DB Function

Function in Excel calculates the depreciation amount of a given asset

What is the DB Function?

The DB function in Excel calculates the depreciation amount of a given asset. If you have worked on many financial models, you must know there's a separate section to calculate the depreciation schedule for all a company's assets.

Many business holders ask why depreciation is given so much importance. If you agree with those people, let me tell you that your business account might be missing out on thousands of tax savings.

Properly calculating asset depreciation allows your business to claim tax deductions over the asset's useful life rather than paying for it entirely upfront. These fixed assets include buildings, machinery, vehicles, equipment, etc.

Generally, there are two methods of calculating the depreciation for an asset - the straight-line method and the accelerated method. The straight-line method is simpler to understand, considering that it takes the initial cost of an asset and divides it by the useful life.

The accelerated depreciation method, although more complex, front-loads the depreciation expense, making it higher in the early years of the asset's useful life. The DB function in Excel utilizes the accelerated depreciation method, specifically the fixed declining balance method, to calculate asset depreciation.

Key Takeaways

- The DB function in Excel calculates asset depreciation, which is crucial for tax deductions. It utilizes the fixed declining balance method, aiding in financial modeling and tax planning.

- It requires parameters like asset cost, salvage value, and useful life. It offers flexibility in period and month inputs, assisting in accurate depreciation calculations.

- Applied in financial scenarios, such as machinery purchases, it provides insights into depreciation amounts over time, enabling strategic decision-making and accounting accuracy.

- Contrasted with straight-line depreciation, it offers a front-loaded depreciation approach, ideal for scenarios with higher initial asset usage and declining value over time.

Understanding the DB function In Excel

The DB function is categorized as a financial function that calculates the depreciation of an asset using the fixed declining balance method.

For example, suppose Ford Motor Company decides to buy additional machinery for its car manufacturing plant. In that case, it can spread out its cost after its purchase over the useful life of that asset.

There are three core parameters that one needs to assess to calculate the depreciation of an asset. They are:

- The useful life of an asset: It is the amount of time the fixed asset is expected to stay productive before it is sold off at its salvage value

- Salvage value: The minimum amount that the fixed asset can be sold off for after its useful life tenure is called the salvage value

- Cost of the asset: The initial cost for which the company purchased the asset

Similarly, the function's syntax requires referencing or hardcoding these values to calculate the depreciation amount for each year over the asset's useful life.

DB Function Formula

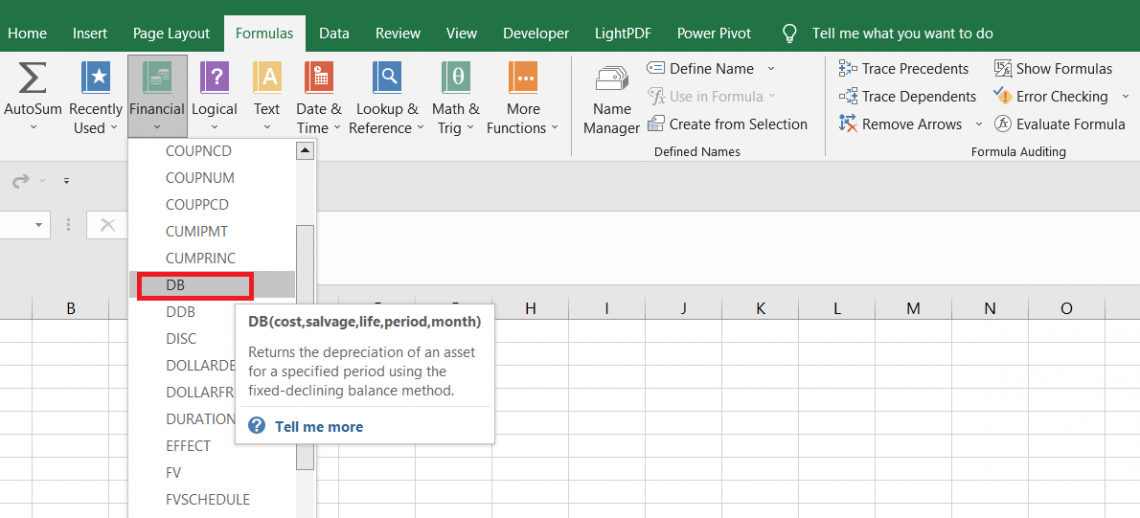

The syntax for the DB function in Excel is:

=DB(cost, salvage, life, period, [month])

where,

- cost - (required) the initial purchase cost of the asset

- salvage - (required) the minimum value for which the asset can be sold off after its useful life

- life - (required) the total useful life of the asset after its purchase

- period - (required) the period for which depreciation will be calculated

- month - (optional) defines the number of months within the first year over which depreciation is calculated, defaulting to 12 if not specified

Note

If the month argument is ignored, the function assumes the default value of twelve months.

How to use the DB Function in Excel?

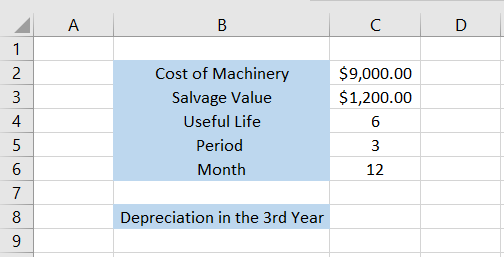

Let’s take a really simple example to understand how the function works. Suppose you own a factory and purchase machinery worth $9,000 with a useful life of 6 years and a final salvage value of $1,200.

What will the depreciation amount be in the third year of the machinery’s useful life? The data looks as illustrated below:

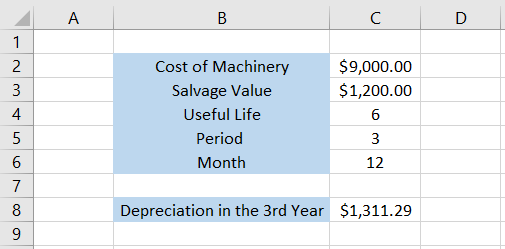

Here, we will substitute all the values such that the formula becomes =DB(C2,C3, C4,C5, C6), which gives the result:

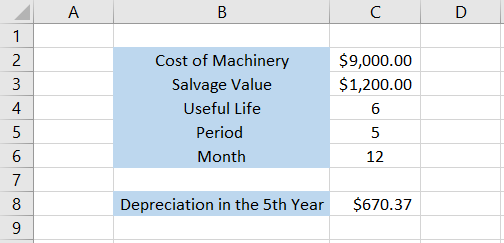

Thus, we get the depreciation amount in the third year as $1,311.29. If we change the period argument’s value to, say, 5, then the depreciation amount becomes $670.37.

As mentioned earlier, the function calculates the depreciation based on the declining balance method. The depreciation amount is larger in the initial stages and then decreases as the asset nears the end of its useful life.

If we had used the general straight-line depreciation, the depreciation amount for each year would have been constant, i.e., $1,300.

DB Function Examples

Now that we know how the function works, let's see an in-depth example of how it can be used in a real-case scenario.

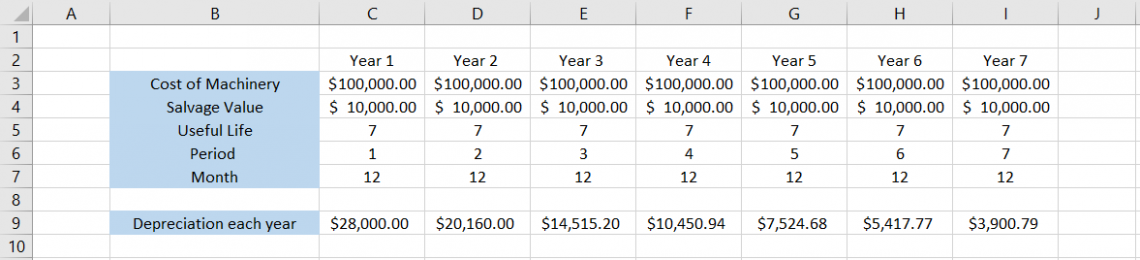

Suppose your organization buys laptops worth $100,000 with a salvage value of $10,000. The useful life of all laptops is seven years. What would be the depreciation value for each year using the accelerated method?

The data looks as illustrated below:

To calculate the depreciation amount in each year, we will use the formula =DB(C3, C4, C5, C6, C7) in cell C9 and drag it across to cell I9, which gives the result:

Thus, the depreciation amount will be the largest in the first year itself, equal to $28,000, followed by $20,160 in the second year, $14515.20 in the third year, and so on.

Hold on; we haven't yet harnessed the full potential of the month's argument. It can accept numbers between 1 to 12, signifying the twelve months in a year. If we want to check the depreciation only for the first quarter of each year, we will input the number as 3 across the table.

Thus, the result then becomes:

This way, you can play around with numbers and find the depreciation for any year's 'n' number of months.

Straight Line depreciation in Excel

What if the accelerated method and the DB function did not exist?

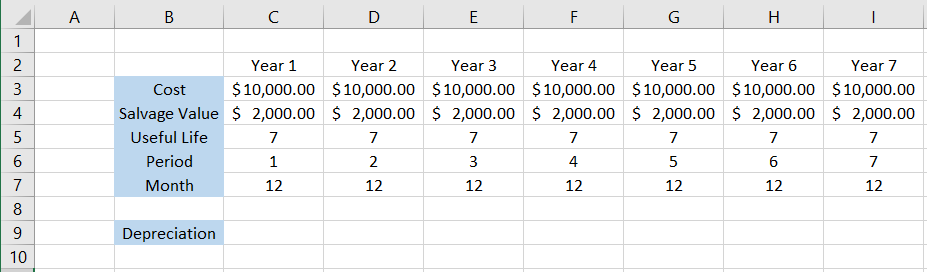

The obvious solution would have been to use the straight-line depreciation method to calculate the depreciation amount for each year. Let's see a small example to understand how it would have worked.

Suppose we have the data as illustrated below:

To calculate the depreciation using the straight-line method, we will use the formula =(C3-C4)/C5 in cell C9 and drag it across to cell I9, which gives the result as $1,142.86.

Using the straight-line method, we know that the asset's cost gets evenly spread out over its useful life. If we want to calculate the depreciation up to the specific number of months, all that needs to be done is divide the annual number by the months.

Hence, if we want to find the depreciation for the first three months, divide $1,142.86 by 3, giving us $380.95.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?