Off-Balance Sheet (OBS)

Refers to a corporation's assets and liabilities that do not show up on the company's balance sheet

What Is An Off-Balance Sheet (OBS)?

An Off-Balance Sheet (OBS) refers to a corporation's assets and liabilities that do not show up on the company's balance sheet.

These items are assets and liabilities of the company, even if they don't show up on the balance sheet. Since there is no equity or debt to reflect these items, there is no need to include them on the balance sheet.

OBS items are often known as incognito leverage. This is because the items belong to or are claimed by some other party. Thus, the firm does not have a direct claim to these items. Therefore they kept them out of their balance sheet.

An example of OBS items is financial firms that provide investment management services. Even though they continue to bring in money, their investments are not included in the balance sheets of the financial institutions.

Using OBS activities may improve earnings ratios like the asset turnover ratio. This is because earnings generated from the activities are included in the income numerator, while the balance of total assets included in the denominator remains unchanged.

Yet, they could be used to deceive other stakeholders, such as investors or other financial institutions. The stakeholders believe that the firm is financially better off than it is.

Key Takeaways

- Off-Balance Sheet (OBS) items are assets and liabilities not shown on a company's balance sheet.

- OBS activities can improve earnings ratios but may deceive stakeholders.

- Firms, lenders, and investors care about OBS for different reasons.

- Investors should consider OBS items to get a more accurate view of a company's financial position.

why do stakeholders care about Off-Balance Sheet?

These items are not always meant to be misleading or dishonest. However, they may be abused to trick outside parties by illegal firms.

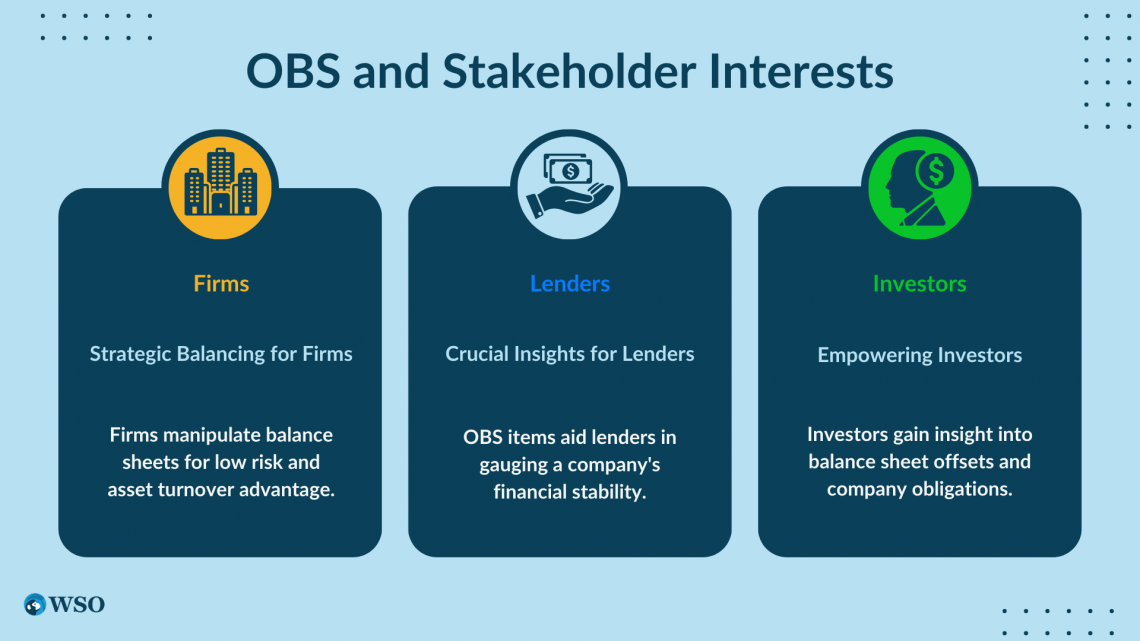

There are some stakeholder who may care about OBS items like:

1. Firms

When firms keep some liabilities out of their balance sheet, they can maintain low leverage and debt-to-equity ratios. By doing so, they convey a low-risk perception.

Moreover, as we mentioned early in this article, firms can improve their earning ratio by reducing the number of assets. Even though certain assets still provide a return, businesses may remove them from the balance sheet. As a result, the asset turnover ratio could be overstated.

2. Lenders

OBS items are essential to investors since they help them comprehend the company's financial situation. For instance, if the company can settle its off-balance sheet liabilities.

3. Investors

Investors will benefit from having a better grasp of OBS if they want to know how much a company has offset on its balance sheet. They will also understand how the set-off rights impact the obligations and rights of the company.

Investors compare businesses reasonably to choose which investment best suits their needs. Then, they capitalize on every OBS item to achieve their desired comparability.

Off-Balance Sheet Examples

These items vary from one firm to the next. They could also be put to use for other purposes. Consequently, there are several methods to arrange these items.

For instance, under financial institutions like banks, there are several activities of off-balance sheet items:

- Letters of credit

- Loan commitments

- Financial assets sold with recourse

- Financial Assets Sold Without Recourse

Lease operation was reported as an item under the prior accounting standards that existed worldwide (IFRS) and in the United States (US GAAP). However, they are on the balance sheet following current accounting standards (ASC 842, IFRS 16).

A credit derivative that can be an off-balance sheet item is a total return swap. Bonds and loans with total return swaps have all the risk passed to the receiver, allowing the receiver to access the asset immediately in exchange for the risk. Financial firms frequently use this type of funding.

Another typical kind of OBS item is accounts receivable (AR). Again, the risk of default is still there and is defined as income that has yet to be collected from the clients. Because of this risk, companies may sell that asset to other companies.

Off-Balance Sheet Financing Reporting Requirements

A typical tendency in developing accounting rules has been to permit fewer off-balance sheet activities. As a result, those who use financial statements can assess how OBS items have affected or might affect firms' financial status.

According to the Security Exchange Commission (SEC) section 401(a) of the Sarbanes-Oxley Act, 2002:

All reports submitted to the SEC and made available to the public must adhere to Generally Accepted Accounting Principles (GAAP). Furthermore, they have to contain no false statements or omissions of information. All substantial off-balance sheet transactions will be included in reports.

Research on off-balance sheet items was issued in 2005 by the Securities and Exchange Commission (SEC). The study found that 1.25 trillion operating lease agreements for SEC registrants were off-balance-sheet transactions. As a result, the SEC proposes changing the current lease accounting rules.

As a result of the SEC's proposal, firms are required to disclose OBS in the notes of their financial statement. However, disclosure is directed only to the extent necessary to an understanding of a registrant's OBS items and their material effects on the following:

- Financial condition

- Changes in financial condition

- Revenues and expenses

- Results of operations

- Liquidity

- Capital expenditures

- Capital resources

Off-Balance Sheet Exposure

The risk associated with OBS exposure is the possibility that OBS items will have unexpected effects on the firm's cash flow, liquidity, or leverage.

OBS exposures can occur in one of two ways, according to Moodys:

1. When a corporation retains the risks and benefits connected with certain rights and responsibilities that fall under the definition of assets and liabilities, the accounting approach partially fails to recognize those assets and liabilities.

OBS exposures, for instance, frequently appear after rights have been assigned or responsibilities have been resolved from an accounting and legal standpoint. However, neither transferring nor settlement has taken place economically.

2. When a business has potential liabilities, but they do not now fit the accounting definition of liability because they are unlikely to occur. However, in the case that specific circumstances materialize, the contingency might eventually turn into a liability.

OBS risks include derivative instruments, contingent assets, and contingent liabilities. These risks are not adequately addressed by accounting treatment.

Activities that do not involve loans and deposits but instead bring in fee income for the banks are called off-balance sheet exposures in the banking industry. Some instances of the banks' OBS exposures include non-fund-based facilities like those we stated above, which are contingent.

On Balance Sheet vs Off Balance Sheet

Items included on a company's balance sheet are known as "on-balance sheet items," Items that are "off-balance sheets" are not disclosed on a company's balance sheet.

The firm's assets and liabilities appear on the balance sheet. At first look, commitments on the company's balance sheet add to its total risk. Furthermore, items on the balance sheet are also easy to analyze.

On the other hand, off-balance-sheet items are disclosed separately from the firm's balance sheet. As a result, businesses use OBS items as management tools. This management tool helps the company mitigate counterparty credit risk and liquidity risk.

Investors need help analyzing the company's off-balance-sheet items. Therefore, when investors examine a company's financial position, they must include all OBS items as on-balance-sheet items. As a result, investors will have a more accurate and unbiased point of view.

The table below summarizes the differences between on-balance and off-balance sheet items.

| The Point of Distinction | On-balance sheet item | Off-balance sheet item |

|---|---|---|

| Reporting | On the balance sheet. | In the notes of the financial statement. |

| Analyzing | Easy to analyze. | Difficult to analyze. |

| Overall risk | Contribute to the overall risk | Reduce the overall risk. |

Off-Balance Sheet (OBS) FAQs

It refers to a corporation's assets and liabilities that do not show up on the company's balance sheet

These care for the items:

- Firms

- Investors

- Lenders

Some of the examples are:

- Accounts receivables (AR)

- Letters of credit

- Loan commitments

- Credit derivatives like total return swap

- Operating lease under the previous standards

To the extent necessary to an understanding of a registrant's OBS items and their material effects on the following:

- Financial condition

- Changes in financial condition

- Revenues and expenses

- Results of operations

- Liquidity

- Capital expenditures

- Capital Resources

These occur:

- When a corporation retains the risks and benefits connected with certain rights and responsibilities that fall under the definition of assets and liabilities, the accounting approach fails to recognize them.

- When a business has potential liabilities, but they do not now fit the accounting definition of a liability because they are unlikely to occur.

Researched and authored by Ahmed Al-Namer | Linkedin

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?