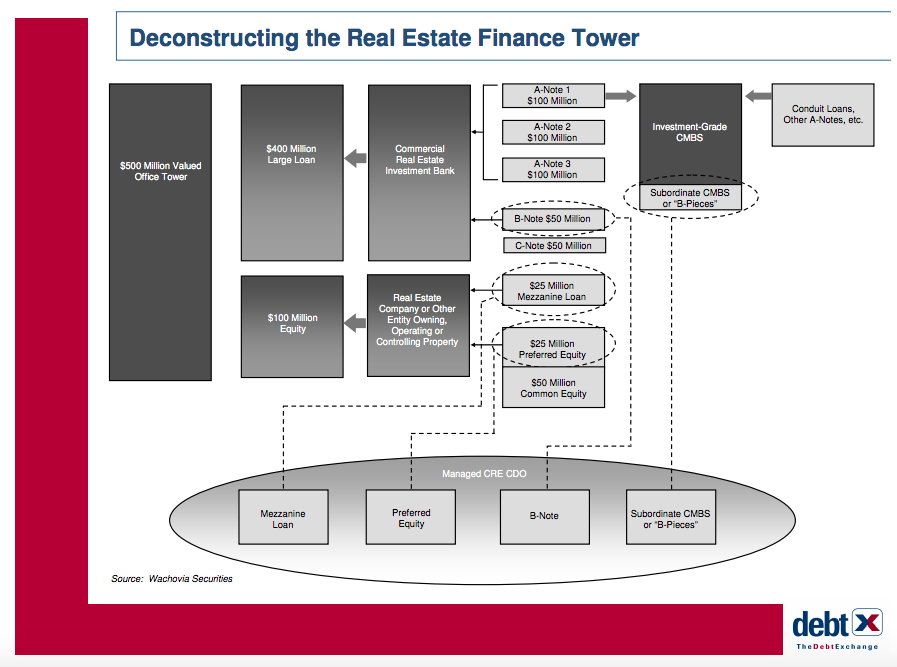

Could someone please explain the difference between B-Note versus B-Pieces/ Subordinate CMBS in reference to this screenshot?

Could someone please explain the difference between B-Note versus B-Pieces/ Subordinate CMBS in reference to this screenshot?

Career Resources

A B-Note is a secondary loan on an individual property, subordinate to the senior loan. It is sometimes called a mezzanine loan.

A B-Piece is the bottom tranche of a CMBS, which is to say, the last to recieve payment in the waterfall and therefore the riskiest and highest yielding tranche of the CMBS. It is subordinate to all of the higher-rated tranches above it.

It's important to clarify however that mezzanine loans are secured by the equity interest while B-notes are technically still secured by the Deed of Trust.

In function however, there isn't much difference.

The chart shows the painful extent that CMBS went through to generate max leverage. "What?You're telling us that the leverage is too high to put into the pool? Screw it, we'll sell off a B-note and engineer the A-note to have a high enough rate to work for the pool"

I have to say I've done a lot of large project financing and this graphic took me a few minutes to digest. From the way they split the first mortgage into multiple "A notes" (I guess to denote multiple bank participation) to making it seem like the B-piece, middle stack, mezz loans and pref all go into the same CDO. Arrows going every which way, six different shades of grey.

Anyways, a CMBS B-piece and a B-note are pretty much completely unrelated in this context except that they both have B's in their name.

Aut recusandae sit quo quibusdam omnis et. Corporis dolorem voluptatum quis tempora aliquid.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...