|

SWIFT Rebound — Okay, so on Friday, we said how the end of the week rebound was just… weird. We don’t want to toot our own horn here, but we were very right, and now every Tom, Dick, and Harry that can spell “stock market” is postulating why.

Let’s take a look at the top contenders.

For starters, it helps to remember that the market’s least favorite thing isn’t necessarily bad news but overall uncertainty. Therefore, as the crisis in Ukraine unfolds, things become clearer and clearer each day, and the market gets a higher resolution view into what tomorrow will look like.

And lately, the metaphorical “tomorrow” has been all about rates. Many have spun the theory that because the Russian invasion in Ukraine is likely just getting underway, traders have lost faith in the idea that JPow’s gonna jack up the fed funds rate to 50 bps at the end of March. Now, all signs point to a “calm” 25 bps jump.

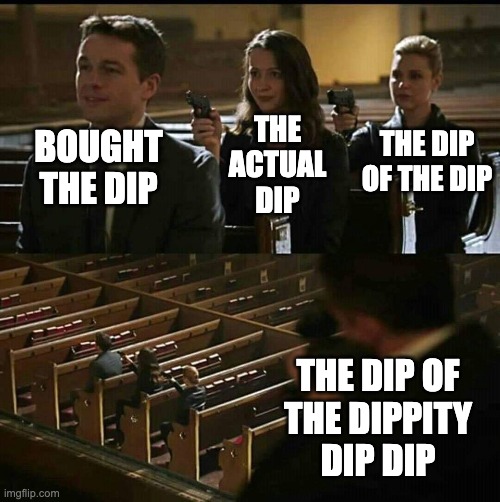

At the same time, buying the dip has become a hotter trend than Silly Bands in the late 2000s. Every investor and their mother by now know to BTFD, and given the absolute pounding growth stocks have taken the past few months, investors are licking their chops at some opportunities.

But, perhaps most important are the sanctions that the US and other Western nations did and did not place on Russia. For starters, not removing the world’s 11th largest economy from SWIFT largely went against expectations.

SWIFT is a messaging system banks use to coordinate transactions, and Russia’s elimination from the network would’ve added friction to the global financial system. Still, blacklisting Russia from SWIFT appears to remain on the table as the aptly described “nuclear option.”

I mean, financial stress or not, anything is better than actual nukes, I guess. With oil prices taking a bit of a breather as well, the market’s fear around the crisis in Ukraine seems to have peaked at the start of last week… at least for now.

Avoid buying the "dip" and then dipping to the dip of the dippity dip dip

Check out WSO Alpha

The Week Ahead — Welcome to your weekly preview of what’s to come for markets in the days ahead if, fingers crossed, the world isn’t over by the end.

Monday: As usual, today’s gonna be the slowest day of the week. From a macro side, we’ve got some treasury auctions, but hard to believe any ape will care about that. But, we do get a look at some hyped earnings, including Lucid, Lordstown, Novavax, and Zoom.

Tuesday: Tuesday’s a bit more fun from a macro perspective. Trade balances, including US imports and exports, will drop along with the Small Business Optimism Index. Some not-so-small businesses will be reporting earnings, however, including SoFi, Baidu, Salesforce, Target, and (please keep it in your pants) AMC. Good luck.

Wednesday: On Wednesday, housing will steal the spotlight. MBA drops a bunch of data, including the latest purchasing index, mortgage applications, rates, and refinancing info. Even more exciting, the IEA will reveal a bunch of global energy bullsh*t and how Russia has ruined that so far. Company earnings include Veeva, Okta, and Snowflake.

Thursday: Pre-Friday is always fun. The latest inflation data release will help keep that true, along with updated jobless claims info. On the earnings side, Kroger, Costco, Best Buy, and Gap will give us a taste of how retail has been doing over the last quarter.

Friday: I hope you aren’t too hungover Friday morning because 1) it’s a weekday, and 2) the University of Michigan drops the latest consumer sentiment data at 8:30 a.m. Alongside, a few companies you’ve never heard of release earnings.

As always, it’ll be a fun week. Even if the events themselves aren’t super fun, you know the Daily Peel will make it so.

|

Et quisquam dolor commodi sed in libero eveniet. Illum et consequatur ipsum perspiciatis illo veniam. Est dolor necessitatibus praesentium qui tempora. Tenetur aut labore corrupti distinctio omnis.

Sit iste fugit quibusdam non. Et veniam natus aut aut delectus. Voluptatem dolorem molestias necessitatibus eum modi quis veniam. Et nesciunt dignissimos rerum voluptatem.

Provident sequi iste et nesciunt dolor dolorum veritatis. Ipsa et incidunt nesciunt omnis officiis. Voluptas voluptatibus consequatur recusandae soluta vel. Consectetur et porro omnis maiores consequatur.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...