Operating Cycle

The duration taken for a corporation to convert inventory purchases into cash revenues from a sale.

What is an Operating Cycle?

The operating cycle (OC) specifies how long it takes for a corporation to convert inventory purchases into cash revenues from a sale. The cash OC, cash conversion cycle, or asset conversion cycle are other common names.

There are three components to the operational cycle: payment turnover days, inventory turnover days, and accounts receivable turnover days. These elements combine to give the total measurement of operational cycle days.

The operational cycle formula and analysis follow logically from these. To be more exact, payable turnover days measure how quickly a corporation can pay off its financial commitments to suppliers.

The next phase is inventory turnover, a ratio that shows how frequently a firm sells and replaces its inventory over time. This ratio is typically calculated by dividing total sales by total inventory.

However, you can also calculate the ratio by dividing the cost of products sold by the average inventory.

The third phase is accounts receivable turnover days when the firm is evaluated on how quickly it can collect money for its sales. As previously stated, the operational cycle is complete when all of these processes are completed.

Understanding Operating Cycle

An OC is the number of days it takes for a company to receive inventory, sell goods, and earn cash from the sale of merchandise. This cycle is crucial in establishing a company's efficiency.

Formula

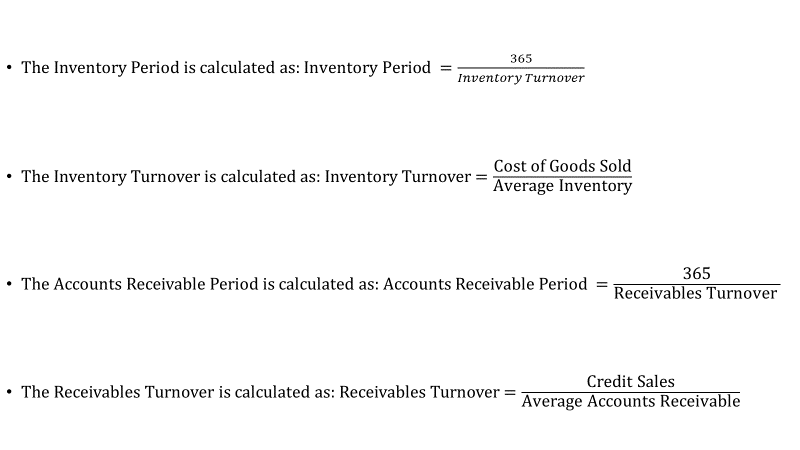

The OC formula is as follows:

Operating Cycle = Inventory Period + Accounts Receivable Period

The inventory period is the time inventory remains in storage before being sold. The accounts receivable period is the time it takes to recover cash from inventory sales.

Therefore, the detailed formula is:

Example Calculation,

| Item | Beginning Balance | Ending Balance | Average |

|---|---|---|---|

| Inventory | $ 2,000,000 | $ 4,000,000 | $ 3,000,000 |

| Accounts Receivable | $ 1,000,000 | $ 2,500,000 | $ 1,750,000 |

| Accounts Payable | $ 500,000 | $ 1,000,000 | $ 750,000 |

| Net Sales | $ 10,000,000 | ||

| Cost of Goods Sold | $ 8,000,000 |

Calculating with the data provided above:

- Inventory Turnover: $8,000,000 / $3,000,000 = 2.67

- Inventory Period: 365 / 2.67 = 136.7

- Receivables Turnover: $10,000,000 / $1,750,000 = 5.71

- Accounts Receivable Period: 365 / 5.71 = 63.9

Operating Cycle = 136.7 + 63.9 = 181.38 = 200.6 ≈ 201 days

Importance Of Operating Cycle

It provides information on a company's operational efficiency. A shorter cycle signifies a more efficient and effective firm.

A shorter cycle suggests that a corporation can swiftly recover its inventory investment and have adequate cash to satisfy its obligations. Conversely, a company's OC is too long might cause cash flow issues.

There are two methods for a firm to lower their OC:

-

Accelerate inventory selling: If a corporation can sell its goods rapidly, the OC should fall.

-

Reduce the time it takes to collect receivables: If a firm can collect credit sales more rapidly, the OC will fall.

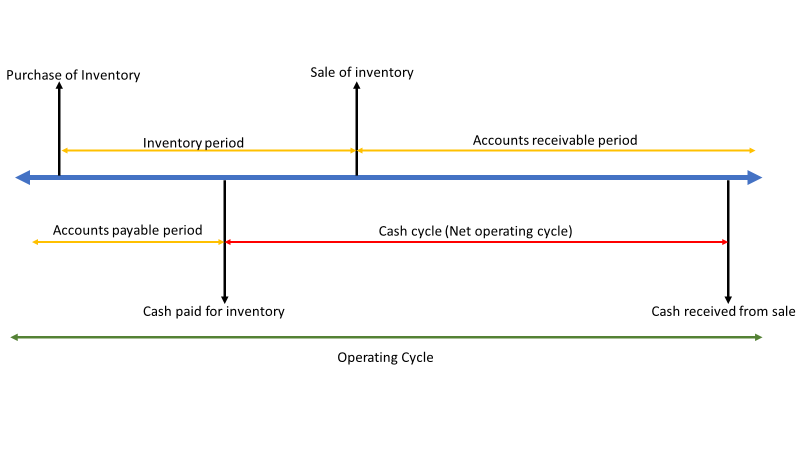

Net Operating Cycle (Cash Cycle) vs. Operating Cycle

The net operating cycle (NOC) is sometimes mistaken for the operational cycle (OC) (NOC). The cash conversion cycle, often known as the cash cycle, illustrates how long it takes a corporation to collect cash from the sale of inventory. To distinguish between the two:

- OC: The period elapsing between the acquisition of inventory and the cash received from the sale of goods.

- NOC: The time it takes between paying for inventory and receiving cash from its sale.

Another formula for the NOC =

Inventory Period + Accounts Receivable Period – Accounts Payable Period

The NOC computation differs from the first in subtracting the accounts payable period from the first because the NOC is only concerned with the time between purchasing items and getting payment from their sale.

The image below illustrates the difference between the cycles:

Factors Impacting Operating Cycle

All of the following elements determine the length of the operational cycle:

- The company's suppliers extend payment arrangements to it. More extended payment periods reduce the operational cycle since the corporation may postpone cash payments.

- Because the projected beginning fulfillment rate is higher, the order fulfillment policy increases the quantity of inventory on hand, lengthening the operational cycle.

- Because looser credit means a longer period until clients pay, the credit policy and payment terms prolong the operational cycle.

As a result, various management actions (or negotiated problems with business partners) can influence a company's operational cycle. The cycle should ideally be kept as short as possible to lower the business's financial requirements.

Examining a potential acquirer's OC can be especially beneficial since it might show opportunities for the acquirer to change the OC to lower cash requirements, which may offset some or all of the financial expenditure required to buy the acquirer.

Significance Of Operating Cycle

The operational cycle is significant because it may notify a business owner how soon goods can be sold. In addition, it determines the efficiency of the organization.

For example, if the company's operational cycle is short, it may quickly execute a turnaround. It may also imply shorter payment periods and a more stringent credit policy.

A shorter operational cycle is preferable since the firm has adequate cash to keep operations running, recoup investments, and satisfy other commitments. In contrast, a company with a longer OC will require more capital to keep operations running.

There are several factors in a company's OC, and an operational cycle may assist in identifying a company's financial status.

The better a business owner knows the company's OC, the better decisions that owner may make for the firm's benefit.

Suggestions For Reducing A Company's Operational Cycle

When aiming to reduce a company's OC, consider the following suggestions:

- Implement a more stringent credit policy: Customers are more likely to pay for their products on time if businesses enforce a rigorous credit policy.

- Reduce the payment terms' duration: The faster a corporation can recover accounts receivable, the shorter its OC.

- Sell inventory quickly: The faster a firm sells its goods, the shorter its OC should be.

Applications Operating Cycle

The notion of the operational cycle reflects a company's genuine liquidity. Investors can determine a firm's investment quality by tracking its OC's historical record and comparing it to peer groups in the same industry.

A short corporate OC is advantageous since earnings are realized quickly. It also enables a corporation to obtain capital for reinvestment swiftly. On the other hand, a long business OC takes a long time for a corporation to convert purchases into cash through sales.

In general, the shorter a company's cycle, the better. This is because less capital is invested in the company process. The most straightforward method is to abbreviate each three-cycle portion by at least a tiny amount.

The collective effect of shortening these parts can considerably impact the total economic cycle. As a result, it may lead to a more profitable business.

Examples Of OC

A few of the examples are:

Example 1

Assume Tom operates a store. His company's OC would begin when he buys various products from suppliers to sell to customers. The OC would not stop until all products were sold and payment was collected from clients.

Example 2

Walmart Stores Inc. (NYSE: WMT) is obsessed with its inventory. Determine its operational cycle, assuming all sales are (a) cash and (b) credit sales.

You may use the cost of revenue as an estimate for purchases (i.e., no need to adjust it for changes in inventories).

| Particulars | USD in millions |

|---|---|

| Revenue | 469,162 |

| Cost of revenue | 352,488 |

| Inventories as of 31 January 2013 | 43,803 |

| Inventories as of 31 January 2012 | 40,714 |

| Average inventories | 42,259 |

| Accounts receivable as of 31 January 2013 | 6,768 |

| Accounts receivable as of 31 January 2012 | 5,937 |

| Average accounts receivable | 6,353 |

Solution

Part (a)

- Step 1: Number of days spent converting inventory to accounts receivable = 365 / 352,488 * 42,259 = 43.75

- Step 2: Because no credit sales are made, the period to collect funds from accounts receivable is nil. Customers pay in cash on the spot.

- Step 3: The operational cycle is 43.75 days, representing the period spent primarily on inventory sales.

Part (b)

There is no change in the days required to convert inventory to accounts receivable.

Days have taken to convert receivables to cash

= 365 ÷ 469,162 × 6,353 = 4.92

Operating cycle =

Days taken in selling (DIO) + Days taken in recovering cash (DSO)

43.75 + 4.92 = 48.68

It should be compared to Walmart's competitors' operating cycles, such as Amazon, Costco, and Target.

or Want to Sign up with your social account?