SYD Function

The function aids in creating a depreciation schedule table where most of the depreciation associated with the asset is recognized in the first few years of its useful life.

What is the SYD Function (Sum of Years Digits)?

The Sum of Years Digits (SYD) recognizes the accelerated depreciation of assets.

SYD can be expressed as a formula or Excel function. It helps create a depreciation schedule table where most of the depreciation associated with the asset is recognized in the first few years of its useful life.

Sum of Years Digits is a useful depreciation method for assets that have a short useful life and go obsolete before reaching their salvage value.

For instance, a company might use SYD for technology-related assets as advancements are regularly introduced in the field, causing previous versions of a technological asset to become obsolete quickly.

Therefore, it can be said that SYD provides a realistic depreciation expense since the method acknowledges that assets are typically more productive and valuable in their early years.

Furthermore, allocating greater depreciation early on results in a larger tax shield for the company as net income has been understated for those years. This would defer tax payments to later years with higher net income due to lesser depreciation recognition.

This method is similar to double declining depreciation for fixed assets. Still, it differs from straight-line depreciation, where the amount deducted is the same for each year of an asset's useful life.

It is important to remember that even though the sum of years digits, double declining, and a straight line are three different depreciation methods, the total depreciation over an asset’s useful life will remain the same for all three methods.

Key Takeaways

- SYD is a depreciation method that aligns a greater proportion of depreciation expense to the early years of an asset’s useful life.

- By concentrating depreciation in the opening years, net income will be understated, allowing a company to claim tax benefits on the asset for that period.

- The components that go into the SYD depreciation formula include total acquisition cost, salvage value, an asset’s useful life, and the sum of useful life. These inputs allow for calculating the depreciation amount and depreciation expense for year 1.

- The sum of depreciation expense through each year of an asset’s useful life should equal the depreciation amount for the asset in year 1. Therefore, the depreciation factor for each year must total up to 1 as well.

- The SYD function in Excel uses the initial cost, salvage value, total useful life of the asset, and Per (the specific year being looked at) in its argument to compute the depreciation expense for a particular year.

- The Sum of Years Digits Formula calculates a new depreciation amount for each year, while the SYD Excel function only uses initial cost. However, both SYD methods use a yearly time component (Depreciation Factor and Per).

- SYD is the preferred depreciation method for companies constantly investing in new equipment or technology. It also improves asset management and better-aligning expenses and revenue for financial reporting.

Sum of Years Digits (SYD) Formula

The first step in the SYD formula involves finding the depreciation amount. This is what will go under the first year of the depreciation schedule. It can be found by subtracting the salvage value from the total acquisition cost of an asset.

Total acquisition cost includes the purchase price, shipping costs, and any other costs undertaken to get an asset ready for use. The salvage value is simply the estimated value of an asset at the end of its useful life.

Once this is complete, a depreciation factor must be created depending on the useful life of an asset. For example, if an asset has a useful life of 4 years, the depreciation factor for its first year would be

Total Useful Life / Sum of Useful Life

To expand on this further, the sum of useful life refers to adding up the total useful life. So, if an asset goes obsolete in 4 years, its depreciation factor for Year 1 = 4 / 4+3+2+1. The depreciation factor for the first year would be 4/10.

For Year 2, the depreciation factor denominator stays at 10, but the numerator is simply one digit lower as a year has passed. So, using the above example, the depreciation factor for Year 2 would be 4-1 / 10 = 3/10.

Finally, a depreciation schedule can be created as we have all the components for calculating the depreciation expense in Year 1.

The initial depreciation amount is multiplied by the depreciation factor for year 1 to provide the depreciation expense in the first year.

The Depreciation Amount for year 2 = Depreciation Amount Year 1 - Depreciation Expense Year 1.

This above process is continued until the final year of the asset’s useful life. However, there is also an Excel function named SYD which fulfills the same method.

To find the SYD function on Excel, one must navigate to the formulas tab and click on the Financials drop-down menu where it can be seen. Alternatively, the syntax of the function can be typed into an empty cell.

The SYD function syntax can be expressed as follows:

=SYD(cost, salvage, life, per)

Where

- Cost: Refers to the initial cost or total acquisition cost for an asset

- Salvage: This looks at what an asset is worth after total depreciation has been accounted for; the salvage value of the asset

- Life: the total useful life of an asset, the number of periods it will be depreciated for

- Per: Specific period for which the depreciation expense is calculated

The underlying logic for the SYD Excel function can be explained using the formula below:

SYD Depreciation = [(Cost - Salvage) * {Life - Per) + 1} * 2]/ [Life * (Life + a)]

The (Cost - Salvage) component refers to the depreciation amount for the specific period used; the Life and Per sections comprise the depreciation factor discussed previously.

There are some arguments one should adhere to prevent any errors in the SYD function:

- Life and Per components must be in the same units of time (day, month, or year)

- If the salvage value is less than zero, it will return a #NUM! error. Similarly, if the Per value exceeds the Life input, it will cause the same issue.

The difference between the SYD formula and the SYD Excel function is that when using the function, one does not need a new depreciation amount for each year as it only uses the initial cost.

A similarity would be that the Per is adjusted for each year in the function while the depreciation factor changes yearly for the SYD formula.

How to use the SYD Function in Excel?

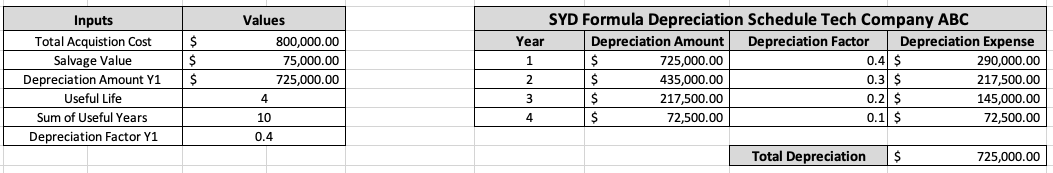

Two depreciation schedules are created using the formula approach and function approach to compare the SYD formula and its corresponding Excel function. Ideally, both tables should be identified as the rationale behind SYD depreciation is the same.

Consider an arbitrary example of tech company ABC purchasing equipment for a new department floor. They put in a buy order for several computers and office phones, which amounted to $500,000.

Additionally, ABC had to pay $50,000 in shipping costs to transport the order on time. A further $250,000 was shelled out for smooth equipment installation.

The tech company deduced that computers and phones have a useful life of 4 years, after which they will be worth $75,000.

There is a high probability that the assets bought will become obsolete before 4 years. Hence management has decided to use the Sum of Years Digits method to depreciate it, which will lead to a favorable tax environment for the company.

Total Acquisition Cost for Equipment = $500,000 + $50,000 + $250,000 = $800,000

The useful life is 4 years, and the salvage value is set at $75,000. The depreciation amount for Year 1 can be calculated.

Depreciation Amount for first year = $800,000 - $75,000 = $725,000

The sum of useful life for the depreciation factor is simply 4+3+2+1 = 10. Now that all the formula inputs are available, a depreciation schedule for tech company ABC’s newly bought equipment can be made.

Note

It is important to reduce the depreciation factor’s numerator by one after every year to maintain accurate depreciation expense numbers.

The first thing to notice is how the depreciation expense for Year 1 ($290,000) is significantly higher than the depreciation expense for Year 4 ($72,500). This indicates the usefulness of SYD, as 70% of the total depreciation is accounted for in the first two years.

If we assume the equipment goes obsolete in three years instead of four, then the SYD method has already depreciated a major chunk of the total value.

Tech Company ABC can now realize most of the tax benefits associated with depreciation by year 2, allowing it to invest in more advanced equipment at an earlier stage instead of waiting for the assets’ useful life to end.

One way to cross-check the SYD formula method is to add the depreciation factor for each year. This should total 1.0; otherwise, the calculation is wrong.

Another key component to notice is that the depreciation amount for year 1 is always multiplied by the depreciation factor for each year.

For example, the depreciation amount for year 2 will not be multiplied by the depreciation factor for year 2. It is simply depreciation amount Y1 - depreciation expense Y1, and hence Y2 depreciation amount is not involved in future calculations.

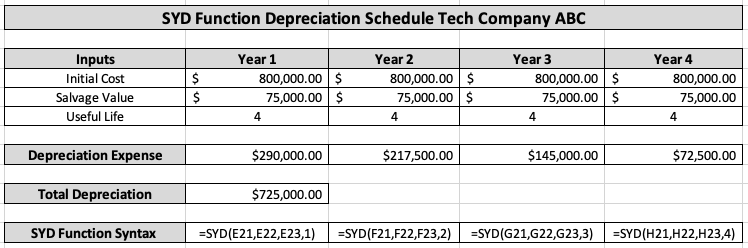

The above depreciation schedule can be confirmed by building a new one using the same inputs but replacing the formula method with the SYD function in Excel. This depreciation schedule should have the same depreciation expense values as in the table above.

The SYD Function Depreciation Schedule confirms the previous findings as the total depreciation equates to the depreciation amount at year 1 for both versions of the SYD method.

When looking at the function’s syntax, it can be seen how the Per component changes for each year, leading to different depreciation expenses. This is similar to the changes undergone by the depreciation factor when using the SYD formula.

The SYD depreciation schedules using the formula and Excel function showcased how the depreciation expense is distributed over the equipment’s useful life. It enhances how one views the utility of fixed assets whilst resulting in tax shields for tech company ABC.

SYD Function Importance in Finance

The practicality of SYD depreciation over basic methods such as straight-line depreciation is that it assigns a greater percentage of depreciation expenses in the first few years of an asset’s useful life.

This is important in finance for various reasons:

- Useful for Financial Analysis: If SYD is the preferred depreciation method for a company, it might indicate that they are regularly investing in new equipment. This can be done if a higher proportion of the assets have a short useful life.

- Tax Benefits: The accelerated depreciation approach of the Sum of Years Digits is important in reducing taxable income for companies. This is because a major portion of the depreciation expense is deducted in the early years of an asset’s life.

- Better alignment of expenses and revenue: By accurately reflecting the depreciation pattern of an asset, SYD allows for a better outlook on financial reporting, as net income is understated in the early years and moves up as the asset matures.

- Improved asset management: Since Sum of Years Digits provides a precise depiction of an asset’s decline in value over time, this gives companies the roadmap to make better decisions on when to replace assets, leading to lower costs and higher efficiency.

In conclusion, it can be said that the SYD depreciation method is beneficial in allocating the cost of holding onto an asset over its useful life.

Note

The distribution of depreciation expenses through an asset’s useful life is best described using the SYD approach instead of straight-line depreciation.

Overall, Sum of Years Digits depreciation gives companies the tools to create an accurate depreciation schedule, receive tax benefits, and better manage assets nearing expiry.

or Want to Sign up with your social account?