Deferred Tax Liability/Asset

An accounting term on a firm’s balance sheet that is used to illustrate when a firm has underpaid on taxes and needs to pay extra.

A Deferred Tax Liability is an accounting term on a firm’s balance sheet that is used to illustrate when a firm has underpaid on taxes and needs to pay extra. The firm will have either not paid some taxes, or have paid too little and is therefore required to pay more in tax in a future period. It is found on the Balance Sheet under Current Liabilities.

Deferred tax liabilities (DTL) and assets (DTA) are opposites. Deferred tax liability is a tax credit for the business that will need to be paid in the future, while a deferred tax asset is a tax credit for current or future taxes.

Consider it as paying a portion of your taxes in advance (deferred tax asset) or adding to your tax liabilities later (deferred tax liability).

There may be a discrepancy between the number of expenses or incomes in the books of accounts and the amounts allowed or rejected under income tax regulations.

Depreciation is a prevalent illustration of this. Accordingly, companies must follow the depreciation rates specified in the Companies Act while keeping their books of accounts. Still, only the rates specified in the Income Tax Act shall be accepted when determining income tax.

Therefore, there is a mismatch between income reported on the books and income taxable under the IT Act.

Taxes on income are accrued simultaneously as the revenue and costs to which they correspond under the matching principle of accounting. However, this matching notion is not used since there is a discrepancy between income reported in the books and taxable income defined by the IT Act.

The remaining amount is therefore indicated as DTA or DTL, and only income tax related to income as per the books is shown as an expense.

It should be mentioned that DTA and DTL should only be considered when there is a transient difference. These are differences that will be resolved in later years.

Analyzing the Effects of Deferred Tax Handling

It's crucial to examine and predict how a deferred tax balance will impact future operations after fully grasping its fluctuations and causes. For instance, deferred tax assets and liabilities can significantly affect cash flow.

A source of cash is either a rise in deferred tax liabilities or a decrease in deferred tax assets. Cash usage also reduces liabilities or a rise in deferred assets.

Understanding the future trend, these balances are going towards should also be done by analyzing the change in deferred tax balances. For example, will the balances keep increasing, or is there a high chance that they will reverse course soon?

These patterns frequently reveal the kind of business the organization is engaged in. For instance, a rising deferred tax liability can indicate that a business is capital-intensive.

This is because the tax depreciation on new capital assets is frequently larger than the decelerating depreciation on older assets. So that plays a big factor here.

A Tax Holiday’s Effect on DTA and DTL

A tax holiday is referred to as a government incentive program for businesses. It offers some tax cut or, in some situations, tax elimination. It is a tactic used for new companies setting up shop in a free-trade zone and is occasionally used to reduce taxes.

The government temporarily waives various taxes under particular circumstances, intending to promote the production and consumption of specific goods and items.

It should be remembered that during the enterprise's tax vacation period, the deferred tax from the timing difference that led to a reversal should not be considered.

Calculating deferred tax related to temporal discrepancies that result in a reversal after the tax holiday should be done in the year it started.

During the enterprise's tax holiday period, deferred tax (DT) from reversing timing differences should not be recognized. However, after the tax holiday, DT is linked to the timing difference that reverses must be recognized in the year of origination.

Conditions Where Deferred Tax Assets or Deferred Tax Liability Arises

Deferred Income Tax Liability may occur in several circumstances. Understanding these circumstances and how they will impact a company's financial records is crucial.

When these occurrences are properly recognized and recorded in a company's financial accounts, it also streamlines the processes for auditors and analysts. The following are a few factors that can cause DTL for a corporation.

1. Varying depreciation rates and methodologies

When there is a discrepancy between a company's method of calculating depreciation on its assets and the one recommended by the IT Department, a deferred tax is produced.

Between the depreciation statistics indicated in a company's financial statements and the related tax filings, this deviation from the tax requirements causes a temporary disparity.

When depreciation on an asset is considered at a lower rate than the income tax department, gross profits get inflated in the books compared to the tax statement for that year. Over the ensuing years, the gap between those two numbers would finally close.

2. Accounting for revenues and costs

The Income Tax Act states that tax cannot be collected only from corporate income that is not realized. As a result, it causes a discrepancy between the revenue reported in tax returns and income statements.

Due to the difference in how revenues are handled, a deferred tax liability must be paid when the revenue is realized in the following period.

3. Continuation of present profits

Businesses frequently have the opportunity to carry over their profits from one year to the next to significantly reduce their tax obligations.

In this scenario, the deferred tax liability is established since the business must pay taxes on the profit carried forward in the following year.

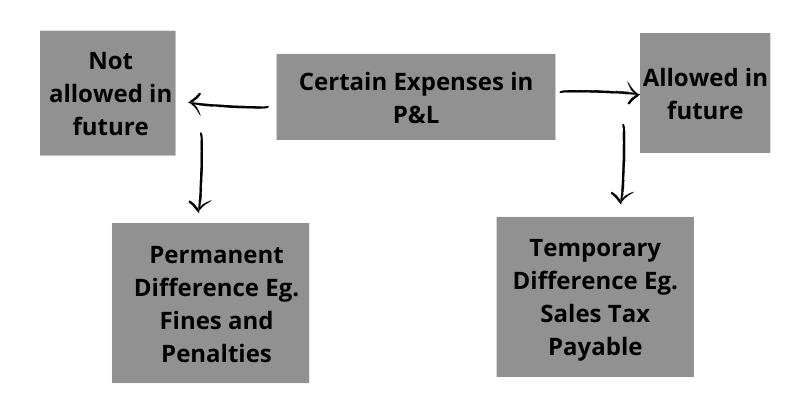

Timing Difference

The tax footnotes that a corporation provides can be useful for an analyst to understand the cause of these deferred taxes. For example, a corporation will frequently describe what significant events occurred during the period that changed the balances of its deferred tax assets and liabilities.

In these annotations, companies will also reconcile effective tax rates. Improved cash flow forecasting is possible by comprehending changes in deferred tax assets and liabilities, as opposed to the net value of the two.

The company calculates its taxable profit in line with the provisions of the Income Tax Act. It derives its book profits from the financial statements issued by the requirements of the Companies Act.

Due to some items that are either permitted or prohibited each year for tax purposes, there is a discrepancy between book profit and taxable profit. The timing difference, which can be one of the following, is the distinction between taxable income or expense and book income.

Temporary Difference:

Differences between book income and tax income that can be reversed in a later period are known as temporary differences.

Permanent Difference:

Permanent differences are discrepancies between book and tax income that cannot be corrected in a later period.

Presentation on the Balance Sheet

Deferred tax assets and liability should be netted off, meaning that only one should be shown on the balance sheet at a time—neither should be shown for the same period as the other.

If the following conditions are met, an item can legally be referred to as a DTA or DTL:

-

The enterprise has a legally enforceable right to set off taxes, such as when the amount representing DTA and DTL is covered by the same controlling tax rules, like the Income Tax Act of 1961, and the laws allow for the making of a single net payment.

-

The business plans on settling the asset and liability on a net basis.

In the balance sheet, DTA and DTL should be listed separately from current assets and current liabilities under their heading.

Example of DTA:

Let's use the example below to grasp the accounting mentioned above better:

A provision for bad debts for USD 400 was included in PQR Private Limited's profit announcement. For income tax, bad debts are accounted for in the year they’re written off.

Therefore, assuming a tax rate of 30 percent, PQR's taxable income would be USD 4,400 (4000+400), resulting in a tax payment of USD 1,320. The tax would have been USD (4,000-400)*30%, i.e., 1080, if bad debts had been permitted as a deduction for tax purposes.

Thus, the corporation will record the following item in its books of accounts and realize a tax asset of USD 240:

Deferred tax asset Dr. 240

Profit & Loss account Cr. 240

Example of DTL:

The different approaches to inventory valuation are an example of deferred tax obligations. A corporation must value its stock using the LIFO (last-in-first-out) method, by U.S. tax law.

To value the inventory, some businesses may use FIFO (first-in-first-out). DTL could emerge from discrepancies between the value of inventory recorded in tax and financial records.

Summary

Deferred tax liabilities and assets are opposites of one another. Deferred tax liability is a tax credit for the business that will need to be paid in the future, while a deferred tax asset is a tax credit for current or future taxes.

Consider paying a portion of your taxes in advance (deferred tax asset) or adding to your tax liabilities later (deferred tax liability).

Last but not least, DTA/DTL should be examined at each balance sheet date and adjusted upwards or downwards to reflect the amount practically guaranteed to be realized.

In other words, you establish a deferred tax liability when you take a tax deduction before deducting the identical item for books or declare income for books before reporting it for taxes.

A deferred tax asset is created when you report taxable income before you report the same income for financial purposes or when you declare a bookkeeping expense before you claim a tax deduction for the same expense.

Understanding these temporary differences may enable you to undertake tax planning tactics that impact your current financial reporting. Therefore, DTLs and DTAs are both crucial components of your financial reporting.

or Want to Sign up with your social account?